metamorworks/iStock via Getty Images

Introduction

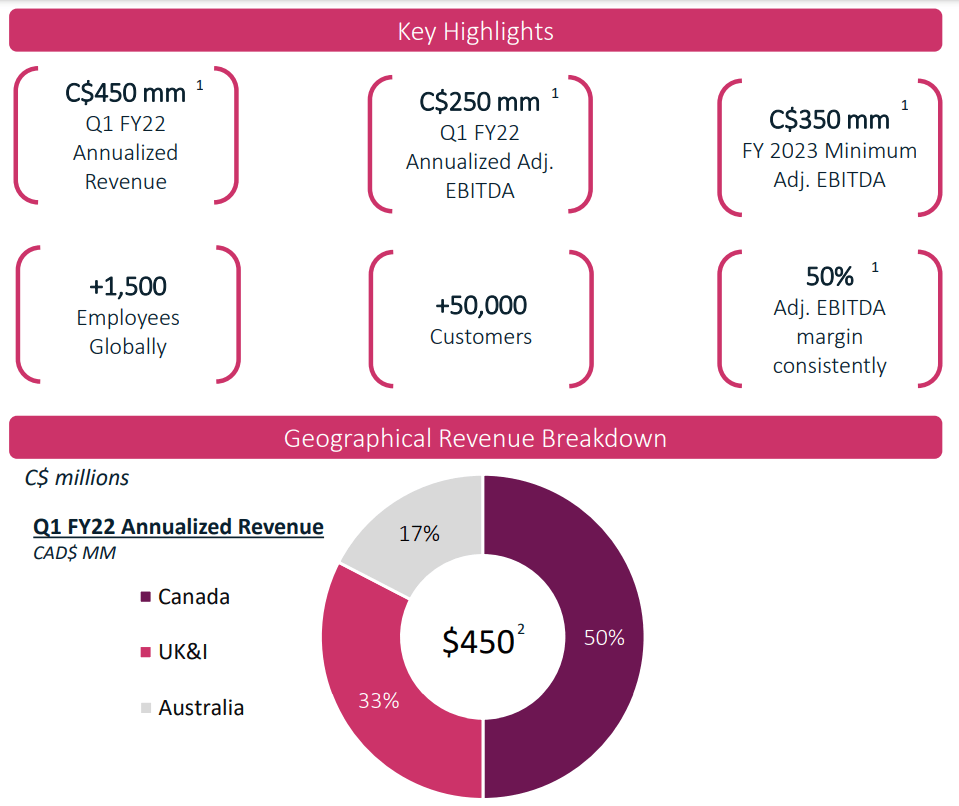

Dye & Durham (TSX:DND:CA)(OTCPK:DYNDF) is a Toronto-based and listed provider of professional service and regulatory compliance software, mostly for real estate, law, and public service sectors. The company also has exposure to payment systems, and this exposure will be increasing thanks to a coming acquisition. More on that later. First, I will discuss why Dye & Durham is an interesting play on the niche software market, and may be a better growth story than competitors such as RELX (RELX), who I have written on.

