sarawuth702/iStock via Getty Images

Introduction

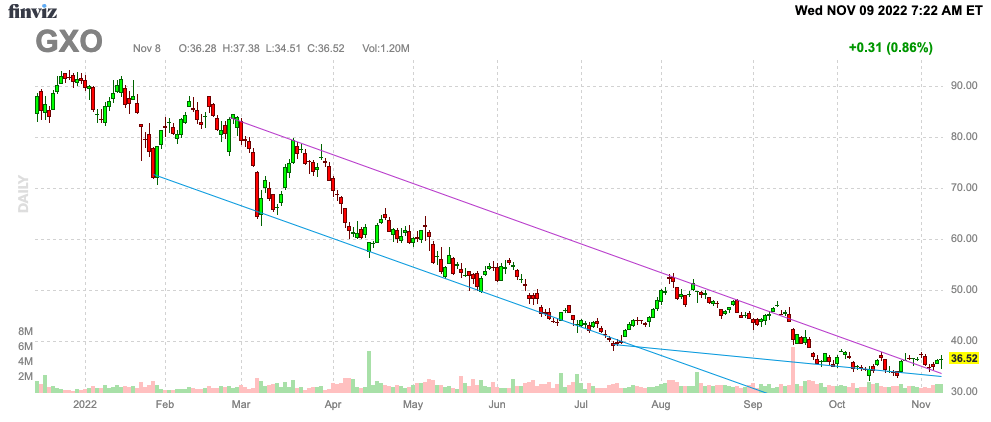

Overall, I have to say that I am quite happy with the way things are going. A lot of themes we’ve discussed in the past few months and years are bearing fruit. For example, energy, defense, agriculture, and the huge outperformance of value stocks, in general. Unfortunately, one thing continued to work against me. And that’s my bullish call on GXO Logistics (NYSE:GXO). My most recent article was written on August 9, 2022, and was titled “The Many Reasons To Be Bullish On GXO Logistics”. Since then, the stock has continued to lose ground as a mix of investors dumping growth stocks and slower sentiment in the transportation industry. However, while GXO is a growth stock, it also has high-value characteristics, which make the company extremely attractive.

In this article, we’ll discuss all of that and more.

So, bear with me!

Growth & Value

Growth and value are two different things – obviously. Growth stocks are stocks with low profits (or losses) that are expected to grow rapidly in the future. Value stocks are more mature businesses, making a lot of money but failing to generate high future growth.

I strongly believe in investing in a mix of the two, which is why I named my Twitter account “Growth & Value”.

Starting with “growth”, GXO is a fantastic company with high growth potential as it operates in one of the most important industries in the world: logistics. Not just that, but GXO optimizes supply chains by applying Industry 4.0 technologies.

Last year, after GXO spun off from XPO Logistics, I wrote the following:

GXO, in this case, provides smart warehousing solutions. Without automated warehouses, Industry 4.0 won’t work. As the company’s 30 seconds YouTube video shows, it’s all about automating warehouses using well-connected robots.

The company mentions three structural tailwinds. All are part of Industry 4.0. These tailwinds are e-commerce, warehouse automation, and outsourcing. All three are connected as e-commerce is a major demand driver, warehouse automation is the way to enhance operations, and outsourcing is what retailers do when looking for advanced warehousing opportunities.

GXO makes the case that these megatrends are in their early stages. While e-commerce is advanced, GXO does mention that only 5% of warehouses are automated. Given that automation is a very tough task to do, I think GXO does have an edge in a rather young industry. Additionally, the company mentions that 70% of warehouses are insourced. That makes sense given the low number of automated warehouses.

Just-released 3Q22 earnings confirm the company’s power to grow. Total revenue growth was 16% to $2.29 billion, beating estimates by $40 million.

Organic revenue growth was 16%. Net M&A added 11% as well, yet this was completely offset by currency headwinds. Currency headwinds were created by a very strong dollar and the fact that the company generates just a third of its revenues in the United States.

I’m not too worried about these currency headwinds. It’s temporary. What matters is that organic growth was strong. This was fueled by strong new order growth.

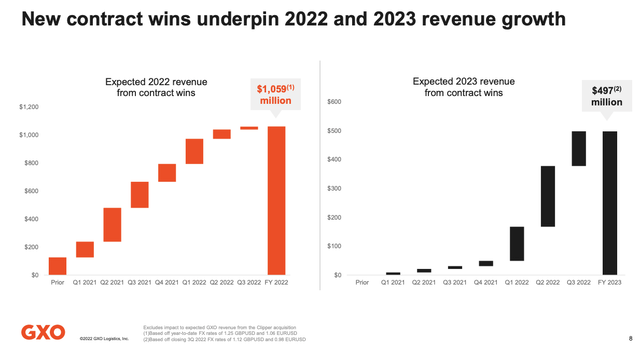

Since early 2021, the company has won close to $1.1 billion in new contracts for 2022. For next year, the company has won close to $500 million in new contracts. Most of them since early 2022.

What’s interesting is that half of the new orders came from companies that are new to outsourced logistics services – at least when it comes to the services offered by GXO.

