ClaudioVentrella

Evil is a choice one makes, not a natural state of being. ― Morgan Rhodes

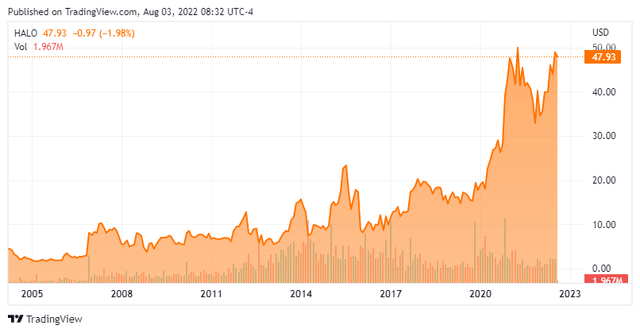

Today, at the request of a Seeking Alpha follower, we are circling back on Halozyme Therapeutics (NASDAQ:HALO) for the first time in many years. The stock is up more than sixfold since we first gave it a ‘thumbs up‘ nearly eight years ago. The company’s business model is delivering consistent growth in an uncertain market. Is the stock a buy at current levels, however? We give our take after the following analysis.

Company Overview:

Halozyme Therapeutics is a biotech concern based just outside of San Diego. The company’s products are based on the ENHANZE drug delivery technology, a patented recombinant human hyaluronidase enzyme (rHuPH20) that enables the subcutaneous delivery of injectable biologics, such as monoclonal antibodies and other therapeutic molecules, as well as small molecules and fluids. The stock sells for around $48.00 a share and sports an approximate market capitalization of $6.6 billion.

The company’s business model is based enhancing the delivery of other injected drugs via an advantageous subcutaneous formulation that improves infusion times. Halozyme partners with major drug makers like Roche (OTCQX:RHHBY) and Johnson & Johnson (JNJ) to employ the company’s ENHANZE platform to improve blockbuster drugs. For this Halozyme earns both royalties and milestone payouts. Since these drugs have already gone through the FDA approval process and are established in their current form, Halozyme development process is streamlined.

