seewhatmitchsee

Sometimes, when you invest in a stock for pure value purposes, you get stuck holding an unattractive asset whose story keeps sliding south. Such is my experience in Groupon (NASDAQ:GRPN), once a popular internet site for bargain deals on local experiences (such as wine tasting). Needless to say, the pandemic has bashed Groupon’s business in a number of ways – by sapping customer demand for events and services, and also by putting many smaller businesses which are the bread and butter of Groupon’s offerings out of business.

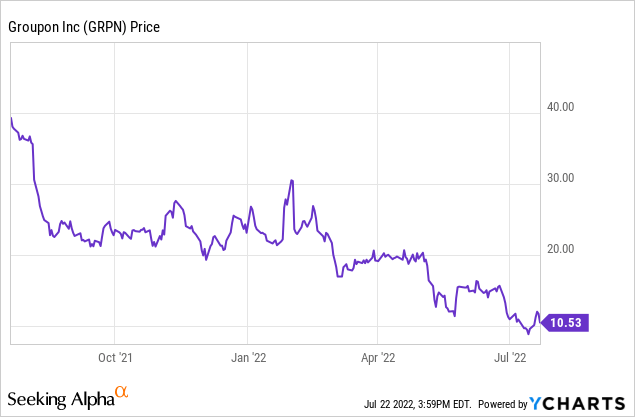

Year to date, shares of Groupon have tumbled more than 60% as investors fled this sinking ship that has reliably posted a worsening story with every quarterly release.

Previously, I had been bullish on Groupon. That rating was predicated on two factors: first, a very cheap share price that was almost “free” when considering the net cash on Groupon’s balance sheet, and second, the appearance of a stable customer and revenue base.

While Groupon’s cheapness is unchanged (in fact, the deeper slide that the stock has seen since April has made Groupon even cheaper than before), its fundamental story has gotten considerably worse, especially as the company’s customer base started tapering in Q1 (more details in the next section). In short, I am now bearish on Groupon – and am now of the view that Groupon’s value element is essentially the market’s way of predicting that Groupon will burn through the cash on its books before it can achieve a liquidity event (and really, with customers and revenue falling sharply, it’s highly unlikely to find a willing acquirer now).

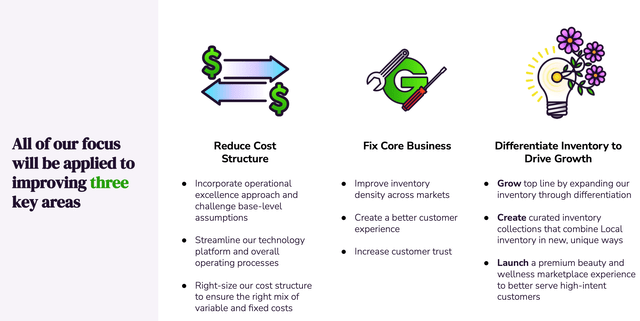

In December, the company tapped a new CEO to lead the business, Kedar Deshpande. Prior to joining Groupon, Deshpande had served as the CEO of Zappos. Together with the leadership team at Groupon, Deshpande unveiled a three-pronged strategy to try to turn the company around:

Groupon turnaround plan (Groupon Q1 investor presentation)

Much of this strategy involves modernizing the technology base that Groupon sits on and improving the inventory of deals it offers to its customers. And while I think these are realistic goals, I do worry about the sinking value of the Groupon brand and the relatively shoddy regard which it’s given today. With the recent evidence that the company’s customer base is starting to bleed, I doubt there are any significant levers the company has in its toolkit to reverse that decline.

Groupon is, undoubtedly, cheap. At current share prices near $10, its market cap is just $314.7 million. After we net off the $403.0 million of cash and $323.8 million of debt on the company’s most recent balance sheet, its resulting enterprise value is $235.5 million.

For the current fiscal year, Groupon is expecting $60-$80 million in adjusted EBITDA – roughly half, by the way, of FY21’s adjusted EBITDA of $143.2 million (which did include a $30 million one-time benefit). It’s also lower than the company’s prior outlook of $112 million in adjusted EBITDA for FY22. Against this new lower outlook, Groupon’s valuation sits at 3.4x EV/FY22 adjusted EBITDA.

In my view, however, it’s not worth buying Groupon simply because it’s cheap – the fundamentals have so much downside risk especially after the recent spate of customer churn and guidance cuts that I think sentiment on Groupon will only continue to worsen. Move back to the sidelines here and cut losses sooner rather than later.

