janiecbros/E+ via Getty Images

Investment Thesis

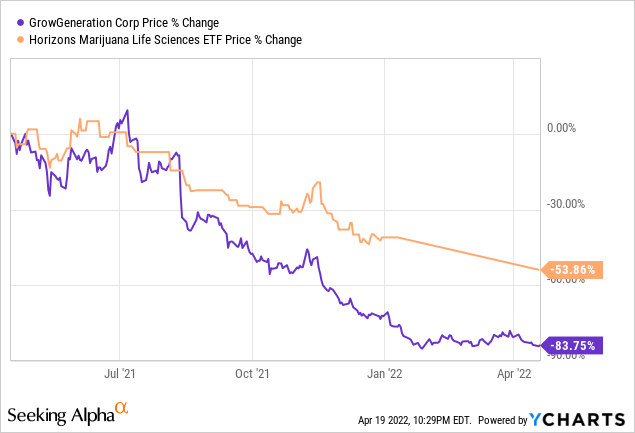

GrowGeneration Corp. (NASDAQ:GRWG) has taken a massive downward leap of 83% in the previous 52-weeks and over 44% YTD. A major reason for the stock’s tumble is the lower 2022 guidance because of issues with the cannabis industry, a major user of the hydroponic systems, specifically “a tremendous oversupply of outdoor cannabis.” These issues will likely cause a dent in the company’s topline performance for the year but provide a nice entry point for an otherwise successfully emerging industry.

U.S. House of Representatives recently passed the Marijuana Opportunity Reinvestment and Expungement ((MORE)) Act, which will end the federal prohibition on cannabis by removing it from the list of banned controlled substances. It will further aid in assisting cannabis-related businesses in the States by, for example, allowing SBA loans and services, etc. Even though the bill has yet to pass the senate, it bodes good tidings for the industry’s progress in the right direction, resulting in the best interest of the Hydroponics industry.

The Hydroponics industry has yet to reach a mature point and is teeming with emerging market opportunities. Even though hydroponics won’t trample traditional farming methods any time soon, the industry segment is gaining traction because of its long list of pros.

GRWG is taking advantage of this fragmented market to acquire and expand its retail garden centers throughout North America, with 23 acquisitions in 2021. It has identified new market opportunities in Connecticut, Ohio, Illinois, Pennsylvania, New York, New Jersey, Mississippi, Missouri, and Virginia. It plans to open 15 to 20 new locations in 2022 and take the total store count to 100 by 2023 to gear its operational performance.

I am bullish on the stock because of the company’s growth strategy to thrive alongside the growing cannabis industry across the United States in the coming fiscal years.

Market Brief

Simply put, Hydroponics is a method of growing plants without soil. It is typically used for indoor cultivation, giving growers the ability to regulate and control better nutrient delivery, light, air, water, humidity, pests, and temperature, resulting in all-year-round crop production. Plants in the hydroponic system can achieve 20–25% higher yields than in a soil-based system with 2–5 times higher productivity.

Hydroponics equipment is primarily utilized by vertical farms producing organic fruits and vegetables and the cannabis and hemp market. Vertical farms have been on the rise due to a rising shortage of farmland, environmental vulnerabilities like drought, other severe weather conditions, and pests. The Associated Press estimates that $32 billion worth of food was produced by hydroponic technology in 2019, projected to grow at 5% CAGR until 2025.

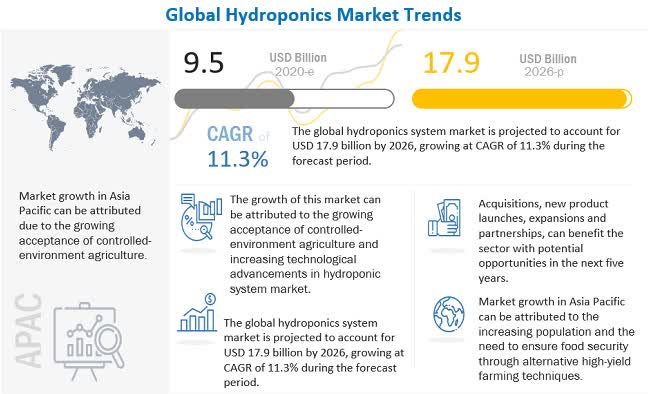

Additionally, with the surge in the legalization of plant-based medicines, primarily cannabis and hemp, and the increasing number of licensed cultivation facilities in North America, Hydroponics products demand is rising. The global cannabis market sales are expected to reach $61 billion, with the Hydroponics market expected to reach $17.9 billion at a CAGR of 11.3% by 2026.

