J. Michael Jones

While there is a lot of back and forth among politicos and politically aligned economists around the definition of a recession and whether the United States is currently in one, we think it’s best to ignore the noise and instead focus on recession-proofing portfolios and portfolio holdings. One of the areas of the economy already starting to show signs of the American consumer straining under the weight of higher inflation is the retail sector. We have already seen teen retailers disappoint, think Abercrombie & Fitch (ANF) and American Eagle Outfitters (AEO), and everyone remembers the Target (TGT) fiasco that still seems to be playing out, so we think that even for the casual market follower, it is quite obvious that something is happening within the retail space.

So What Should Investors Do?

We think that investors, especially those who have to have exposure to retail, should focus on companies who have solid balance sheets, are generating cash today and have a decent amount of cash on hand with little to no debt. To be clear, when we discuss debt, we are referring to it in the traditional sense, not the new form of accounting which takes into account a company’s lease obligations. While the lease obligation line item can give you insight into the future annual costs of maintaining a business’s physical footprint, we think it clouds the picture on a company’s ability to navigate a recession.

The fact is that clothing stores are out. Retailers geared towards the teen crowd or trendy approachable fashion should be avoided. Instead, investors should focus on retailers with a niche that has minimal downside and can create cash flow during a rough period economically.

Haverty Fits The Bill

One name in the retail space we have found that looks like a solid candidate for recession-proofing the retail allocation of one’s portfolio is Haverty Furniture Companies, Inc. (NYSE:HVT). The company is a small furniture retailer based in Atlanta, GA that focuses on markets in the Southeast and a few in the Midwest. The majority of the company’s stores are located in some of the fastest-growing Southern states, such as Florida (30 stores), Texas (21 stores), Georgia (17 stores), North Carolina and Virginia (8 stores each).

