Nariman Safarov/iStock via Getty Images

My investment thesis

Despite the stock price has fallen nearly 44% from last year’s all-time-highs, WD-40 Company (NASDAQ:WDFC) is way overvalued. The outperformance of the stock compared to the S&P 500 index (SPX) (15.4% versus 12.2% annualized total return) has been mainly driven by extreme multiple expansion. Still, investors should keep this under-the-radar stock on their watchlist.

WD-40 Company: A simple but great business

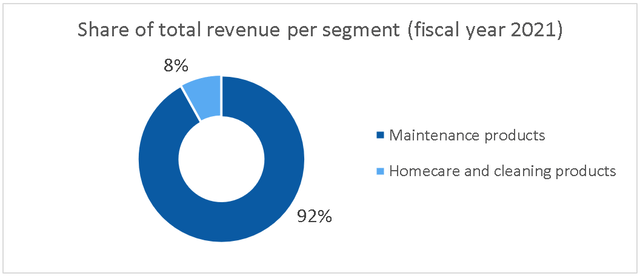

WD-40 Company is an iconic American household business, selling maintenance, homecare, and cleaning products in more than 176 countries and territories worldwide. Over the years, the company has acquired multiple brands resulting in a family of brands and product lines. The company generated a total revenue of $488.1 million over fiscal year 2021. Sales are divided into two groups:

- Maintenance products ($448.8 million).

- Homecare and cleaning products ($39.3 million).

The maintenance products segment is clearly the largest segment, responsible for 92% of total revenue.

Share of revenue per segment (WD-40 Company 2021 Annual Report)

The company’s signature product is WD-40 Multi-Use, which is sold in the famous blue and yellow can with the little red top. This simple product accounts for a significant majority of total company sales. Currently, the maintenance products segment consists of various products that are sold under the WD-40, 3-IN-ONE, and GT85 brands. Before analysing this company, I never knew that they also sell homecare and cleaning products. Several brands are sold in specific markets worldwide, such as 2000 Flushes, Spot Shot, Carpet Fresh, 1001, Lava/Solvol, and X-14.

Maintenance Products (WD-40 Company Corporate Overview)

Moats protecting the business

The WD-40 Company is only a mid-cap stock with a market cap of $2.55 billion, but it has still managed to achieve a dominant market position in its maintenance product categories. Both WD-40 Multi-Use Product and 3-IN-ONE combined have a market share of 86% in the United States. Such a huge market share can only be achieved if a business has advantages over competitors. In the following, I will name two moats that give WD-40 Company competitive advantages.

1. Brand

WD-40 Company relies on brand awareness among consumers. The brand is, in my opinion, also the main moat for this business. I think nearly everyone knows what WD-40 Multi-Use is and the majority of households will own one of more cans of it. A survey in 1993 already revealed that WD-40 products could be found in 4 out of 5 households in the United States. Apparently, people are willing to pay a slightly higher price for a WD-40 product instead of another competing product (with potentially a lower level of quality).

2. Product quality

This one is related to ‘Brand’, as I believe that the brand awareness is so high because the product has some many use cases and is very reliable. Therefore, it makes sense for a household to always have a can within reach. Whether it is a squeaky door hinge, a freezing lock, or dirt in your car’s paintwork – WD-40 will do the job.

All in all, WD-40 Company’s market position depends on product quality, future product innovation, and brand awareness among customers. The business could be disrupted if a more superior product enters the market, but this has not yet happened since the secret formula was founded nearly 70 years ago. Besides, if a competitor would want to build a new brand, it would require a lot of time and money. Thus, despite the simple nature of WD-40 Company’s business, I think it will be protected by its moats in the foreseeable future.

