Shidlovski/iStock via Getty Images

Guardant Health, Inc. (NASDAQ:GH) is a leading precision oncology company that provides a comprehensive suite of genomic profiling and molecular diagnostics products to identify the appropriate cancer treatment for each individual patient. The company’s tests are used to detect the presence of cancer in patients throughout all stages of the disease, starting from screening with their Guardant SHIELD up to including advanced treatment with their Guardant360.

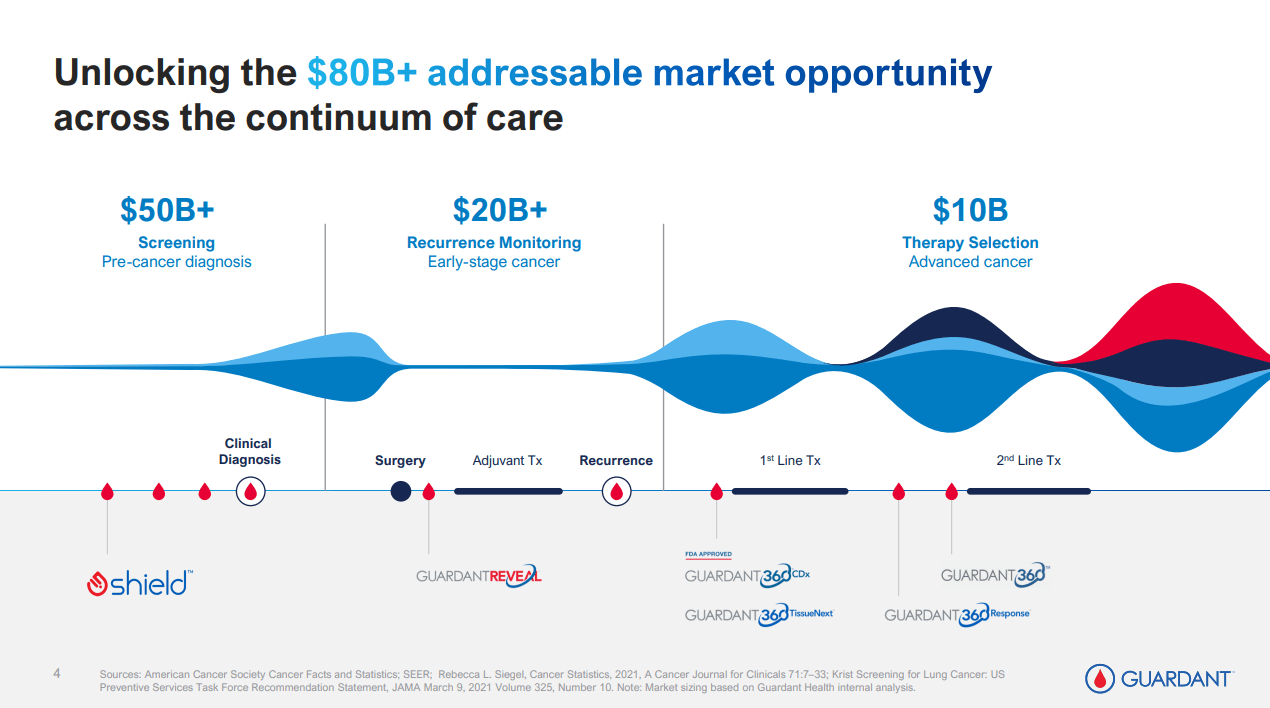

GH has been able to grow its revenue by expanding its product portfolio and successfully expanding into new opportunities such as the Guardant360 CDx test. As a result, this makes the company well positioned to capitalize on their growing $80 billion addressable market in cancer care continuum.

GH’s products remain important to society and are well positioned to benefit from rising TAM across the cancer care continuum. However, in light of a slowing global economy and the likelihood of a global recession, this could lead to less funding for cancer screening and treatment, which could hurt GH’s top line. GH remains unprofitable making it unappealing despite a massive price drop year to date, and it is relatively expensive in comparison to its peers, making it a viable stock short play in today’s bearish market.

GH: $80 billion TAM (William Blair 42nd Annual Growth Conference)

GH recently launched Shield™, its first blood-based test for the detection of early-stage colorectal cancer (CRC). In fact, it continues to make a difference for the better, as quoted below.

