Charday Penn

A Quick Take On HashiCorp

HashiCorp (NASDAQ:HCP) went public in December 2021, raising approximately $1.22 billion in gross proceeds from an IPO priced at $80.00 per share.

The firm provides IT cloud infrastructure capabilities for organizations worldwide.

Until management makes meaningful progress toward operating breakeven, I’m on hold for the stock, although the company’s other performance, such as its uncommonly high retention rate metric, is a bright spot that warrants its inclusion on a watch list for future consideration.

HashiCorp Overview

San Francisco, California-based HashiCorp was founded to create a range of infrastructure services (IaaS) for cloud IT deployments for the purpose of simplifying and automating IT operations.

Management is headed by Chairman and CEO, David McJannet, who has been with the firm since July 2016 and was previously VP of Marketing at GitHub.

The company’s primary offerings include:

-

Terraform – provisioning

-

Vault – security

-

Consul – networking automation

-

Nomad – orchestrator

- Managed Services

The firm pursues larger customers through a direct sales group and mid-size and smaller firms through self-serve or managed offerings.

HCP also has developed an extensive network of cloud service providers and independent software vendors and integrators that work with the company to broaden its reach.

HashiCorp’s Market & Competition

According to a 2021 market research report by Research and Markets, the infrastructure as a service market (IaaS) is expected to grow by $136 billion from 2021 to 2025.

This represents a forecast CAGR for the period 2021 to 2025 of 27%.

The main drivers for this expected growth are the continued transition of enterprises to cloud applications and the need to drive efficiencies across all aspects of the enterprise.

The IaaS market is also expected to benefit from continued developments in container technologies and as enterprises continue to embrace container-based applications as a way to provide more robust and efficient scalability.

In addition, the development of “multi-cloud” solutions, offering the flexibility of running applications from multiple cloud vendors, will further drive demand in the IaaS market.

The increasing adoption of cloud technologies for mission-critical applications in sectors such as healthcare, finance, and government will drive further growth in the IaaS market.

Also, as companies transition to cloud infrastructures, their systems are becoming more complex and there is a substantial need for vendor reduction to improve integration and lower complexity.

In addition, the IaaS market is expected to be further strengthened by increasing adoption of cloud-native architectures, serverless computing, and artificial intelligence.

These technologies are expected to create a surge in demand for IaaS solutions as they are increasingly being used to optimize the performance of cloud-based applications.

Major competitive or other industry participants include:

-

Amazon

-

Microsoft

-

Google

-

Red Hat

-

CyberArk

-

VMware

-

IBM

-

In-house IT approaches

HashiCorp’s Recent Financial Performance

-

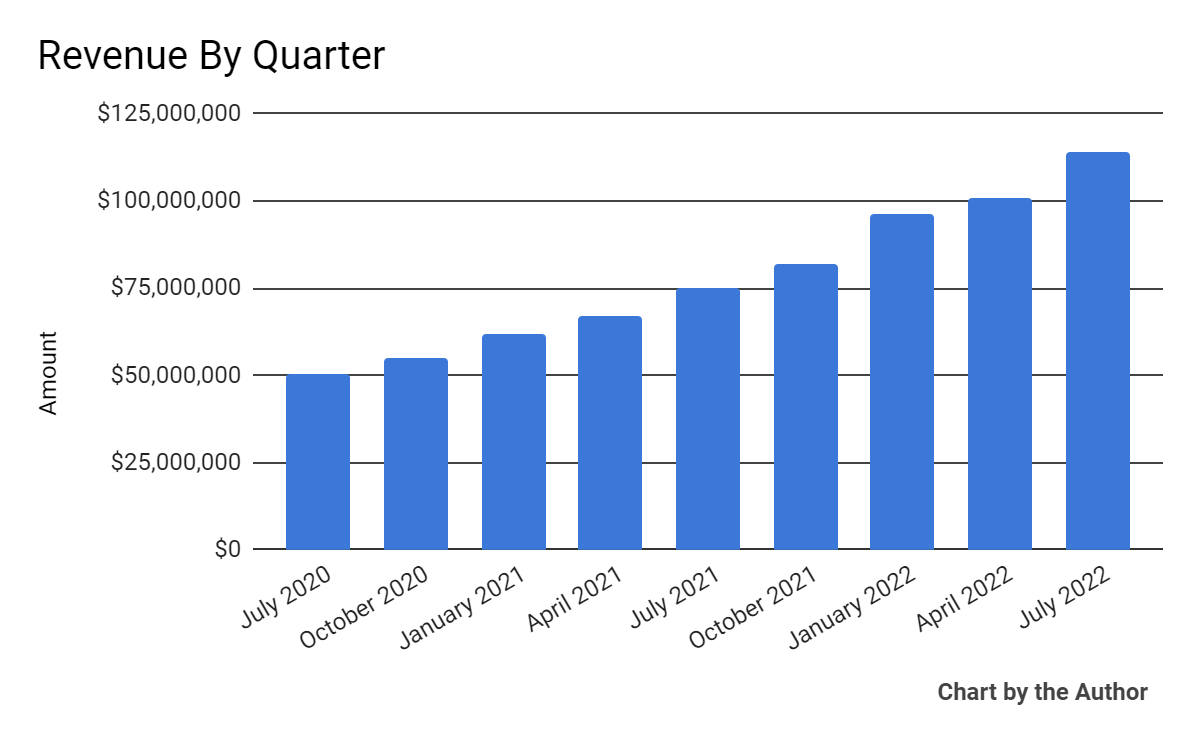

Total revenue by quarter has grown markedly in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

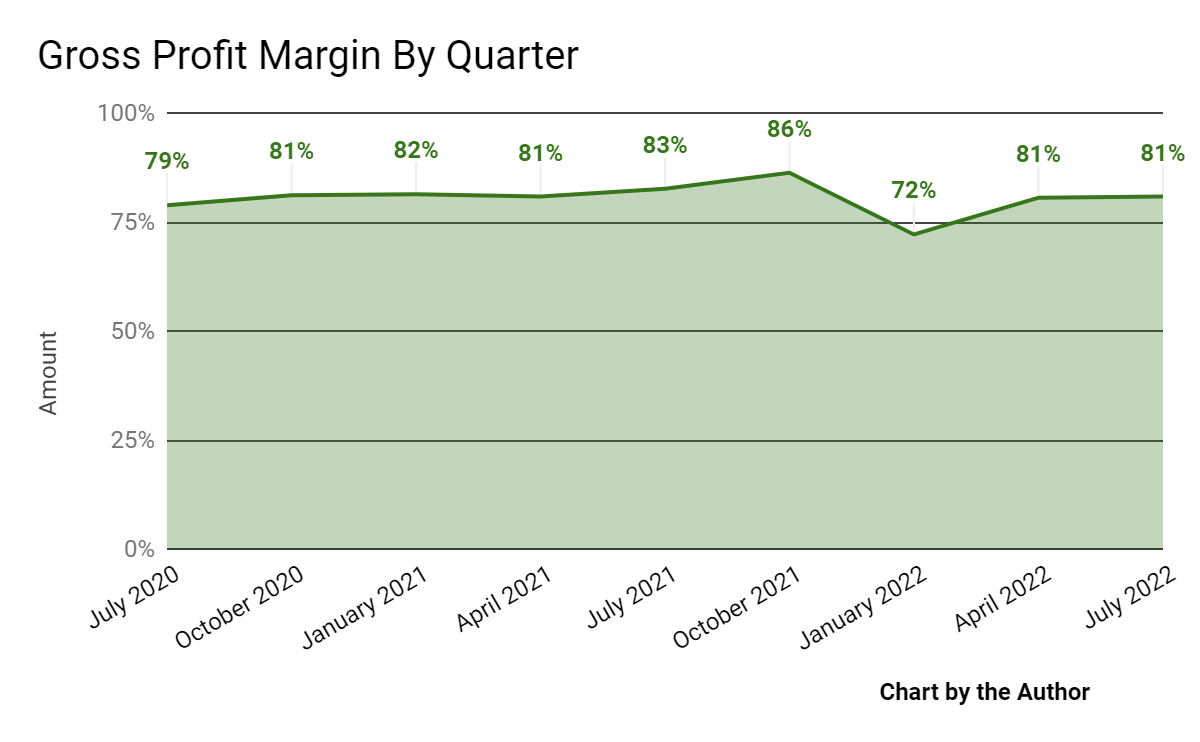

Gross profit margin by quarter has been under pressure recently:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

