imaginima/E+ via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on April 10th.

REIT Rankings: Healthcare

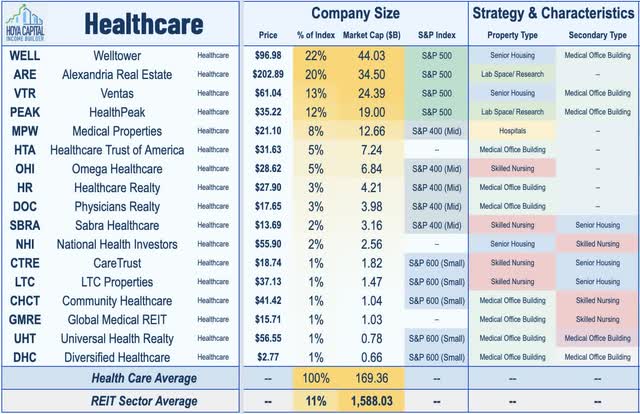

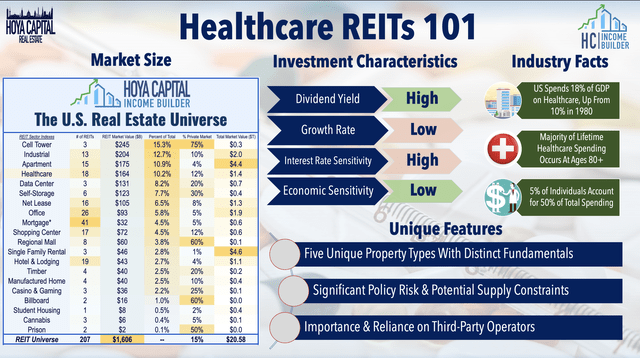

Healthcare REITs – which were the weakest-performing property sector in 2021 – have been one of the top-performing REIT sectors in early 2022, as COVID headwinds finally begin to abate. Encouragingly, the Omicron COVID wave merely slowed – but didn’t derail – the demand recovery across the senior housing and skilled nursing sector, but staffing shortages have been the more critical issue of late with some operators are faring better than others. Within the Hoya Capital Healthcare REIT Index, we track all 17 healthcare REITs, which account for roughly $170 billion in market value.

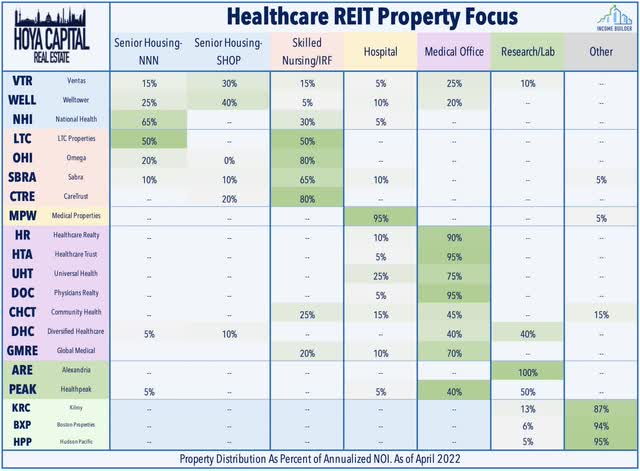

Healthcare REITs were literally “ground zero” of the COVID pandemic, and will experience lasting effects – both positively and negatively – from the (hopefully) once-in-a-generation pandemic. There are five distinct sub-sectors within the healthcare REIT category – senior housing, skilled nursing, hospital, medical office, and research/lab space. The senior housing sub-sector is comprised of independent living, assisted living, and memory care facilities – which REITs typically categorize based on lease structure: triple-net leased (“NNN”) properties and senior housing operating (“SHOP”) properties.

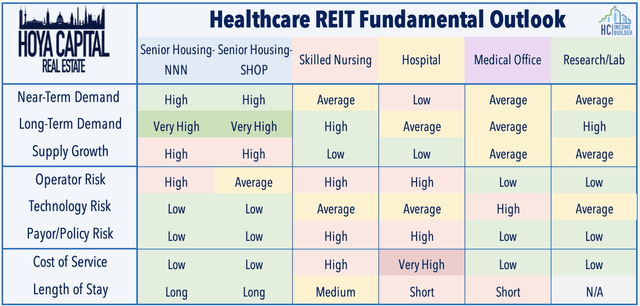

Each of these sectors has distinct risk/return characteristics and has been affected by the pandemic in varying intensities. While SHOP facilities were the hardest hit by the pandemic, no sector was entirely immune. For the “public pay” skilled nursing and hospitals REITs – which rely heavily on Medicare and Medicaid reimbursements – the pandemic initially exasperated issues with their troubled operators before a wave of government relief funds temporarily quelled these concerns, until this funding began to dry up and the issues have re-emerged. Meanwhile, medical office demand has remained relatively steady throughout the pandemic, while lab space demand from biotechnology and pharmaceutical companies has been extremely strong.

