cemagraphics

It’s been about three months since I put out my latest cautionary piece on Altair Engineering Inc. (NASDAQ:ALTR), and in that time the shares have dropped about 11.2% against a loss of about 2.5% for the S&P 500. It’s time to review the name again to see if it’s worth considering taking a position or not. After all, a stock trading at $47.30 is, by definition, a less risky investment than the same stock when it’s trading at $53.25. I’ll make that determination by looking at the updated financial history, and by looking at the stock as a thing distinct from the underlying business. Additionally, I suggested that investors who insisted on remaining long here switch to calls, and I’m champing at the bit to write about how that trade worked out when compared to a long stock position.

Welcome to the “thesis statement” portion of the article, where I regale you with the highlights of my thinking in a short, hopefully pithy statement. This allows you to get the highlights of my arguments immediately, which then gives you the option to turn away from this article before you’re exposed to too much of my tiresomeness. This is just one of the many value-added services I offer to my readers, because I’m absolutely obsessed with trying to make your lives as comfortable as possible. You’re welcome. I think the financial history here remains very troubled, as evidenced by the ongoing disconnect between revenue and net income. It seems that the more this company sells, the greater are its losses. That written, the capital structure here remains very strong, so there’s no risk of this stock going to zero anytime soon, meaning that at some point the shares will represent good value. The problem is that they’re not reasonably priced at the moment, so I would recommend continuing to eschew this name. For those disagreeable souls who don’t see the logic of my position, and want to take a bullish position here, I remain of the view that the calls I recommended last time remain the best, forgive the pun, option.

Financial Snapshot

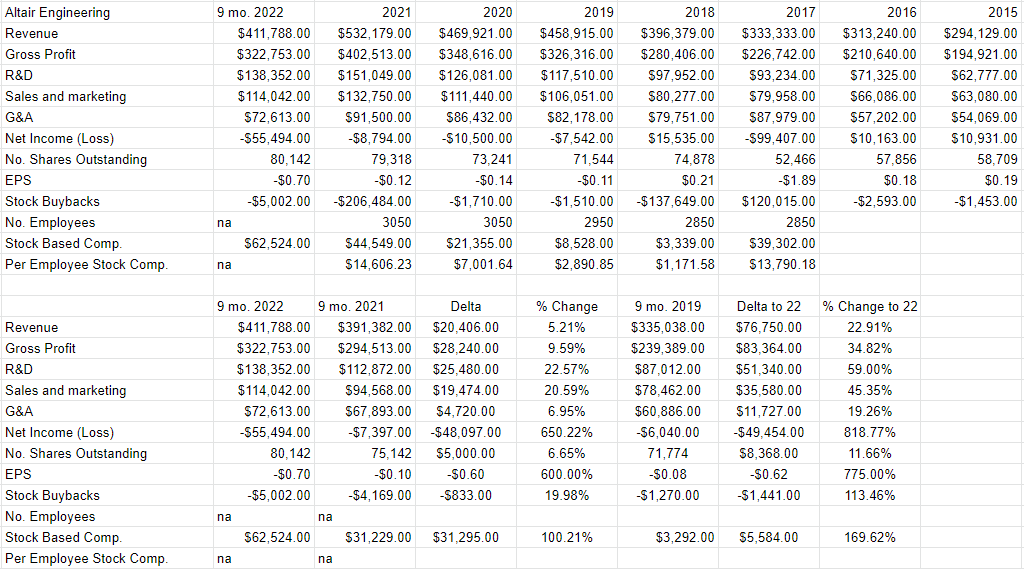

There’s no way to sugarcoat this, so I’m just going to come out with it. The financial history here is not great in my view. The biggest problem in my view is the very tenuous connection between revenue and net income. I calculated the correlation between the top and bottom lines for your enjoyment and edification and found that the correlation between revenue and net income is r=0.10. In my view, that relationship was driven higher by the relatively profitable 2018. Sadly for shareholders, the company hasn’t returned to profitability since.

Focusing on the more recent periods, we see the more evident disconnect between revenue and net income. Specifically, revenue for the first nine months of 2022 was 5.2% higher than it was this time last year, while net income absolutely cratered, with the net loss expanding by about 650%. Writing in terms of dollars, the $20.4 million uptick in revenue wasn’t sufficient to make up for the $25.5 million uptick in R&D expenses, $19.5 million uptick in sales and marketing expenses, or $4.7 million uptick in G&A expenses. Of course this prompts the question that I often ask about companies like this: if growing sales won’t drive profits, what will?

That written, I don’t think there’s much risk on the balance sheet here. About 53% of the capital structure is made up of cash, which suggests to me that there’s little chance of this enterprise going out of business anytime soon.

Owners can also take some solace in the fact that employees have been treated very well here in my estimation. For example, while net losses expanded from $8.8 million for the year 2021 to $55.5 million for the first nine months of this year, the company spent $62.5 million on stock-based compensation. So, there’s that.

I’d characterise this as a perpetual loss machine, but that alone doesn’t disqualify it from consideration as an investment. I’d be happy to buy this stock at the right price.

Altair Engineering Financials (Altair Engineering investor relations)

The Stock

My regulars know that I consider the business and the stock to be distinctly different things. This is because the business generates revenue by selling software, data analytics, and cloud solutions, while the stock is a speculative instrument that gets traded around based on long-term expectations about the business. Given that the financial statement valuation of the business is “backward-looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two.