Markets & Markets

As both these industries grow hand-in-hand, a unique market opportunity is presented for GrowGeneration because of its vast network across the states that caters to end-to-end solutions for commercial and craft growers.

In the states with a mature cannabis market, for instance, California, the single largest cannabis market in the U.S, where 36.5% of the company’s stores are located, the company is well-positioned to generate sustainable, repeat revenue through the sale of consumables. In contrast, with the recent legalization of plant-based medicines in emerging markets, growers are ramping up their operations and purchasing non-consumables CapEx items for buildouts.

Company Overview

GrowGeneration is the “largest chain of hydroponic garden centers in North America”. It is a market leader in marketing and distributing “nutrients, growing media, advanced indoor and greenhouse lighting, vertical benching, environmental control systems”, and hydroponic gardening accessories.

The company “owns and operates 63 specialty retail hydroponic and organic gardening stores” across 13 states in the U.S, selling over ten thousand products, including organic nutrients and soils, advanced lighting, and hydroponic equipment to commercial growers in the plant-based medicine market, craft growers, and vertical farms.

Financial Performance & Position

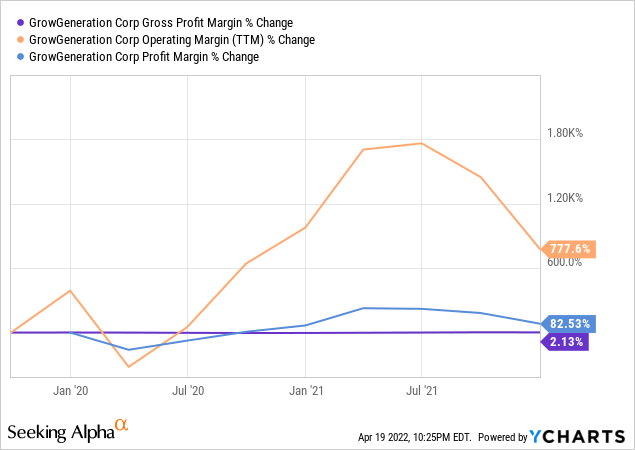

GrowGeneration had YoY revenue growth of 118.5%, from $193.4 million in 2020 to $422.5 million in 2021, including a 24.4% YoY growth in same-store revenue. Comparatively, the cost of sales grew by 113.8% YoY, resulting in a 160 basis point YoY increase in gross profit to 28%.

Operating expenses came in at 142.3% higher than in 2020, primarily because of the addition of 23 new stores, resulting in a five-fold increase in depreciation and amortization expense. Therefore, the 82% YoY increase in EBITDA is a much better metric for measuring the company’s operational performance than the marginal net income growth of 25 basis points.

In 2022, the company expects its revenues at $445 million at the high point, representing a 5% YoY growth rate in the best-case scenario, and the EBITDA to stay relatively flat. This steep decline from the current growth resulted in a faltered market sentiment and a sell-off, resulting in the stock price plunge. The weak guidance is because of weaker-than-previously-expected commercial CapEx sales to customers because of the headwinds in the cannabis market.

Despite the company’s unimpressive short-term estimates because of the cannabis industry, the long-term prospects appear to be solid. BDSA, a leading market researcher for the cannabinoid industry, forecasts global cannabis sales to grow with a CAGR of 16% to $61 billion by 2026, and in the direct interest of the Hydroponic industry and, in turn, GrowGeneration.

