Solskin

Investment Thesis

Guardant Health (NASDAQ:GH) shares demonstrated an aberrant trading pattern yesterday (Friday, November 4th) after the San Diego-based gene testing company released Q3 results for the period ending September 30th, which were slightly below expectations. Revenue stood at $117 million, missing consensus estimates by just about half a million, while EPS stood at -$1.18 compared to the -$1.14 Wall Street forecast.

Shares dropped nearly 9% in the early hours of trading before rebounding, ending the Friday session up 5%. The company’s aberrant trading pattern mirrors two conflicting dynamics. First, shareholders’ renewed emphasis on clear profitability paths from growth companies as the Fed raises capital costs. Second, the company’s unique circumstances manifested in rapid regulatory and commercialization success in the past six months, creating a valid argument for higher spending; one management and many shareholders approve, notwithstanding Goldman Sachs (GS) and Credit Suisse (CS), both lowering GH’s ticker price targets from $80 to $70 per share after the earning release.

Although the market quickly forgave GH for its aggressive spending during the quarter, the paradigm shift from “growth at all costs” to the more delicate balance of “profitable growth” manifested itself in the trading patterns of its peers. For example, Veracyte (VCYT) and Exact Sciences (EXAS) shares rose by double-digit rates on lower Q3 operating spending and adequate growth. In contrast, CareDx (CDNA) shares tanked on Q3 results showing an unbalanced focus on profitability at the expense of commercial development, an unsuitable combination in the nascent gene testing market.

This piece reiterates the modestly-bullish rating laid out in the previous article. However, it acknowledges a higher risk/reward balance going into 2023 on higher spending.

Revenue Trends

GH reported solid growth figures, with sales rising to $117 million in Q3, up $22 million (24%) from the same period of last year, driven by increased clinical and biopharma testing volumes. Higher spending was notable, with GAAP and non-GAAP operating expenses rising 29% and 49%, respectively, outpacing the increase in revenue. This constitutes a deviation from what I believe is a paradigm shift in the gene testing industry, emphasizing a new delicate balance between profitability and growth.

Management’s approach appears to prioritize pursuing new target markets, presenting themselves as “low-hanging fruits,” leveraging the company’s existing cfDNA platform. For instance, in September, the company introduced its +800 gene panel Guardant Infinity to the biopharmaceutical industry for cancer research and drug development. In August 2022, the GH expanded Guardant Reveal, its Minimal Residual Disease “MRD” cancer recurrence risk test to lung and breast cancer patients. It was also only in May that the company launched Guardant Shield for early detection of Colorectal Cancer in the US, utilizing its cfDNA platform.

The company also scored significant regulatory wins in the past few months. For example, the FDA recently expanded the label of its flagship product, Guardant 360, as a companion diagnostic test for AstraZeneca’s ENHERTU for treating non-small lung cancer Patients. Another example is the Medicare coverage decision for Guardant TissueNext earlier this year, which contributed to higher spending.

One need also to acknowledge recent expansion in Europe and Asia, manifested in the opening of the company’s first liquid biopsy center in Europe, in partnership with Vall d’Hebron Institute, as recently as last May. LinkedIn data shows a 17% increase in hiring in the company’s Asia Pacific, Middle East and Africa “AMEA” subsidy after acquiring Softbank’s share in the joint venture four months ago, not to mention the Japanese regulator’s marketing authorization for the use of Guardant 360 as a companion diagnostic with Keytruda, Merck’s (MRK) therapy for metastatic melanoma.

Not capitalizing on this opportunity through awareness campaigns targeting physicians and opinion leaders would be a significant waste, especially given the competitive landscape. In management’s view, these developments necessitate increasing hiring and spending, and I don’t believe the company plans to tame spending any time soon. In April 2022, GH leased 37,000 square feet at 10578 Science Center Drive, San Diego, and announced aggressive hiring plans.

