gorodenkoff/iStock via Getty Images

Healthcare represents a massive chunk of the U.S. economy. So large is the space that there exists the opportunity for there to be countless multibillion-dollar businesses in operation across several different segments of the health care industry. One of these multibillion-dollar firms that focuses on acquiring, developing, owning, leasing, and managing healthcare real estate throughout the nation is Healthpeak Properties (NYSE:PEAK). In recent months, the company has exhibited quite a bit of pain, even relative to the broader market downturn. However, the picture for the business from a fundamental perspective looks quite robust. And if management can deliver on their own guidance for the current fiscal year, then the company might make sense for some investors to buy into. While the firm would likely fare well for investors in the long run, I do still think that there are better opportunities that can be had. So because of that, and because of the uncertainty regarding management’s ability to deliver on guidance, I am still rating the company a ‘hold’ for now. But if the stock falls further or if fundamentals come in even stronger than anticipated, it could be due for an upgrade.

A healthy prospect

Back in February of this year, I dedicated an article to whether or not Healthpeak Properties was a good opportunity for investors to consider. I was impressed by the company’s continued growth over the past few years. I saw that the firm was fundamentally solid, but I was disappointed by the underperformance of its stock relative to the broader market in the months leading up to the publication of that article. I also recognized that the company was trading at a rather high premium. All combined, this led me to conclude that this is a quality operator but that there are likely better prospects on the market to be had at this time. Because of that, I ultimately rated the business a ‘hold’, indicating my belief that its returns would more or less match the broader market for the foreseeable future. Since then, the company has performed slightly worse than I anticipated. While the S&P 500 is down by 13.3%, shares of Healthpeak Properties have lost investors 17.4%.

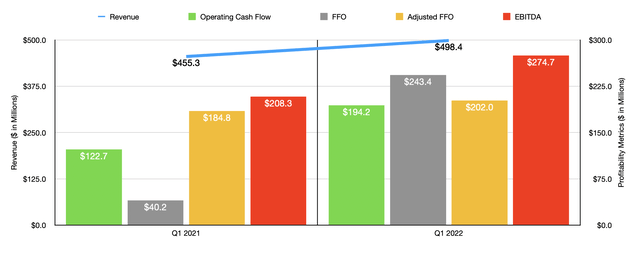

To be clear, this weakness in share price has had nothing to do with the company’s fundamental condition. That situation appears to remain intact. To see what I mean, we need only look at the recent financial performance provided by the business. When I last wrote about the company, we had data covering through the 2021 fiscal year. Today, we have one extra quarter we can look at. During the first quarter of the company’s 2022 fiscal year, revenue came in strong at $498.4 million. That is 9.5% higher than the $455.3 million generated just one year earlier. It’s worth noting where this increase in sales came from.

For starters, rental and related revenues associated with the same property locations for its Life Science properties did increase year over year to the tune of 5.1%. Part of this was attributable to an improvement in the company’s average occupancy rate from 97.9% to 98.4%. It also saw the average annual total revenue per occupied square foot rise from $63 to $67. Under the Medical Office segment, the improvement in sales associated with the same property locations was 4.3%, with average annual total revenue per occupied square foot rising from $30 to $32, while average occupancy remained flat at 91.5%. And under the Continuing Care Retirement Community segment, the increase here was 4.7%, with occupancy rising from 78.7% to 80.9%, while the average annual rent per occupied unit increased by 7.5%. The company also benefited from other factors, such as an extra $5.2 million from government grants and from the acquisition of additional properties. The total number of Life Sciences properties increased from 141 to 149. Under the Medical Office category, the increase was from 286 to 300. Meanwhile, the firm saw a decline of two units from 17 to 15 under its Continuing Care Retirement Community operations.

With revenue rising, profitability followed suit. Operating cash flow went from $122.7 million in the first quarter of 2021 to $194.2 million in the first quarter this year. FFO, or funds from operations, increased from $40.2 million to $243.4 million. On an adjusted basis, the increase was from $184.8 million to $202 million. Meanwhile, EBITDA surged from $208.3 million to $274.7 million. When it comes to the entirety of the 2022 fiscal year, management has not provided any guidance from a sales perspective. But they do believe that FFO per share will be between $1.70 and $1.76. At the midpoint, this would translate to FFO of $933.4 million. On an adjusted basis, this number should be about $922.6 million. No guidance was given when it came to other profitability metrics. But if we assume that those will increase at the same rate, then we should anticipate operating cash flow of $999.6 million and EBITDA of $1.32 billion.

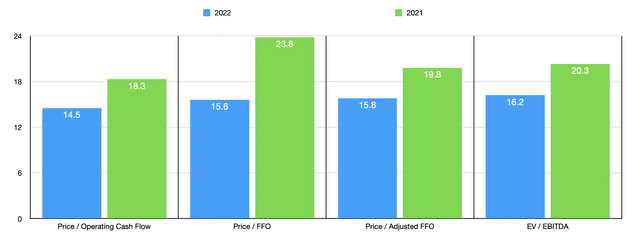

Using this data, we can effectively price the company. On a forward basis, the firm is trading at a price to operating cash flow multiple of 14.5. This is down from the 18.3 reading that we get if we use 2021 results. The price to FFO multiple should drop from 23.8 to 15.6, while the adjusted equivalent for this should drop from 19.8 to 15.8. And finally, the EV to EBITDA multiple for the company should decline from 20.3 to 16.2. To put the pricing of the company into perspective, I did compare it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 10.5 to a high of 19.5. Using the 2021 results, four of the five firms are cheaper than Healthpeak Properties. Meanwhile, using the EV to EBITDA approach, the range was from 10.3 to 19.7. In this case, our prospect is the most expensive of the group. If we were to use the estimates for 2022, the price to operating cash flow approach would result in only two of the five companies being cheaper than our prospect, while the EV to EBITDA approach would result in two of them being cheaper.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Healthpeak Properties | 18.3 | 20.3 |

| Medical Properties Trust (MPW) | 11.6 | 10.3 |

| Ventas (VTR) | 19.5 | 18.8 |

| Omega Healthcare Investors (OHI) | 10.5 | 11.8 |

| Healthcare Trust of America (HTA) | 17.7 | 19.7 |

| Healthcare Realty Trust (HR) | 17.3 | 17.6 |

Takeaway

The data right now suggests to me that Healthpeak Properties is definitely showing potential. The company’s bottom line continues to improve as its top line expands. This is also the kind of business that should achieve sound financial performance even if the economy takes a step back. But given how shares are priced relative to similar players, I cannot yet convince myself to rate it a ‘buy’. If we see its price fall further and/or the company can achieve the 2022 figures without experiencing a rise in price, then I would consider doing this. But in the meantime, I’ve decided to keep my ‘hold’ rating on the business.

Be the first to comment