Link FY21 Annual Report

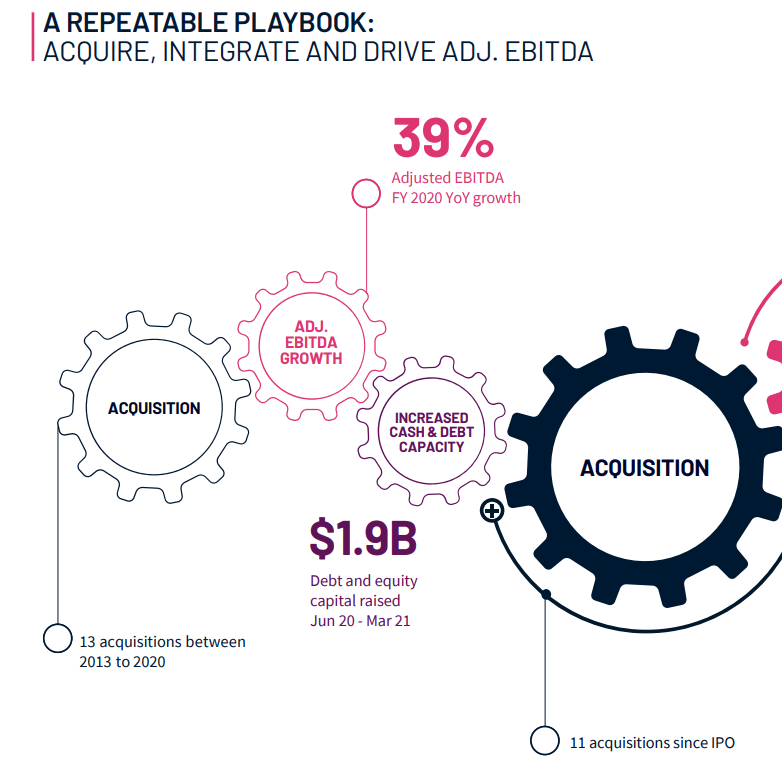

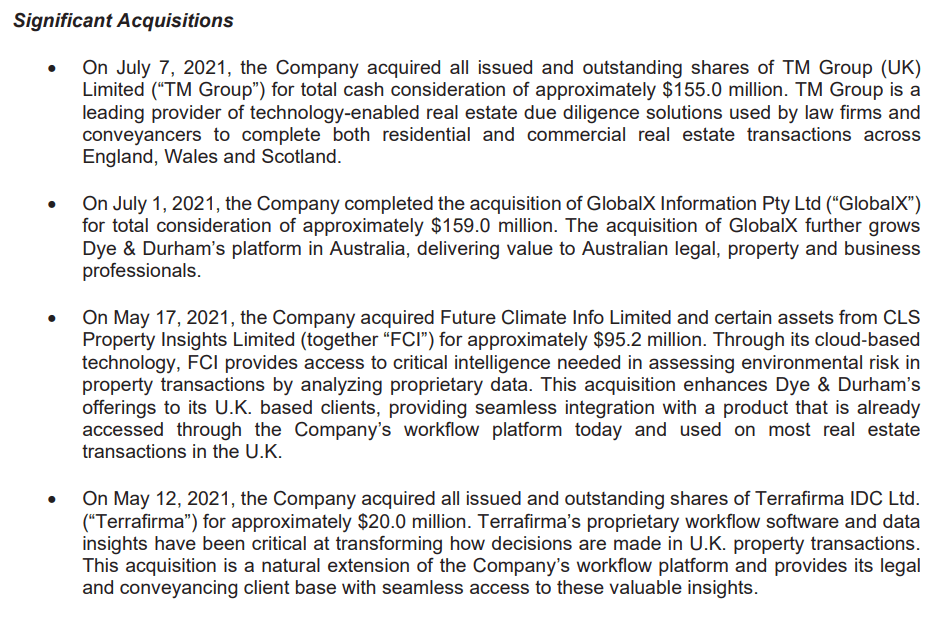

The name of the game for DND is bolt-on acquisition-driven growth. Between 2013 and 2020, the company performed 13 acquisitions and grew from a few million in revenues per year to over $300 million USD per year. DND uses advantages in broad platform offerings all in one cloud offering to drive recurring, or long-term contract, revenues. Also, high profit margins are also used to build up cash to acquire new businesses to add to the platform, increasing the enticement for potential users. Since a second IPO in the summer of 2020, the company has been on an acquisition spree adding over seven major acquisitions for more than $1.15 billion CAD. This business style has unique financial consequences, and I will discuss them in this article.

Link FY21 Annual Report Link FY21 Annual Report Link FY21 Annual Report

Financials

Dye & Durham is unique for US-based investors due to the fact that revenues are primarily derived from services offered outside the US, primarily Canada, the UK & Ireland, and Australia. While not a global endeavor, this contrasts with US and continental Europe facing Thomson Reuters (TRI) and RELX. At the same time, organic growth is not quantifiable as nearly all growth is derived from recent acquisitions. However, adding all these new customers from each new subsidiary allows for future recurring revenue growth per user, an important metric to watch moving forward.