25% of new orders came from competitors. The remaining 25% came from new outsourcing opportunities.

New wins include major companies like Boeing (BA), Nike (NKE), Raytheon Technologies (RTX), and Samsung. All of these are companies relying on incredibly smooth supply chains.

The average contract duration is five years. After that, the company usually keeps up to 95% of its customers (retention rate).

It also helps that 45% of revenue comes from contracts that incorporate costs. It’s an easy way to pass through inflation.

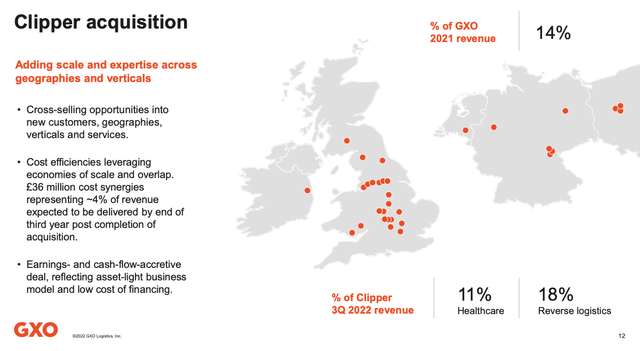

Moreover, the company added exposure overseas by adding Clipper to its portfolio.

On October 4, the company gained regulatory approval for the acquisition of Clipper Logistics. As reported by Seeking Alpha:

As one company, we expect to accelerate growth by expanding our geographic presence in key markets and verticals, bolstering our roster of blue-chip customers and enhancing the breadth of innovative warehouse capabilities we provide,” GXO CEO Malcolm Wilson said. “We share a commitment to ESG, providing an exceptional customer experience and harnessing technology to improve efficiency, productivity and employee safety. Being a great fit culturally will underpin our future success and make for a seamless integration.

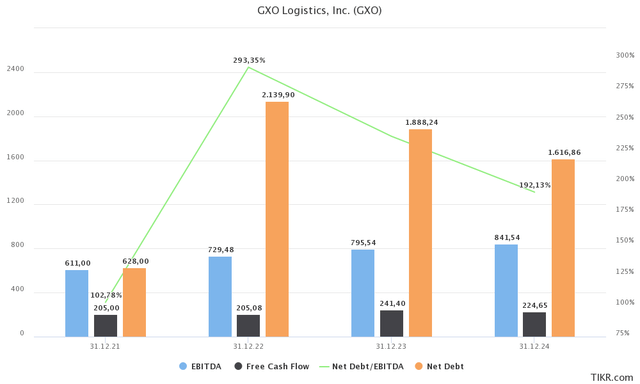

On a full-year basis, the company expects organic revenue growth to come in between 12% and 16%. Adjusted EBITDA is expected to be at least $715 million. 30% of that is expected to be turned into free cash flow. That’s roughly $215 million or 5% of the company’s $4.3 billion market cap.

Adjusted diluted EPS is expected to come in between $2.70 and $2.90. The consensus was $2.77, which is good news.

With that said, the company combines growth with value. Despite annual CapEx of roughly $300 million, free cash flow is expected to remain in positive territory. This allows the company to reduce net debt and engage in M&A like the acquisition of Clipper. The longer-term EBITDA growth rate is at least 11%, which I expect to last.

In light of that, GXO remains attractively valued. The company has an enterprise value of $6.2 billion, consisting of its $4.3 billion market cap and $1.9 billion in expected net debt. Note that net debt is expected to quickly fall to less than 2.0x EBITDA, which is a healthy development. The company has a BBB investment-grade credit rating.

That enterprise value is 7.8x next year’s EBITDA of roughly $800 million.

In my last article (when GXO was trading at 10x 2023 EBITDA), I wrote:

[…] paying 10x 2023 EBITDA is not a valuation that makes sense, as it’s too cheap. Even if economic growth deteriorates further, I don’t see a scenario where things get so bad that investments in supply chains are canceled. Delayed maybe, but not canceled. Also, as I already said, an implied free cash flow yield of 4.4% is a great deal. It’s similar to the free cash flow of some of the dividend growth stocks that I own.

Hence, I stick to my thesis that GXO should not be valued at less than $100 per share. Although, it may take some time until the stock reaches that target.

For now, I’m quite happy with the stock price as we’re seeing an attempt to bottom. I think this bottom may hold, providing investors with mid and long-term upside.

FINVIZ

Takeaway

GXO continues to execute. The company is winning new contracts, paving the way for sustained long-term EBITDA growth backed by secular tailwinds.

The company is generating increasing free cash flow used to reduce net debt and grow its business through M&A.

GXO is what I consider to be a perfect mix between growth and value. Unfortunately, the stock price has suffered since the spin-off last year. Investors have ignored Industry 4.0 stocks and everything that worked during the pandemic.

As GXO brings value to the table – on top of long-term growth – we are now dealing with an extremely attractive valuation.

While it’s hard to say when the stock will take off, I believe GXO is bottoming.

The risk/reward is attractive and I do not believe that GXO deserves to trade below its all-time high. Hence, that remains my target for the next 2-3 years.

(Dis)agree? Let me know in the comments!

Be the first to comment