Healthcare REIT Fundamentals

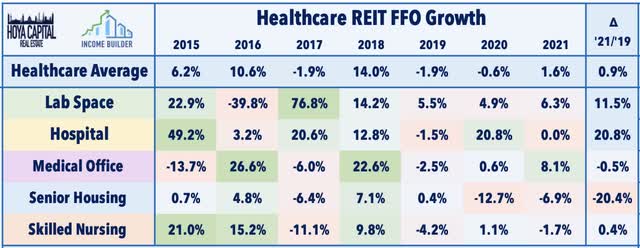

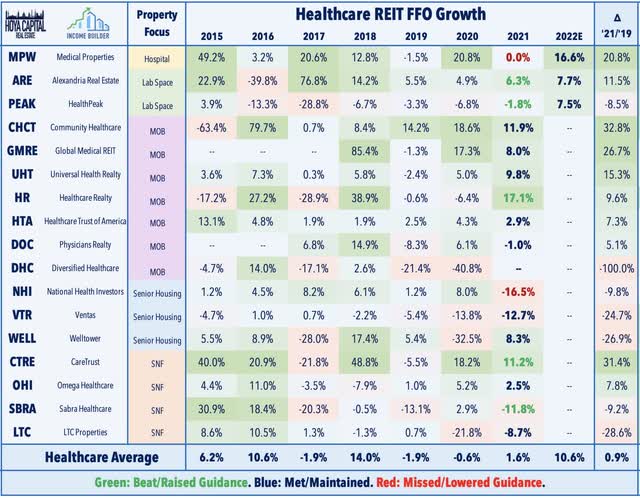

Senior housing REITs have taken on more operating exposure over the past decade as they attempt to mitigate the risks from third-party operators, a shift which has come back to bite these REITs in recent years, particularly during the pandemic. The result of this shift and the broader bifurcation in operating performance between these healthcare sub-sectors is apparent in their reported Funds From Operations (“FFO”) metrics as senior housing FFO declined more than 20% between 2019 and 2021 while medical office FFO was roughly flat and Skilled Nursing FFO actually increased during these two years due to the relative protection of the triple-net lease structure.

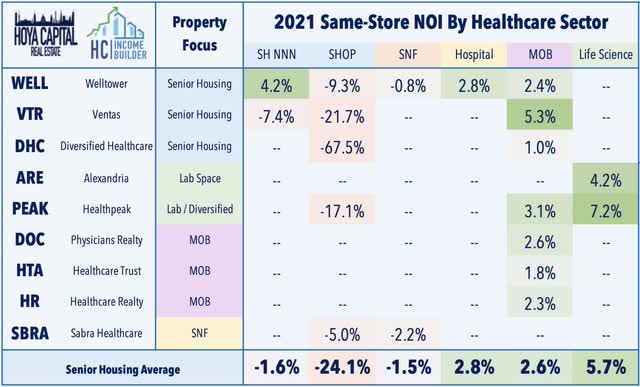

Looking deeper at property-level metrics, a similar story is apparent through the same-store Net Operating Income (“NOI”) metrics for full-year 2021. Life sciences properties averaged NOI growth of 5.7% in 2021 while the medical office sector posted respectable growth of 2.6% for the year. Within the senior housing and skilled nursing sectors, properties leased under the triple-net structure posted modest NOI declines while SHOP assets saw sharp declines. That said, while the triple-net structure allowed these REITs to avoid much of the downside from property-level operations, their tenants took a significant hit and as we’ll discuss more below, non-payment of rent has become a mounting issue for some of these NNN assets. Operator issues are far less of an issue with SHOP assets, which are expected to deliver substantial NOI growth during the post-pandemic recovery and provide superior levels of inflation protection.