DND Annual Report

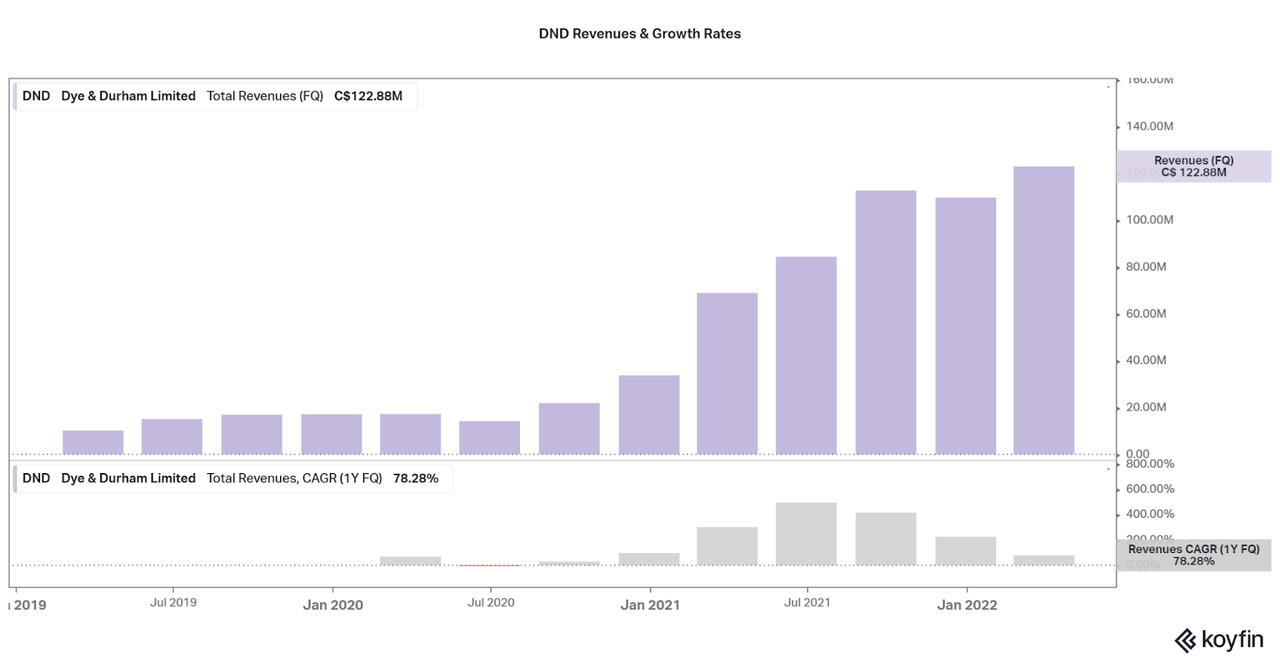

The significant acquisition-fed inorganic growth is visible in a quarterly revenue chart. Just six short quarters ago in late 2020, Dye & Durham saw only C$20 million in revenues that quarter. Now revenues are 6x that amount at C$122 million, investors can see the benefits of multiple acquisitions. This accounts for YoY growth rates between 75% and 400%, all while the share price has only risen 50% from IPO in 2020. The current valuation will be important factors when considering the company, and I will discuss these metrics later in the article.

