Ronald Martinez/Getty Images News

Investment Thesis

The price of Brent and WTI “black gold” has been steadily above $ 90/bbl for more than six months, allowing oil producers to gain record profit. We believe shares of oil companies have almost completely recovered from the rally. However, we expect oilfield service companies to intercept the alpha from producers, as this is a bet on the long-term trend. Although the global economy shall enter recession in Q4 2022 – Q1 2023 and the oil price is expected to fall to $77, it is still above the breakeven point of oil producers, according to our forecasts. Given this, we have decided to explore what to expect from the oilfield services industry. Our choice is Halliburton (NYSE:HAL).

We are on the verge of recession, but the oil price shall not fall much

The US is headed for recession which shall happen before the beginning of the new year. The dynamics of Manufacturing PMI is consistent with it.

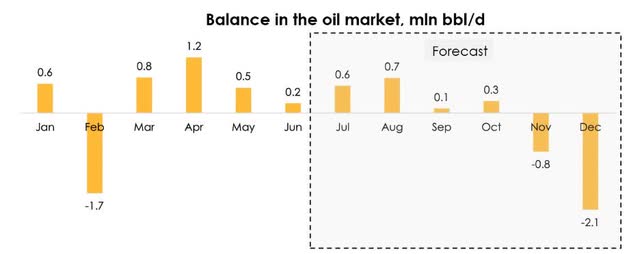

First, we do not expect oil prices to fall significantly even under recession due to the projected deficit of 0.2 mln bbl/d in 2H 2022. However, the deficit may increase to 2.1 mln bbl/d by December if OPEC+ does not ramp up the production rates.

In the baseline scenario we expect the US GDP to decline in Q4 2022 for the first time, recession is likely to occur in Q1 2023. Therefore, we expect the oil price to fall to $77/bbl in Q4 2022.

|

3Q22 |

4Q22 |

1Q23 |

2Q23 |

|

|

Old forecast |

124 |

142 |

100 |

77 |

|

New forecast |

100 |

77 |

80 |

100 |

The breakeven point of oil producers allows them not to cut capex

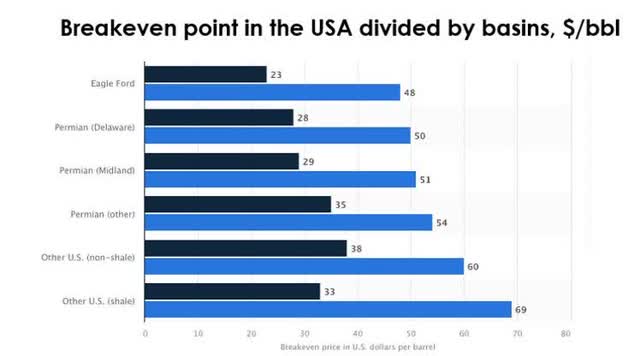

However, even with oil prices falling to $77/bbl, almost all projects remain profitable, according to Statista. Given the projected deficit in the sector, as well as high profitability of projects, we do not expect demand for drilling to fall. Neither shall the average ticket.

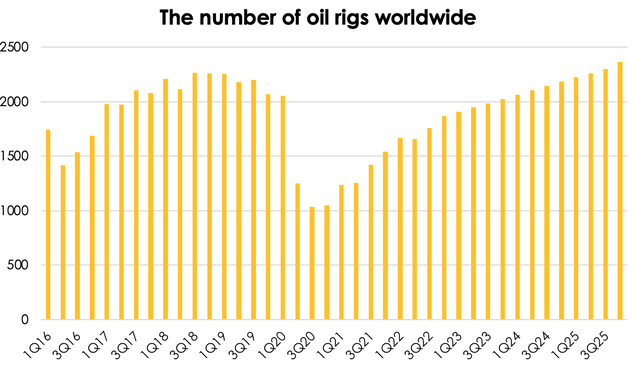

In this regard, we suppose that the bet on drilling companies is a bet on the long-term trend. The number of drilling rigs in the world is expected to reach the level equal to 2019 results by 2024.

