Ronald Martinez

By its very nature, the energy sector is very much capital intensive. As such, there are a number of products and services that are needed in order for the industry to function. There are many players in this space, but one of the largest is Halliburton (NYSE:HAL). With a market capitalization of $25.8 billion, this enterprise is a true behemoth in the energy services space. It engages in a variety of activities involving the completion and production of oil and natural gas properties, as well as the drilling and evaluation process for fields where oil and gas can be extracted. Recent financial performance achieved by the company has been quite robust. But as the broader market has fallen and as investors fear the impact that a recession might have on energy output, shares have tanked. Though this has proven painful for investors, the data so far does make the company look quite affordable at this time. Of course, data regarding the near-term future of the oil space in particular has been mixed. And the ultimate direction that takes will have some impact on the company’s near-term prospects. But given how cheap shares are and considering the likelihood that the business can weather most any storm, I cannot help but be bullish on it moving forward.

Shares look cheap

On April 23rd of this year, I wrote my most recent article about Halliburton. In that article, I said that the company was showing signs of a full recovery. It still was not at pre-pandemic levels of activity, but the overall trend was promising. Even in the worst case, I said that the stock would likely be considered fairly valued. But more likely than not, I felt as though upside was on the table. This favorable risk-to-reward prospect caused me to rate the business a ‘buy’, reflecting my belief that the business would very likely outperform the broader market for the foreseeable future. Since then, a lot of pain has hit shareholders. While the S&P 500 is down by 10.9%, shares of Halliburton have generated a loss for investors of 24.3%.

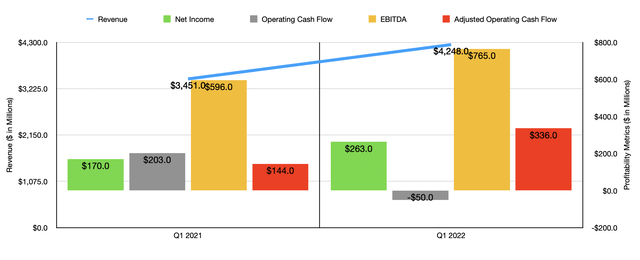

Interestingly, we don’t actually have any additional fundamental data covering the company since my last article. And what insight we have from analysts is currently bullish. For instance, at present, the expectation for the second quarter of the company’s 2022 fiscal year is that it will generate revenue of $4.71 billion. If this comes to fruition, it would represent a 27.1% increase over the $3.71 billion in revenue generated the same time one year earlier. Although this increase may seem unrealistic, the company saw a similar improvement in the first quarter of the year. Revenue of $4.28 billion then was 24.1% above the $3.45 billion the company generated just one year earlier. The revenue figure ultimately reported was also $83.7 million above what analysts anticipated. Analysts also have a favorable outlook on profitability, with earnings per share forecasted at $0.45. This is almost double the $0.26 per share the company reported one year earlier. In this case, the picture is less certain. In the first quarter of the year, the company reported profits of $0.29 per share. That actually missed expectations by $0.05.

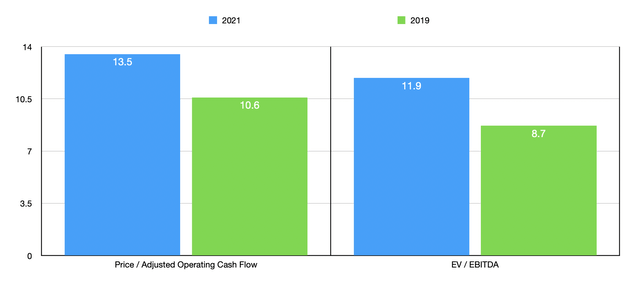

Unfortunately, we don’t really have any guidance for the current fiscal year. However, if we value the company based on 2021 results, a year in which the bottom line for the business was demonstrably worse than what 2022 is shaping up to be, shares still look cheap. On a price to operating cash flow basis, the firm is trading at a multiple of 13.5. Meanwhile, the EV to EBITDA multiple is even lower at 11.9. In the event that the company eventually returns to the kind of performance experienced before the pandemic, then shares would be even cheaper still. The price to operating cash flow multiple would come in at 10.6, while the EV to EBITDA multiple would be 8.7.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. Using our 2021 results, the firm was cheaper than all but two of the companies, with those businesses ranging from a low of 10.3 to a high of 651.9. It’s cheaper than three of the five firms using the EV to EBITDA approach, with the multiples there ranging from 6.5 to 26.6. I also looked at it through the lens of what occurs if financial performance reverts back to pre-pandemic levels. With the price to operating cash flow multiple of those firms ranging from a low of 6.7 to a high of 16.8, three of the five are cheaper than our prospect. Using the EV to EBITDA approach, the range was from 8.3 to 14.4. In this scenario, only one of the five companies was cheaper than Halliburton.

| Company | Price / Operating Cash Flow (2021) | EV / EBITDA (2021) | Price / Operating Cash Flow (2019) | EV / EBITDA (2019) |