We believe our Shield blood test has the potential to be much more effective in reducing CRC mortality and adding more life years gain than any other stool-based screening test. Throughout the history of Guardant, we have dealt with several skeptics who claim that blood test cannot add value in oncology. And every time they have been proven wrong. And liquid biopsy showed it can, in fact, transform precision oncology. Source: Q1 2022 Earnings Call Transcript

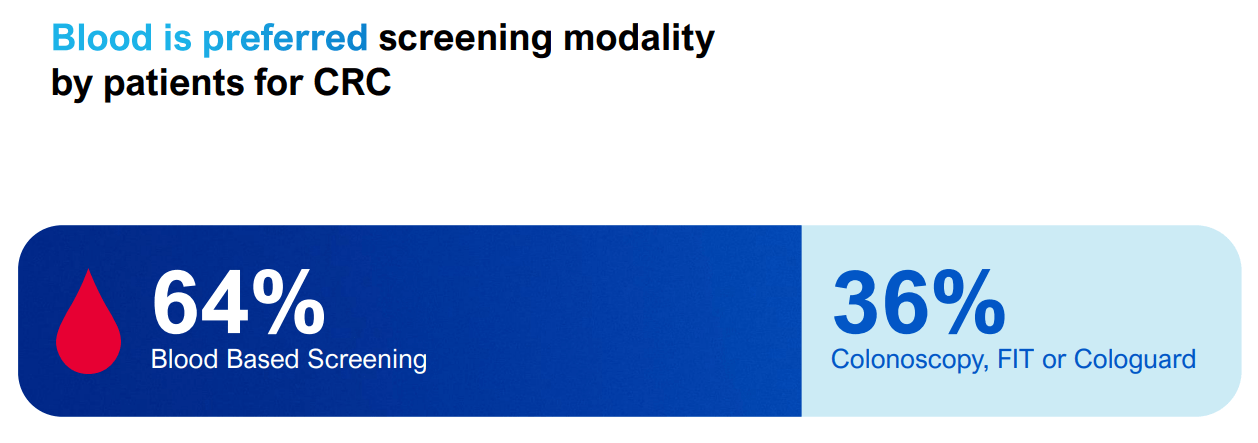

According to the management, blood-based tests are getting more attention over traditional fecal immunochemical tests (FIT), as shown in the image below, which may support its growing topline.

GH: Getting Some Approval From Patients (William Blair 42nd Annual Growth Conference)

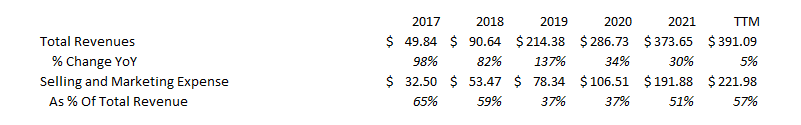

In my opinion, GH is well positioned to capitalize on analysts’ topline estimate of reaching over $1 billion in 2026. However, despite its growing top line, GH was unable to translate this to a positive bottom line due to massive operating expenses and inefficiency in their sales and marketing expenditures.

GH: Inefficient Marketing Expenditures (Company Filings. Prepared by InvestOhTrader. Amounts in Millions)

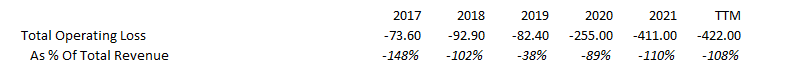

GH has been consistently growing its top line, but figures from 2020 started to slow down, contrary to its selling and marketing expenses trend. This inefficiency continues to widen its operating loss, which is currently at -$422 million, its highest operating loss record since 2016.

GH: Widening Loss (Data from Seeking Alpha. Prepared by InvestOhTrader)

Although there is a ballooning in its total operating expenses, according to the management, a portion of this is attributed to significant investment, which will continue to drive improvement in its commercial infrastructure and product pipeline.

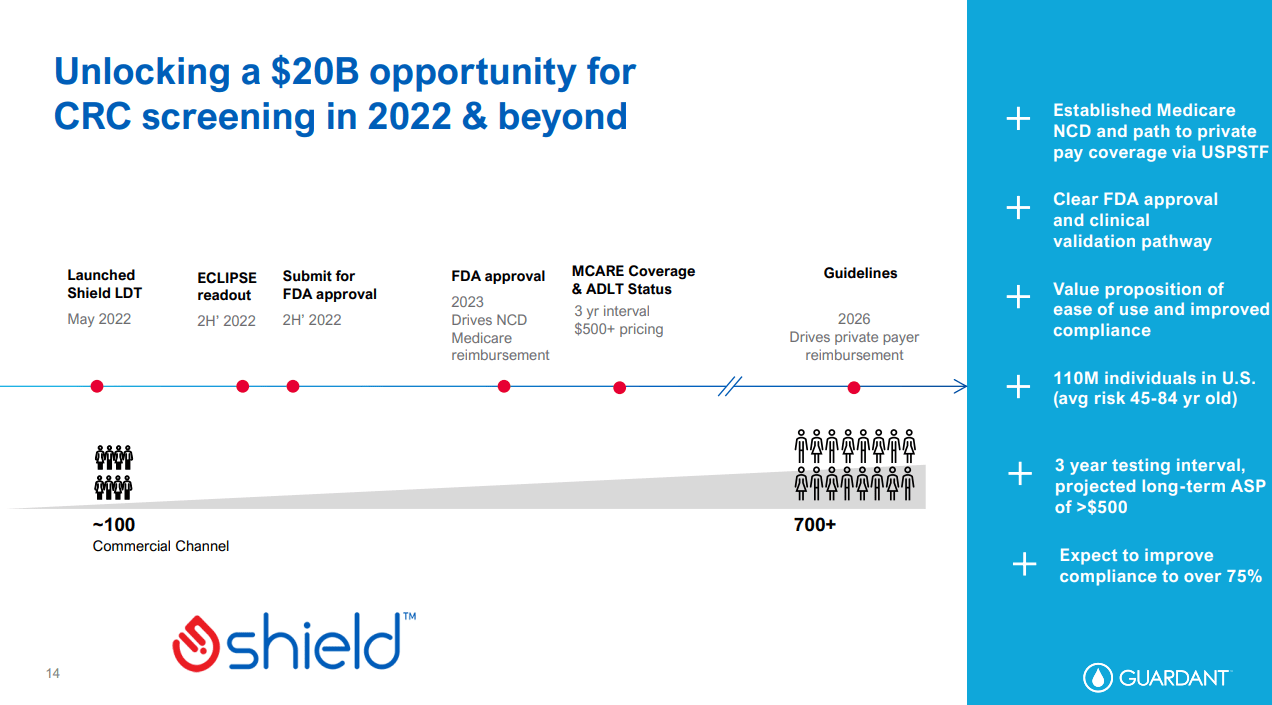

Risk Note: Interesting 2022 and Beyond

GH: GH Working To Be First Blood-based (William Blair 42nd Annual Growth Conference)

Looking at a long-term perspective, Guardant Health has much more to offer, especially with its evaluation of the ctDNA LUNAR test in an Average Patient Screening Episode (ECLIPSE), which is expected by the management to be a readout around September this year. A positive readout may help the company get the United States Preventive Services Task Force’s (USPSTF) guidelines inclusion, according to the management. This catalyst will allow GH to be the first blood-based cancer screening test covered by Medicare and potentially secure Advanced Diagnostic Laboratory Test (ADLT) status.

We have already started our modular submission to FDA and are planning to submit our PMA application by end of the year, pending successful ECLIPSE readout. We believe we will be the first to have a blood-based cancer screening test with Medicare coverage and FDA approval. Post approval, we have the opportunity to ADLT status for this test. And with PAMA, we are confident that we will be able to secure Medicare pricing of over $500. We are clearly operating in a very different environment than 8 years ago, and I’m confident about our pricing strategy. Source: Q1 2022 Earnings Call Transcript

In my opinion, improvement in sales and marketing expenditures in the future and a positive update about ECLIPSE in H2 2022 may help the company look fundamentally attractive.

Company Valuation

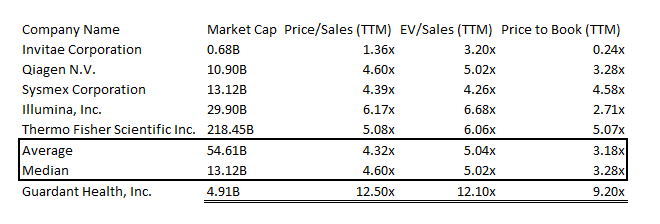

GH: Relative Valuation (Data from Seeking Alpha. Prepared by InvestOhTrader)

Invitae Corporation (NVTA), Qiagen N.V. (QGEN), Sysmex Corporation (OTCPK:SSMXY), Illumina (ILMN), Thermo Fisher Scientific (TMO)

GH can undoubtedly increase its top line over time, but its current inability to shift its operating expenses into a healthy bottom line appears to be more difficult to manage, especially in today’s declining economy.

Looking at the image above, after plunging more than 50% from this year’s high, the company still possessed unattractive multiples compared to its peers. GH has a trailing 12.50x P/S ratio, down from its 5-year average of 31.38x and is trading at a higher multiple compared to its peers’ average of 4.32x. In my opinion, even at an estimated 3.75x P/S at today’s rising interest rate, GH still remains expensive. This is especially true if GH comes out of breakeven and starts to produce a positive EBITDA margin of 20% in 2026. Assuming a 10% discount rate at an implied EV/EBITDA multiple of 15x, I believe we might see GH at around $20 in the next few years.

Additionally, looking at its pricey EV/Sales and P/B multiples of 12.10x and 9.20x, respectively, and its slowing revenue growth forecast of 24.64% compared to its 30.32% YoY growth in FY2021, I believe GH is still unattractive at today’s price. I believe that NVTA is a much safer investment compared to GH, especially considering its five-year revenue compounded annual growth rate of 72.53%, compared to GH’s 71.41%, and of course, it has a much cheaper multiple.