May Company Presentation

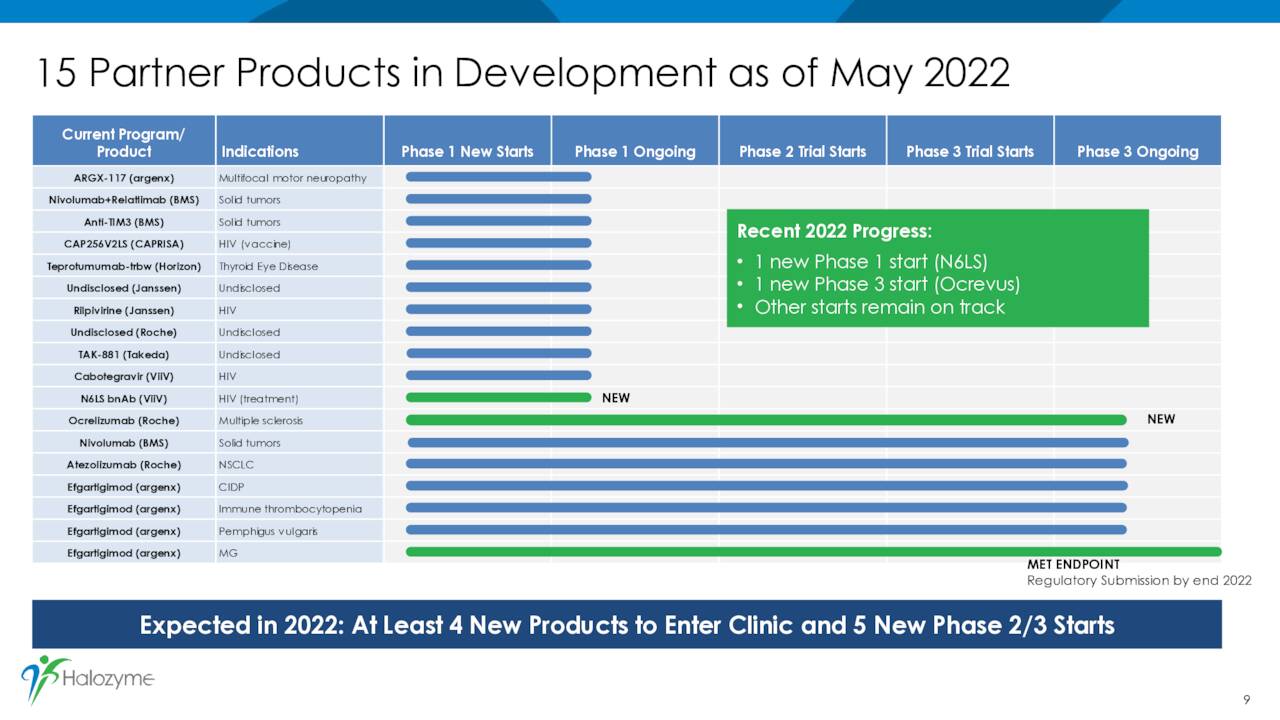

The company has numerous ‘reformulated‘ products on the market and myriad others in development. In June, Halozyme announce the launch of TLANDO™ (testosterone undecanoate), an oral treatment indicated for testosterone replacement therapy in adult males. This is the second hormone replacement therapy the company has launched after Xyosted was approved in 2018. TLANDO was acquired in the Antares Pharma purchase (See section below).

May Company Presentation

Recent Developments:

In March, In March 2022, the company announced it has entered into a global collaboration and license agreement for ENHANZE® technology with Chugai Pharmaceutical. Halozyme received an upfront payments of $25 million from Chugai and is eligible to receive additional future payments of up to $160 million as well as royalties on commercialized sales.

In Spring, Halozyme purchased Antares Pharma (ATRS) for just under $1 billion that included an approximate 50% buyout premium. The acquisition marries Antares’ auto-injector technology Halozyme’s ENHANZE formulations. This should the injection of larger volumes as well as faster injections. An article in May does a good job explaining the benefits of the deal.