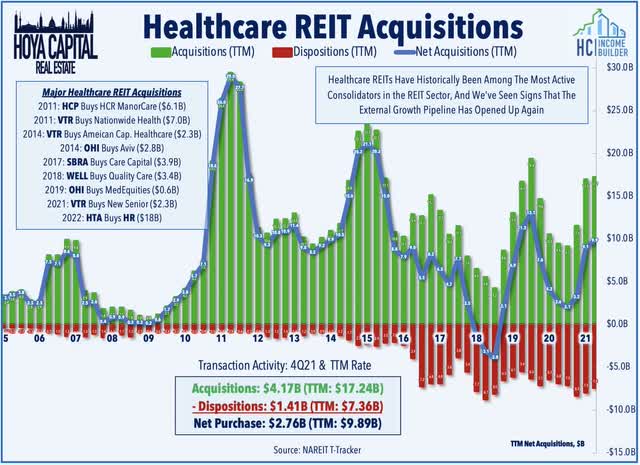

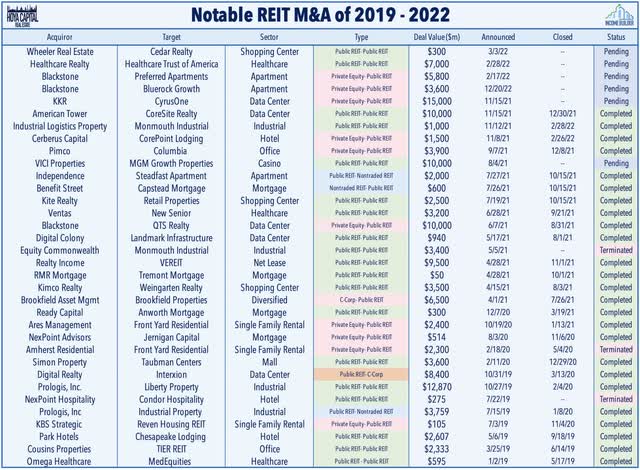

As we forecast last quarter, plentiful acquisition opportunities have been a silver lining of the pandemic and we projected that we may see a “buying spree” similar to the prior recession when these REITs acquired tens of billions of dollars worth of assets from troubled operators. Healthcare REITs have historically been among the most active acquirers and consolidators, using the competitive advantages of their REIT structure to fuel accretive external growth. We’re not seeing that wave of consolidation occur quite yet as Healthcare REITs have acquired nearly $10B in net assets over the last twelve months, the largest haul since late 2019.

