_ultraforma_

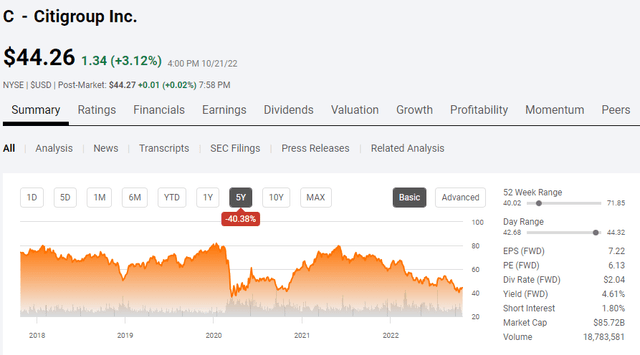

Market sentiment isn’t changing where Citigroup Inc. (NYSE:C) is concerned. Over the previous 5-years, C has generated a -40.38% return, and while C made a run back to the $80 range in the summer of 2021, it’s been all downhill from there. Over the past year, C has declined by -37.23%.

Berkshire Hathaway (BRK.A, BRK.B) added shares at an average price of $61.56 in Q1 2022, and since then, shares have dropped -$17.30, or -28.1%. After reading through the earnings report and looking through earnings from Wells Fargo (WFC), Bank of America (BAC), JPMorgan Chase (JPM), and U.S. Bancorp (USB), shares of C still look drastically undervalued as Mr. Market has valued them at deep discounts to book, tangible book, and equity. I am not sure what it’s going to take for C to break the downtrend, but I will continue to add to my position and reinvest the dividends until it does.

Citigroup had another strong quarter, and once again, Mr. Market hasn’t changed its mind

C delivered $18.15 billion in revenue, which was a 6.1% YoY increase and a beat on the consensus number by $230 million. C generated $1.50 in EPS, which was a beat on the bottom line of $0.05 compared to the consensus estimates. C’s book value per share of $92.71 and tangible book value per share of $80.34 at quarter end increased 1% and 2%, driven by net income and less shares outstanding. As many suspected, net interest income (NII) increased 18% YoY to $12.6 billion due to the rising rate environment. C has a gross loan yield of 6.55%, which is up 1.27% YoY. I feel that C delivered a solid quarter due to the economic environment.

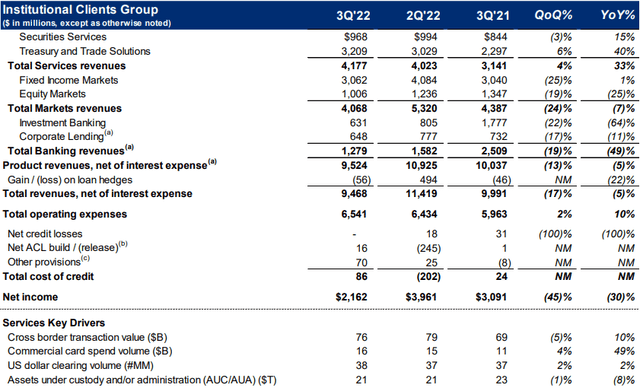

The market may be looking too closely at the wrong things. The Institutional Client Group saw its revenue decline by -5% YoY and -17% QoQ as it fell to $9.47 billion in Q3. Personal banking and wealth management increased 6% YoY, and its legacy franchises increased 66% YoY. The investment banking environment hasn’t been easy in 2022, and C saw its investment banking revenue decline by -64% ($1.15 billion) YoY, while corporate lending also declined by -11% ($84 million) YoY in Q3. The market may also be taking into consideration larger credit costs, which appreciated by 7% QoQ to $1.37 billion. C’s average loans declined by -2% driven by impacts from foreign exchange translation and lower balances in Legacy Franchises.

Overall, I was impressed with the earnings report, as we are experiencing slowing global growth and a recessionary environment domestically. C continues to deliver on the strategy they presented at their previous investor day. Going into Q4, C has guided that they will deliver low single-digit growth in their total revenue of $71.9 billion, which excludes $700 million from divestitures. I believe that C is showing that they can navigate this operating environment responsibly and drive substantial metrics from their businesses. If the market turns in 2023 and investment banking picks back up while we are still in a rising rate environment, I think C can surprise the market with large beats on the bottom line.

Citigroup is still the most undervalued large bank based on the metrics I look at

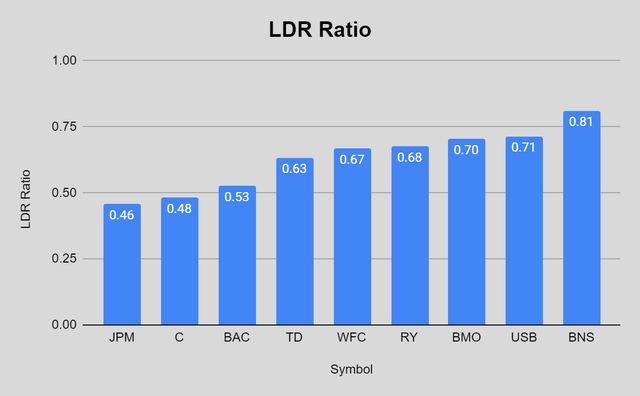

I don’t have a good answer as to why C is drastically undervalued, and that’s what makes me intrigued by them. I have updated my metrics which include P/E, P/B, Loan Deposit Ratio (LDR), equity to market cap ratio, tangible book value to market cap, discounts to book and tangible book, and the dividend metrics. Based on the metrics I look at, C looks very undervalued. Here is a brief summary of these metrics:

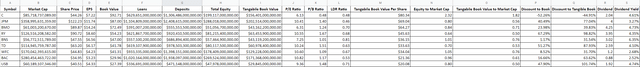

Price to Earnings P/E

- A company’s P/E ratio is important in comparing with similar firms in the same industry.

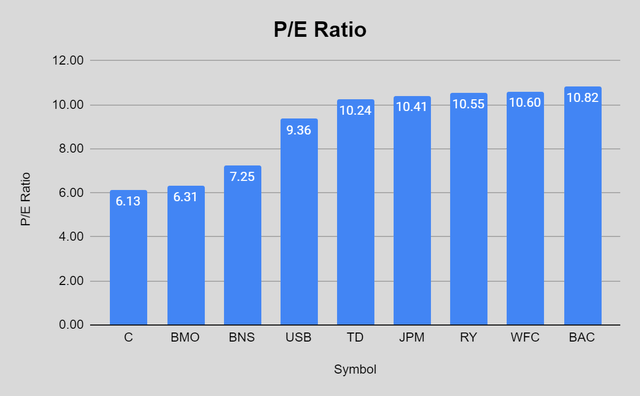

Price to Book P/B

- P/B ratios are commonly used to compare banks, because most assets and liabilities of banks are constantly valued at market values.

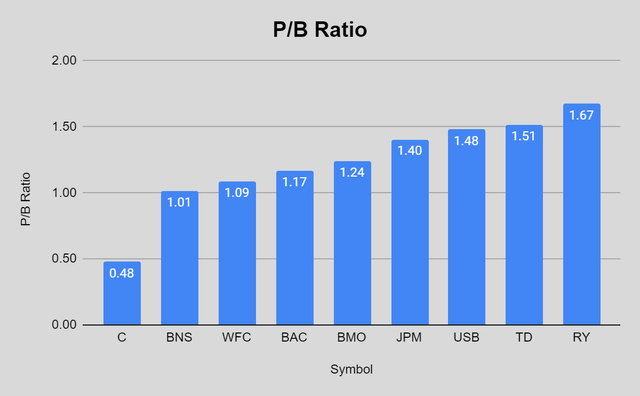

Loan Deposit Ratio LDR

- Indicates the bank’s liquidity.

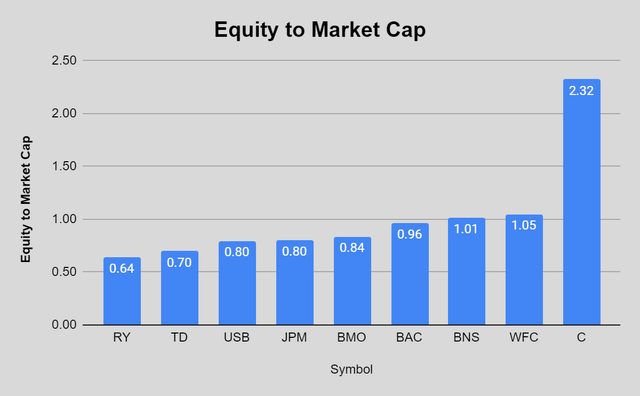

Equity to Market Cap

- Valuation the market has placed on the company’s equity

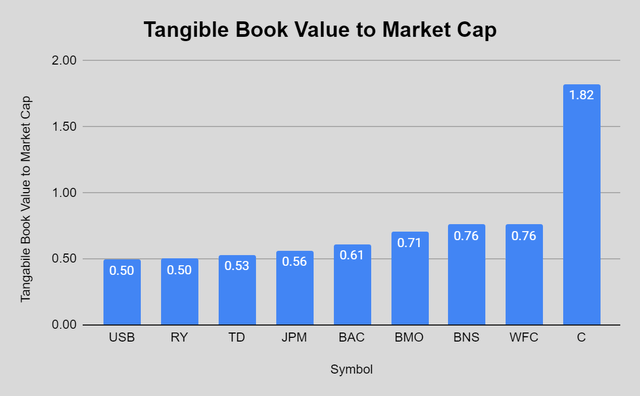

Tangible book value to market cap

- Tangible book value excludes the value of intangible assets such as goodwill. Intangible assets such as goodwill are not as easy to liquidate as tangible assets, and even though they have value, I believe finding the tangible book value is a more realistic measure of a company’s value. I wanted to see how the tangible book value compared to each company’s market cap

Dividend Yield and Payout Ratios

- Amount of earnings each company pays per share through its dividend and how much of its earnings are paid

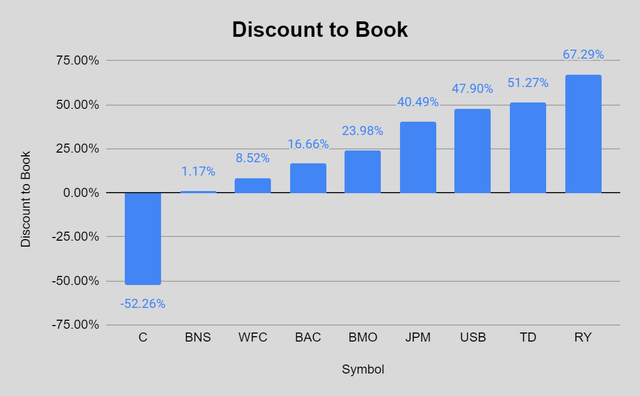

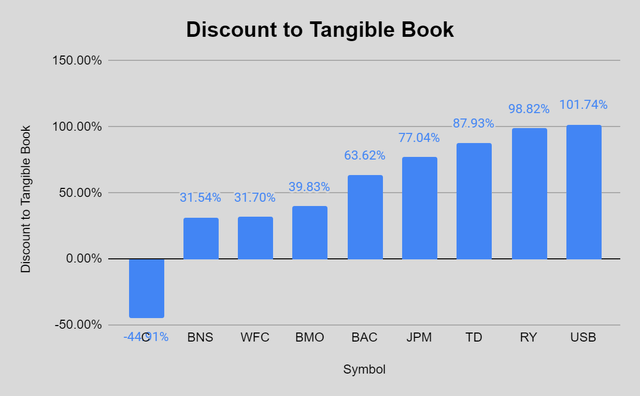

% difference between tangible book value and share price

- Indicates if the market is discounting a company’s shares or placing a premium on them

% difference between market cap and equity

- Indicates if the market is placing a positive multiple on a company’s equity of discounting it

I used the following companies:

- The Bank of Nova Scotia (BNS)

- U.S. Bancorp (USB)

- Bank of America (BAC)

- JPMorgan Chase (JPM)

- Wells Fargo (WFC)

- Royal Bank of Canada (RY)

- The Toronto-Dominion Bank (TD)

- Bank of Montreal (BMO)

Steven Fiorillo, Seeking Alpha

Currently, C is trading at the lowest P/E valuation of its peer group. On its own, this would indicate that C is trading at a lower valuation, but a company with a high earnings growth rate should typically command a higher P/E ratio because the EPS is increasing faster than the EPS of a slow-growth company. This is why the P/E ratio is just one component of the overall evaluation.

Steven Fiorillo, Seeking Alpha

C is also trading at the lowest P/B ratio. This is interesting because the book value of a company is the net value of all its assets after deducting liabilities. This indicates how much capital an individual needs to invest in a company’s net assets. Since a bank’s assets and liabilities are marked to the market, its book value should theoretically resemble the share price or market value.

This is one of the red flags in Mr. Market’s pricing, which makes me think C has become a broken stock. C is the only big bank that trades under a 1 P/B ratio, and what’s even more perplexing is that C trades at a P/B of 0.48. C looks drastically undervalued as each of its peers trades at a minimum of a 1/1 ratio.

Steven Fiorillo, Seeking Alpha

The LTD ratio is critical in assessing a bank’s liquidity. If this metric is too high, the bank may be susceptible to a bank run due to rapid changes in its deposits, meaning it may not have enough funds to cover its requirements. If the ratio is too low, it can indicate that a bank is not meeting its earning potential. C has the 2nd lowest LDR ratio, which is a good indication that C is potentially undervalued.

Steven Fiorillo, Seeking Alpha

The equity a company has on its balance sheet is what investors are left with after all of the liabilities are deducted from their assets. The lower the multiple, the higher the valuation the market has placed on a company’s equity. Anything over a 1x multiple means that the market has negatively valued the equity in a company. Only 3 of the 9 banks have above a 1:1 equity to market cap ratio, while BNS and WFC are just slightly above even with a 1.01x and 1.05x ratio. C is trading at a 2.32x equity-to-market cap ratio, which seems unrealistic. There is more than double the market cap on the books in outright equity. Based on this metric alone, C is incredibly undervalued.

Steven Fiorillo, Seeking Alpha

Tangible book value is more focused than book value because it strips out items under a company’s assets, such as goodwill and intangible assets. These items can’t be sold at auction if a company is forced into liquidation. I think of the tangible book value as the hard assets that can be sold for cash. What I am seeing with C’s tangible book value compared to its market cap is outright perplexing. C has 1.82x its market cap in tangible book value, while not a single other bank I looked at has a 1:1 ratio.

Steven Fiorillo, Seeking Alpha

Only C is trading at a discount to book. Currently, C is trading at a -52.26% discount to book as its book value is $92.71. When it comes to tangible book, C is trading at a -44.91% discount. The 2nd lowest discount to tangible book is a 31.54% premium since none of the other banks I looked at trade at a discount. By these valuation metrics, C looks like it’s on the clearance rack. I thought that the investment from BRK.A would help restore some credibility to C after it was released in the 13F filings, but Mr. Market didn’t budge.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Citigroup’s dividend is well covered and its large yield is enticing

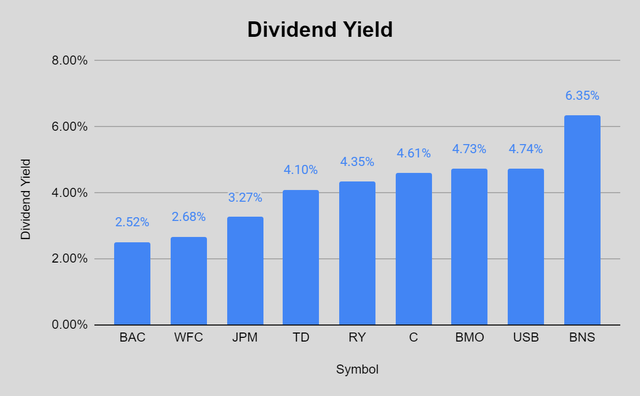

C has the 4th largest yield of the group, as it pays a dividend of $2.04, which is a yield of 4.61%. C’s dividend hasn’t increased since the summer of 2019, but prior to the dividend increases being halted, C had grown its quarterly dividend from $0.01 to $0.51 in 5 years. C has a 27.53% payout ratio based on its forward EPS, which leaves a large runway for dividend growth in the future. I am happy sitting back and collecting my dividends from C and reinvesting them at these prices, and I don’t see a reason to worry about the dividend being reduced any time soon.

Steven Fiorillo, Seeking Alpha

Conclusion

I believe C is a broken stock, not a broken company. C is trading at a -52.26% discount to book, a -44.91% discount to tangible book, has 2.32x the amount of equity on its books compared to its market cap and has 182% tangible book value compared to its market cap. Based on all of the metrics I look at when it comes to banks, C looks like it’s being singled out and trades at a valuation that is well under market value. I still believe C presents a great opportunity for capital appreciation and generating income. Today, you can buy shares at a -28.1% discount (-$17.30) compared to the $61.56 average price BRK.A purchased them at the beginning of the year.

Be the first to comment