Koyfin

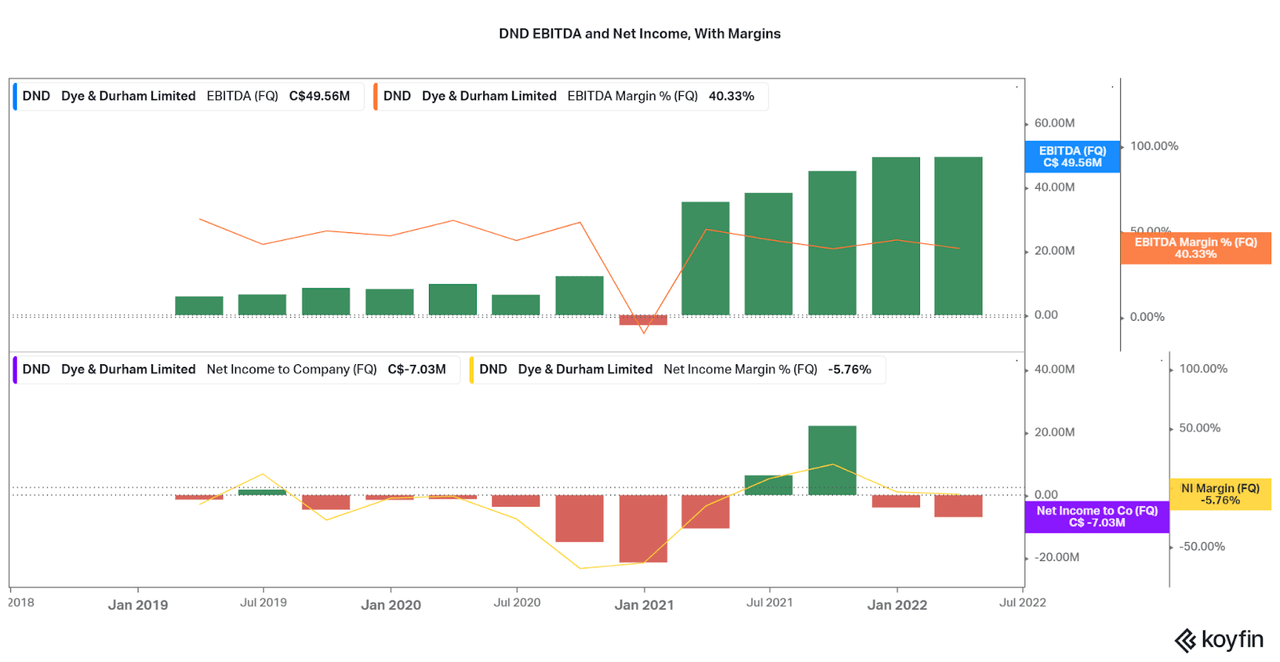

Along with the rise in revenues comes a swift rise in EBITDA. The current EBITDA of between C$40 and C$50 accounts for EBITDA margins of 40-45%, quite high even for software providers. However, cracks begin to form when looking at Net Income as we can see that all profits are going towards investments. Although when the time come, the company can easily scale back on investments and offer consistent and significant net income growth for investors. The question will be when does the company transition from bolt-on growth to margin expansion.

With a large acquisition lined up for the end of 2022, and lofty goals of C$1 billion in annual EBITDA, I do not expect this pattern to subside soon. This is viable for investors as long as the profitability and balance sheet can support these investments. So far, strong gross and EBITDA margins allow for significant amounts of cash to be saved up each year, but now let’s look at the balance sheet.