A great business combined with great financials

Besides WD-40 Company being a great business, the company also has great financials. Let’s take a look at the company’s overall historical performance. Over the last four years, the company managed to generate a steady annual revenue growth of 6.4% on average. However, gross profit and EBITDA have been growing at lower rates. This is because both gross margin and EBITDA margin have been decreasing every year, mainly due to input costs. The company gross margin target is 55.0% which I think they can achieve once commodity prices come down. But, the EBITDA margin is quite far away from the 25.0% company target. One positive note is that they managed to grow EPS with 8.2% annually, due to changes in taxes and share repurchases.

|

2017 |

2018 |

2019 |

2020 |

2021 |

4Y CAGR |

|

|

Sales ($ million) |

$380.5 |

$408.5 |

$423.4 |

$408.5 |

$488.1 |

6.4% |

|

Gross profit ($ million) |

$213.9 |

$225.3 |

$232.3 |

$223.0 |

$263.7 |

5.4% |

|

Gross margin (%) |

56.2% |

55.2% |

54.9% |

54.6% |

54.0% |

|

|

EBITDA ($ million) |

$82.7 |

$86.4 |

$90.0 |

$84.9 |

$95.9 |

3.8% |

|

EBITDA margin (%) |

21.7% |

21.2% |

21.2% |

20.8% |

19.6% |

|

|

EPS ($) |

$3.72 |

$4.64 |

$4.02 |

$4.40 |

$5.09 |

8.2% |

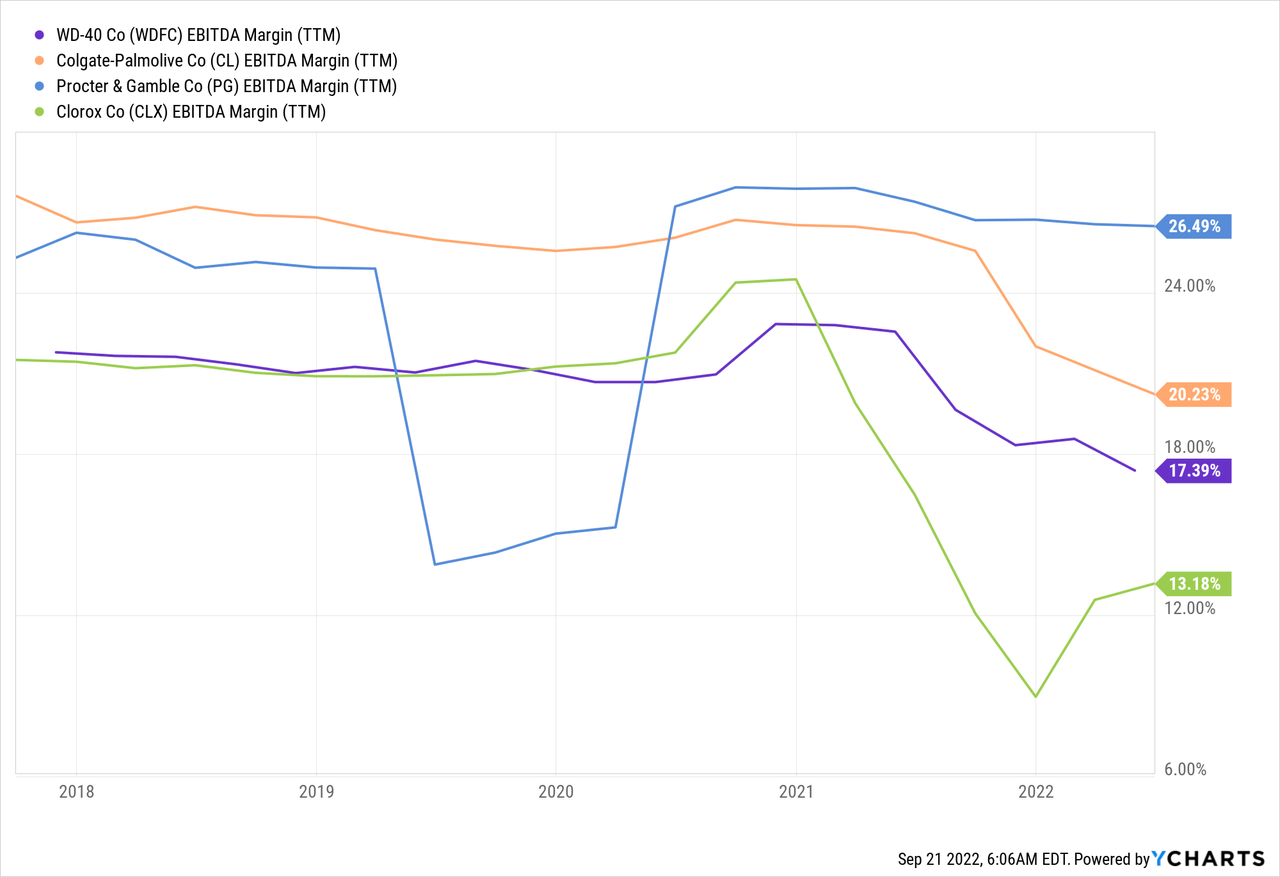

Now let’s see how WD-40 Company performs compared to its peers. Compared to other household product companies like Colgate-Palmolive Co (CL) and Procter & Gamble Co (PG), the EBITDA-margin of WD-40 Company is significantly lower (see graph below). On the other hand, WD-40 Company does a better job on keeping up the margins than Clorox Co (CLX) in the current inflationary environment.

