SolStock

The market-wide sell-off has allowed me to establish positions in wish list tickers and add to some of my favorite positions. In addition, the indiscriminate selling stress has unearthed countless small and mid-cap healthcare tickers that offer attractive risk-reward profiles. Harvard Bioscience (NASDAQ:HBIO) is a small-cap life-science technology company that is trading a significant discount after dropping ~70% over the past twelve months despite significant upside potential. I believe the market has taken the selling too far and provided me with an opportunity to add to a minuscule position and make HBIO a larger element of my Compounding Healthcare “Bio Boom” Portfolio.

I intend to provide a brief background on Harvard Bioscience and its recent performance. Then, I discuss why I have HBIO in my Bio Boom Portfolio. In addition, I point out some notable downside risks that investors should consider. Finally, I reveal my strategy for managing my HBIO position.

Background On Harvard Bioscience

Harvard Bioscience is dedicated to developing, manufacturing, and the commercialization of the technologies, products, and services used in R&D and pre-clinical testing for drug development. Harvard Bioscience is basically divided into two segments which are Cellular and Molecular Technologies “CMT” product, and Pre-Clinical products. The company markets its products through their sales organizations and through distributors to the healthcare industry, universities, hospitals, and institutions both in the U.S and internationally.

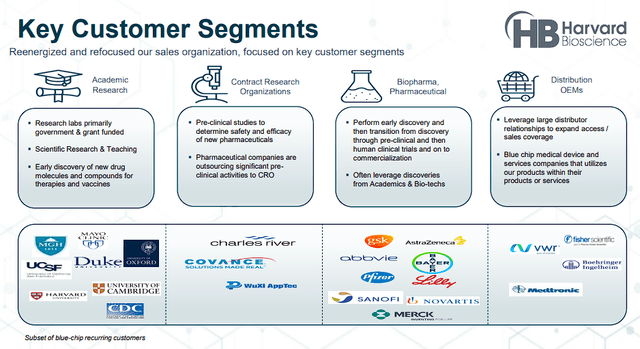

Harvard Bioscience Customer Overview (Harvard Bioscience)

Their CMT products are instruments for tissue and organ-based lab research including gene therapy and small molecules. The company’s CMT products include syringes, peristaltic pumps, infusion systems, spectrophotometers, microplate readers, amino acid analyzers, gel electrophoresis equipment, electroporation equipment, and electrofusion instruments.

The Pre-Clinical products are intended to help analyze laboratory data for drug research. These products include telemetry and inhalation products, which include the required sensors, components, and software for the tests.

Recent Performance

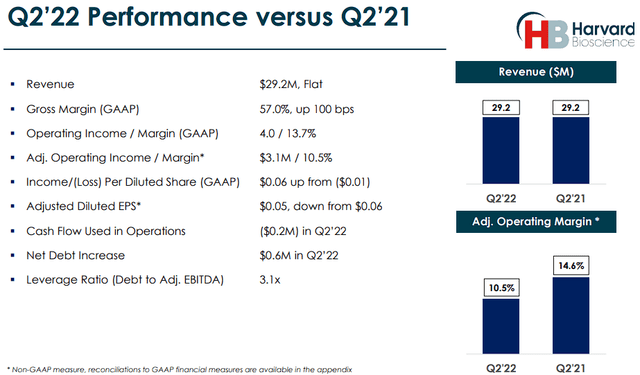

In Q2, the company’s revenue was flat at $29M with CMT rising 17%, but Pre-Clinical dropped 9%. The company reported that CMT is transitioning to higher-margin products from direct sales, which is driving growth.

Harvard Bioscience Q2 Performance (Harvard Bioscience)

The Pre-Clinical segment’s drop was most associated with a $0.9M currency impact, along with delays from China attributable to COVID-19 shutdowns. In addition, the company reported an impact on margins due to inflation and rising freight costs. In order to counter these issues the company has attempted to reduce OpEx and cut obsolete non-strategic product lines.

In terms of cash, the company finished Q2 with roughly $4.2M in cash and cash equivalents.

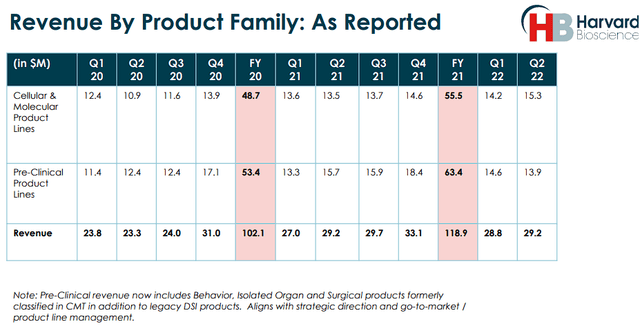

Harvard Bioscience Revenue by Segment Since 2020 (Harvard Bioscience)

Overall, the company has reported respectable growth over the past couple of years and is on track to report additional growth for 2022 despite significant economic headwinds. In fact, the company is still expecting to report 1% to 5% growth in Q3, with gross margins improving to roughly 58%. What is more, they are projected to report positive free cash flow and net debt reductions in the second half.

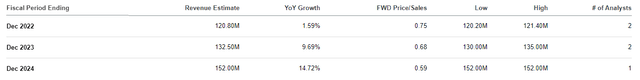

What is more, the Street is projecting Harvard Bioscience to hit roughly $121M this year and will experience double-digit growth through 2024.

Harvard Bioscience Revenue Estimates (Seeking Alpha)

Bio Boom Candidacy

The Bio Boom Portfolio is an assembly of healthcare tickers that are speculative, however, they offer substantial upside as a result of a potent upcoming catalyst, projected revenue growth, or a potential turnaround. Normally, these are small to mid-cap companies with volatile tickers that will offer cyclical trading opportunities to help extract considerable profit while mounting a “house money” position for a long-term investment. These tickers will be traded on condition that it remains “in play” or the company advances to my Bioreactor Portfolio.

For HBIO, I am considering the ticker’s valuation, growth metrics, and buyout potential. Primarily, I am looking at HBIO’s valuation, which I believe is a significant discount based on multiple metrics and models. Principally, HBIO is trading below 1x forward price-to-sales (0.75x) for its 2022 revenue estimate. Usually, tickers that are trading under a 1x forward price-to-sales are often more than a few years away from being profitable. whereas HBIO is within arm’s reach of reporting a positive EPS.

Another point to keep in mind is that the laboratory analytical instruments industry’s average price-to-sales is around 6x, so, I believe HBIO should be trading at around $17.40 per share if it was to be priced with its peers. On this basis, with HBIO is currently trading in the $2 area, and I believe it is reasonable to say that HBIO is trading at a discount for its 2022 projected revenue.

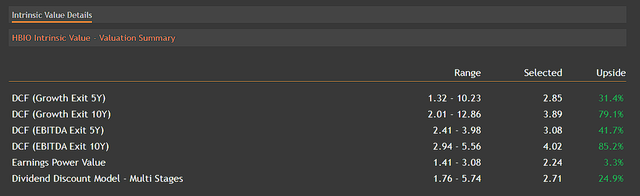

HBIO Valuation Models Summary (Value Investing)

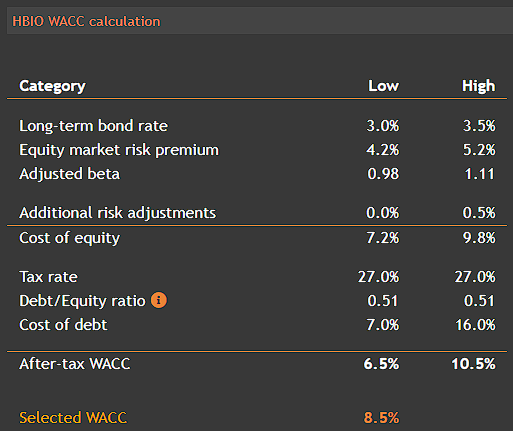

If we take a look at some of the standard valuation models, HBIO is undervalued at these trading levels. HBIO’s 5-year growth DCF (WACC 8.5%, Long-Term Growth Rate 4%) is at 2.85 and the 10-year growth DCF is at $3.89, which is about 79% higher than its current share price. The DCF 5-year EBITDA model has HBIO’s fair price around $3 and the 10-year is at about $4 (WACC 8.5%, Peers’ EV/EBITDA Multiples 12.4x), up nearly ~85% from its current share price.

HBIO WACC Calculation (Value Investing)

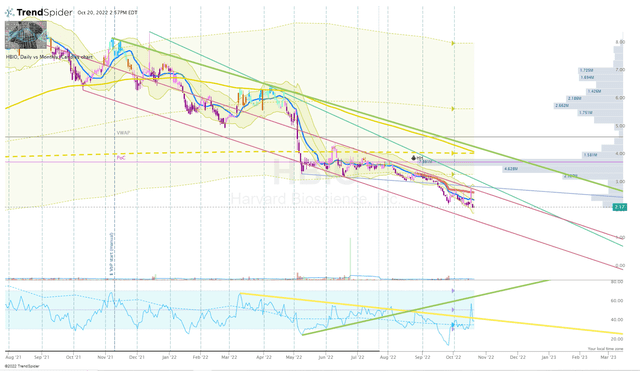

Despite the company’s current value and long-term outlook, the share price has deteriorated by roughly 70% over the past twelve months. This divergence between the company’s intrinsic value and the market’s valuation provides an opportunity to invest in a ticker that is technically oversold with an attractive risk reward. Considering the points above, I would say that HBIO is a perfect candidate for the Bio Boom Portfolio.

Notable Risks

HBIO has a number of notable downside risks that could be fueling the selling pressure and preventing a resurgence in the share price. Firstly, the company’s cash position is concerning with only roughly $4.2M in cash and cash equivalents at the end of Q2. Luckily, Harvard Biosciences is not a cash incinerator, and that cash position could last into 2023. Still, investors have to expect the market to be cautious about HBIO until the financing concern is addressed.

Secondly, Harvard Biosciences is not a consistently profitable company with undulating EPS. Indeed, the company is reporting growth and has a great long-term outlook, however, the market is probably going to continue to penalize the ticker that is reporting irregular earnings.

Finally, the company has incredibly strong competition including from other life science research companies including, Lonza Group (OTCPK:LZAGY), Becton, Dickinson (BDX), Danaher Corporation (DHR), Bio-Rad Laboratories (BIO), PerkinElmer (PKI), and Thermo Fisher Scientific (TMO). These companies are commercial powerhouses that could impede Harvard Bioscience’s growth and hurt the company’s long-term outlook.

Considering the points above, I have to give HBIO a conviction rating of 2 out of 5.

My Plan

In the face of the market’s enduring sell-off, I am considering adding to my minuscule position in the near term below my Buy Threshold of $2.12 to take advantage of the market’s environment.

HBIO Daily Chart (Trendspider)

Once I have added to the position, I will make an effort to make periodic additions on high conviction reversal setups under my Buy Threshold. On the other hand, I will set sell orders around my Sell Targets in order to get my position to a “House Money” status to hold for a long-term investment.

I expect to maintain an HBIO position for at least five years in anticipation that the company will continue to be a leader in the life science and research instruments industry and the market will ultimately recognize the company’s value, or the company is acquired at an acceptable valuation.

Be the first to comment