Koyfin

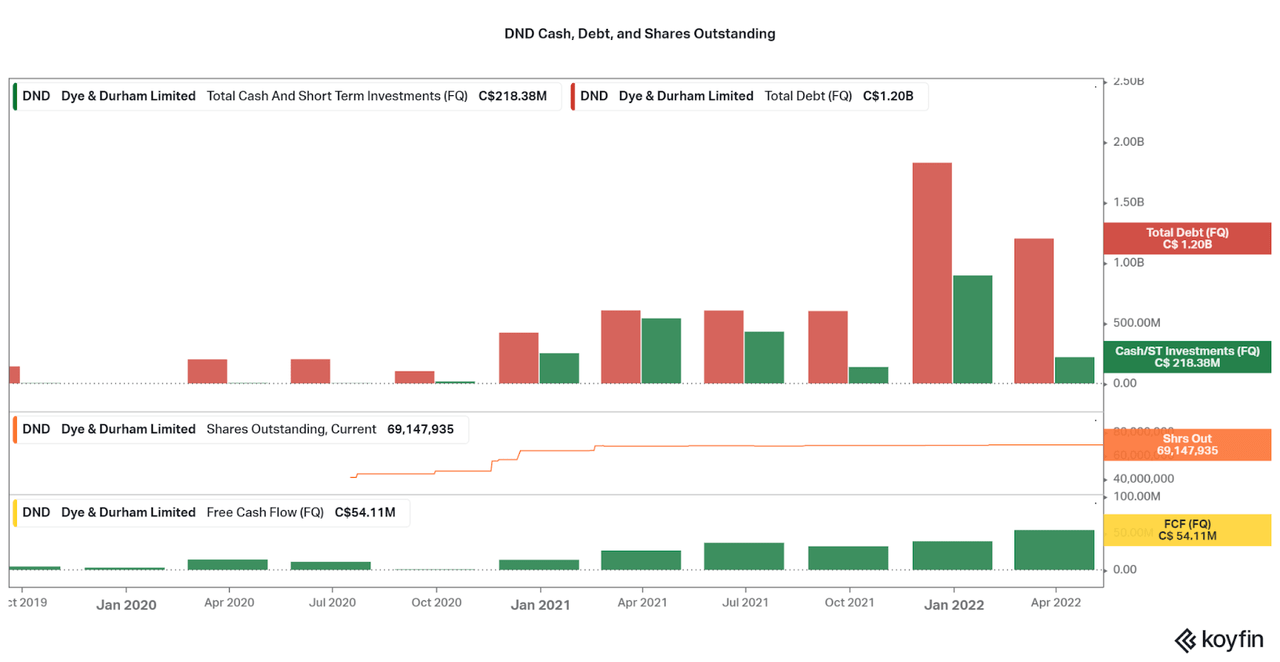

One risk to consider for the investment is that much of the cash required for these recent acquisitions has been supplied by debt and dilution. While dilution has calmed down since late 2020, shares did double in that short time after IPO. Recently, the company has issued over C$1 billion in debt rather than issuing new shares. While this favors investors, indirect risks associated with the increased leverage are also detrimental.

This means that investors must look forward to sufficient profit margins to be able to pay off this debt, and also grow fast enough to negate the effects of interest rate costs. As such, the company is fairly risky and investors must rely on the managing skills of the leadership. I tend to avoid gambling on a single factor such as this.