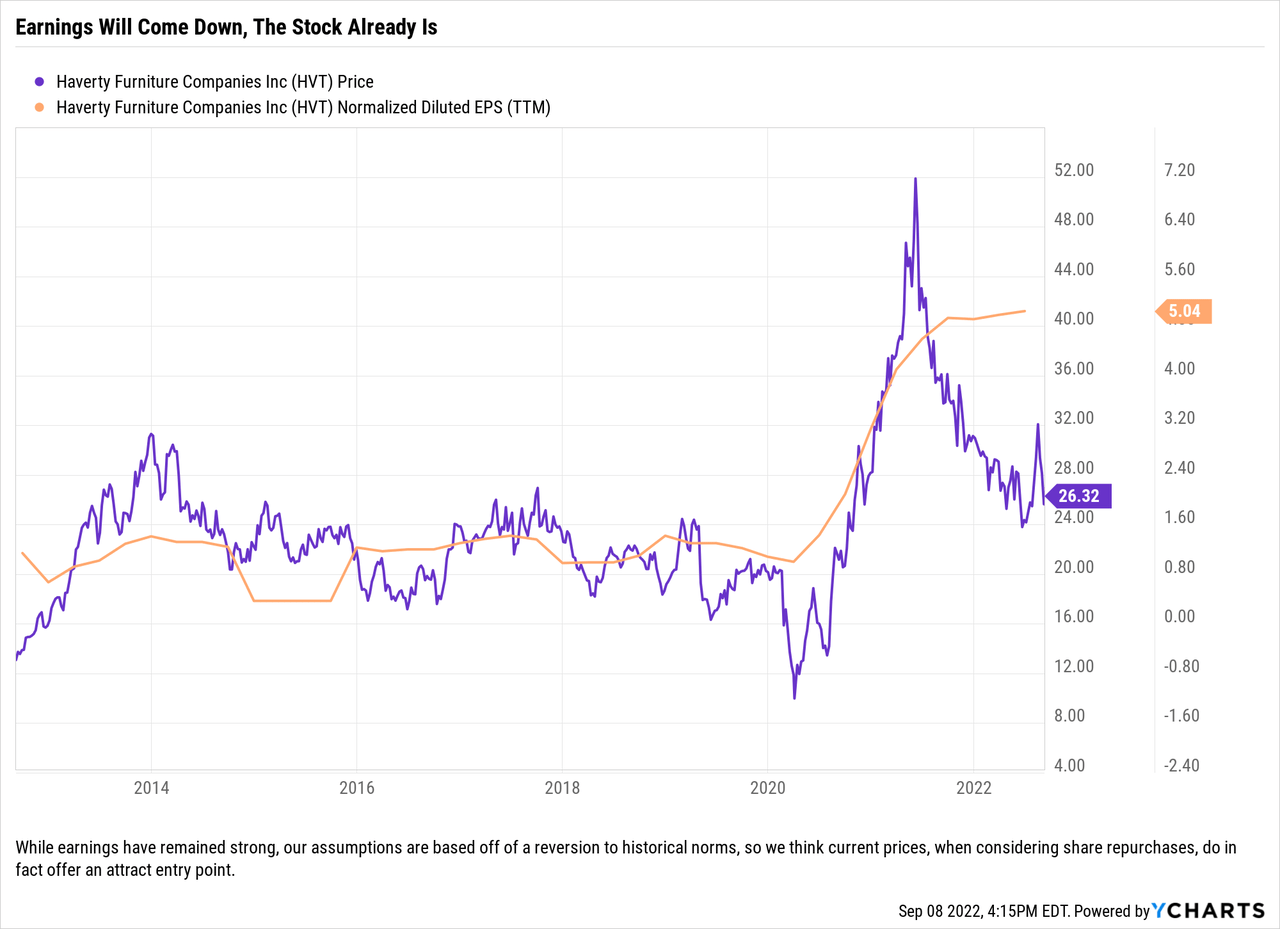

Haverty is a closely held company that has Class A shares (with 10 votes per share) that enable the founding family to control 75% of the board. The common shares get to nominate 25% of the board, but also get a dividend that is 105% the size of the dividend for the Class A shareholders. This is a nice perk, especially when the dividend has grown over 15% the last 5 years. The dividend yield of 4.28% (excluding special dividends) is quite respectable, and we think relatively safe based off of the company’s operating results over the last decade. The company had a rough patch during the housing crisis, to be sure, but if we are planning to get through a recession, we are pretty confident that the company can continue to cover the dividend based off of operating results and the number of shares that have been retired in recent years.

Shareholder-Friendly Capital Programs

Haverty’s management has run a solid capital allocation plan for years. The company has consistently raised their dividend over the years and has a history of paying a special dividend at least once every two years. The special dividend has actually increased up to $2/share (from the historic $1/share level) the last two times that the company has paid them (which were paid in back-to-back years) and investors should find out in the next 60-80 days whether the company will be issuing a special dividend for the current year. Our inclination is that they will and that this would get them back on their schedule of paying out special dividends in even years.

The company also approved a new authorization for its stock repurchase program to purchase up to $25 million in stock, continuing with management’s desire to refresh the program and keep it at $25 million. Since the start of 2020, the company has repurchased $86.5 million of its common shares and with the shares now lower it appears that they will be able to get a little more bang for their buck.

Strong Balance Sheet

The company ended the second quarter with $143.5 million in cash and cash equivalents with no long-term debt. Historically the company kept around $50 million to $80 million in cash on hand, which is why we think that the company can continue to repurchase shares and also pay out another special dividend this year. That would get them back into the top of their range and keep the balance sheet in tip-top shape.

Impacts Of A Recession

Looking at the company’s historical results, the recent share repurchases and the last few years’ worth of store openings and closings, we think that the company could very well still have EPS over $1/share during a Fed-induced recession. While the new housing market might very well disappear in a meaningful way, if people are unable to move because their house is a little underwater, or they would have to downsize because of the rise in interest rates, so they cannot move, there is the possibility that remodeling a room or two within a house and getting new furniture gets more attention. We know that this trend is already happening among some of our friends as they wait for general contractors to have time to do add-ons or wait for prices to retreat a bit from the amazing run over the last few years, so this could blunt any big blow from an economic downturn.

If the company can in fact remain profitable and maintain cash flows, we think the most pain shareholders might feel is an expiration of the share repurchase program as that is the one big luxury that has been added in recent years by management.