May Company Presentation

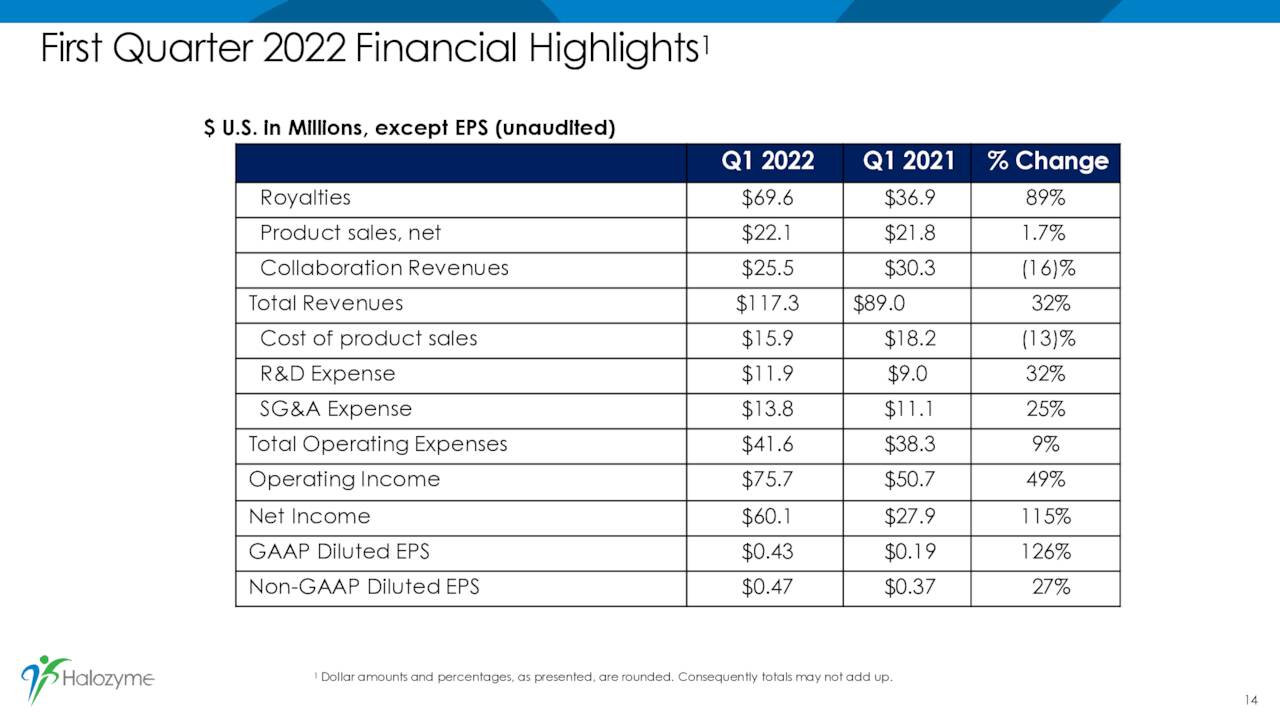

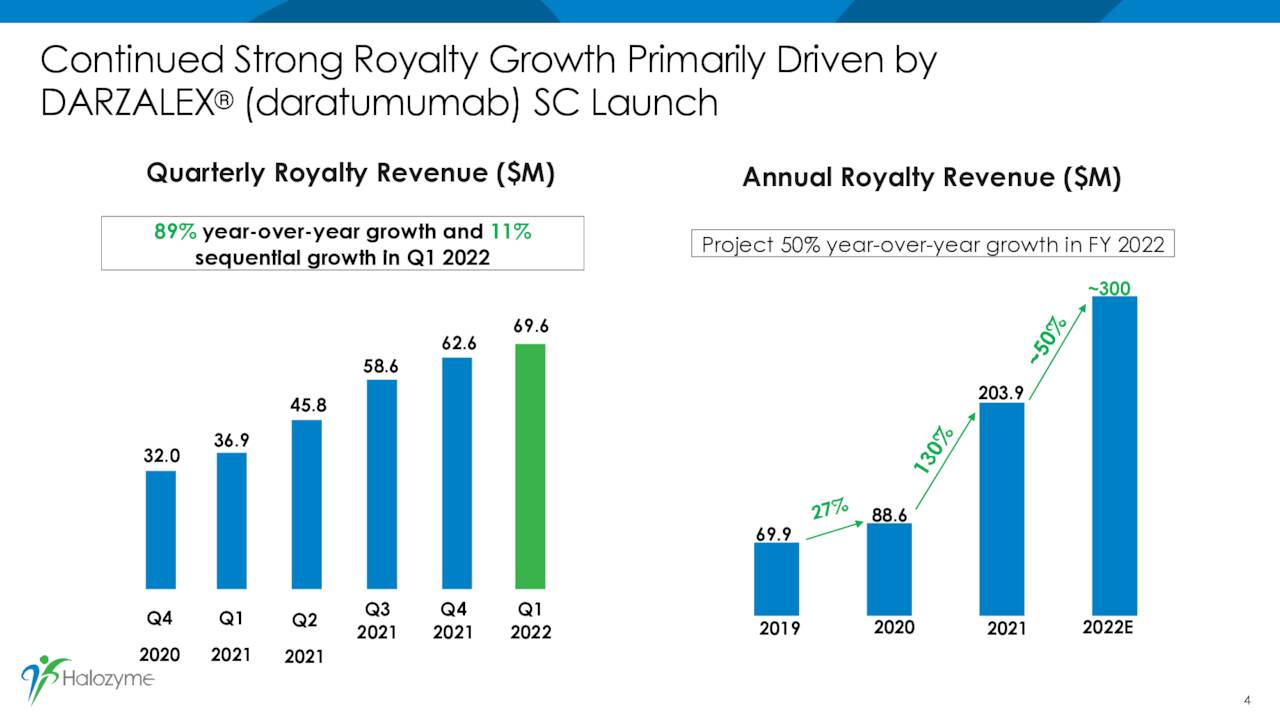

On May 10th, the company posted first quarter earnings results. The company had a net GAAP profit of 47 cents a share as revenues rose nearly 32% on year-over-year basis to just over $117 million. Both top and bottom line numbers missed the consensus at the time. $69.6 million of overall revenue came from royalties, primarily driven by sales of Darzalex.

