Arkadiusz Warguła/iStock via Getty Images

As demand for air travel is picking up globally, investors have been focused on investing in airline and travel stocks and those are some pretty straightforward investing ideas I would say. However, I believe that airport names of which there are not that many open to public investment are an overlooked opportunity. In this report, I want to have a look at the most financial results for Grupo Aeroportuario del Sureste (NYSE:ASR).

About Grupo Aeroportuario del Sureste

Grupo Aeroportuario del Sureste is an international airport group operating airports in Mexcio, the US and Colombia. The company operates nine airports in Mexico, including Cancún International Airport which is the second biggest airport in Mexico with over 22 million passengers annually accounting for over 75% of the traffic flow through the Mexican airports operated by the airport group. Luis Muñoz Marín International Airport in San Juan with over 9 million passengers annually is the second biggest airport in the company’s portfolio and the only airport it operates in the US. The third biggest airport that the group operates is the José María Córdova International Airport that serves the Medellín Metropolitan Area and has nearly 8 million passengers each year. It is the biggest airport in the portfolio of six airports operated in Colombia.

Making Money As An Airport

So, how do airports make money? It are basically two revenue streams, the first one is aeronautics revenues that include landing and departure fees, passenger charges, terminal space rentals, security and aircraft parking. The second stream is non-aeronautical revenues which include things like car parking, car rental, ground transportation, retail, food and beverages and fast track.

So, there are two revenue streams that are well-suited to capitalize on the travel rebound. On one hand, we have airlines increasing their flight schedules again which benefits the airline via aeronautical revenues. On the other hand, the passengers are returning to the terminal halls and they have money to spend which benefits the commercial revenues which form a big portion of the non-aeronautical revenues.

So, as an airport to make money you have to appeal to airlines providing smooth operations and offer travelers a unique experience.

Third quarter results Display Stellar Growth

Grupo Aeroportuario del Sureste

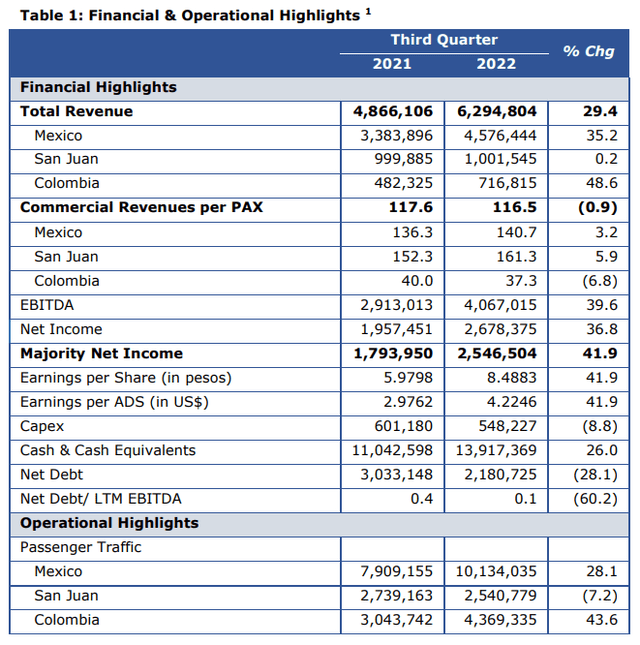

Third quarter results showed stellar growth wit a 29.4% increase in revenues to Ps.6.3 billion. Revenue growth outpaced passenger traffic growth in all three airport portfolios. Only San Juan, saw passenger traffic decline driven by a 1.5-day closure of the airport due to Hurricane Fiona in September, but its revenues remained stable despite a 7.2% reduction in passengers. In Colombia, a commercial revenues per pax declined nearly 7% due to the depreciation of the Colombian peso. Overall, the third quarter put on display solid growth in passenger numbers and revenues and on 30% revenue growth a 40% EBITDA growth was realized improving its debt-to-EBITDA to 0.1 from 0.4. These results are particularly strong considering that the operating costs excluding construction costs were 23.6% higher driven by labor, maintenance and higher energy costs.

Grupo Aeroportuario del Sureste

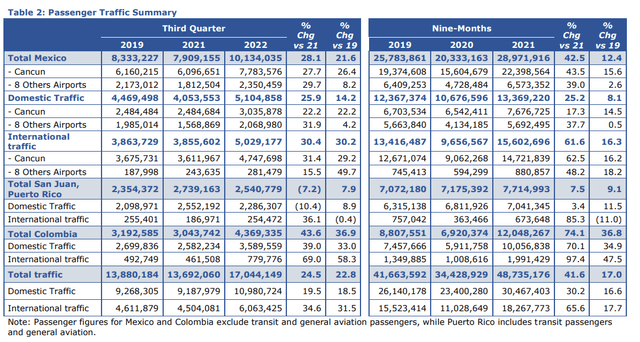

Looking at the passenger traffic summary, we see that compared to 2019 the airports are operating at levels higher than pre-pandemic with exception for San Juan international traffic. Noteworthy is that domestic business travel has not fully recovered and some airports won’t recover until 2023 likely furthering strengthening the overall performance of the group. Additionally, Canadian traffic is only 65% recovered providing further upside to the growth profile which will already translate this winter season.

Improving net debt position

Grupo Aeroportuario del Sureste

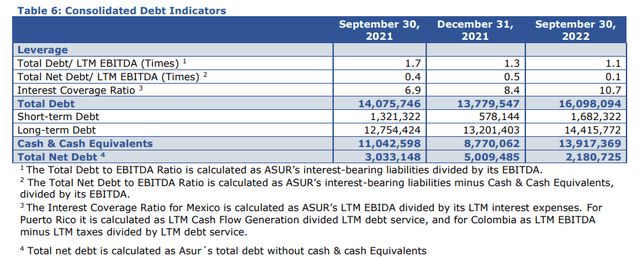

Overall, while total debt has increased, stellar performance at the airline group provided for improved financial metrics. The total debt to EBITDA dropped from 1.7 to 1.1 and net debt dropped from Ps.3 billion to Ps.2.2 billion indicating a net debt to EBITDA of 0.1. For 2022 there are no debt repayments and for 2023 and 2024 Ps.1.7 billion and Ps.1.78 billion in principal debt payments are due, which the airport group can easily pay for with its cash and cash equivalents.

The risks for Sureste

I believe the opportunities for Sureste are plenty, it has shown years of growing passengers numbers and its acquisition of Colombian airports provides a nice diversification that could further translate to growth. Overall, inflationary pressures are a risk as is the case for many businesses these days. Additionally, Cancún is Sureste’s show pony and that is not something bad but Cancún is a tourist destination and not so much an airline hub. Therefore, continued leisure demand and more importantly international leisure demand is required. If macroeconomic headwinds are prevalent this could become a problem for Sureste as the recovery in Canadian travel will unlikely offset any macroeconomic driven softening in leisure travel. Mexico is not really known as being the safest place for locals or for tourists and that means that any eruption in violence could bring tourist sectors to their knees like we saw happening in Tunisia some years ago.

Conclusion: A Bet On Air Travel Recovery Without Fuel Costs

Shares of Aeroportuario del Sureste in my view are attractive. The airport group is benefiting from pent up demand being releases to the market and that is expected to continue in the months to come and in the form of Cancún airport it operates a big destination airport for tourists. So, the company offers a compelling play on air travel and leisure travel recovery without the nasty fuel cost overhang that airlines face. With margins over 50%, manageable debt and the Colombian airports as a potential growth driver, I believe that shares of a nice opportunity for investment

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment