Dan Kitwood

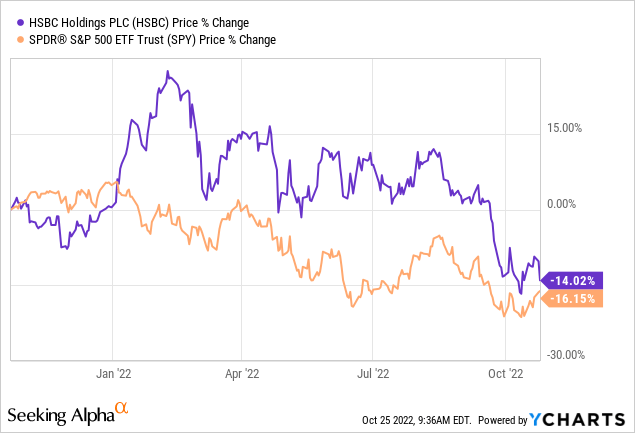

HSBC (NYSE:HSBC) delivered its third-quarter earnings report on Tuesday, revealing robust quarterly results. In addition, the bank’s earnings release included various notable events, namely a change in the CFO position and the reclassification of a key business unit.

We researched the company’s prospects in tandem with its market-based characteristics and discovered numerous factors worth considering. Despite HSBC’s impressive third quarter, we remain coy about the stock’s prospects; here’s why.

HSBC Q3 2022 Earnings Review

Operating Results

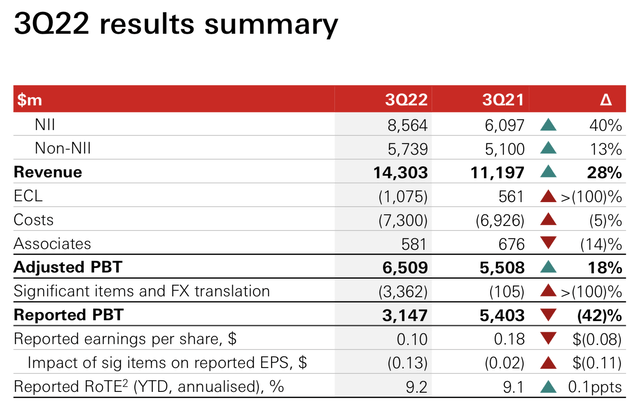

It has to be said that HSBC’s core operations are impressive. The bank delivered strong interest-based income, conveyed by a 40% year-over-year surge. The bank’s increase in interest-based income didn’t surprise us, given the rise in global interest rates. Looking ahead, we anticipate interest income to grow as potential inflationary pivots could further assist the bank’s credit market activities.

Furthermore, HSBC’s non-interest income segment also saw improvements, posting 13% better numbers than this time last year. The bank’s lower fees were offset by higher trading income, which is undoubtedly a surprise to us as 2022’s stock bear market likely harmed most banks. Thus, credit needs to be given to HSBC’s asset allocation.

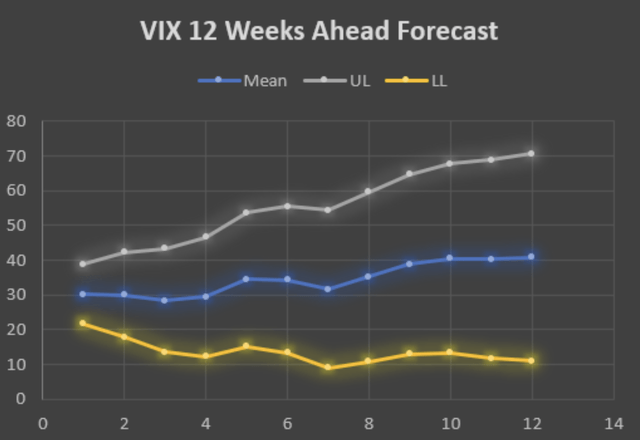

Although HSBC’s trading segment performed admirably in the past year, we’re concerned about systemic headwinds. For instance, we forecasted the VIX in one of our previous articles (diagram also inserted below), and a seasonal time series analysis indicates that market volatility could exacerbate in the coming months, subsequently compressing equity prices. Thus, it’s possible that global equity markets could remain on a downward trajectory, simultaneously providing a threat to HSBC, which derives approximately 17.4% of its revenue from trading activities.

