Imgorthand/E+ via Getty Images

Investment Summary

We continue to locate selective opportunities within the broad healthcare spectrum in 2022. Lately, we’ve been closely watching Treace Medical Concepts, Inc. (NASDAQ:TMCI) and following its recovery off a published short report and its Q3 FY22 numbers. We’re here today to discuss our broad findings in the stock.

Net-net, TMCI’s Lapiplasty procedure is a key differentiator in our opinion that’s beginning to accelerate in adoption and surgeon preference. As TMCI builds momentum around this and its other orthopedic procedures, the market continues to reward the stock and we rate it a buy. We are seeking an initial objective to c.$32.

Key downside risks include that markets can take another downturn, the short-thesis gaining momentum resulting in large selling volumes, and/or the company substantially missing its growth percentages down the line. Moreover, if there’s any new safety concerns with the procedure, this is likely to hurt TMCI’s stock price as well. Investors should keep these risks front of mind if considering a position.

Key differentiator: Lapiplasty procedure

We believe the key differentiator for TMCI is its Lapiplasty procedure.

In order to understand what the procedure is, and its benefits, we have to first understand two biomechanical pathologies that occur in the foot. These are called metatarsus adductus (“MTA”) and hallux valgus (“HV”), better known as “bunions.”

Longitudinal and cross-sectional studies demonstrate that HV/bunions is/are the most common foot deformity in humans. Bunions affect the metatarsophalangeal [big toe] joint, and results in substantial pain and loss of functionality.

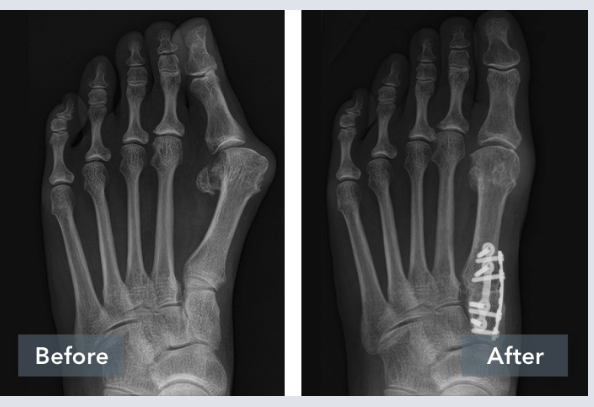

Basically, the big toe joint adducts [moves towards the body’s midline] whilst the remainder of the 1st ray remains rigid, thereby gapping the joint and producing a bony protrusion at the ball of the foot. You can seen an example of this in the images below.

Exhibit 1. LEFT: Example of hallux valgus / bunions, with the “big toe” adducting to the midline, with the ball of the foot rolling inwards. RIGHT: Same foot post Lapiplasty from Treace Medical.

Data: Treace Medical Website: “Lapiplasty Procedure”, retrieved from: https://www.lapiplasty.com/surgeons/lapiplasty-procedure/

The market is wide and growing for HV treatment, with 23% of adults aged 18–65 and ~36% of those over 65 presenting with the condition. Most commonly, it affects females, and/or those with “flat feet” – in other words, a lack of longitudinal arch support. Meanwhile, the global bunion corrective market is set to grow at CAGR 6.9% from FY23–30′.

In that vein, the major cause of the condition has been identified as footwear. Most predominantly, ladies footwear.

In particular, high heels and pointed-toe shoes have been identified as key culprits in the formation of the condition. As the condition progresses, the benefit of conservative treatment [physiotherapy, etc.] becomes futile and corrective surgery is required.

In the realms of treatment, outcomes are mixed and there’s a high chance of the condition reoccurring in more than 70% of cases.

Traditional corrective surgery is cumbersome and requires patients to be non-weight bearing (“NWB”) for roughly 8 weeks.

TMCI’s Lapiplasty is designed to address some of these procedural downfalls.

In particular, the recovery time appears shorter, with a NWB period of 2 weeks, whereas it’s been shown to maintain correction in 97–99% in 13–17 months respectively.

We believe this has the potential to create a remedial breakthrough in this otherwise complex segment, thereby disrupting conventional routes of treatment.

Recent Developments

The major update in the TMCI story is the short report posted by Culper Research (“Culper”) on November 15.

Culper was critical of TMCI’s operating model, citing that:

“[The] primary innovation has not been in any sort of medical advancements, but in aggressive reimbursement practices and deceptive DTC marketing.

We view these business drivers as problematic and self-defeating, as insurers appear to have begun placing Lapiplasty procedure reimbursements under scrutiny while customer complaints about misleading claims from Treace are mounting.”

As such, the firm believes there is downside risk in TMCI stock and has its short position made clear for the world to see.

Culper’s report is very heavy on detail, and we encourage investors to familiarize themselves with the contents of it to make the most informed decision possible.

After the report was released, investors sold TMCI stock and pushed it from $24 to $19 in the matter of 1 day. However, the market was exceptionally quick to price in the downside, with the stock finding a bottom immediately, before rallying back to its new highs. In the week following, TMCI also posted its Q3 FY22 results, spurring a reversion to the mean in its share price as well.

The question is, what merit does the short thesis have, and to what extent will it affect the stock?

Noteworthy, is that short interest in the name is 8.15%, yet, it has rallied to 52-week highs despite all the recent short attention.

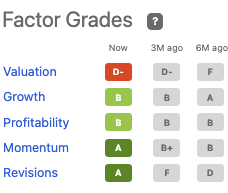

Moreover, TMCI is still rated highly on Seeking Alpha’s quantitative factor grading [Exhibit 2]. In particular, the change from 6 and 3 months ago respectively is a standout, in our opinion.

Exhibit 2. TMCI Seeking Alpha factor grades

Data: Seeking Alpha, TMCI quote page

Aside from the above, the company also advised that its SpeedPlate system. Simply, the system is a fixation platform that enables the Lapiplasty and Adductoplasty procedures to be performed using 2cm wide incision points into the forefoot and metatarsals.

Q3 results are indicative of market penetration

Turning to TMCI’s Q3 numbers, the company booked YoY revenue growth of 53% to $33.1mm. Of this, 74% was generated by the direct sales force. It ended the quarter with 143 reps, up 77% from the 81 direct reps last year.

TMCI sold 5,075 Lapiplasty procedure kits in Q3, up 44% from the year prior. It estimates it has penetrated 5% of the estimated 450,000 of bunion surgeries performed in the U.S. each year. That’s up from 3.5% a year ago.

It saw a 39% YoY growth in the number of surgeons using the system to 2,218. On a TTM basis, we note the company has ~10,100 kits per surgeon in the field, up from 10,000 the year prior. It is booking sales on this base at an average sale price of $5,794 per case, up 600bps YoY. It bought this down to quarterly OpEx of $37.7mm and a net loss of $0.22 per share, ahead of the consensus estimate.

Management revised guidance to $135–$138mm in revenue for FY22, calling for 43–46% YoY growth at the top. This adds to our buy thesis.

TMCI: market data

Given the volatility in forward earnings for TMCI, we’ve taken a deep look at its market and technical data to understand the market’s positioning in the stock.

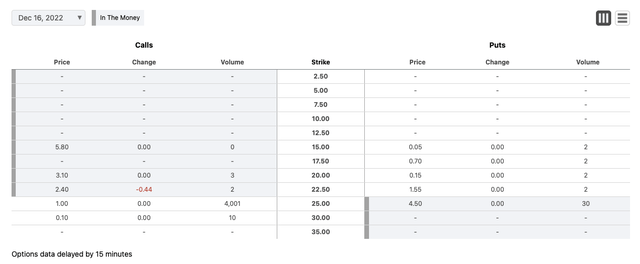

Looking out towards end of December and then March FY23, we see the option chain is stacked fairly evenly on both sides of the book. Investors are loading up on calls and puts in the name for contracts expiring December 2022, seen below.