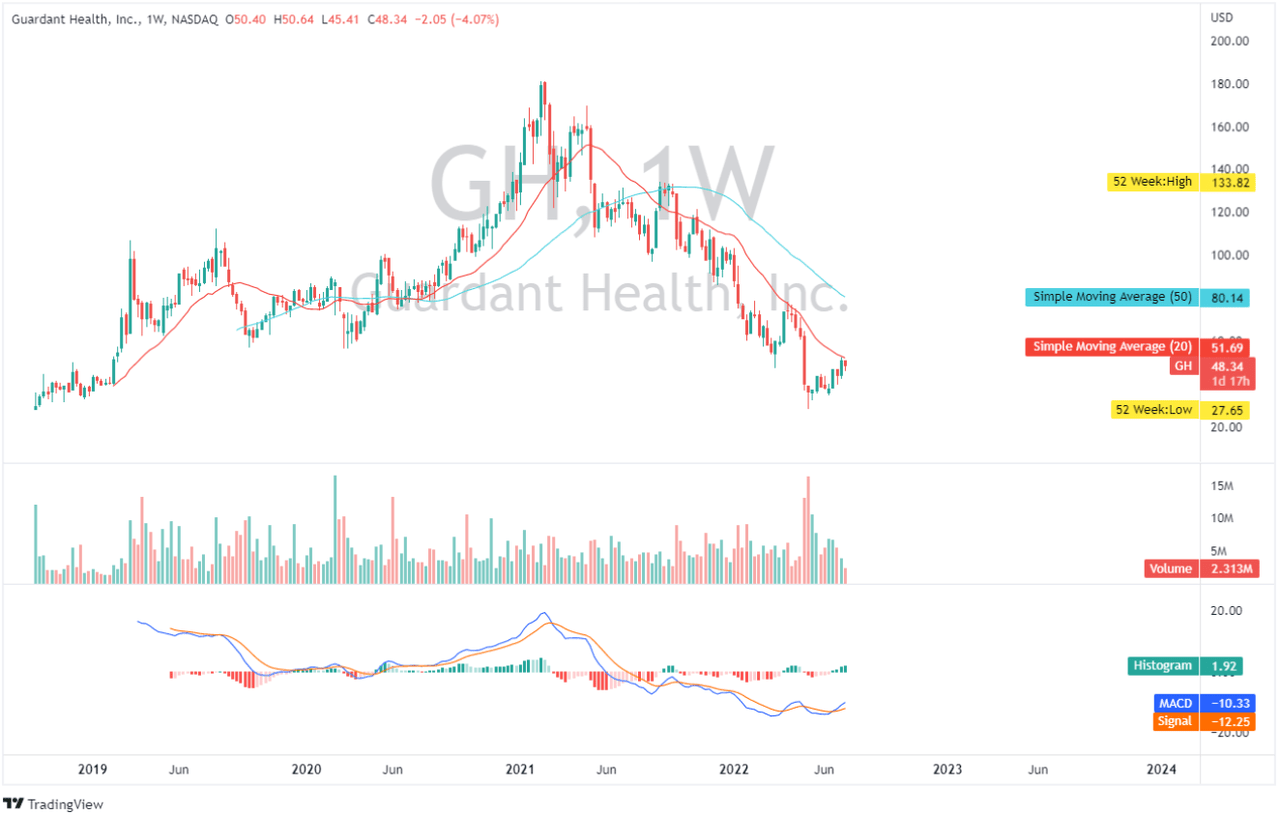

At a Logical Resistance

GH: Weekly Chart (TradingView.com)

Guardant Health is currently trading below its 20-day moving average, which may serve as a psychological resistance in place. As of this writing, it has a 4.38% short interest, a borrowing cost of 0.25% and 700,000 shares available to be sold. Buying a put option at today’s price may eliminate volatility risk due to a positive reading catalyst which is expected to be released by the management around September this year. Looking at its MACD indicator, GH trades above its signal line, implying a weak bullish price action since it remains below the zero line.

Final Key Takeaways

GH’s positive catalyst about its growing TAM and numerous line up of product portfolio updates seems challenged by today’s macro environment where analysts expect a more than 50% chance of the US having a recession this year. The uncontrolled inflation will eventually hurt people’s disposable income and might lead to high unemployment rates which in turn may affect the overall oncology testing demand. As a result, this may lead to a widening net loss, which could lead to potential dilution just to fund its core operating expenses. On top of its challenged demand environment, GH is still unprofitable and is still trading at high multiples, making it unattractive at today’s price.

Thank you for reading and good luck everyone!

Be the first to comment