Valuation

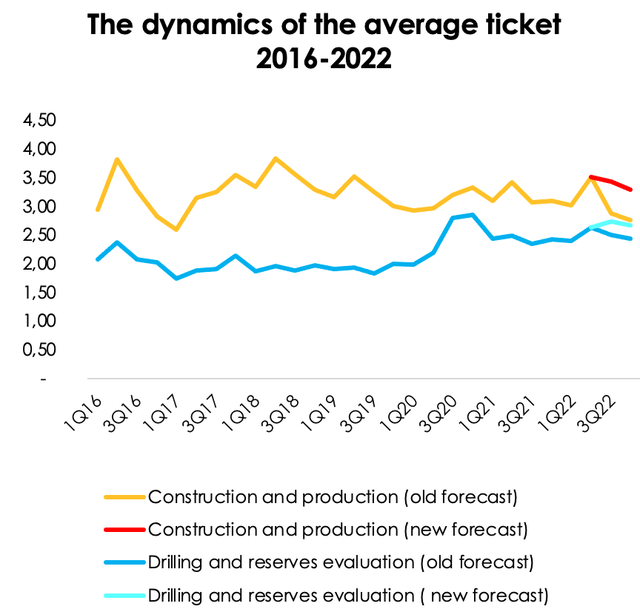

Due to greater acceleration of the average ticket as of the end of Q2 2022 compared to our earlier estimates, the 2022 average ticket per derrick has been revised upwards from $2.9 mln to $3.3 mln in the construction and production segment and from $2.5 mln to $2.6 mln in the drilling and reserves evaluation segment.

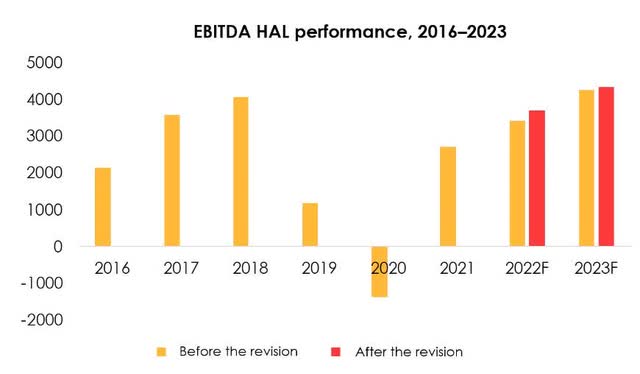

By reconsidering the average ticket, we have revised our 2022 EBITDA forecast from $ 3417 mln (+26% y/y) to $ 3709 mln (+34% y/y) and from $ 4263 mln (+25% y/y) to $ 4331 mln (+18% y/y) in 2023.

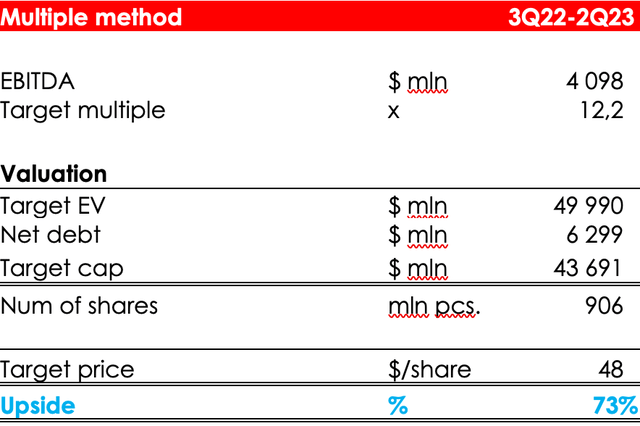

According to our valuation, the upside over the one-year horizon is 73%.

The factors behind the company’s growth:

- Accelerating global drilling activity amid projected oil shortage.

- Increase of the average ticket per derrick on the backdrop of high demand.

Risks:

- The main risk for the company is a more severe drop in demand for oil due to the upcoming recession. Consequently, the value of “black gold” shall fall substantially. More than 30% of global projects shall become unprofitable if prices fall below $ 60/bbl.

The conclusion

We expect the oilfield services sector to be one of the main beneficiaries of continued strong oil demand and crude shortages. High demand for crude allows companies to index the average ticket per derrick on a quarterly basis. The bet on drilling is a bet on the long-term trend that is not expected to subside over several years.

We believe that an excellent HAL stock entry point for long-term investors has now emerged amid fears of global recession. The company also pays attractive dividend, the current forward dividend yield is 1.2%. To understand the price movements, we recommend monitoring the US drilling rigs dynamics issued by Baker Hughes.

Be the first to comment