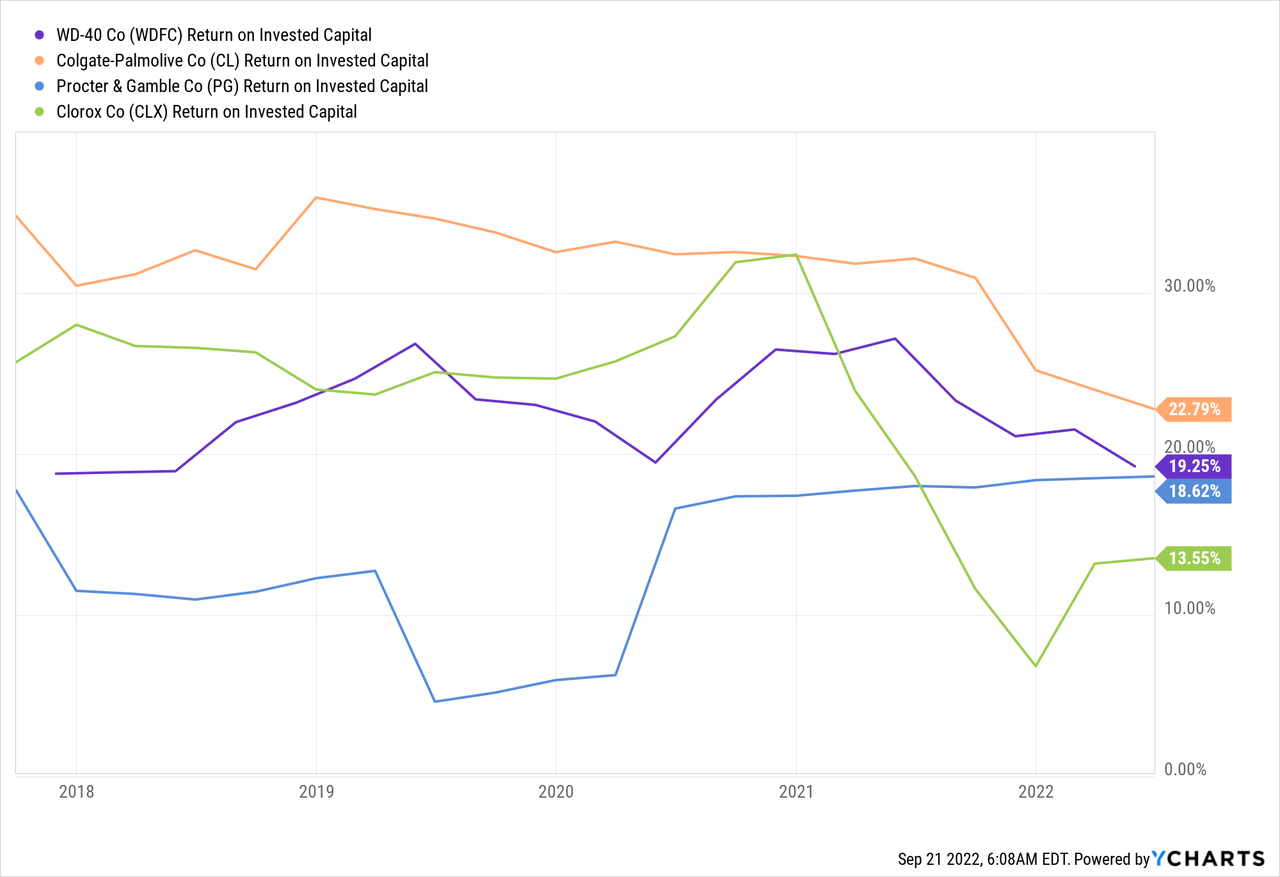

The return on invested capital is in-line with WD-40 Company’s peers. I personally strive for companies with a ROIC >10%, so the company is able to drive high returns on every dollar invested.

Balance Sheet

Besides decent growth and margins, the WD-40 Company has a pretty good balance sheet with low leverage. This shows that despite the dividends and share repurchases, management is prudent with capital allocation – a big positive.

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Cash & Cash equivalents ($ million) |

$117.2 |

$49.1 |

$27.2 |

$56.5 |

$86.0 |

|

Short-term & current debt ($ million) |

$20.0 |

$23.6 |

$21.2 |

$0.8 |

$0.8 |

|

Long term debt ($ million) |

$134.0 |

$62.8 |

$60.2 |

$113.1 |

$114.9 |

|

Net debt ($ million) |

$36.8 |

$37.3 |

$54.2 |

$57.4 |

$29.7 |

|

EBIDTA ($ million) |

$82.7 |

$86.4 |

$90.0 |

$84.9 |

$95.9 |

|

Net leverage |

0.4x |

0.4x |

0.6x |

0.7x |

0.3x |

Why WD-40 is way overvalued

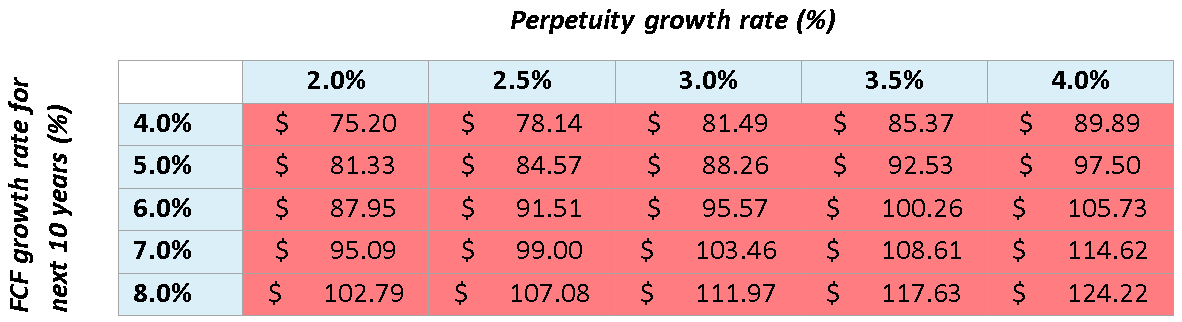

WD-40 Company has a decent moat and I like some of their financials. But, as mentioned in my investment thesis, the stock is way overvalued. In the following I will show you why, starting with the Discounted Cash Flow Analysis. I often use this well-known method to calculate the intrinsic value of a business. Because it is very hard to predict the exact growth rates, I use different values in a sensitivity analysis.

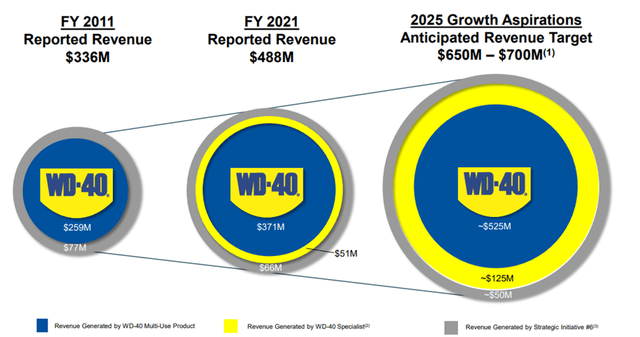

The question is what are realistic future growth rates for this company. The company is aiming at $650-$700 million in sales by FY2025. This would imply an average annual revenue growth between 7.4% and 9.4%. While I think it is a great company, this is not very probable as revenue grew 3.8% on average FY2011-FY2021, and 6.4% on average FY2017-FY2021. Achieving the company growth aspirations would require a significant growth acceleration. Assuming that margins will return to the mean, I think that a free cash flow growth rate between 4.0% (bear case) and 8.0% (bull case) is a suitable range.

Revenue growth targets (WD-40 Company Corporate Overview)

The perpetuity growth rate is typically between historical inflation (2-3%) and historical GDP growth rate (4-5%). Because WD-40 Company mainly sells household and industrial products, the 2.0%-4.0% range is a suitable assumption for the perpetuity growth rate.

|

Input |

Value |

|

First year of projections |

2022 |

|

Personal Required rate of Return |

10.0% |

|

Number of shares outstanding |

13.627 million |

|

Net borrowings |

$29.7 million |

|

Base free cash flow (fiscal year 2021) |

$69.6 million |

|

Free cash flow growth rate for next 10 years |

4.0% / 5.0% / 6.0% / 7.0% / 8.0% |

|

Growth rate in perpetuity |

2.0% / 2.5% / 3.0% / 3.5% / 4.0% |

The current stock price ($186.57) is not even close to the intrinsic values I calculated with the Discounted Cash Flow Analysis.

Sensitivity analysis valuation WD-40 Company (Author)

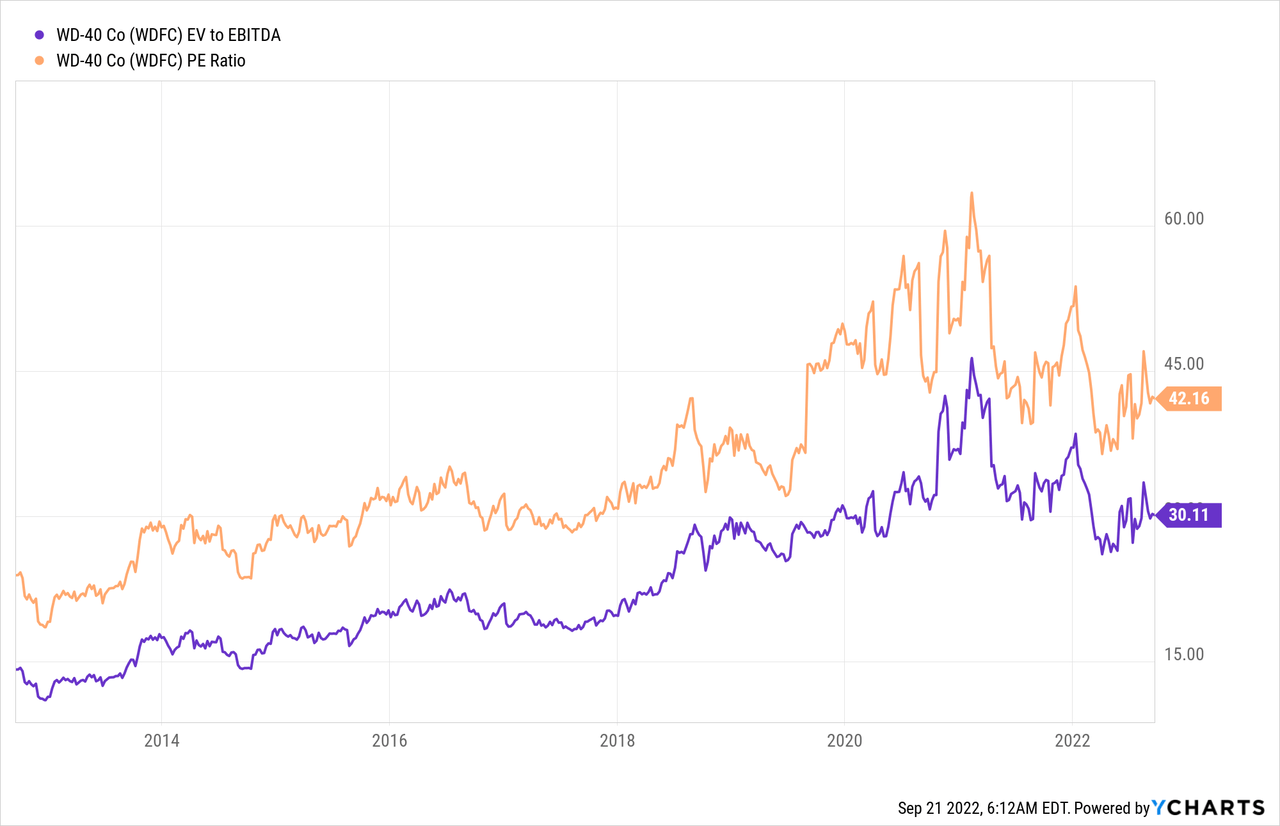

Next, we will look at the EV/EBITDA and PE ratio, two often used multiples to value stocks. As shown in the graph below, the stock has experienced extreme multiple expansion over the years. Because revenue has only grown mid-single digits on average, this multiple expansion has caused WD-40 Company to outperform the S&P 500 index. Multiple expansion of this magnitude might be right is the business model of the company had changed over the past decade, like Microsoft Corporation (MSFT). But this is not the case. While the EV/EBITDA and PE ratio have come down a bit, a lot of further downside is required for them to reach historical levels. If the PE ratio would fall to let’s say 20x, this would imply a share price of $101.80 assuming the FY2021 diluted EPS – this is approximately in-line with the calculated intrinsic values by the Discounted Cash Flow Analysis.

I can think of two explanations for the overvaluation of this stock.

- The market assumes that growth will exceed management expectations. This is possible, but given the historical financial figures not very probable in my opinion.

- The market demands a lower return on investment. I personally aim at a >10.0% return on my investment and I do not often lower this number. Let’s see what return on investment you can expect with the current stock price ($186.57). If you use a FCF growth rate of 6.0% and perpetuity growth rate of 3.0% in the Discounted Cash Flow Analysis, I receive a return on investment of roughly 6.7%. This might be sufficient for some investors, but not for me.

Other bearish arguments to consider

Besides the overvaluation of the stock, there are some other risks that could affect the business:

- We should recognize that WD-40’s products, especially the homecare and cleaning products, are highly competitive, competing with many other products for shelf space. As some competing products might be lower priced and marketed by companies with greater financial recourses, WD-40 Company relies heavily on its brand and product value.

- It is hard to identify a visible moat for the homecare and cleaning products, as these are sold in specific local markets. The company also recognizes that these products encounter most competition. I understand that management wants to diversify its business with different brands, but these products account for such a minor portion of total revenue that I honestly do not see the added value.

- The company isn’t able to maintain margins in times of inflation. Currently, margins have been seriously impacted by costs for distribution, freight, warehousing, production, chemicals, and aerosol cans. This decreases the bottom line result. On the other hand, I believe the higher costs are temporary and margins will return to normal in the mid-term.

Final thoughts

WD-40 Company has a simple but great business, protected by moats, which will enable WD-40 Company to maintain (or even expand) its market share in the maintenance products category. There is also a lot to like about the financials, although margin strength has significantly decreased over the last few years. My perspective is that margins will recover eventually once cost headwinds subside. The combination of a great business and great financials makes this an interesting company to put on your watchlist.

What I like the least about this company is the valuation of the stock. Despite the recent fall of the stock price, the current valuation is nearly twice the intrinsic value calculated by my Discounted Cash Flow Analysis. Due to this extreme overvaluation, I currently rate this stock a Sell.

Be the first to comment