Q1 download

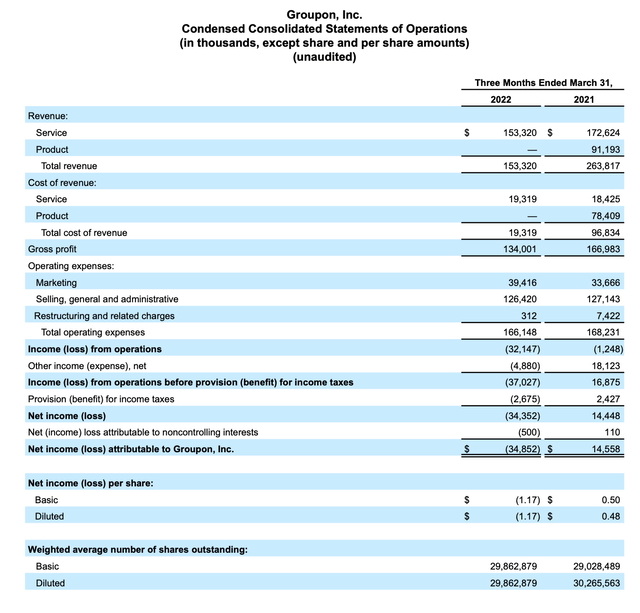

Let’s now go through the company’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Groupon Q1 results (Groupon Q1 investor presentation)

Groupon’s revenue declined -42% y/y to $153.3 million in the quarter, missing Wall Street’s expectations of $165.3 million (-37% y/y) by a five-point margin. You’ll notice that a big chunk of this revenue miss was driven by the loss of product revenue, which was Groupon’s decision to exit the first-party marketplace business. Still, however, core services revenue still also fell -11% y/y.

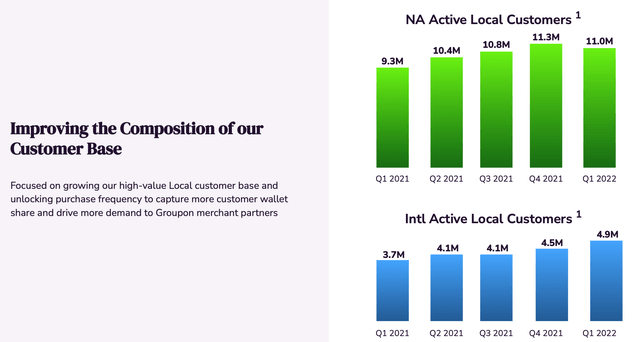

The company’s base of active customers in North America, which makes up roughly three-quarters of the company’s Local segment revenue, slipped to 11.0 million in the quarter. The company defines an “active” customer as someone who has made a purchase over the trailing twelve months. You’ll notice that there was a lot of customer growth during 2021, but if these activities were one-time, we could very well see a continued peeling-off of Groupon’s customers. Active customers did still grow internationally, but revenue per customer here is slightly lower than in North America.

Groupon customer trends (Groupon Q1 investor presentation)

Groupon had been hoping for purchases to rebound once the Omicron wave passed, but this has not materialized. Per new CEO Kedar Deshpande’s remarks on the Q1 earnings call:

In the first quarter, we didn’t see local demand come back as Omicron cases began to subside. We had expected to see a pattern similar to what we saw last year in the wake of Delta. So we executed on the initiatives that reflected our expectation for increasing demand post Omicron but this demand did not materialize. As you know, Groupon is a marketplace that offers discounted experiences and services. And merchants simply did not need to leverage the Groupon marketplace as much as we thought they would, coming out of the pandemic. And this has been worsened by inflationary headwinds. With demand high and capacity low, merchants did not need to sell discounted inventory in our marketplace. In addition, we saw merchant availability contribute to driving refund rates higher, which put further pressure on our inventory levels as well as adjusted EBITDA. While we think this is transient, you will hear us talk about our plans to make Groupon more helpful to merchants throughout the economic cycle.”

The company’s strategy to reverse this negative customer trend is to focus on curated, packaged experiences. The company wants to move away from being a “deep discount” experiences brand to one that curates somewhat-discounted packages (an example here that Deshpande gave is a date night combo that includes dinner at an Italian restaurant plus bowling). The company wants to roll out a new marketplace offering by the end of the year that will separate this new approach from Groupon’s existing deep-discount brand.

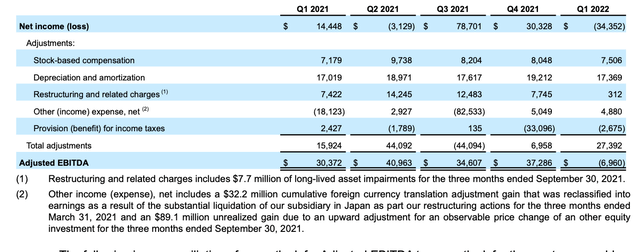

Meanwhile, however, Groupon’s profitability is struggling. Adjusted EBITDA fell to a -$7.0 million loss in the quarter, down from a $30.3 million gain in the first quarter of last year.

Groupon adjusted EBITDA (Groupon Q1 investor presentation)

For next year (FY23), the company still targets to deliver 15-20% adjusted EBITDA margins and $100+ million in annual free cash flow. Groupon, however, does not have a great track record for executing on its commitments (look no further than the massive guidance cut that the company gave for this year, from $112 million in adjusted EBITDA to $70 million at the midpoint). In my view, Groupon will be hard-pressed to meet these lofty targets (and given where the stock is currently trading, Wall Street doesn’t have much faith either).

Key takeaways

Groupon is cheap, but it’s cheap for a reason. The company is struggling to maintain relevance for its brand, and sweeping changes to rebuild its technology platform and roll out a new marketplace offering may backfire. In a market era where many higher-quality stocks are also trading at a deep discount in the tech sector, I would dump Groupon and invest elsewhere in preparation for a year-end market rebound.

Be the first to comment