Koyfin

From Bolt-On to Transformative

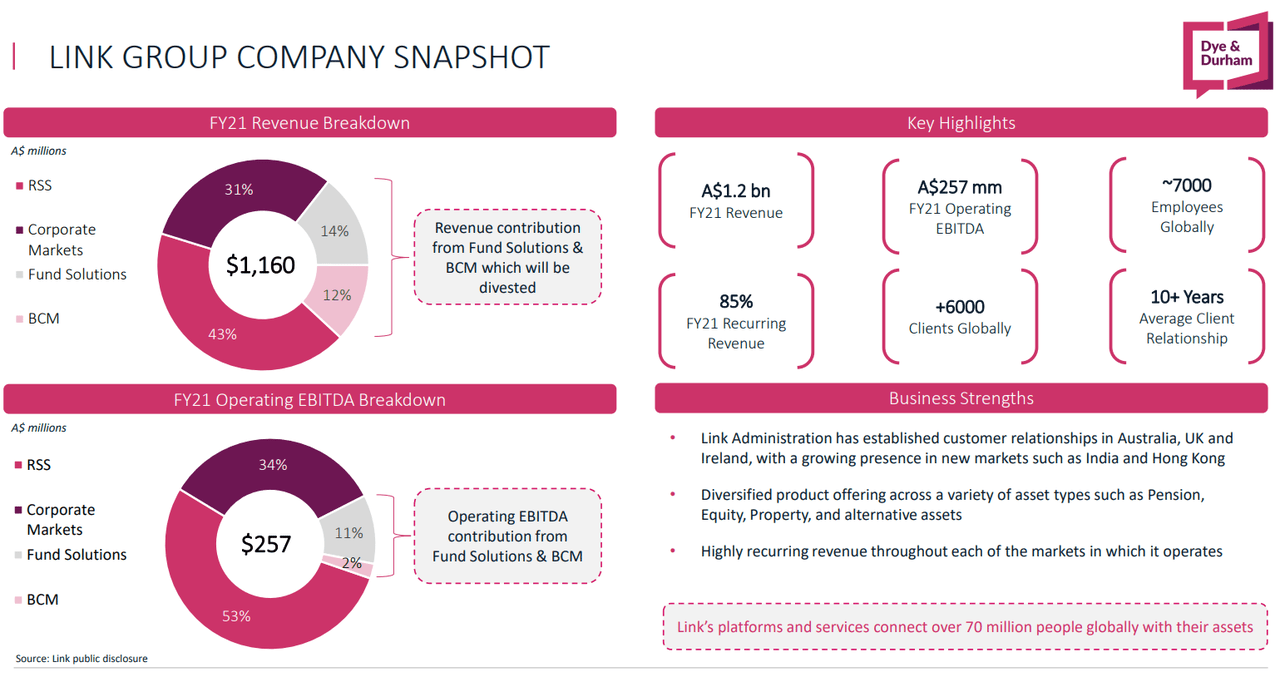

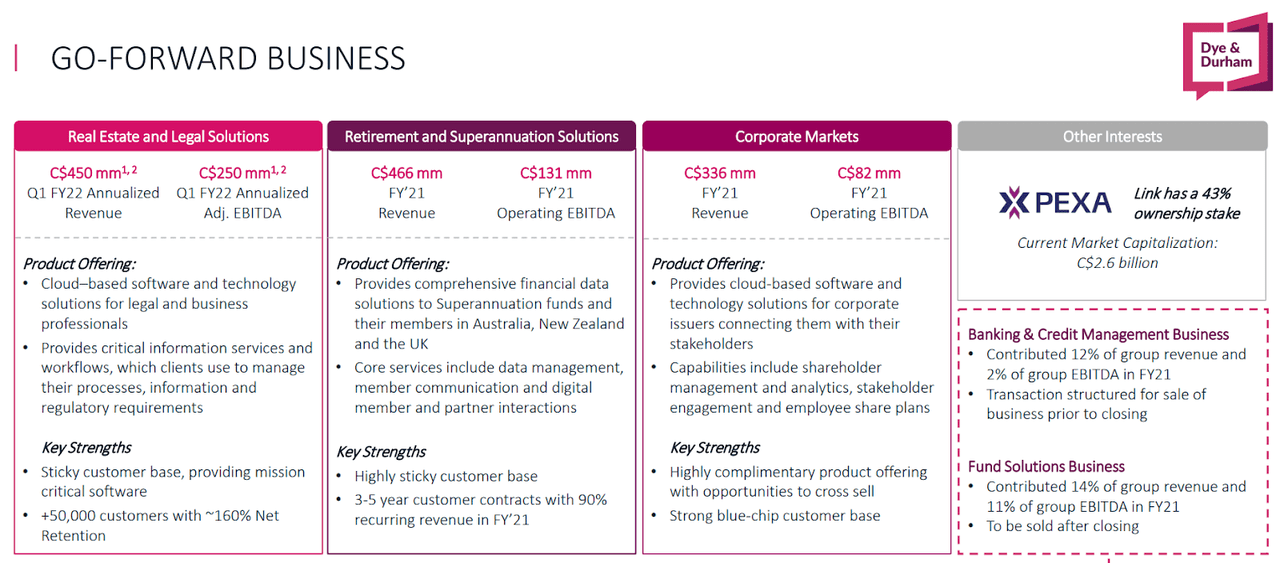

A recently announced acquisition is quite the change for Dye & Durham. The company announced the acquisition of Link Holdings, an Australia-based provider of a range of financial services, particularly for pension and retirement solutions. The recently revised offer is now around A$2.5 billion, or C$2.3 billion. DND will be issuing more debt to fund the purchase, and it will be far more transformative than bolt-on in nature. The acquisition also comes with some risks that will influence the joint company outlook.