HSBC

Pearl Gray Equity and Research; Data from Yahoo Finance

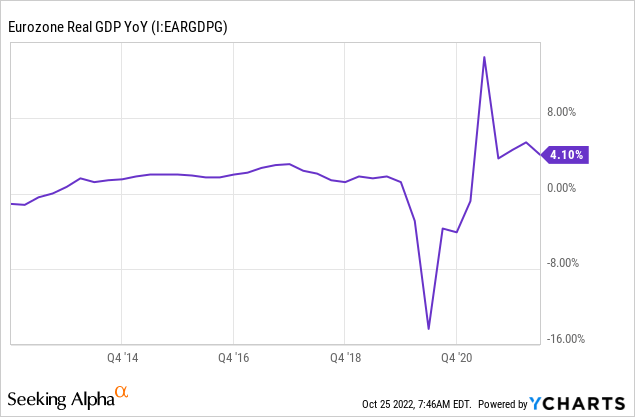

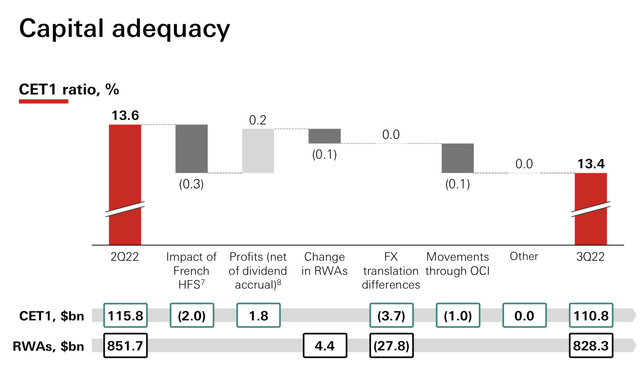

Furthermore, HSBC has plans to offload its French retail operations and suffered a $2.4 billion impairment during its last quarter when it restated the assets as “held for sale”. Assets must be tested for impairments whenever their financial statement classification changes and are often marked down. Thus, we don’t believe this event bears any long-term side effects. In fact, a pivot out of a slowing Eurozone and into growth markets could benefit HSBC’s long-term trajectory.

Business Pivot

Asia and Middle East Exposure

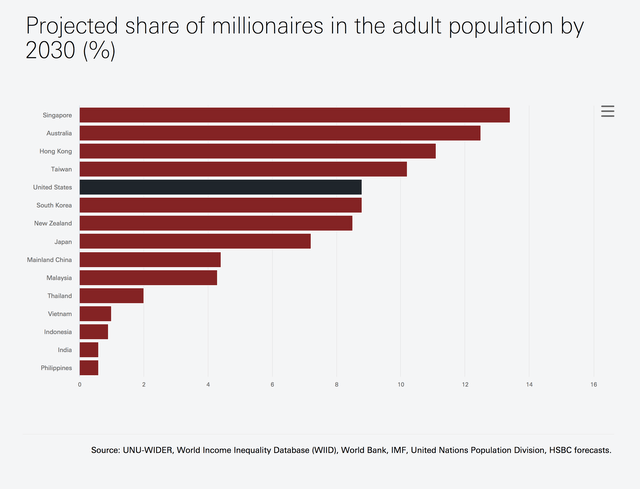

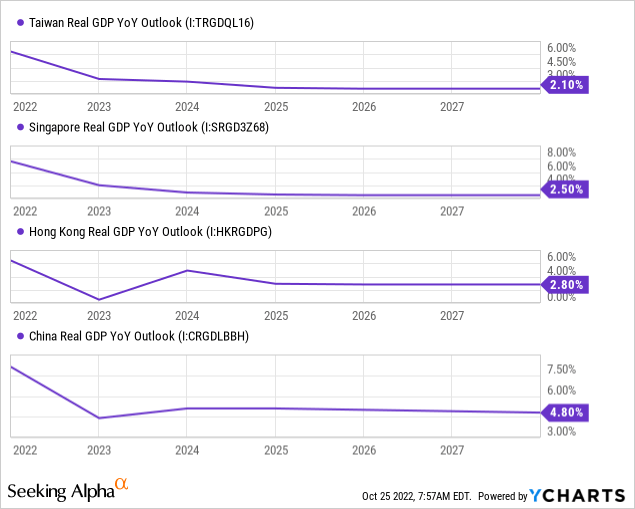

As previously mentioned, HSBC has plans to pivot out of certain areas in the Eurozone and North America. The bank plans to scale in Asia and the Middle East with an illustrious $6 billion Hong Kong, Singapore, and China spending plan geared toward wealth management.

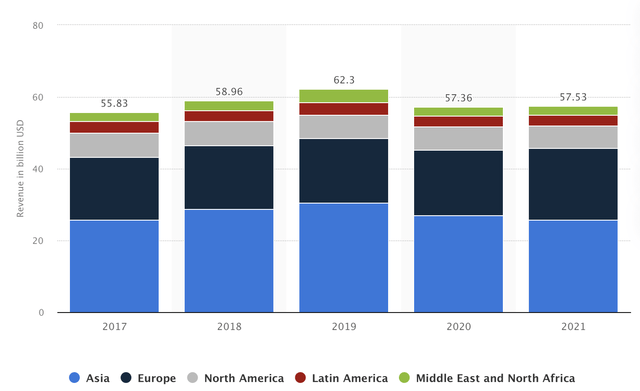

Revenue by region – 2021 (Statista)

There’s no doubting the fact that HSBC’s more Asia-centric approach could yield benefits to its shareholders. Demographic and parsimonious macroeconomic data suggest that it’s an obvious move for a company looking to stimulate growth. We particularly back a higher presence in Singapore due to its flourishing economy.