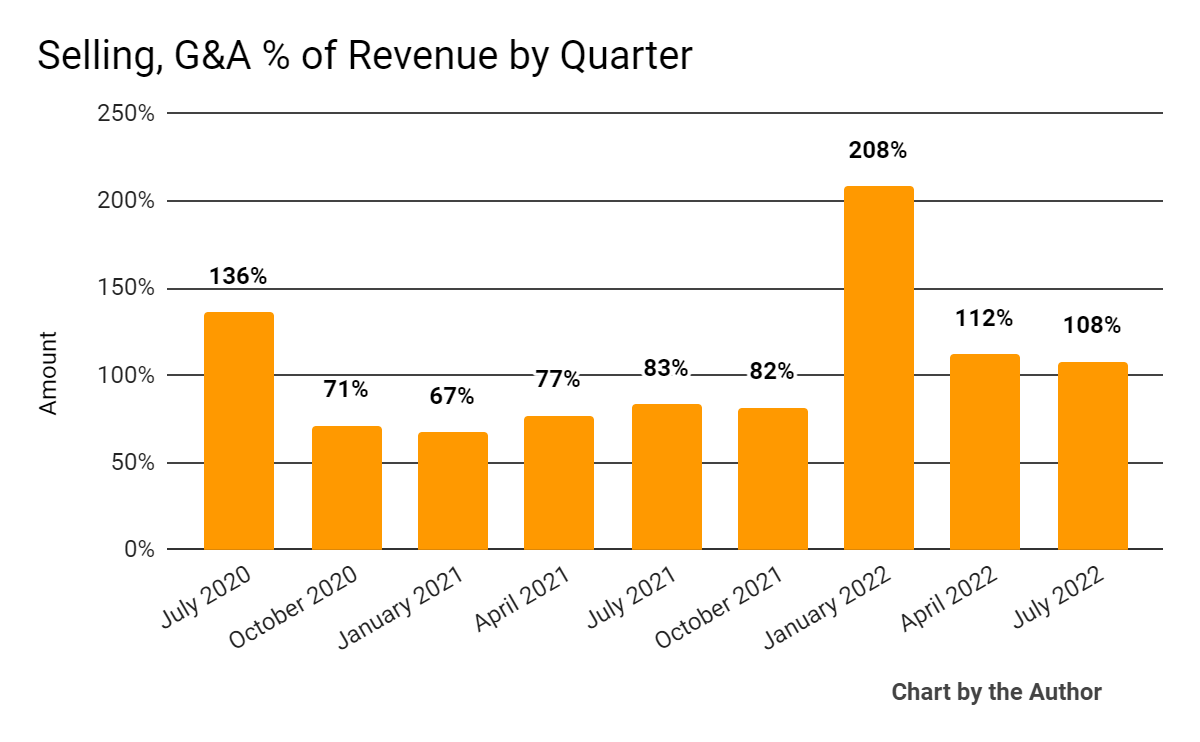

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in recent reporting periods:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

