georgeclerk

Thesis

The Goldman Sachs Treasury Access 0-1 year ETF (NYSEARCA:GBIL) seeks to track performance of the FTSE US Treasury 0-1 Year Composite Select Index. As per the Index literature:

An extension of the flagship FTSE US Treasury index series, the FTSE US Treasury 0-1 Year Index is a representative measure of the of the performance of US Treasury bills, US Treasury notes, and US Treasury bonds with time-to-maturity greater than or equal to one month and less than one year. Stand-alone index series to track the performance of US Treasury Bills and Bonds, as well as term segments

The ETF collateral currently has a weighted average maturity of 0.38 years and a duration of 0.37 years:

Duration (Fund Fact Sheet)

The fund is very much akin to rolling 4-5 months T-bills and currently exposes a 2.07% SEC yield:

SEC Yield (Fund fact sheet)

The very short duration profile for the fund really provides for this instrument to be viewed and used as a “cash-like” instrument. The fund has minimal to no impact from rising rates in terms of pricing and re-sets to the front end of the yield curve constantly. That means investors will actively get higher yields as Fed Funds move higher. GBIL is the perfect instrument to actively and dynamically capture the front end of the yield curve with de-minimis duration impact.

The fund is flat year-to-date, unlike some other short term bond funds which run slightly higher duration. Do not expect long term gains here from GBIL, just view it as a cash like instrument that dynamically captures the front end of the yield curve and gives an investor who does not want to roll T-Bills on their own the exposure to higher short term yields.

We believe we are in a bear market and the current violent equity market rally is the result of short positioning being squeezed out. Some market participants try to take advantage of bear markets by entering short positions (either outright or via ETFs). Unfortunately, market timing is a very difficult thing to do and bear market rallies thrive on investors being squeezed out from short positioning. We believe the best way to ride out the current storm is via a large cash allocation. GBIL does that wonderfully and gives investors exposure to the front end of the yield curve and rising yields.

Performance

On a year-to-date basis the vehicle is virtually flat:

YTD Performance (Seeking Alpha)

We can see from the above graph that other short term securities funds have slightly negative total return performances due to the fact that they run some sort of duration in their portfolios. They will recover, but a duration close to 1 year or above that will produce a negative result. GBIL is almost flat for the year due to the short duration profile.

On a 3-year time series GBIL is slightly positive:

3-Year Performance (Seeking Alpha)

Do not expect any outsized gains here. This vehicle is a cash like instrument and in the past years with short term yields very low GBIL did not generate much in terms of yield/total return.

GBIL Quote Mechanism

We also like the fact that GBIL follows the T-Bills quoting methodology. As a brief “101” on Bills, these instruments are issued at a discount and the yield represents the difference between par and the discount:

Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. Your interest is the face value minus the purchase price. It is possible for a bill auction to result in a price equal to par, which means that Treasury will issue and redeem the securities at par value.

Source: TreasuryDirect

We can see that GBIL is trading around 100, similar to a T-Bill face value. It should stay around 100 as well going forward given its composition and de-minimis duration.

Holdings

The fund holds only treasury securities:

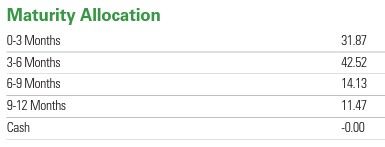

From a maturity standpoint more than 73% of the fund is composed of securities with maturities of less than six months:

Maturity Allocation (Fund Fact Sheet)

By having such short dated collateral the fund ensures that its pricing is not significantly affected by the current rising rate environment and that the “pull to par” effect is rolled over expeditiously.

Conclusion

GBIL is a U.S. T-Bills ETF with a very short duration of 0.37 years. The vehicle falls in the short bond funds product family and should be viewed as a cash like instrument. The fund dynamically captures the rising front end of the yield curve and had de-minimis negative impact from rising rates. GBIL has a current 30-day SEC yield of 2.07% and represents a good vehicle to ride out the current bear market. We believe we are in the midst of a bear market rally fueled by investors covering short positioning and feel the best way to ride out the upcoming storm is in a cash-like instrument such as GBIL.

Be the first to comment