gokhanilgaz

October 26th ended up being a really great day for shareholders of Harley-Davidson (NYSE:HOG). After reporting both sales and profits that well exceeded expectations for the third quarter of the company’s 2022 fiscal year, shares roared higher, closing up by 12.6%. Although the company does continue to face some problems, this most recent data is encouraging and shares of the enterprise are trading at levels that investors should consider to be quite cheap. Due to these factors, I feel comfortable keeping the company at the ‘buy’ rating I have had it at for nearly a year now.

Great Q3 results from Harley-Davidson

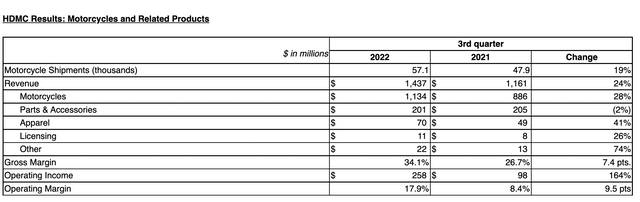

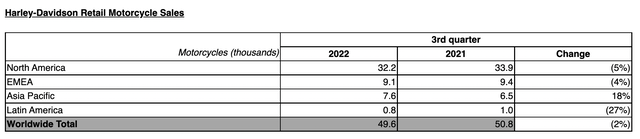

Before the market opened on October 26th, the management team at motorcycle manufacturer Harley-Davidson reported financial results covering the third quarter of the company’s 2022 fiscal year. Pretty much across the board, financial results for the company came in robust. For instance, revenue totaled $1.65 billion. This represents a 20.7% increase over the $1.37 billion reported in the third quarter of 2021. On top of that, it also translated to a beat of $290 million compared to what analysts anticipated. This surge, it should be said, was driven by a couple of factors. First and foremost, the company benefited from an increase in wholesale shipments of 19.2%. This took the number of units shipped from 47.9 thousand to 57.1 thousand this also came as the number of retail motorcycle sales actually declined slightly from 50.8 thousand to 49.6 thousand.

Harley-Davidson

Harley-Davidson

If this disparity seems odd, consider how the data actually works out. The increase in wholesale shipments seems to have largely been driven by low inventory levels that the company had to help make up for. You see, the vast majority of revenue generated by Harley-Davidson is through its activity of providing independent retailers and other parties its own products wholesale. The fact that shipments were high suggests that overall demand for its offerings is high as well. But the weak retail sales implies that the company still did not offer up enough product at the right price to meet that demand in its entirety. Management did say, however, that as inventory is replenished near the end of the quarter, retail performance showed signs of improvement. If the opposite had taken place, then you could argue that the firm was overproducing motorcycles.

Overall motorcycle revenue for the company was up by 28%. Even stronger was the 41% rise in apparel spending. Licensing, meanwhile, was up by 26%, while miscellaneous activities were up 74%. The only weak spot for the company from a sales perspective seemed to have been parts and accessories. Revenue here was down by 2% because of lower retail motorcycle volumes. This may also seem peculiar, but when you consider that the lead time for motorcycles is different than it would be for parts and accessories, the disparity makes sense. It’s also worthwhile to note that the financial services portion of the company also grew, with revenue climbing from $205 million in the third quarter of 2021 to $212 million the same time this year.

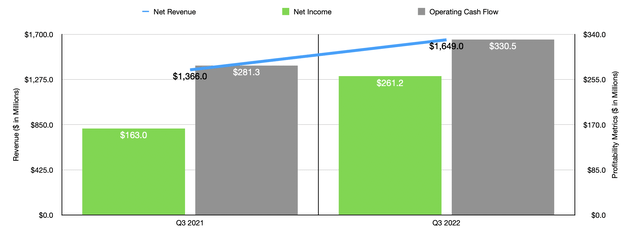

Author – SEC EDGAR Data

The increase in revenue for the company also brought with it improved profits. Net income totaled $261.2 million for the quarter. This was up from the $163 million generated in the third quarter of 2021. This translated to a profit per share of $1.78. In addition to beating out the $1.05 per share in the profits generated the same quarter last year, the company’s bottom line also came in $0.39 per share higher than what analysts anticipated. Most notably, the company saw its gross profit margin shoot up from 26.7% to 34.1%. This increase was driven by a 5% benefit caused from improved pricing and product mix. In addition to that, the company also benefited from greater manufacturing leverage and lower tariffs. Operating cash flow also followed suit, rising from $281.3 million to $330.5 million. Unfortunately, management has not yet released the firm’s 10-Q, and what financial data they have released is somewhat limited. That prevents us from making certain adjustments to operating cash flow. And it prevents us from having a good handle on what EBITDA was for the quarter.

Author – SEC EDGAR Data

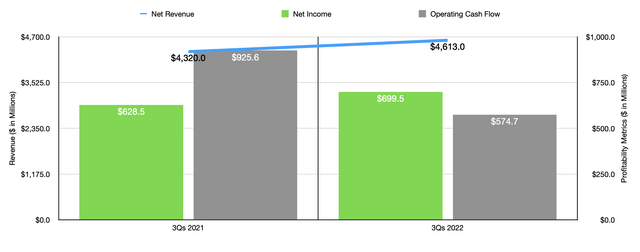

Thanks to the strong performance on both the top and bottom lines, the company is doing well for the 2022 fiscal year as a whole. For instance, revenue in the first three quarters of the year totaled $4.61 billion. That’s up 6.8% compared to the $4.32 billion generated the same time last year. Net income with the company, meanwhile, rose by 11.3% from $628.5 million to $699.5 million. The only profitability metric that was definitely down was operating cash flow. This fell from $925.6 million in the first three quarters of 2021 to $574.7 million at the same time this year. Once again, we have the same problem when it comes to EBITDA as we do for the third quarter alone. But we do know that through the first half of the year, the metric came in at $665.5 million, down from the $710.3 million reported one year earlier. Using the same approach when it comes to adjusted operating cash flow, we would see a decline from $494.3 million to $445.1 million.

Management did reaffirm guidance for the 2022 fiscal year. This calls for their revenue, excluding financial services revenue, to climb by between 5% and 10%. And they should also see an operating income margin of between 11% and 12%. But on the financial services side, operating income should fall by between 20% and 25%. While this is all fine and dandy, it doesn’t give us a great deal of understanding as to what the actual bottom line results for the company should be. If we instead rely on current data to project out what the rest of the year might look like, we would anticipate net income for the year of $723.5 million, adjusted operating cash flow of $941 million, and EBITDA of $939.7 million.

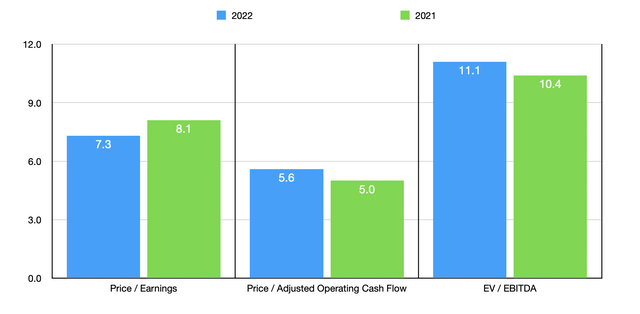

Based on these figures, the company is trading at pretty low levels. The forward price-to-earnings multiple of the company is 7.3. This is down from the 8.1 using data from 2021. The forward price to adjusted operating cash flow multiple would rise from 5 using data from 2021 to 5.6 using the projected results for this year. And the EV to EBITDA multiple would climb from 10.4 to 11.1. Truth be told, there aren’t really any good companies to compare Harley-Davidson to, but I would feel comfortable saying that these multiples are very low on an absolute basis.

Author – SEC EDGAR Data

Outside of the fundamental picture, there are some other topics that need to be discussed. First and foremost, during the quarter, the company purchased about $12 million worth of shares, totaling 0.4 million units in all. This may seem disappointing to some investors, given how small the purchase was. But for the first three quarters as a whole, the company has repurchased 8.4 million units for a combined $324 million. The second interesting update involved the company’s LiveWire operations. On September 26th, the company completed its previously announced business combination under which LiveWire EV, the company’s electric motorcycle unit, combined with ABIC to create a new publicly traded company under the LiveWire Group name. That maneuver ultimately raised $294 million in net proceeds inclusive of the funds that Harley-Davidson provided. At present, Harley-Davidson owns 89.4% of the entity, implying total value for shareholders of $1.36 billion for the company as of this writing.

Takeaway

Based on all the data provided, I will say that, on the whole, Harley-Davidson performed remarkably well. The company’s top line and bottom line results easily exceeded expectations. Admittedly, there was some weakness when it came to retail sales and sales associated with parts and accessories. Year to date, cash flow is also a concern. But when you adjust for changes in working capital, the picture is not all that bad. Despite the fact that shares of the company have now risen by 12% since I last wrote about it in November of 2021 while the S&P 500 has dropped by 17.8%, I do still think that further upside could be on the table. Because of that, I have decided to retain my ‘buy’ rating on the company for now.

Be the first to comment