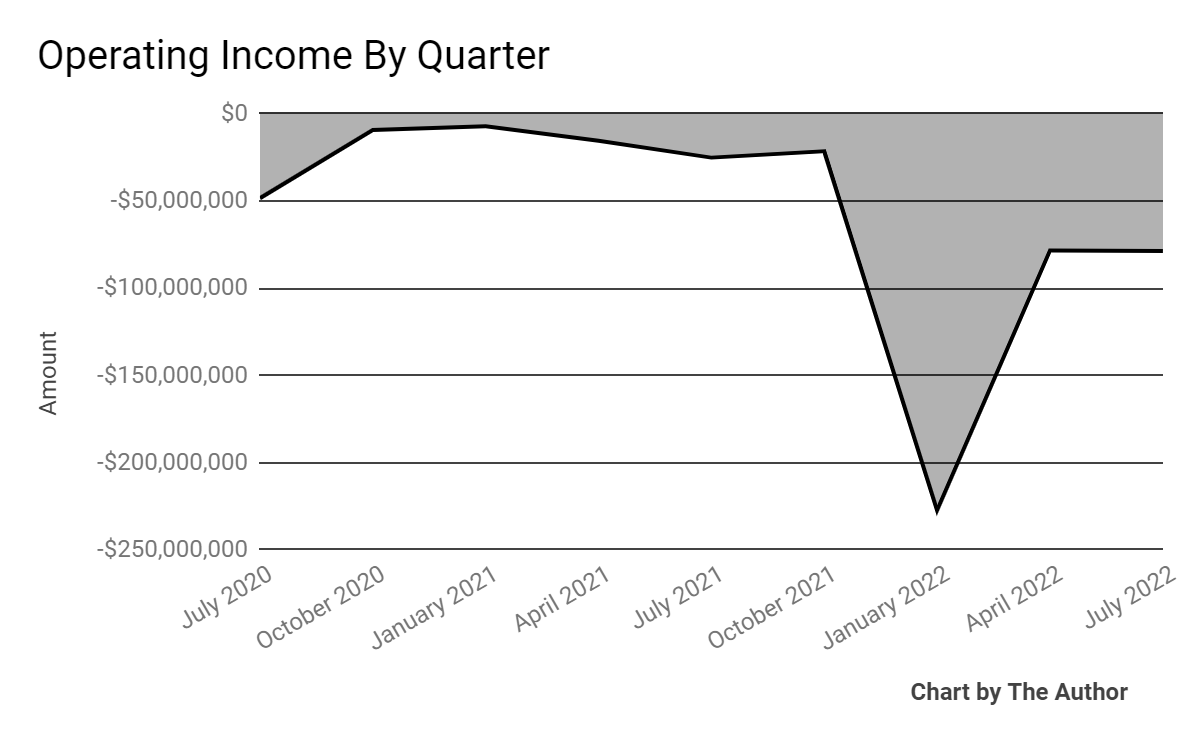

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

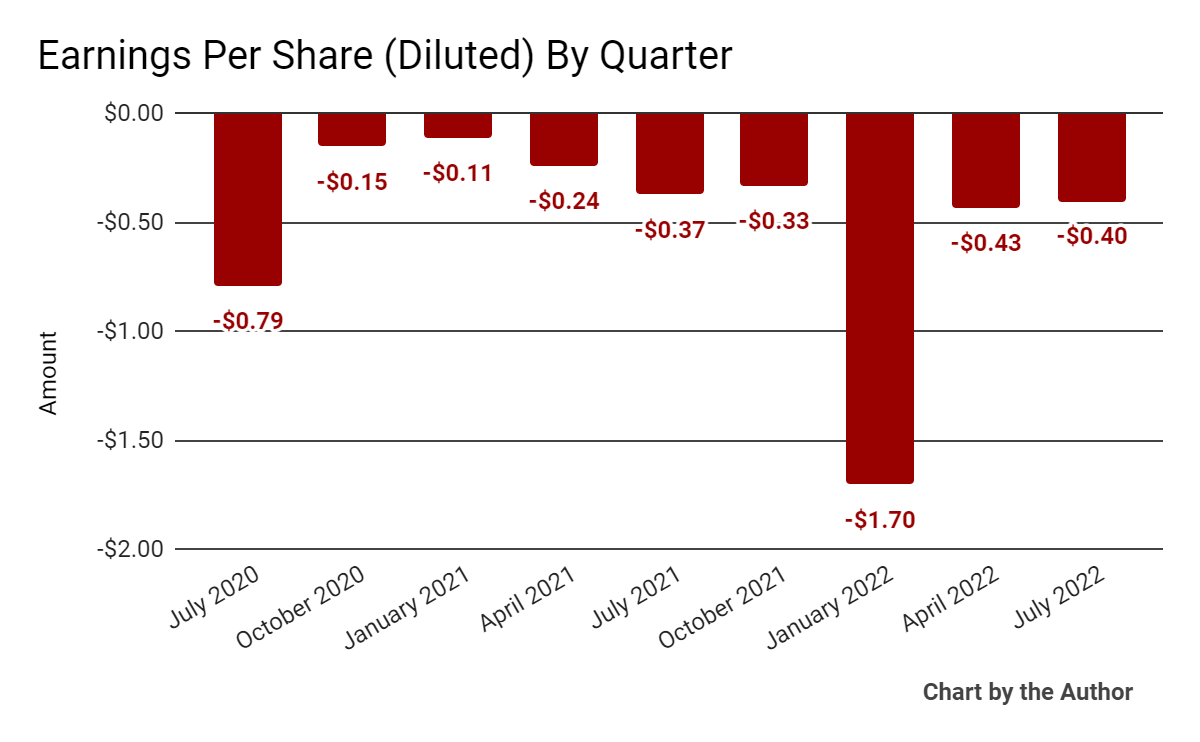

Earnings per share (Diluted) have remained substantially negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