Additionally, this stock, like all stocks, can be affected by changes in the overall market. The crowd may change its views about the desirability of “stocks” as an asset class, and that will impact individual stocks to some degree. Let me flesh this idea out a bit by using this stock as an example. Some portion of the 11.2% loss here may be attributed to the fact that the broad market is down about 2.5%. If people have eschewed “stocks” in general, we might expect that Altair Engineering, too, is taken down. Some portion of this drop may not be company specific. Of course it’s impossible to prove this counterfactual, but I’m of the view that some portion of the loss can be “blamed” on the reduced attractiveness of equities as a group.

So, to sum up, the business generates revenue and losses at a fairly rapid rate, while the stock bounces up and down based on the crowd’s ever-changing views about the future. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. I like to buy stocks when the crowd is particularly down in the dumps about a given stock, because those expectations are easier to beat.

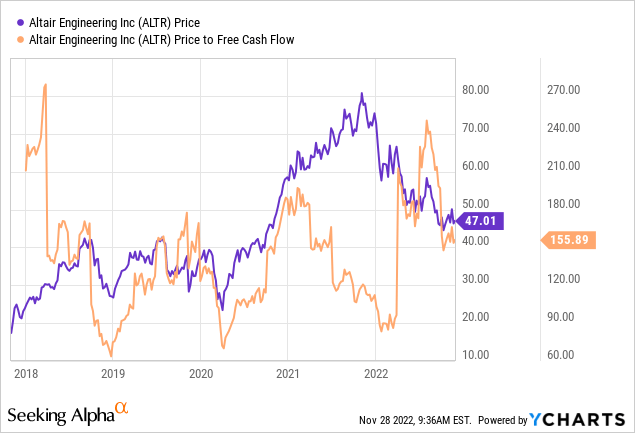

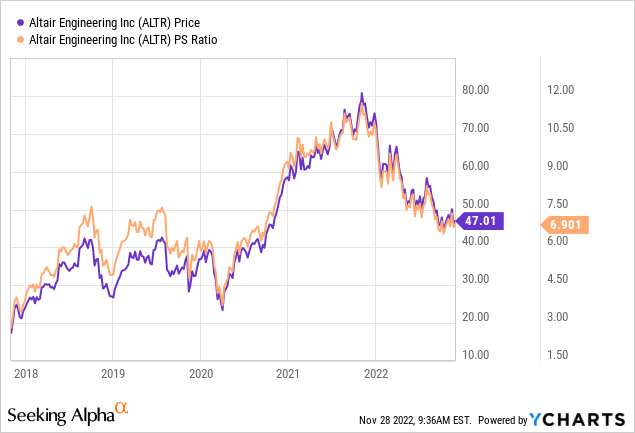

Another way of writing “down in the dumps about a given stock” is “cheap.” I like to buy cheap stocks because they tend to have more upside potential than downside. As my regulars know, I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship of price to some measure of economic value, like sales, earnings, and the like. I like to see a stock trading at a discount to both its own history and the overall market. When I last reviewed Altair, the shares were trading at a price to free cash flow ratio of over 200 times, and the shares were changing hands at just under 8 times sales. Fast forward to the present, with the shares down nicely and here’s the lay of the land.

Source: YCharts

At the same time, the shares are about 13.75% cheaper on a price to sales basis, per the following. In my view, “cheaper” is not the same as “cheap”, because the shares remain elevated by historical standards. The shares remain about 2.875 times more dear than the S&P 500.

Source: YCharts

I’d say that the shares are certainly cheaper than they were when I last reviewed this name. I’m always comfortable running the risk of repeating myself, so I’ll repeat. “Cheaper” is not the same thing as “cheap.”

As my regulars know, in order to validate (or refute) the idea that the shares aren’t objectively cheap, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If the crowd is assuming great things from the company, that’s a sign that the shares are generally expensive. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Altair Engineering at the moment suggests the market is assuming that this company will now grow profits at a rate of about 9.4% from here. Given that the company has been “in the red” since 2018, I consider this to be a wildly optimistic forecast, and I must therefore recommend continuing to avoid the shares.

Options As Alternative

While I don’t think there’s much reason to buy this stock, I have lived long enough to be very surprised by various markets over the years. The crowd often behaves unexpectedly, and I’m open to the possibility that the excessively ebullient crowd drives these shares higher in spite of the ongoing losses. For someone who has this view, and insists on remaining bullish here, I would recommend calls in lieu of shares. As I pointed out in my last article, calls offer much of the upside of the stock at a fraction of the capital at risk.

In my previous missive on this name, I recommended people who want to stay long here switch to call options. Specifically, I recommended the April 2023 calls with a strike of $50. At the time, these were asked at $9.70. At the moment, they’re asked at $5.50, so they’ve definitely lost value as the stock has dropped about $6.50 in price. For those interested in staying long here, I would recommend these same call options today. For about 12% of the capital at risk, the investor will enjoy much of the upside between now and the third Friday of April 2023. I think this is a reasonable price to pay for five months of potential upside here. By expressing the bullish position via call options, the investor saves 88% of their capital, and protection of capital is very important in the domain of investing.

Be the first to comment