May Company Presentation

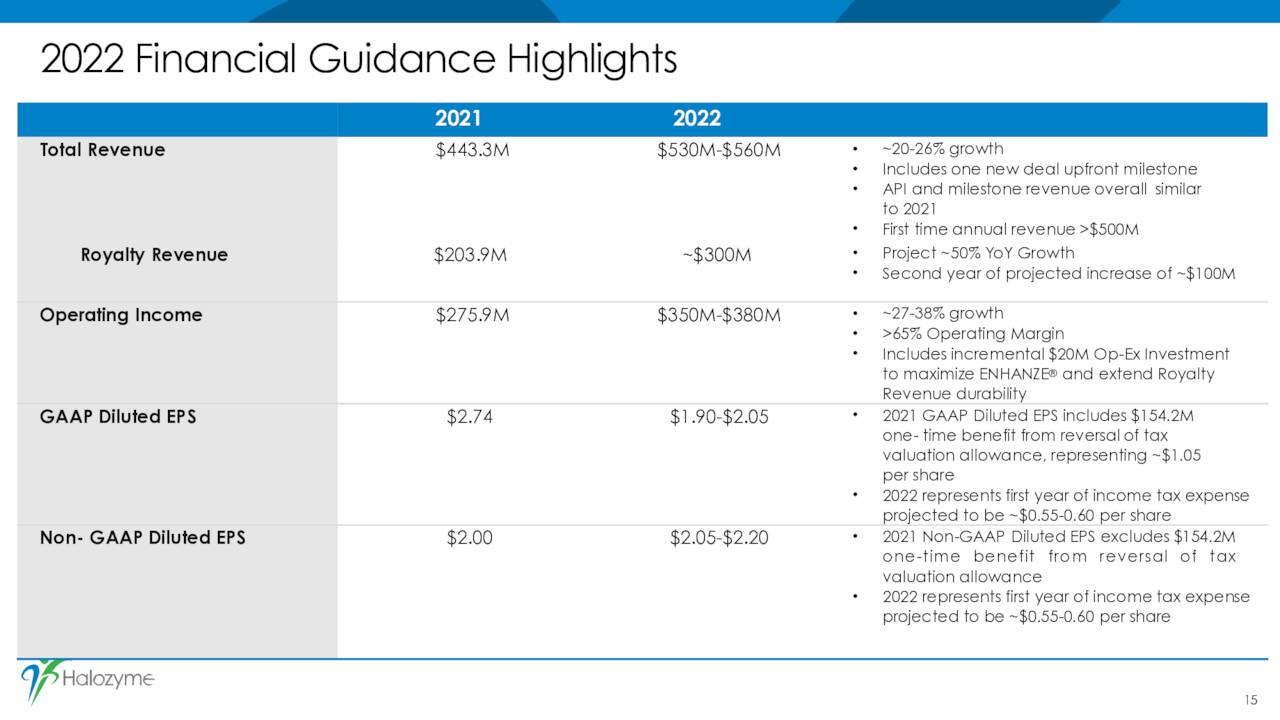

Leadership sees between $530 million to $560 million in overall sales in FY2022, representing 20% to 26% growth over FY2021. Management also projects operating income of between $350 million to $380 million in FY2022, 27% to 38& above FY2021 levels. As of yet, guidance does include the recent purchase of Antares Pharma.

May Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community is just so-so on the company’s prospects at the moment. So far in 2022, eight analyst firms including Goldman Sachs and JP Morgan have reissued Buy or Outperform ratings on the stock. However, price targets proffered only range from $45 to $60 a share. Piper Sandler currently has a Hold rating on the stock with a $42 price target.

There has been no insider activity in the shares so far in 2022. About one out of every 16 shares outstanding is currently held short. The company cash and marketable securities balance increased by just over $45 million during the first quarter to just over $785 million, prior to the Antares’ purchase.