Financial Position

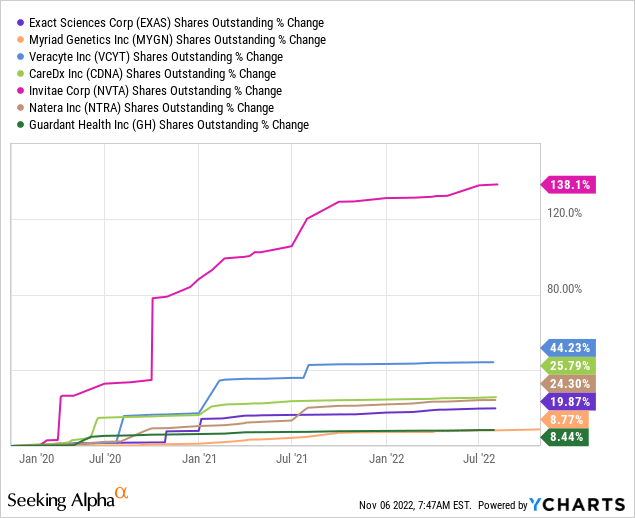

In addition to the commercial and regulatory developments, GH’s increased spending is supported by a robust balance sheet to back it. Share dilution has been minimal during the quarter, limited to the company’s stock-based compensation. Thus, the $78 million Q3 cash burn is largely offset by its $1.2 billion dry powder as of September 2022. Going forward, I believe this is enough cash to sustain the company’s R&D and SG&A spending as it expands its testing menu, with minimal dilution risk. As shown in the graph below, during the last three years, GH’s share count growth has lagged behind that of its rivals.

The company holds $1.2 billion in debt. However, this is a 0% convertible debt maturing in 2027. It carries dilution risk, perhaps in the medium term, more than anything else. The conversion rate is 7.2 shares per $1000 principal amount held. Thus conversion price stands at $139 per share. Until 2027, or until GH shares triple from the current level of $47 per share, conversion is out of the money, and I am a little concerned about the issue. Plus, the magnitude of dilution is 8.5 million shares, representing 8.5% of the current outstanding shares. Thus, even if conversion materialized today, the dilution rate would remain below its peers.

Unique Market Position

GH is what one would expect when a Key Opinion Leader, “KOL,” makes a job transition into the device diagnostic manufacturing business. The company has a robust clinical trial pipeline requiring extensive spending, but it has a unique position in the market with a solid regulatory foundation. The company works to obtain FDA pre-market approvals “PMA” for almost all its products. More importantly, it derives most of its revenue from Guardant 360, which is already FDA-approved, making it stand out from other peers such as Invitae (NVTA), Natera (NTRA), and other players exploiting the CLIA-waiver to market their products as Laboratory Developed Tests “LDTs.”

In January 2022, the company enrolled the first patient for the SHIELD Lung study to detect lung cancer. The study is massive, with 10000 participants. The company is studying the Guardant screening test through the ECLIPSE study, which has 12,000 participants and expects to gain FDA approval in 2023.

In a previous article, I lowered the regulatory risk of FDA oversight over the LDT market from high to medium, given the Republican Party’s lead in mid-term elections and their historical business-friendly approach to healthcare policy. Nonetheless, the risk still exists, and I believe that beyond political dynamics, bipartisan support for FDA oversight over LDT is forming, giving GH a unique advantage over many of its peers, exploiting the 1988 CLIA waiver, and allowing marketing LDTs with minimal FDA oversight.

Summary

The market quickly forgave the company for deviating from what I see as a broad industry pattern, now focusing on delivering clear profitability paths instead of untamed spending to deliver growth. This new paradigm was manifested in GH’s peers, nonetheless, namely EXAS, VCYT, and CDNA, who saw double-digit price swings after Q3 results last week, at least validating our hypothesis laid out in previous articles.

GH’s unique trading pattern on Friday mirrors the company’s unique position and circumstances that necessitate a ramp-up in spending and warrant the gene testing firm an exception from the current industry paradigm. In the past few months, the company introduced multiple new products, gained FDA label expansion for its flagship product, and implemented an aggressive international expansion, all warranting additional hiring and operational spending, as mirrored in its Q3 financial result.

This update reiterates GH’s buy rating but downgrades the company’s outlook going into 2023, based on competitive trends and higher spending, compared to its peers.

Be the first to comment