naphtalina/iStock via Getty Images

It’s been a little over 2.5 months since I finally turned bullish on The Greenbrier Companies Inc. (NYSE:GBX), and in that time the shares have returned a negative 7.3% against a loss of about 3.2% for the S&P 500. It’s time to decide whether or not it makes sense to buy more, take my lumps, or hang on. After all, there’s growing evidence that the world economy is slowing dramatically, and it may be time to do the financial equivalent of battening down the hatches. I’ll make this determination by reviewing a recent conversation between Greenbrier’s VP of Corporate Finance and Investor Relations and Cowen’s Machinery and Transportation Equipment analyst. These two people obviously know the business very well, and I think it would be helpful for investors to understand their perspective before deciding to take any action. If you want to review the entire 34 minute long conversation, you can find it here.

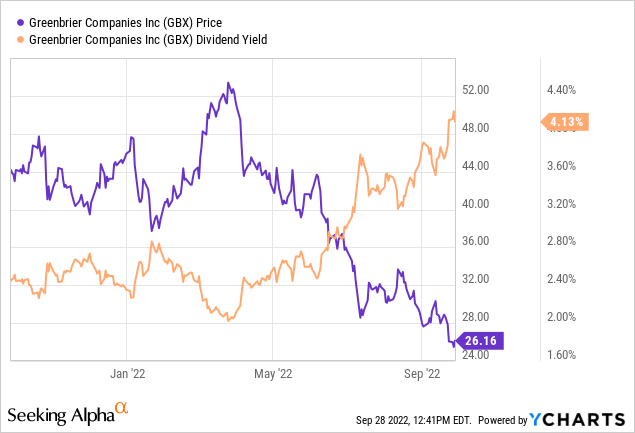

We’re all busy, so this “thesis statement” paragraph will be shorter than usual. I am now of the view that Greenbrier stock is a strong buy. The problems the company is facing are of a short term nature in my view, and my view is buoyed somewhat by the insider buying we’ve seen recently. I think the stock is now very cheap, near multi-year low valuations. Finally, investors are being paid to wait with a very compelling, well covered, 4% dividend yield.

Highlights of the Presentation

There were five topics broadly covered, and I want to go through each of them below. After listening to this conversation, my confidence in my Greenbrier investment improved dramatically.

Barriers to Entry

The two spoke about barriers to entry, and this resonated with me because I’ve had similar conversations with people who fretted that the barriers to entry are not high. In one conversation I heard that “all you need” is an abandoned manufacturing facility “somewhere”, a few million dollars’ worth of equipment, a few million for input costs like steel etc., and “bingo, you’re in business.” In my view, and it was expressed by the Greenbrier executive and the analyst, so it’s obviously correct, is that you need more than the physical ability to produce a freight car. You need decent customer relationships, and customers need to have some confidence that you will be around when the inevitable warranty issues crop up. So, while barriers to entry appear quite low at first sight, I would argue that they’re quite high.

Current Softness in the Business

Two reasons were cited for the softness in the business of late: trouble with the rail network and the volatility of the price of inputs. I think investors should keep these in mind. If the headwinds seem permanent, it’s the case that the earning’s power of the company is likely permanently impaired. If the headwinds are temporary, the market, which forecasts the long term, will cease punishing the shares.

The North American rail network is apparently having issues at the moment, so many shippers are not allowed to add cars to the rather stretched network. Until service improves, and bottlenecks are eliminated, customers will deliver more product by truck. This obviously isn’t ideal for Greenbrier, but nor is it ideal for the customer because trucks are much more expensive than rail. Thus, both sides of the transaction have a strong incentive to eliminate this issue, suggesting that it will eventually work itself out favourably. So, some of the softness in the business is dependent on when service can improve on the North American rail network. Both sides of the conversation see this issue working itself out in 2023.

Greenbrier is likely to see margin pressures into the fourth quarter, though things are improving. I’d characterise this as an issue of timing and volatility of input costs. For example, imagine that a customer ordered a car nine months ago, and Greenbrier ordered the inputs to fulfill that order three months ago. The customer locks in a rather decent price based on the then input costs, and Greenbrier orders inputs like steel six months later, after steel prices started to decline.

ARI Acquisition

The Greenbrier official and the analyst spoke optimistically about the ARI manufacturing acquisition that Greenbrier undertook way back in July 2019. Each admitted that the timing wasn’t fortuitous, because it happened about the same time as steel prices started to rise, and then, as you may recall, the world was thrown into chaos because of a worldwide pandemic. The optimism about the ARI assets remained relatively high on the call, as the acquisition gave Greenbrier a nice, high end footprint in North America. If you’re interested in reading my thoughts on this acquisition, here’s an article I wrote about it after it was announced but before it closed. In case this current article gives you all of the Doyle that you can stand for a day, I’ll give you the highlights of my thinking about the ARI acquisition now. After reviewing the last public financial results at ARI, I determined that Greenbrier overpaid for the business. Specifically, I was troubled by the fact that ARI’s gross margin had been in decline for years, and I thought (and think) paying $430 million for a business that spits out about $16.5 million is a bit rich given the risks present. In spite of the fact that I’m both a “fuddy” and a “duddy”, optimism apparently remains fairly high about the acquisition.