| Halliburton | 13.5 | 11.9 | 10.6 | 8.7 |

| Baker Hughes (BKR) | 13.1 | 12.1 | 6.7 | 13.5 |

| Tenaris SA (TS) | 651.9 | 6.5 | 8.7 | 8.3 |

| NOV Inc. (NOV) | 25.4 | 26.6 | 13.4 | 12.2 |

| Schlumberger (SLB) | 10.3 | 10.9 | 10.3 | 9.2 |

| ChampionX Corporation (CHX) | 18.9 | 8.8 | 16.8 | 14.4 |

Mixed expectations for the industry

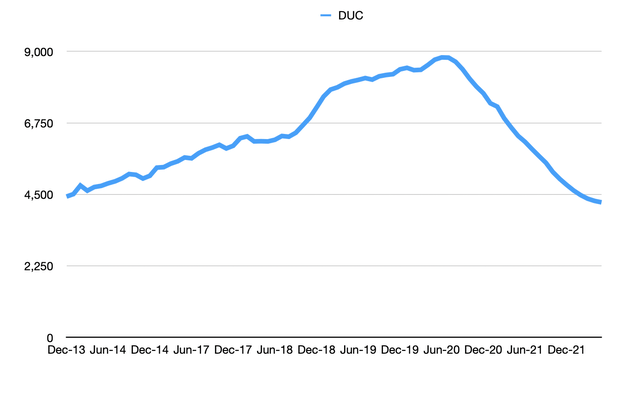

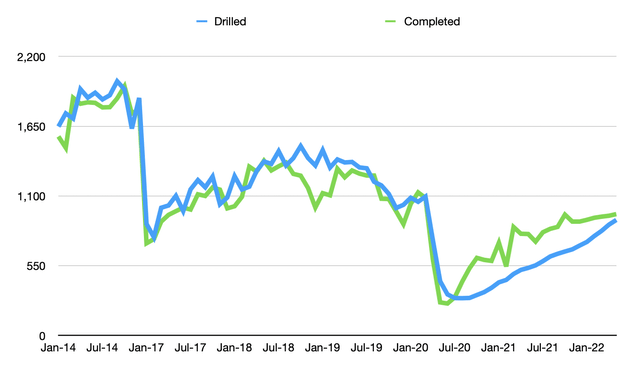

2022 has proven to be a wild ride for the energy sector. Both oil and natural gas skyrocketed before coming down some. Admittedly, both are still elevated compared to levels that they were at in prior years. Oil is currently around $95 per barrel, while natural gas is about $6 per Mcf. As a company dedicated to servicing energy companies across the globe, Halliburton’s fortunes are determined by what kind of activity and how much of that activity takes place regarding this sector. While I do contend that some of the data is mixed, I would say that most of it is definitely favorable for the company. For starters, we need only look at drilling and completion activity in the US. As you can see in the chart above, the total number of drilled but uncompleted wells, or DUCs, has fallen significantly over the past couple of years. They ultimately peaked at 8,809 back in June of 2020. Today, they have fallen to 4,229. This occurred as both the number of wells drilled and the number of wells completed increased, but with completions ultimately outpacing the number drilled. This is important because it means that the inventory of wells that are ready to complete has dropped, making it more difficult for the industry to rapidly increase output.

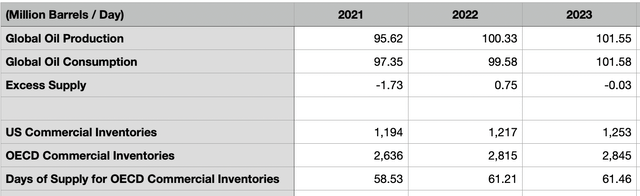

But this is just one piece of the pie. We should also pay attention to forecasts regarding global supply and demand. The EIA (Energy Information Administration) seems to have a slightly less optimistic outlook for oil bulls. Although for the 2021 fiscal year, demand outpaced supply by a rather meaningful amount, it’s expected that OECD inventories will still rise this year and next, driven in large part by surplus output this year. Generally speaking, we should expect to see a balanced oil and gas market that involves 60 days’ worth of consumption being stored in OECD inventories. That number is expected to climb to 61.21 days this year before climbing further to 61.46 days in 2023. Although this may not seem like much, the 2023 forecast would result in an extra 148.3 million barrels in inventory than what is typically needed.

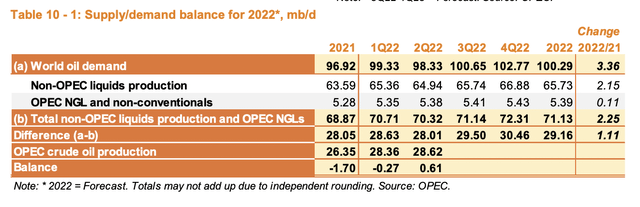

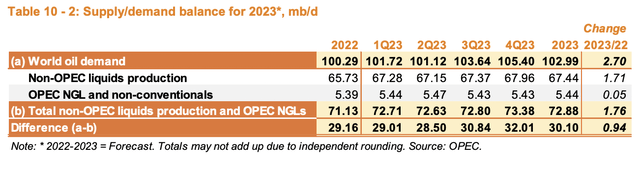

Fortunately, it is not clear that the EIA will be accurate. Although it is certainly biased, OPEC, in its monthly report, has a solid track record of being pretty correct. For the second quarter of this year, they did say that there was a surplus of oil in the amount of 0.6 million barrels per day. However, for the year as a whole, if OPEC nations keep their output unchanged and forecasts for non-OPEC nations are accurate, we should see a shortage for 2022 as a whole in the amount of 0.6 million barrels per day. Depending on what happens next year, that picture could change even more in favor of oil bulls. I say this because they anticipate demand growing a further 1.76 million barrels per day next year, with the end result potentially being a scenario where demand outpaces supply by as much as 1.55 million barrels per day. That would prove remarkably bullish for a company like Halliburton because of the demand it would place on the services for additional energy output growth.

Takeaway

At this point in time, I understand why investors are a bit scared. However, we need to focus on the long-term picture. What we know today is that shares of Halliburton look to be attractively priced. In the event that it eventually reverts back to pre-pandemic levels, it could be even better as a prospect. Granted, there is uncertainty regarding the course that the oil and gas markets will take moving forward. But given how cheap the stock is right now, I can’t imagine it being worse off than fairly valued should demand for its services decline. For all of these reasons, I have decided to retain my ‘buy’ rating on the business.

Be the first to comment