Exhibit 3. TMCI options chain, December 2022 expiry

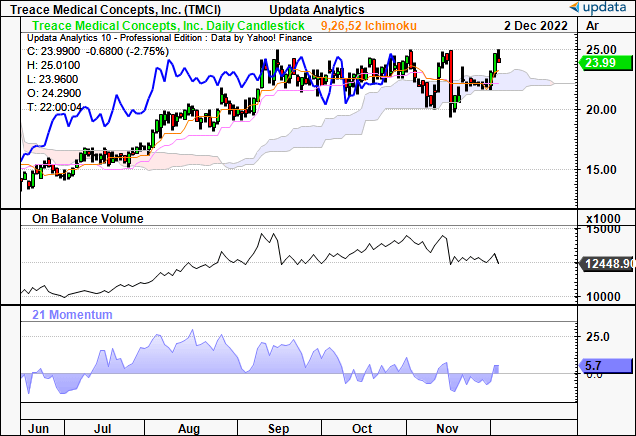

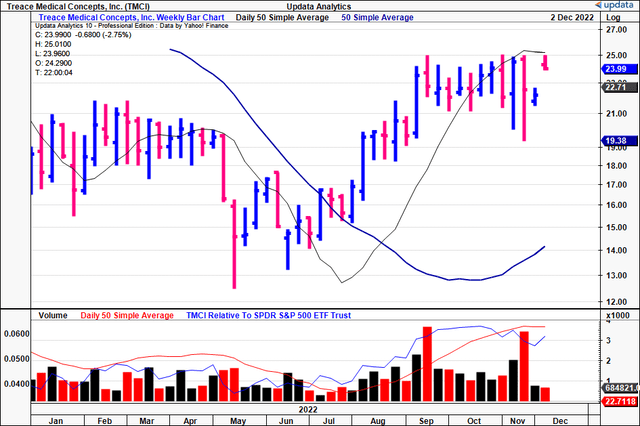

Moreover, the stock has rallied off its May highs and is now trading sideways for the last 11 weeks. However, whilst this has been the case, at the same time, the volume trend has been ascending.

The combination of sideways action with ascending volume is evidence of strong support, in our estimate.

The stock is now testing the 50DMA, and a breakout above the 50DMA would add another bullish thrust to the stock price in our estimation.

Exhibit 4. TMCI 2022 price evolution [weekly bars, log scale]

We’ve now got shares trading above the cloud and setting new highs, whilst on balance volume remains elevated in continuation of its longer term uptrend. Momentum has settled to lower levels, however.

Exhibit 5.

Data: Updata

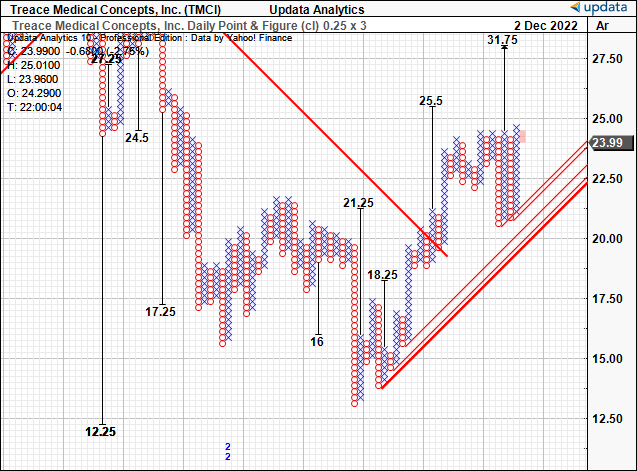

As such, we have technically-derived price objectives to $31.75 [Exhibit 6]. The stock is trading well off its lines of support, and we look to this level for our next objective in the stock.

Exhibit 6. Upside targets to $31.75.

Data: Updata

Conclusion

Net-net, we rate TMCI a buy on its differentiated core offering, the Lapiplasty and Adductoplasty procedures, that we feel have the potential to create a remedial breakthrough in the segment. We see accelerated adoption from physicians and user accounts already, and are seeking an initial objective of $31.75 in Treace Medical Concepts, Inc.

Be the first to comment