HSBC

Despite the various plus points of HSBC further emphasizing Asia, we’re worried about the bank being overly exposed to geopolitical risk. Emerging markets/newly developed markets tend to carry excess geopolitical risk as the respective nations drift nearer to long-time developed nations. For instance, risk in China and Hong Kong is at multi-decade highs after President Xi’s re-election. The signs are that China’s once more drifting towards an authoritarian state, which could hinder capitalist activities in the region.

HSBC’s New Chief Financial Officer

After releasing its third-quarter earnings report, HSBC announced a change in its C-Suite, with the company’s CFO position changing hands. HSBC’s new CFO will be Georges Elhdery, who takes the place of outgoing Ewen Stevenson. There are no signs that this is a tactical shift as it’s labeled a ‘succession plan’ change. Thus, we see no material effects in this change.

Capital Adequacy – Basel III

The final operational feature we observed was the bank’s capital adequacy ratios, which remain firm, as conveyed by its CET 1 ratio of 13.4%. The bank’s CET 1 did suffer a slight dent due to the French divestment and unfavorable other comprehensive income movements, mostly due to fair value adjustments and credit risk.

We don’t see any issues here. Matters such as hyperinflation in Argentina and Turkey could add instability to the bank’s FX translation differences. However, core business activities will likely smooth things out.

HSBC

Dividend Outlook & Valuation

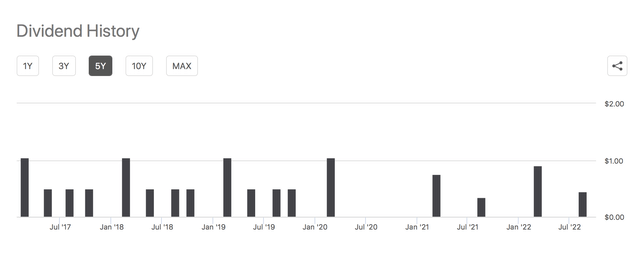

Dividends

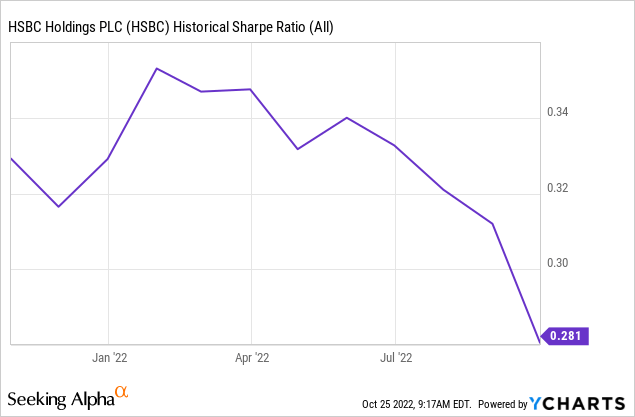

HSBC announced that it plans to reinstate dividends from 2023 to 2024 with a targeted 50% dividend payout ratio. Despite its claim, the global economic risk could hinder the prospects of dividend payouts. At a Sharpe Ratio of 0.281, we’re not comfortable betting on HSBC for pure capital gain purposes.

Seeking Alpha

Valuation

Key metrics suggest that HSBC stock is undervalued on a relative basis. For example, its price-to-book ratio of 0.64 implies the bank stock’s traded price is underscored by the marketplace. Price-to-book ratios are essential for banking stocks as a financial institution’s book value accurately represents the company’s holistic value, given that its assets are quoted and frequently traded.

Furthermore, HSBC’s price-to-earnings is accommodated with a PEG ratio of merely 0.16, implying that the bank’s earnings-per-share growth outpaces its stationary price-to-earnings ratio.

Collectively, HSBC seems undervalued. However, beware that relative valuation metrics are merely indicators and should always be looked at in collaboration.

| Price-to-Book | 0.64x |

| Price-to-Earnings | 8.01x |

| PEG | 0.16x |

Source: Seeking Alpha

Concluding Thoughts – Is HSBC Stock a Buy, Hold, or Sell?

We place a hold rating on HSBC stock. The bank presented robust third-quarter earnings driven by higher interest rates and well-executed trading activities. However, we believe geopolitical risks in Asia creates a hefty risk premium for the stock. In addition, the bank’s valuation metrics are appealing; however, we’re unwilling to bet on price action alone and would only consider a bullish call on the stock once its dividend profile aligns.

Be the first to comment