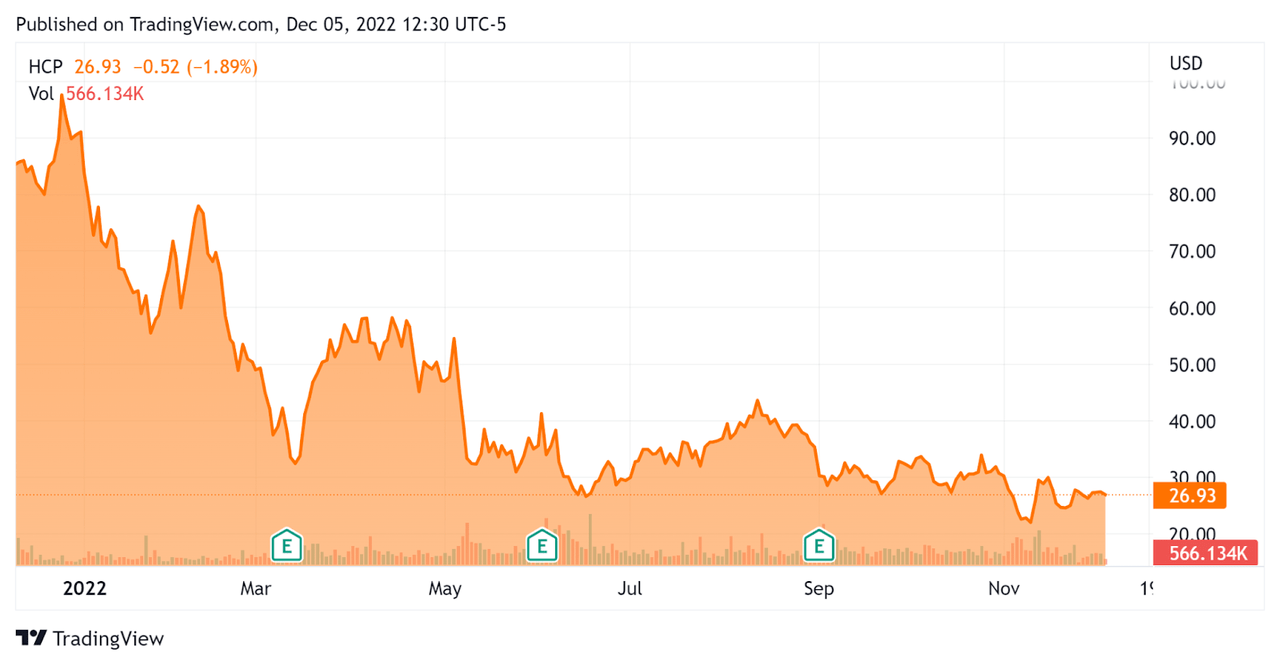

Since its IPO, HCP’s stock price has dropped 68.2% vs. the U.S. S&P 500 Index’s drop of around 12.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For HashiCorp

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

9.8 |

|

Revenue Growth Rate |

51.9% |

|

Net Income Margin |

-102.3% |

|

GAAP EBITDA % |

-99.5% |

|

Market Capitalization |

$5,120,000,000 |

|

Enterprise Value |

$3,840,000,000 |

|

Operating Cash Flow |

-$100,920,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.86 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

HCP’s most recent GAAP Rule of 40 calculation was negative (47.7%) as of FQ2 2023, so the firm performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

51.9% |

|

GAAP EBITDA % |

-99.5% |

|

Total |

-47.7% |

(Source – Seeking Alpha)

Commentary On HashiCorp

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted the addition of 30 customers with each representing at least $100,000 in annual recurring revenue.

Its current large customer base was 734 at the end of the quarter.

The firm is seeing growth from its newer managed offering, and management plans to continue adding new features and capabilities to the platform.

As companies transition from on-premises systems to the cloud, HashiCorp’s systems operate as the new ‘system of record’ for each layer of their IT stack, so once the company gains a customer, that customer tends to remain and add new capabilities as they move over to the cloud.

As to its financial results, topline revenue rose 52% year-over-year while non-GAAP remaining performance obligations (RPO) rose 48% to nearly $500 million.

The company’s net dollar retention rate was 134%, indicating very good product/market fit and high sales and marketing efficiency.

However, the firm’s Rule of 40 results have been quite poor over the trailing twelve-month period due to its high operating losses.

Gross profit margins have been under pressure in recent quarters while SG&A as a percentage of revenue has risen markedly, resulting in high operating losses.

However, management said it is transitioning to a period of ‘improving operating margin’ as it increases its focus on operating efficiency.

For the balance sheet, HCP ended the quarter with $1.29 billion in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was $101.2 million, of which capital expenditures accounted for just $200,000.

The company also issued $286 million in stock-based compensation, so it’s no surprise the stock has dropped markedly in the year since its IPO.

Looking ahead, management said they expect ‘some macro headwinds’ in the coming quarters and to reduce their previous investment levels.

For the full fiscal year ahead, the firm expects revenue of $445 million at the midpoint of the range and non-GAAP net loss per share of $0.96 at the midpoint, although the non-GAAP loss likely excludes stock-based compensation, which has been quite high historically.

Regarding valuation, the market is valuing HCP at an EV/Sales multiple of around 9.8x.

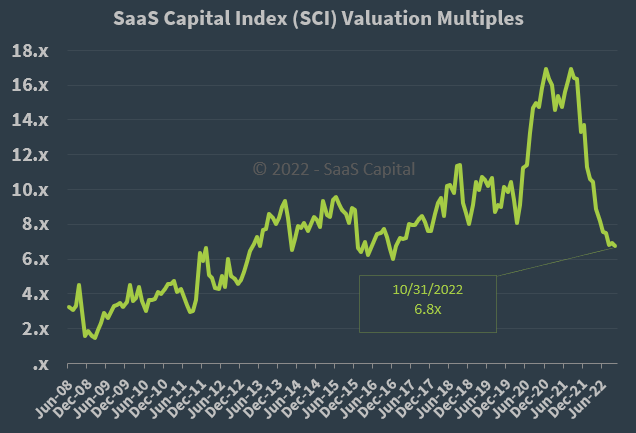

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at October 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, HCP is currently valued by the market at a premium to the broader SaaS Capital Index, at least as of October 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles, and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a ‘short and shallow’ recession and a reduction in the pace of interest rate hikes, resulting in a more favorable price multiple to the stock.

HCP has been beaten down since its IPO due to the firm’s worsening operating losses in a growing cost of capital environment.

Until management makes meaningful progress toward operating breakeven, I’m on Hold for the stock, although the company’s other performance, such as its retention rate metric, is a bright spot that warrants its inclusion on a watch list for future consideration.

Be the first to comment