Lead Time

I think the company’s backlog and order book offer excellent visibility into the future of this business. If orders dry up, that’s a very bad sign, obviously, and on this call I expected to hear about customers pulling orders, because I’m of the view that the economy is slowing, aggregate demand is shifting to the left, etc. The opposite seems to be the case, though, and order flow remains robust. If a customer orders freight cars today, the earliest they’ll get them is May-June of next year at the earliest. Some lines are booked solid into the Autumn of next year, and some lines are slammed until calendar 2024. This gives reasonably good visibility into future revenue, obviously. It’s worth noting that this isn’t just a Greenbrier phenomenon, as the same thing is happening at Trinity, for instance, at the moment.

Currency

As someone who earns in U.S. dollars and spends in much weaker currencies, I have to write that I’m enjoying the current rise of the greenback against every other currency. Given this dynamic, an investor would be forgiven for assuming that a company like Greenbrier that manufactures in pesos and sells in U.S. dollars would be in great shape at the moment. The problem is that this company, unlike someone like myself, has physical input costs that they must pay for in the weak currency, and those input costs are priced in greenbacks. Thus, investors would be wise to discount any thoughts they might have about the positive effects of currency differentials.

In my view, all of the points made above are either objective positives for the firm, or give me some confidence that the problems are temporary. For what it’s worth, the analyst community seems to agree that Greenbrier is in a great position long term. Thus, I’d be comfortable adding to my Greenbrier position at the right price.

The Stock

My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs, like steel, and turns them into rolling stock. The equity, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, the tightness of the North American rail network, the state of the lease fleet etc. It may also be the case that some analyst decides that “future growth catalysts” are weaker than once thought, and the stock falls in price in sympathy, in spite of absolutely no change at the company. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. Put another way, an argument could be made that fully 3.3% of the 7.6% loss in Greenbrier’s price was “caused” by the 3.3% drop in the S&P 500. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

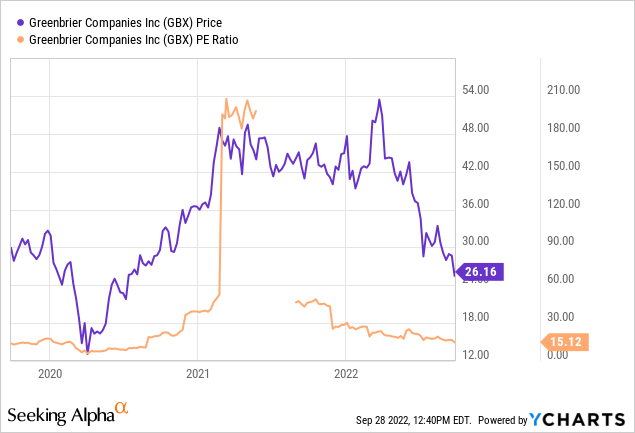

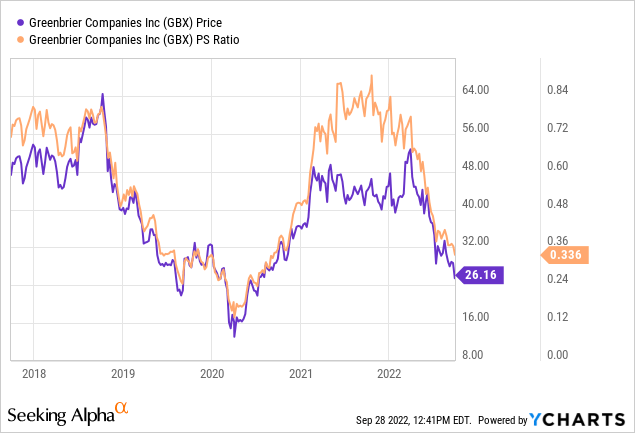

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Way back in July, I got excited about this business because it was trading at a PE of 13.25 and the market was paying $0.44 for $1 of future sales. I also considered the 3.66% dividend to be relatively good. Fast forward to the present and here’s the state of the world:

Although the shares are a bit more expensive on a PE basis, they’re 25% cheaper on a price to sales basis, and the yield has spike about 12% over the past few months. If the shares were compelling before, they’re very compelling today.

But Wait, There’s More

I’ve written it before, and I’m sure I’ll write it again. If the people who know the business best put their own capital to work in it, that’s a very positive sign in my view. I like being on the same side of the table as people who have a deeper insight into a given enterprise than anyone on Wall Street. With that in mind, I would point out that Antonio Garza bought 8,195 shares for a little over $30 per share. When a person with this much knowledge about the company is willing to tie up $250,000 of their own capital in the stock, that’s a very good sign in my view.

Conclusion

Although some of the headwinds we’ve seen will likely remain for the remainder of this year and into next, I think the long term growth prospects for this business are intact. I think it makes a great deal of sense to buy when others are fearfully selling this name, and I think the well covered 4%+ dividend yield will offer investors a decent incentive to hang on and wait for this story to unfold.

Be the first to comment