Healthcare REIT Performance

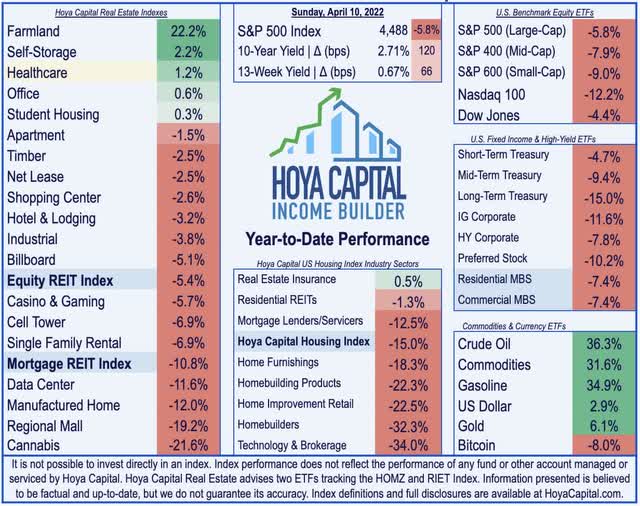

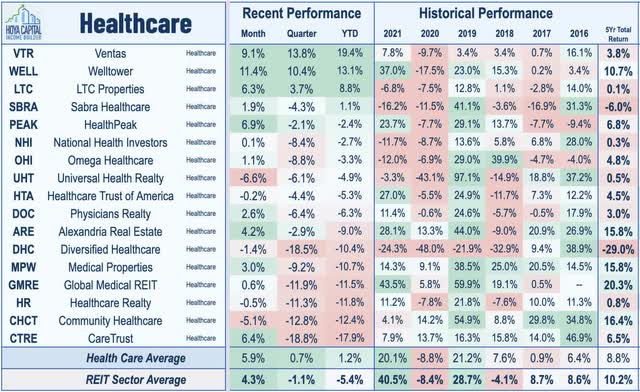

Propelled by the long-awaited waning of the COVID pandemic, healthcare REITs have been among the performance leaders thus far in 2022. The sector was slammed during the early onset of the outbreak and after a post-vaccine resurgence, the share price recovery stalled in the back half of 2021 amid the Delta and Omicron waves, and healthcare REITs ended the year as the worst-performing REIT sector with total returns of 16%, underperforming the 41% returns on the Equity REIT Index. Closely mirroring the COVID cases-count trends, the rebound has resumed over the past quarter, The Hoya Capital Healthcare REIT Index is higher by 1.2% in 2022 compared to the 5.4% decline from the market-cap-weighted Vanguard Real Estate ETF (VNQ) and the 28% returns from the S&P 500 (SPY).

Diving deeper into notable individual performances, senior housing REITs have led the way in 2022 with Ventas (VTR) and Welltower (WELL) each higher by more than 13%. Despite a pull-back last week, skilled nursing REITs have also been outperformers this year, led by Sabra Health Care (SBRA) and LTC Properties (LTC). Medical office and lab space REITs have lagged this year, however, pressured by a rotation from growth and defensively-oriented REITs into more value-oriented and pro-cyclical sectors that are better-positioned to keep up with inflation. Small-cap CareTrust (CTRE) – which had impressively managed to avoid operator issues in recent years – has lagged after announcing plans to sell about 32 assets operated by troubled tenants, representing about 10% of its portfolio.

We also saw some major healthcare REIT M&A news as medical office building owners Healthcare Trust of America (HTA) and Healthcare Realty (HR) announced an agreement to merge in an $18B deal that will create the largest pure-play medical office building owner in the United States. Met by a lukewarm response by investors, HTA – the target – is little-changed from the announced deal while HR – the acquirer – is lower by 5%. Under the terms of the deal, HTA shareholders receive total consideration of $35.08 per share, comprised of a special cash dividend of $4.82 per share and a transaction exchange ratio of 1-to-1 based on HR’s share price of $30.26 on Feb. 24, 2022. Upon closing in Q3, the new company will continue to operate with the Healthcare Realty name and trade on the NYSE under the ticker symbol HR.

Senior Housing Fundamentals

Several healthcare REITs provided business updates last week in conjunction with their participation in the Credit Suisse Healthcare REIT Summit and ahead of the closely-watched National Investment Center (“NIC”) quarterly senior housing report. Welltower reported that it expects its normalized FFO to exceed its prior guidance range in Q1 and noted that its average occupancy is expected to exceed its previous assumption with a 420 basis point increase from last quarter. The prior week, Ventas reported similarly solid trends in Q1 with a same-store occupancy rate that was roughly flat at 83%.

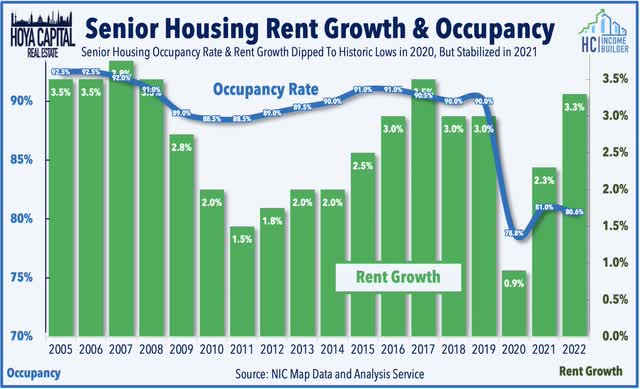

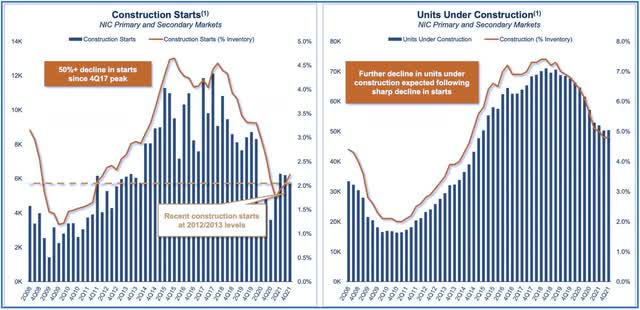

The NIC report showed that, despite the Omicron-driven COVID surge, senior housing occupancy rates increased for the third consecutive quarter in Q1, rising 20 basis points to 80.6%, representing a 2.5% increase from a pandemic low of 78%. Operators were able to achieve rent growth of 3.3%, the strongest quarter of rent growth since 2017, led by a record-high 4.1% rent growth in assisted living facilities, which had seen more significant occupancy declines during the pandemic than the independent living segment. Also of note, NIC reported a slowdown in inventory growth to the lowest since 2013 – good news for senior housing REITs as supply growth had been the most persistent headwind for the senior housing sector before the pandemic.