Verdict:

The current consensus has Halozyme earnings roughly $2.25 a share in FY2022 as revenues rise more than 35% to $610 million. In FY2023, the analyst community has the company earnings some three bucks a share as revenues hit $800 million.

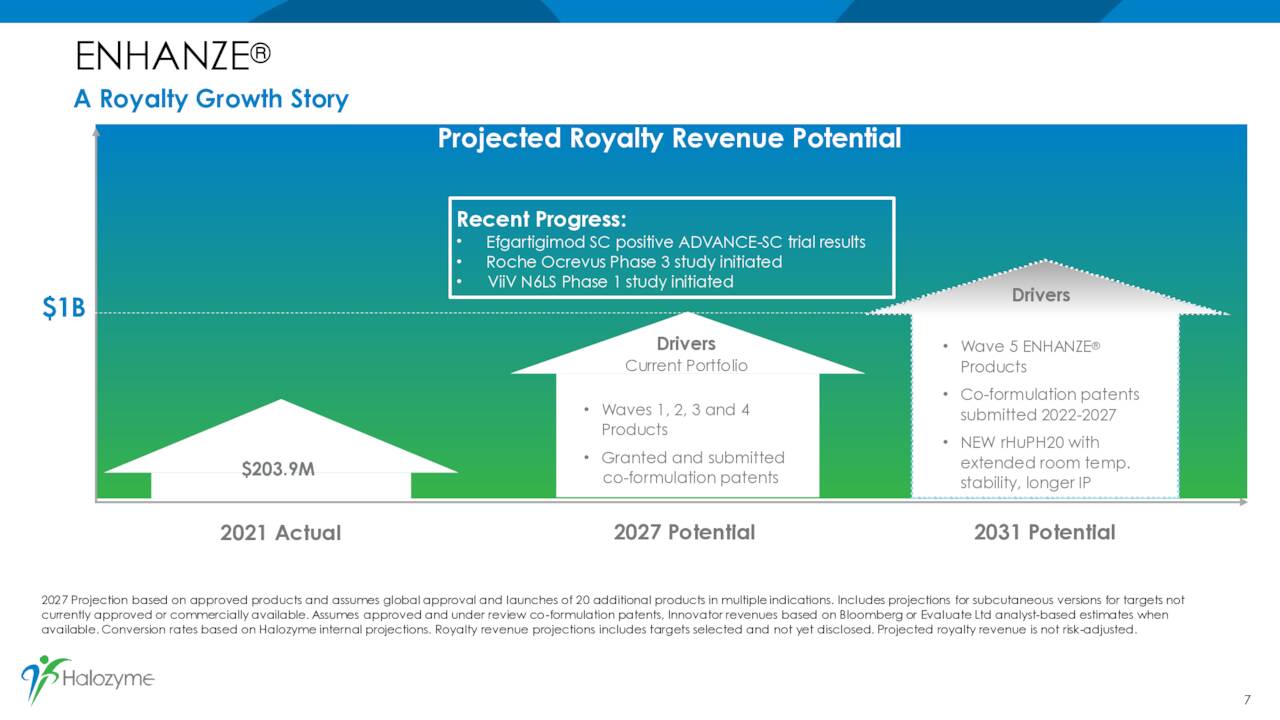

Management sees royalty payments (which are less ‘lumpy than milestone payouts) hitting $1 billion by FY2027. That means an investor is paying just over six and a half times recurring FY2027 sales. Looking at P/E, the stock is valued at over 20 times this year’s profits or 16 times projected FY2023 earnings.

May Company Presentation

Given the company’s growth and business model those valuations are not excessive, but neither are they cheap. That leaves me with the view that Halozyme is fairly valued here, which seems to be the consensus in the analyst community based on current price targets.

There are options available against this equity. So, if HALO drops below the $45 level in the next market pullback, I will probably initiate a small ‘watch item‘ position in the shares via covered call orders given option premiums are solid. Other than that, I have no investment recommendation on Halozyme at this time.

A lie doesn’t become truth, wrong doesn’t become right, and evil doesn’t become good, just because it’s accepted by a majority. ― Booker T. Washington

Be the first to comment