urbazon/E+ via Getty Images

HealthEquity, Inc. (NASDAQ:HQY) stock has ebbed and flowed, making it ideal for trading. That is what we do. In our last analysis, we said we would be “sellers around $80” and buyers closer “to $55.” Well, a few weeks ago HealthEquity stock peaked at $79.20 and has fallen very hard since, getting down to about $57 not long ago. Our ranges were pretty spot on. Since then, HQY stock has mean-reverted. That means the stock cannot be trade, as we see it equally likely that the stock falls or gains. We do not like those odds. We tilt the odds in your favor with our analytics and ranges. So, once again, for a public column, HealthEquity is a hold here.

In our column in late summer, we stated:

“Generally speaking the stock is a buy in the $50s, a hold in the $60s, and a sell in the $70s and $80s.”

Well folks once again, that is our current take. With the stock in the high $60s, we think upside is capped in the near-term, and is equally likely to fall back the same amount. So, hold. But if it spikes, you sell, if it falls back sub $60, get to buying. That is our funds’ trading opinion. Please understand, that HealthEquity really is a trading name. Most investors have seen zero gains in 5 years. But if you bought and sold anywhere close to the above ranges a few times, you would be far outpacing investors and the market. That is how we make our money. We trade the ranges, at least with a name like this.

We get it, sometimes people are afraid to trade. Sure, timing is hard, and sometimes you will sell too soon, but you certainly won’t let gains get wiped away. So, follow our suggested ranges, and you will do well. We like the company, and its operations, but HealthEquity stock remains expensive. Let us discuss.

Discussion

We continue to like this company’s mission of connecting consumers to care, but HealthEquity is a pretty niche play. It is a tough operating sector, believe it or not. You see in healthcare savings in this country, many health plans and employer sponsored products allow members to use products such as health savings accounts, or HSAs, health reimbursement accounts, or HRAs, and Flexible Spending Accounts, or FSAs, to pay for routine healthcare expenses, while also using a high deductible insurance plan to mitigate catastrophic medical expenses.

HealthEquity understands that these high deductible insurance policies are typically lower in cost, and the user pays medical claims out of a pre-tax pre-funded spending account, often with a debit card provided by a bank or insurance plan. You see, with this type of model there is some advantage. They can provide people more flexibility and control when paying for medical expenses and can offer an alternative, or even a supplement, to traditional health insurance plans.

The HSA market is currently around $100 billion in custodial assets spread across nearly over 35 million accounts. The overall market here is still estimated to grow to more than $500 billion over the next few decades. If the company can execute and keep its cost profile down, HealthEquity should see some real growth. But the stock has told the story, it just never escapes this range it is stuck in. Performance remains mixed.

Performance discussion

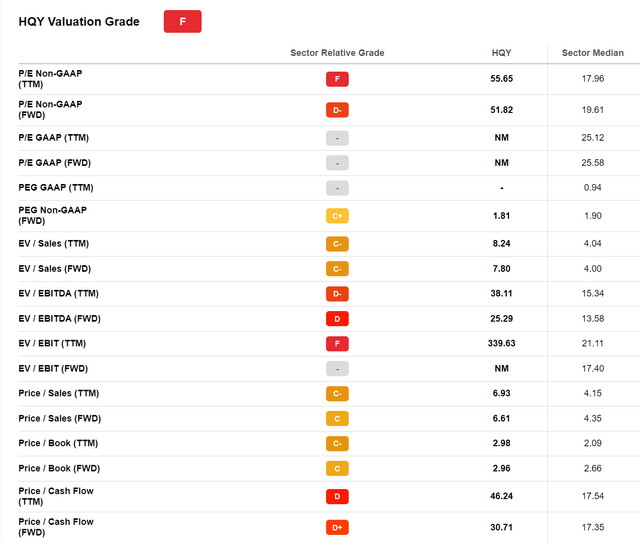

Yet, HealthEquity saw a quarter that was mixed when it just reported earnings. On the surface, we saw a revenue beat versus consensus estimates, along with earnings that surpassed estimates. That was welcomed but the stock barely reacted, perhaps because performance relative to the valuation suggests that the stock is expensive. You see the company’s performance (i.e., growth) suggests the valuation might be too rich. Growth was quite good, but the stock is trading at some deep multiples relative to earnings and EBITDA:

Seeking Alpha HQY Valuation Page

So, it is still extremely expensive. Does the performance justify this? Well the key metrics suggest there is growth, but it is not wildfire-like expansion here.

The top line revenue showed nice growth, but was not overly strong. It was still quite good, at $216.1 million. This was an increase of 20% compared to $180.0 million last year, while last year’s numbers were a sequential contraction so there was a favorable comp here. Something to keep in mind.

As a reminder, there are 3 segments of operations. The company reported service revenue of $108.6 million, rising $5.6 million sequentially. Further there was custodial revenue of $74.6 million rising from $65.6 million in the linked quarter, and interchange revenue of $32.9 million which was a sequential decline from $37.5 million. So a bit mixed. But when we factor in the expenses, the company saw a net loss of $5.0 million, or $0.06 per share.

We despise losses even if it is on a GAAP basis and there are adjustments to make. At 51X adjusted earnings losses are just a recipe for stock erosion. But, making those adjustments, we saw net income of $32.4 million, or $0.38 per share. Earnings are down folks. Now, in Q2 2022, earnings contracted. Here, EPS was up 9% to $0.38 per share. 9% EPS growth is pretty weak for the valuation here.

Where there was strong news was the growth in adjusted EBITDA. Adjusted EBITDA was $73.4 million, a nice increase from $67.0 million in the sequential quarter and up 20% from a year ago.

Accounts on the rise

This comes despite many more new accounts being sold and more assets under management. There were 170,000 new HSAs, a larger increase in accounts sold vs. the 151,000 sold last year. HSAs in total were 7.7 million, an increase of 23% year-over-year. Total accounts were 14.5 million, including 6.8 million other consumer-directed benefits, about flat from Q2 2022, so, a mixed data point. In terms of assets, the company has $20.2 billion of HSA assets. This is an increase of 23% year-over-year. but is down about 1% from Q2 2022.

Looking ahead

The outlook was an increase for the fiscal year, but the company is still losing money on a GAAP basis. As noted in the press release for the year:

management expects revenue of $850 million to $860 million. Its outlook for net loss is between $34 million and $27 million, resulting in net loss of $0.40 to $0.32 per diluted share. Its outlook for non-GAAP net income, calculated using the method described below, is between $106 million and $114 million, resulting in non-GAAP net income per diluted share of $1.26 to $1.35 (based on an estimated 84 million diluted weighted-average shares outstanding). Management expects Adjusted EBITDA of $261 million to $271 million.

If EPS comes in at the midpoint of $1.30, would be down from $1.33 in fiscal 2022, and down from $1.69 in fiscal 2021. Folks, this is moving in the wrong direction, and that right there is why we would NOT be investors. That said, the early view of fiscal 2024 is revenue of $960 million, a rise of around 11-12% from fiscal 2023. EBITDA should widen to $316 million based on a forecast of 33%-34% of revenue. So, some growth is on tap, but it does not mean it is worth a buy. HealthEquity is overvalued here, and better for trading. Let the valuation come in.

Take home

HQY stock is a hold here, but once again it is a sell if the market takes this higher toward $80. We are buyers in the mid-$50s. Trade this stock, an investment in HealthEquity, Inc. is going nowhere.

Be the first to comment