Dye & Durham and Link Group have agreed to amend the proposed transaction’s scheme implementation deed (“SID”) to reflect a reduced base consideration of A$4.81 per Link Group share in an all-cash offer.

Link Acquisition Presentation

Most importantly is the balance between a huge increase in yearly revenues, but far lower profitability. To combat this, DND is looking to sell off fund solutions and banking segments as a way to drive profitable growth. The combined company will be far more diverse in terms of offerings, and the value proposition is that this will increase recurring revenues and revenue per user metrics moving forward. Unfortunately, the new DND will have less profitability to pay off the significant levels of debt, so any issues arising from bringing the two groups will hurt the prospects.

The only good point of the acquisition is the cheap purchase price. With no growth moving forward, the acquisition cost would take ~8 years to pay off in terms of current Link EBITDA. Based on Link’s historic growth, which is quite poor (see growth chart below), DND is taking a huge risk in expecting a turnaround for the lagging business. This adds even more importance to the need for a successful turnaround.

Investors must be incredibly careful when considering the growth moving forward, especially when considering what synergies can be found when real estate and legal solutions are mixed with retirement, pension, or corporate market solutions. I see little cross sell, but I am sure the management knows more than me. Just look for DND to pass on operation efficiency to improve margins at the least. Either way, new leverage issues and the higher probability for dilution are also reasons to be wary.

Link Acquisition Presentation

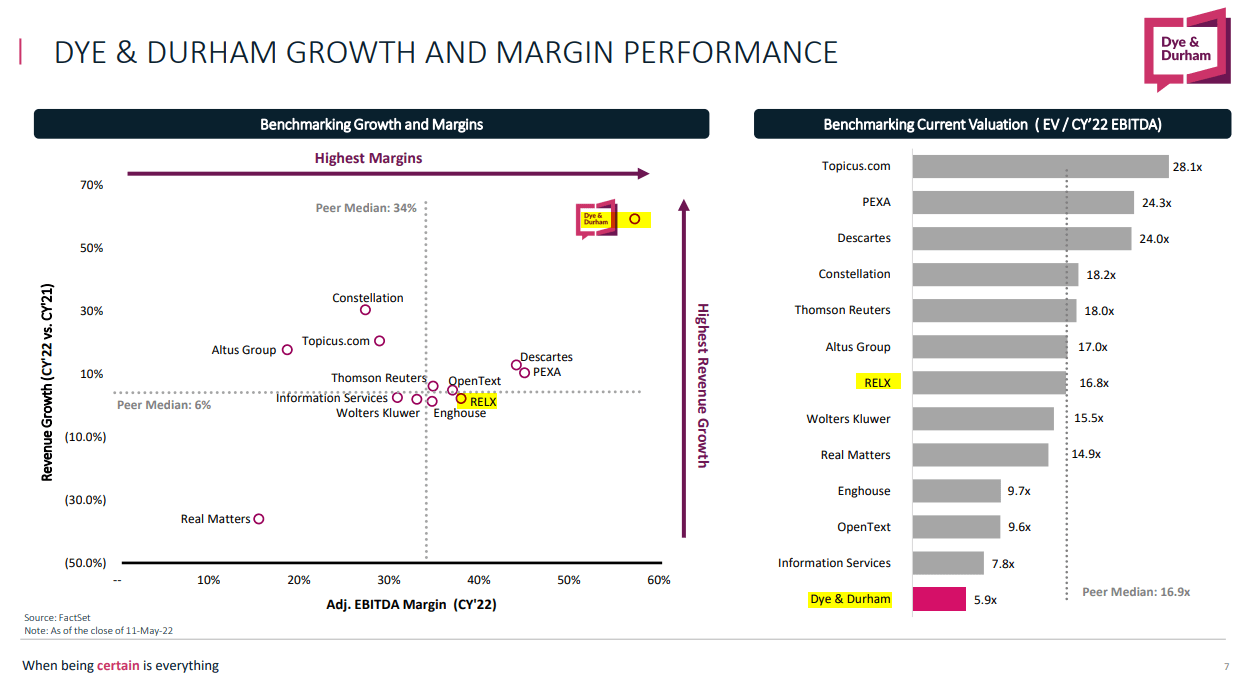

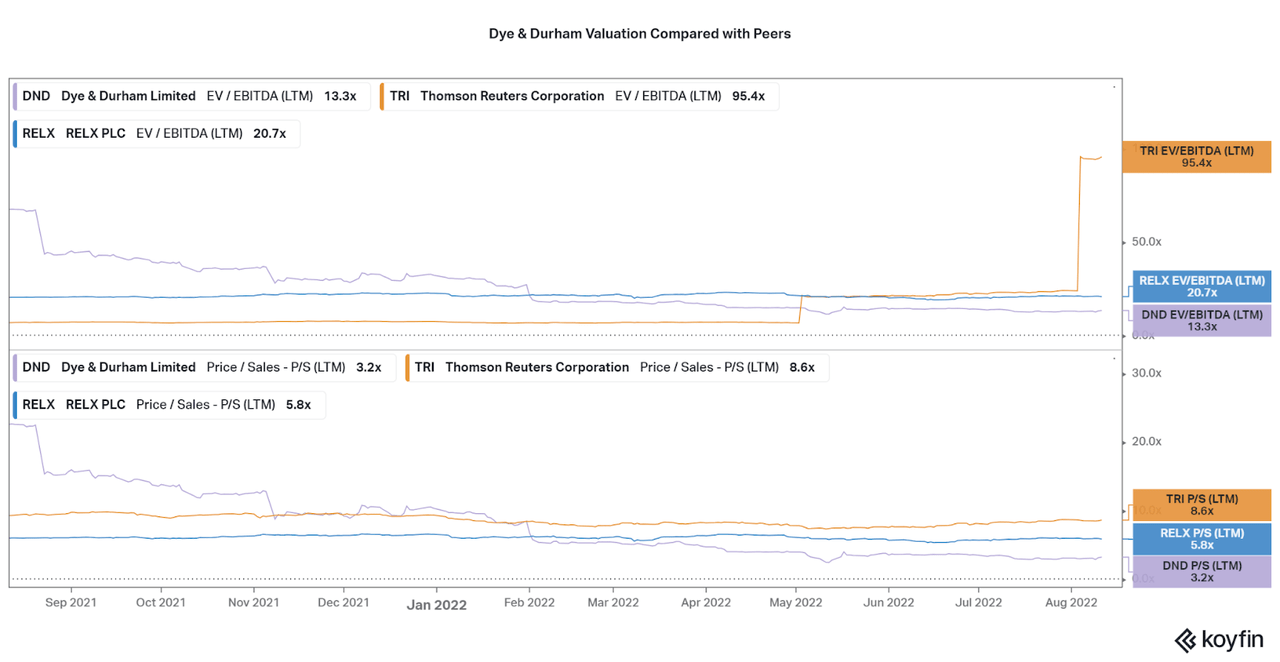

Cheap for a Reason

As a result of a sell-off and dull expectations for the coming acquisition, Dye & Durham now sees one of the lowest valuations in the industry. If considering conservatively managed bolt-on acquisition-driven growth and high profit margins, I would say the current price is a steal. However, the risks associated with the Link acquisition are now reflected in the share price. Due to the nature of the industry, bolstered by the strength and stability of Reuters and RELX, I would stick with those names rather than face undue risk when investing in DND. I believe that the share price will remain low while investors mull over the performance of the Link acquisition, and only if shares get much cheaper would I begin thinking the risk/reward was viable.

DND Investors Presentation Koyfin

Conclusion

The balance between risk and reward is always a fine line to tread, tough to balance, and difficult to assess. While DND offers a unique growth story in a typically slow moving professional services industry, I believe they have bit off more than they can chew with the Link acquisition. Therefore, I will remain on the sidelines and encourage others to do the same. I hope this article leads you to think twice about pouncing on the high growth low value name, and consider the growing risks. I just wish the company kept to the bolt-on strategy rather than Link, as the story would be much different.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment