Solskin

Shares of HCA Healthcare (NYSE:HCA) have fallen by over 20% this year as rising costs have squeezed profitability. Fortunately, there is growing evidence that we are passing the worst of the labor cost problems while increasing reimbursement rates will facilitate faster top-line growth. This comes against a backdrop of relatively low healthcare spending in what should be a secularly growing part of our economy given aging demographics. At just 11x earnings and less exposure to the cyclical aspects of the economy, HCA is an attractive defensive investment.

HCA’s stock has been hit not by a revenue problem but by a margin problem. Last quarter for instance, revenue rose $400 million to $14.82 billion, but adjusted EBITDA declined by $180 million to $3.04 billion. Salaries and benefits rose 6.4% to $6.8 billion, consuming 45.8% of sales up by 160 basis points from last year while supplies and other operating expenses were essentially constant at 33.8% of sales. HCA is seeing costs rise significantly and not been able to pass on these increases, in part because wages can rise at any time during a year while reimbursement rates are generally set once or twice during the year. As we will discuss below, both of these factors should improve next year, enabling a margin recovery.

It should be noted that while the company is seeing declining margins. Excluding special items, the company earned $4.21 last quarter, though given lower margins that was down about 4% year on year. That does position the company to earn about $17 this year, giving the stock a roughly 11x multiple. That has translated to about $900 million in free cash flow so far this year, but that has been depressed by seasonal working capital swings, which have consumed $1.8 billion in cash so far. As these normalize in the second half, free cash should improve and finish the year around $5 billion, giving the stock a 9% free cash flow yield.

With this cash flow, the company has aggressively been buying back stock–$4.8 billion so far this year. The company’s share count is down 10.8% over the past twelve months to 296 million. HCA has repurchased 1/3 of the company since December 2013 playing a meaningful role in its long-term EPS growth. So while margins squeeze have been a headwind, financial results remain solid.

As said above, the key challenge that has been hitting hospitals is inflation. Costs for everything, including labor, have been rising putting pressure on the bottom line. This is particularly true because unlike a gas station, which can change prices every day, their prices are generally locked in for several months or a year, based on negotiations with insurers and Medicare. Medicare has decided to raise inpatient reimbursement rates for fiscal 2023 (which began October 1, 2022) by 4.3%, a much larger increase than the 3.1% originally proposed and the 2.5% last year, reflecting faster input and labor cost inflation.

With Medicare and Medicaid accounting for about 40% of HCA’s revenue, this will be a $600-800 million direct benefit to HCA’s top-line. At the same time, faster Medicare reimbursement growth sets a baseline for negotiations with private insurers, which account for the vast majority of its remaining revenue, potentially creating about $2.5 billion in upside revenue potential just from pricing, let alone volumes. All in all, its pricing position looks much stronger today than it did 6 months ago when a more modest Medicare increase was proposed.

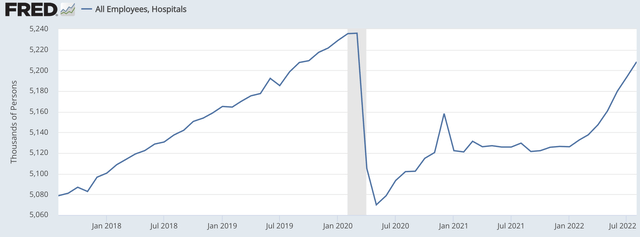

At the same time, cost pressures may be getting better. Hospitals have spoken frequently of the difficulty in finding staff and nursing shortages, which has pushed wages up. As you can see below, as with most sectors, hospital employment fell sharply in 2020, but it was very slow to recover as workers moved to other industries in a very tight labor market. However in recent months, employment has rebounded much more sharply as the jobs market has begun to soften elsewhere with the Federal Reserve trying to cool an over-heated labor market. The recent easing of staffing problems should help alleviate strains in HCA’s operations, improving margins and efficiency. Because HCA faces a wage not a demand problem, the more successful the Fed is in softening the labor market, the more HCA benefits, making it one of the few companies that is a winner from a slowing economy.

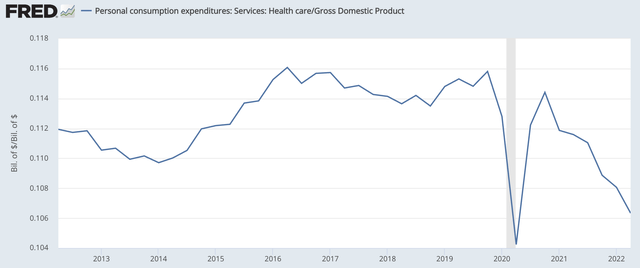

Additionally, there were many things that were surprising and hard to predict about the COVID-19 pandemic, but to me, nothing was more surprising than that healthcare spending would fall during a pandemic. In hindsight, it makes sense as governments restricted non-essential (which tend to be more expensive) surgeries and people were likely more reluctant to go see doctors, for fear of catching COVID from other sick patients. As a share of GDP, health spending still remains very low at 10.6% from 11.2-11.4% prior to COVID.

After the initial drop in 2020 when restrictions on non-essential surgeries were imposed, there was a rebound as those were more removed, but health care spending has been sluggish over the past 18 months even as the economy continued to recover, losing ground with its weight nearly returning to the depths of COVID restrictions. Eventually though, people do get sick, they do need to have even “non-essential” surgeries (a term which included major things like hip transplants or minor heart operations), and hospitals are likely to get busier.

We also have a growing elderly population. 17% of Americans are over 65 years old; that was just 13% in 2010. As the country continues to age, that will all else equal increase demand for health care. As a consequence, I view it as a matter of when, not if, we return to the level of health care spending seen before the pandemic. Returning to the low end of 11.2% equates to another $150 billion in annual health care spending, which should translate to faster revenue growth for firms across the industry, including HCA.

With rising reimbursement rates and the potential for a recovery in health care demand, I believe HCA can generate mid-single digits revenue growth, and if wage pressures fall by just 1/3 from this year, a conservative estimate, margins should expand by 40bp. That combination will drive earnings growth of about 9%. Plus, the company’s share count continues to fall, reducing the denominator by another 5-7%. That means EPS growth should be about 15%, or $19.25-$19.5, leaving the stock with a forward P/E below 10x.

For a company that will benefit from a slowing labor market, has minimal cyclical exposure, and is an aggressive repurchaser of its stock, that is a compelling valuation. I am looking for shares to trade back to $250 or 13x earnings with a 7% free cash flow yield. At $200 or below, I would recommend buying HCA. It is a defensive firm with a trajectory to improve margins at a discount valuation.

Be the first to comment