Closing Thoughts

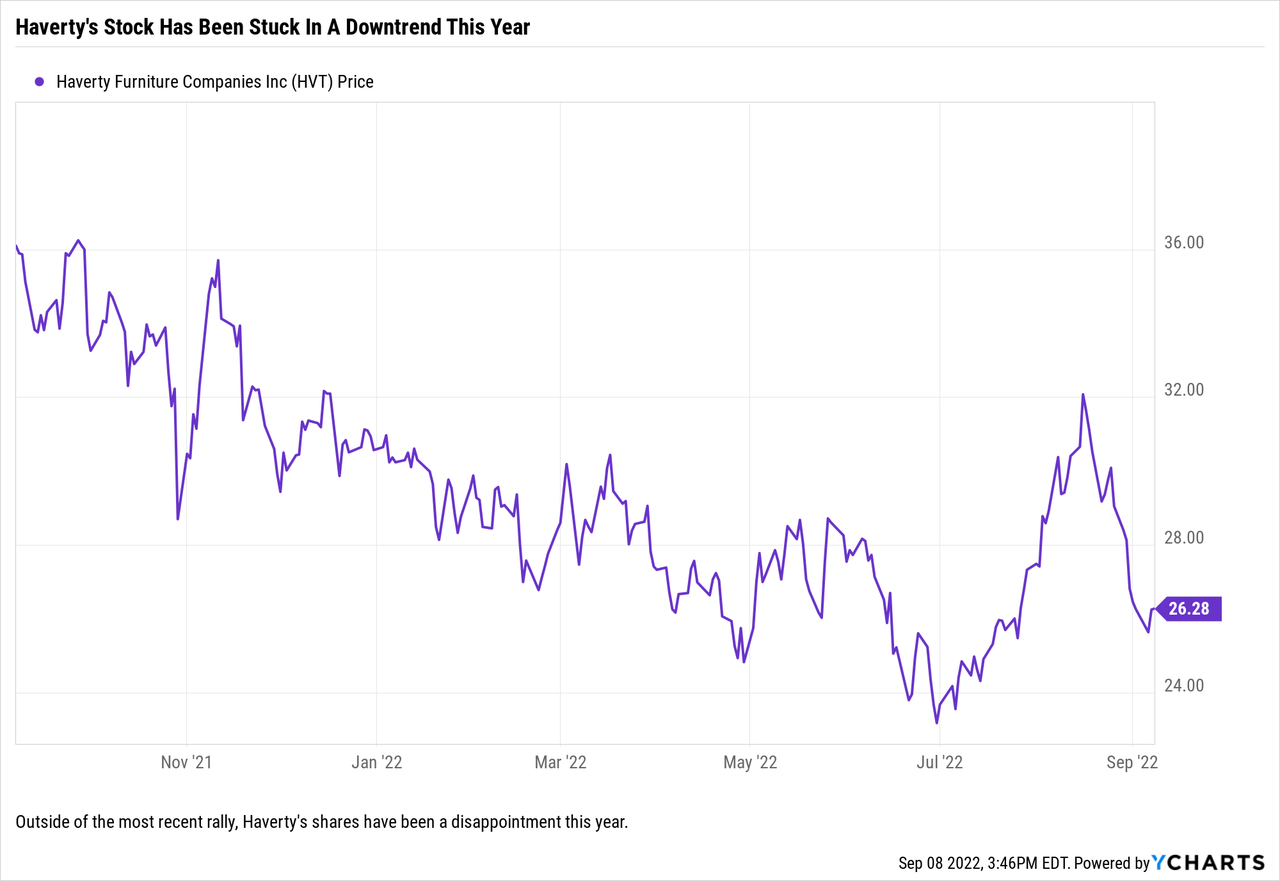

We actually like this name a lot and think from current prices that the worst-case scenario for a Fed-induced recession takes the shares down to $18-$20/share. The stock repurchase program provides some short-term insulation from volatility, but more importantly, we think that the dividend provides the best downside protection at these levels. There are a lot of levers that the company could pull if the economy got really bad, and that could include monetizing in some way the 40 store locations which are owned by the company. We are “nibblers” at current prices but would certainly get more aggressive were the stock to see a pullback towards the $20/share level.

Be the first to comment