To grow its footprint across the industry, the company acquired 23 new locations at approximately $81 million, penetrating various markets and achieving a robust market growth in 2021, both organic and inorganic. Additionally, its website is garnering over 160,000 visitors a month, aiding in crossing the $36 million mark for online sales. This market penetration and growth strategy work well for the company as it ramps up its operations throughout the country to inflate revenues, lower the cost of sales, improve profitability, and secure a long-term position.

The company expects to invest approximately $20 million in 2022 to open 15 to 20 new stores and an additional $10 million for acquisitions and technology expenses. These can easily be covered with the company’s available liquidity of $81 million but are expected to be covered with cash generated from operations in the current year, keeping the company’s liquidity position strong and intact. The company is essentially debt-free with strong liquidity, bolstering its fundamentals and aiding the growth prospects through lucrative acquisitions.

GrowGeneration is gearing up its initiatives in 2022 to overcome the cannabis industry-related headwinds, especially through market growth achieved with capital investments. By 2023, the company expects the accretive earnings from its 2022 investments to kick in and inflate the topline growth, including hitting a 20% revenue portion mark from its private labels, up from the current 8%. Based on the current state of the company and industry growth, it is likely that the company will achieve these objectives by the next fiscal year.

Valuation

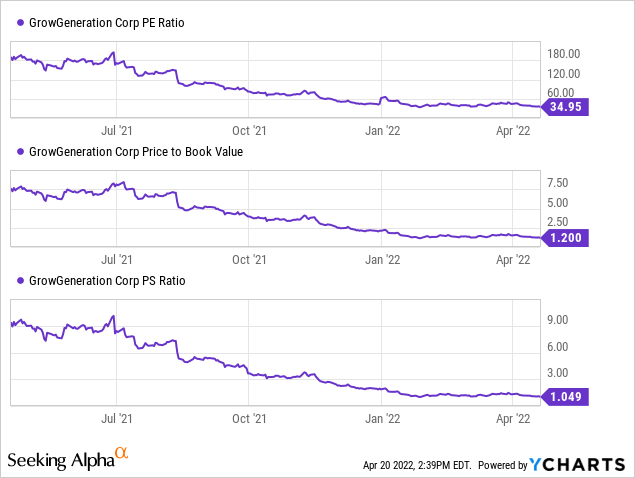

A simple look at the company’s relative valuation metrics shows a straight decline from its valuations from a year ago. The PE multiple has dropped down from over 150 to around 35, PS from around 6 times sales to 1.2, and PB has plummeted from a multiple of 9 to about 1.

Even though these values have had a steep decline, the PE is still almost 1.7 times the industry median of 13.56, and the PS is a little over the industry median of 1.02. The PB is the only metric where the company does better than its peer at about half the industry average.

The bludgeoned shared price has brought the valuation metrics from ludicrously high multiple earlier this year, and these metrics will most likely persist through the year and even start gaining upward momentum once the positive market outlook kicks in and the share price starts rising compared to the earnings, which aren’t projected to be impressive for 2022.

Risk-averse investors will find these valuations attractive enough to take up the opportunity and take a position in the Hydroponics industry. In contrast, risk-averse investors might still want to wait for at least the Q2 earnings report.

Conclusion

Despite the headwinds, the long-term prospects of the cannabis industry are strong, and with the MORE act on the move, GrowGeneration stands to heavily benefit from the high market demand expected to be created for CapEx sales to the industry because of its strong position in the Hydroponic industry.

GRWG’s footprint across a vast number of states, rapidly growing further, will grant the company a strong foothold in mature and emerging cannabis markets when the industry is federally bolstered, initiating a strong market demand for cannabis growing facilities.

The bashed-down share price has helped tone down the previously high valuation metrics and brought them to acceptable levels. If the company starts delivering as per its guidance in the upcoming quarterly reports, the stock may start seeing ascension in expectation of the strongly guided 2023 by the third or fourth quarter of 2022.

Overall, the company operates as an integral function of a growing industry, boasts strong fundamentals, and is well-positioned to leverage the upcoming boom in the cannabis industry.

Be the first to comment