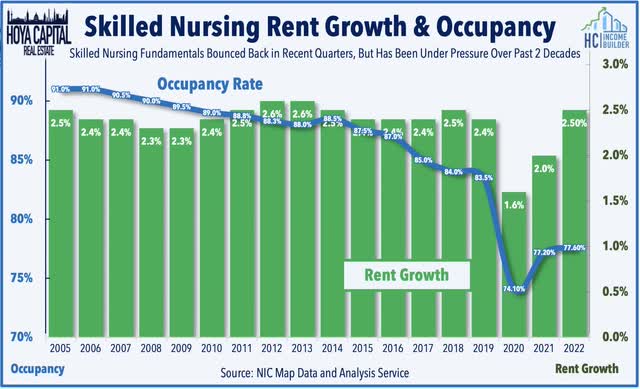

Skilled Nursing REIT Fundamentals

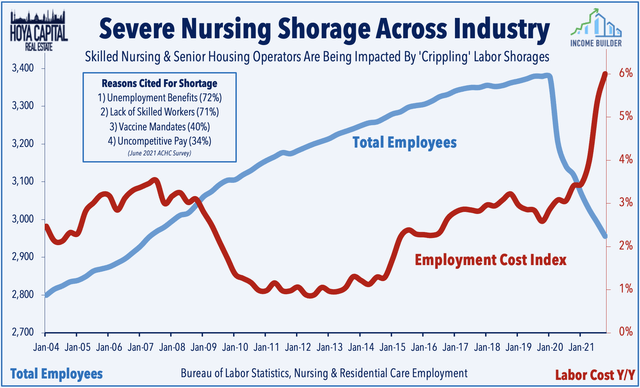

For skilled nursing REITs, operator issues have re-emerged as government relief funds begin to dry up and as labor shortages intensify. Operator struggles are certainly nothing new for SNF REITs and remain the primary source of near-term and medium-term risk. Staffing shortages have become critical issues at skilled nursing facilities, pressuring not only operating margins but also forcing some facilities to turn away new business. According to a survey from the NCAL, facilities cited the lack of qualified interested candidates which most attributed to a combination of unemployment benefits, vaccine mandates, and uncompetitive wages.

Skilled nursing REIT Omega Healthcare (OHI) dipped last week after providing a business update in which it noted that an additional operator representing 2.4% of its total had stopped paying rent in March. While OHI collected 93% of its 4Q21 rents, operators representing 18% of its total have stopped paying rent as of March 2022. National Health Investors (NHI) also reported that it collected 78.4% of March cash rents – roughly consistent with its Q4 collection rate of 79% – as several troubled operators continue to defer rent payments. Sabra noted last quarter that Avamere, its largest tenant at 9.3% of NOI, experienced cash flow constraints resulting from admission bans and increased labor pressures.

Checking The Pulse of Healthcare REITs

Taking a step back, Healthcare REITs are among the largest publicly-traded property sectors, comprising roughly 10% of the broad-based “Core” REIT ETFs. Within the senior housing sector, CBRE estimates that there are roughly 3 million professionally-managed senior housing or skilled nursing units in the US, representing roughly 2% of the total US housing stock. These REITs primarily lease properties to tenants under a long-term triple-net lease structure, though these REITs have taken on increasingly more operating responsibilities over the past decade as they attempt to mitigate the risks of their struggling third-party operators.

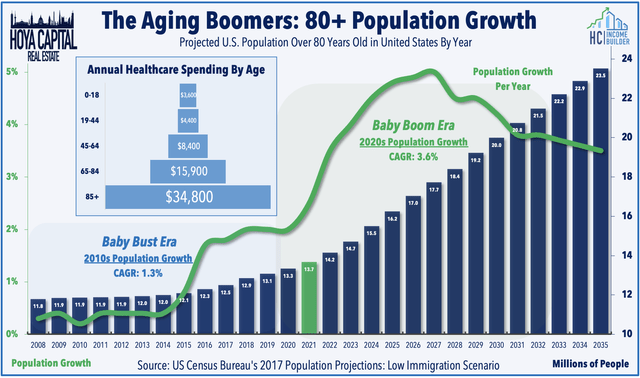

Helping to provide some additional light at the end of the tunnel for the entirety of the healthcare REIT sector, the demographic-driven demand boom from the aging Baby Boomer generation is finally on the horizon. After years of stagnation in the critical 80+ population cohort, this age segment will nearly double over the next 30 years and grow at an estimated 4% per year through 2040. The Boomer generation is substantially wealthier than the Silent Generation that preceded it and driven by robust home price appreciation and stock market gains, Boomers have accumulated $1.6 trillion in excess savings over the past two years according to recent Federal Reserve data.

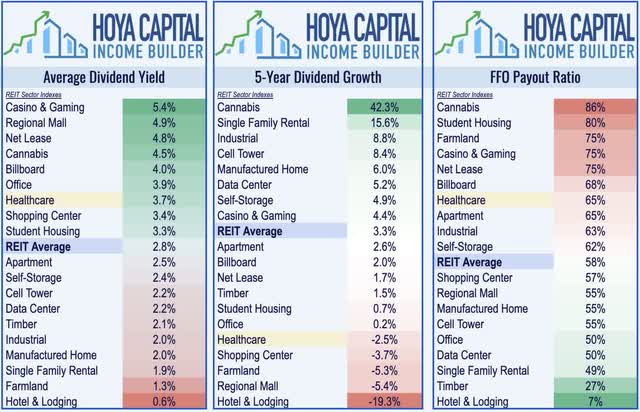

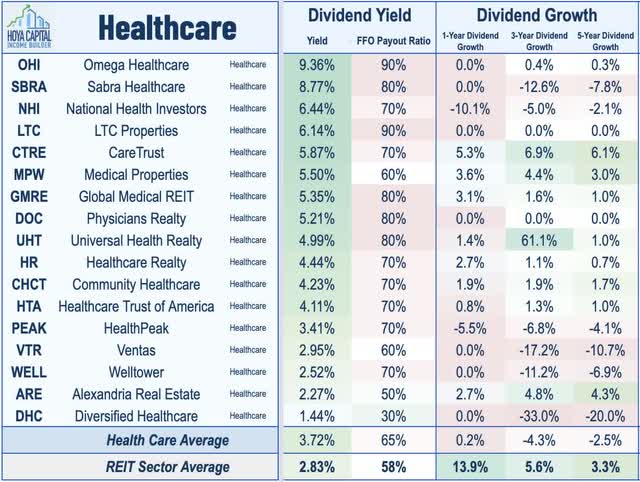

Healthcare REIT Dividend Yields

Healthcare REITs have historically been strong dividend payers and continue to rank towards the top of the REIT sector in that regard. Healthcare REITs currently pay an average dividend yield of 3.7% – well above the market-cap-weighted REIT sector average of 2.8%. While several healthcare REITs have delivered very strong dividend growth in recent years, on average, the sector has seen muted dividend growth over the past half-decade.

With a reasonable payout ratio of around 65%, on average, we believe that current dividend levels for healthcare REITs look healthy and sustainable. Eight healthcare REITs boosted their dividend last year while another four have raised their payouts this year: Community Healthcare (CHCT), Medical Properties (MPW), Global Medical (GMRE), and CareTrust (CTRE). Dividend yields of the individual names in the healthcare REIT sector range from a low of 1.44% from Diversified Healthcare (DHC) which cut its dividend last March to a high of 9.36% from Omega Healthcare (OHI).

Takeaway: Positive Prognosis, Risks Remain

Healthcare REITs – which were the weakest-performing property sector in 2021 – have been one of the top-performing REIT sectors in early 2022, lifted by an improving fundamental outlook for senior housing. After a decade of lackluster performance and strenuous portfolio repositioning, the long-awaited demographic tailwinds are finally arriving for senior housing REITs, while new supply growth has moderated. With nursing shortages likely to persist, and with a dimming outlook for significant further COVID relief funds, however, caution is warranted for Skilled Nursing and “public-pay” healthcare REITs which appear fully valued. We’ve been selective in our Income Builder portfolios with recent allocations towards higher-quality senior housing and select medical office REITs, while maintaining our long-term overweight in lab space-focused REITs.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment