Olga Nikiforova/iStock via Getty Images

Introduction

Even though Guess, Inc. (NYSE:GES) is down -34% YTD, in my personal opinion, now is not a bad time to go long. First, despite the decrease in traffic in stores, the company is able to raise product prices and demonstrate positive revenue growth at a time of pressure on consumers’ discretionary spending. In addition, despite the increase in input costs, the company is able to control the main operating costs in order to maintain profitability. Also, I believe that at the moment the company continues to trade below fair value and has potential for growth.

Projections

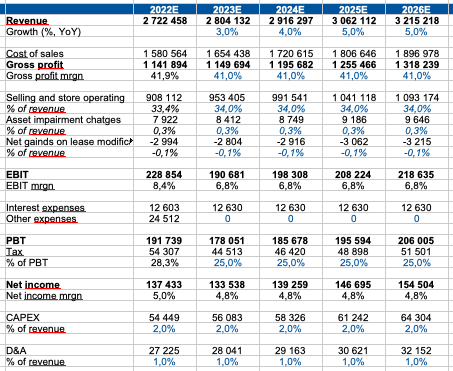

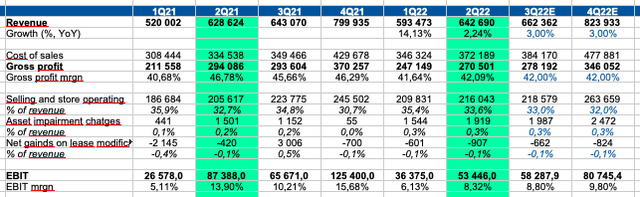

Gross profit margin: in my opinion, the gross margin in the next quarters will be at the level of 2 quarter, because, according to management, the company has successfully increased the prices of its main products, but pressure from negative store traffic and high discounts remains.

Selling and store operating costs: based on current trends and historical data, I believe that the level of expenses (% of revenue) will remain at current levels in the coming quarters, because, due to increased competition for labor, the company has already managed to raise wages payment earlier.

Revenue growth: I expect single-digit growth in the following periods. While the company is able to pass on the increase in input costs to the end consumer, in my personal opinion, the pressure on store traffic will continue.

Quarterly projections:

Yearly projections:

Personal calculations

Valuation

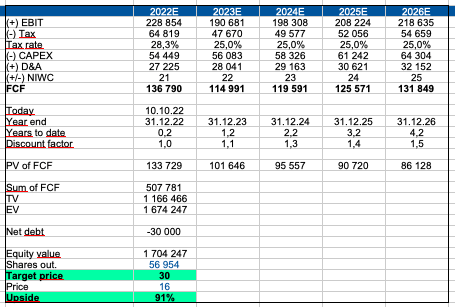

For company valuation, I prefer to use the discounted cash flow (“DCF”) model, for the following reasons:

Firstly, the company operates in a stable market and has a long period of historical data.

Secondly, based on historical trends, company management statements, and macro data, I can make assumptions about the growth of business revenue

In addition, based on macro data and data from peers, I can make assumptions about the impact of the current and future macro situation on the company’s cost growth rate

For evaluation, I use the following inputs:

WACC: 10.6%

Terminal growth rate: 3%

Personal calculations

Multiples

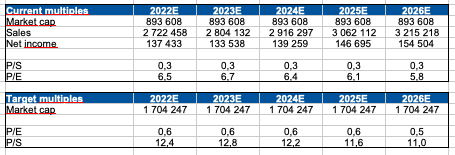

Also, in my personal opinion, the company is cheaply valued according to the P/E multiple.

Drivers

Macro: monetary easing by financial authorities, lower inflation, rising real incomes and recovery in consumer confidence could support consumer discretionary spending.

Growth: rising prices for the company’s core products, new store openings and growing online sales could support the company’s revenue growth.

Margin: thanks to rising prices and effective management of operating expenses, the company is able to maintain a stable level of operating profitability.

Risks

Macro: a continuation of the tightening cycle of monetary policy could have a negative impact on real consumer incomes and consumer confidence, which could have a negative impact on business growth.

Margin: rising inflation and rising input costs may continue to have a negative impact on the operating profitability of the business.

Conclusion

Despite the fact that the company continues to face pressure on same-store sales and pressure on growth and profitability, I believe the business is underpriced. In my opinion, the company is able to continue to show positive growth in revenue due to the possibility of higher prices for the end consumer. In addition, economies of scale and effective cost management help keep operating costs under control. According to my DCF model, the fair share price is $30 (upside potential 90%).

Be the first to comment