adventtr/E+ via Getty Images

A Quick Take On Dolby Laboratories

Dolby Laboratories (NYSE:DLB) reported its FQ3 2022 financial results on August 9, 2022, missing expected revenue and beating EPS estimates.

The company develops and licenses audio and imaging technologies for use in media, entertainment and communications applications.

I’m not optimistic on the overall sour global economic backdrop, which I believe will weigh negatively on the firm’s growth trajectory.

So, I’m on Hold for DLB over the near term.

Dolby Laboratories Overview

San Francisco, California-based Dolby Laboratories was founded in 1965 and develops various audio and imaging technologies primarily for media applications across a range of devices.

The firm is headed by Chief Executive Officer, Kevin Yeaman, who was previously Chief Financial Officer at Epiphany and VP of Worldwide Field Operations at Informix Software.

The company’s primary offerings span the industries of:

-

Music

-

Cinema

-

Gaming

-

Home Entertainment

The firm acquires customers through developing relationships with audio and visual equipment OEMs and with software developers.

Dolby’s Market & Competition

According to a 2022 market research report by Market Research Future, the global market for consumer audio products of all types is expected to exceed $234 billion by 2030.

This represents a forecast CAGR of 16.3% from 2022 to 2030.

The main drivers for this expected growth are rising demand for greater entertainment options, adoption of advanced wireless solutions and a growing number of internet-connected homes.

Also, the North America region is expected to account for the highest market share through 2030.

Major competitive or other industry participants include:

-

Apple Inc.

-

Harman International Industries Inc.

-

Bose Corporation

-

Sonos, Inc.

-

Sony Corporation

-

DEI Holdings, Inc.

-

Sennheiser Electronic GmbH & Co. KG

-

VIZIO

-

VOXX International Corporation

-

Plantronics, Inc.

-

Ossic Corporation

-

Phazon

-

Trüsound Audio

-

Jam

-

Earin

-

Human Inc

Dolby’s Recent Financial Performance

-

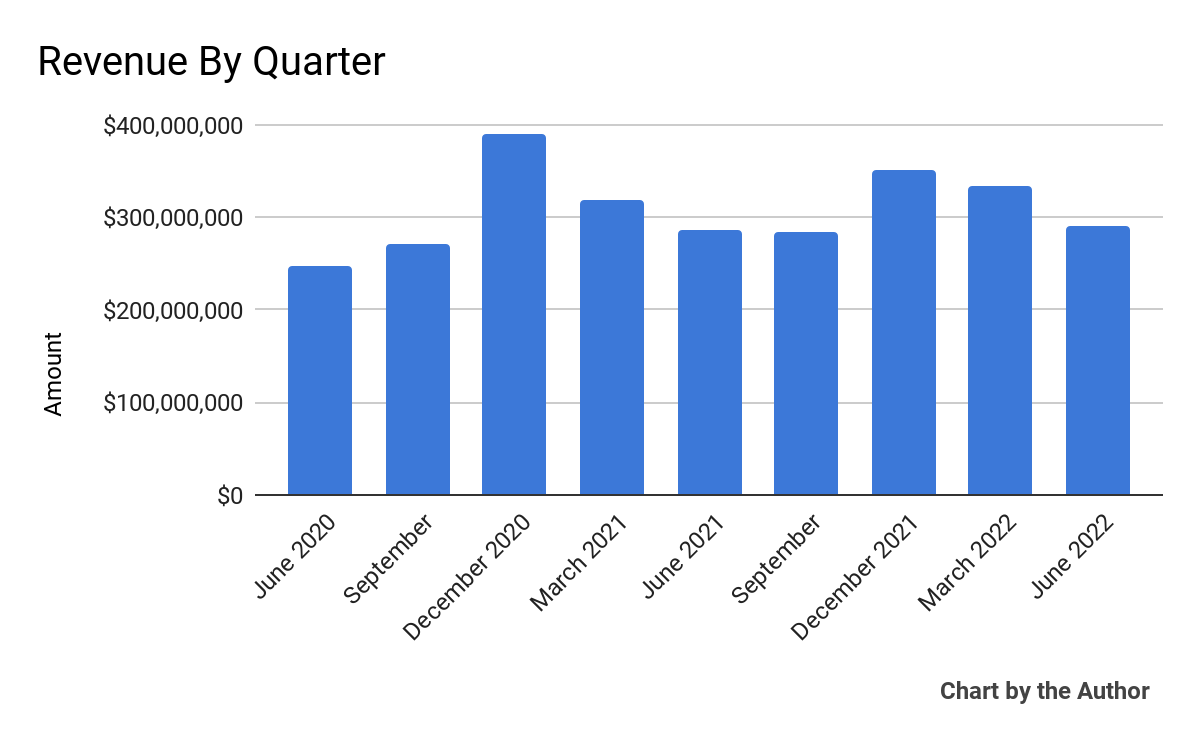

Total revenue by quarter has been uneven, as the chart shows below:

9 Quarter Total Revenue (Seeking Alpha)

-

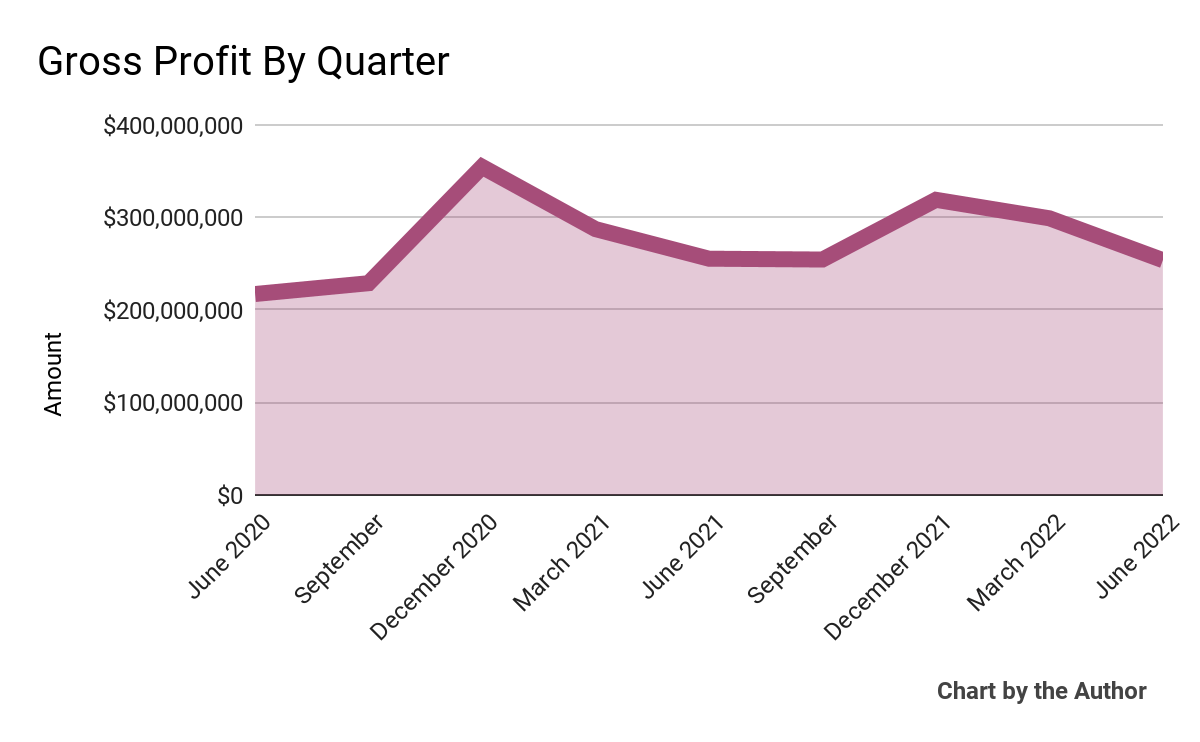

Gross profit by quarter has been uneven and trending lower in recent quarters:

9 Quarter Gross Profit (Seeking Alpha)

-

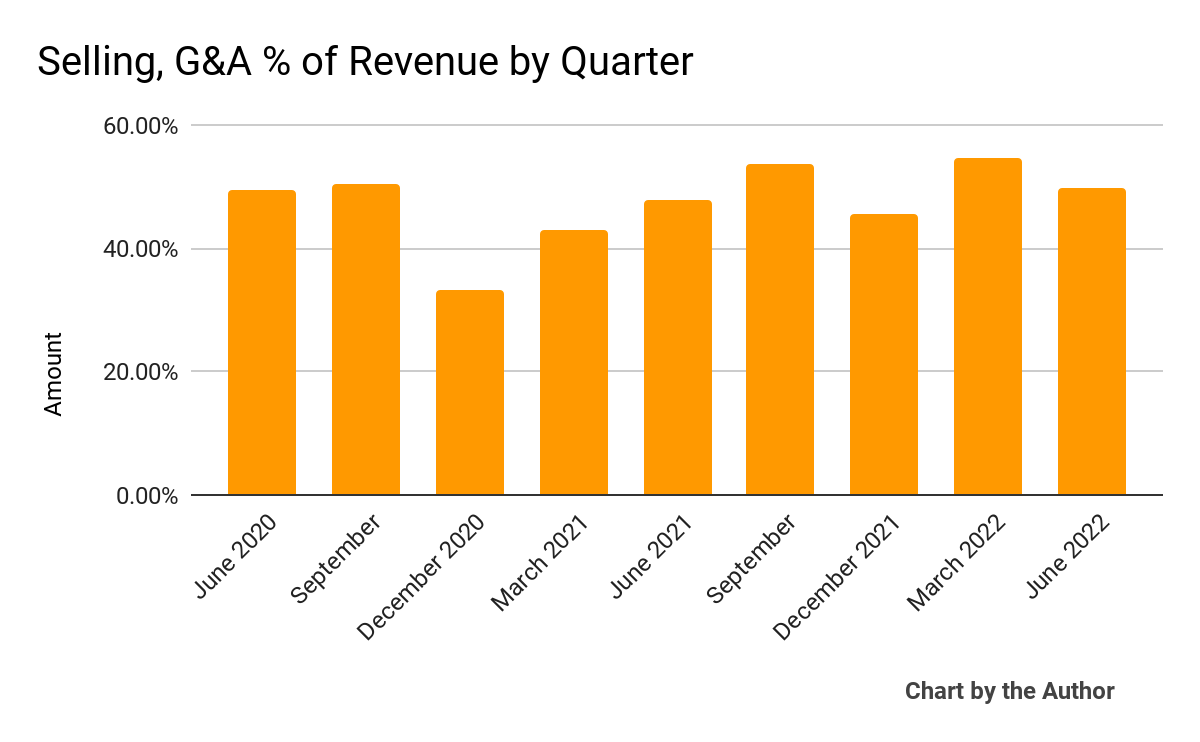

Selling, G&A expenses as a percentage of total revenue by quarter have been trending higher recently:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

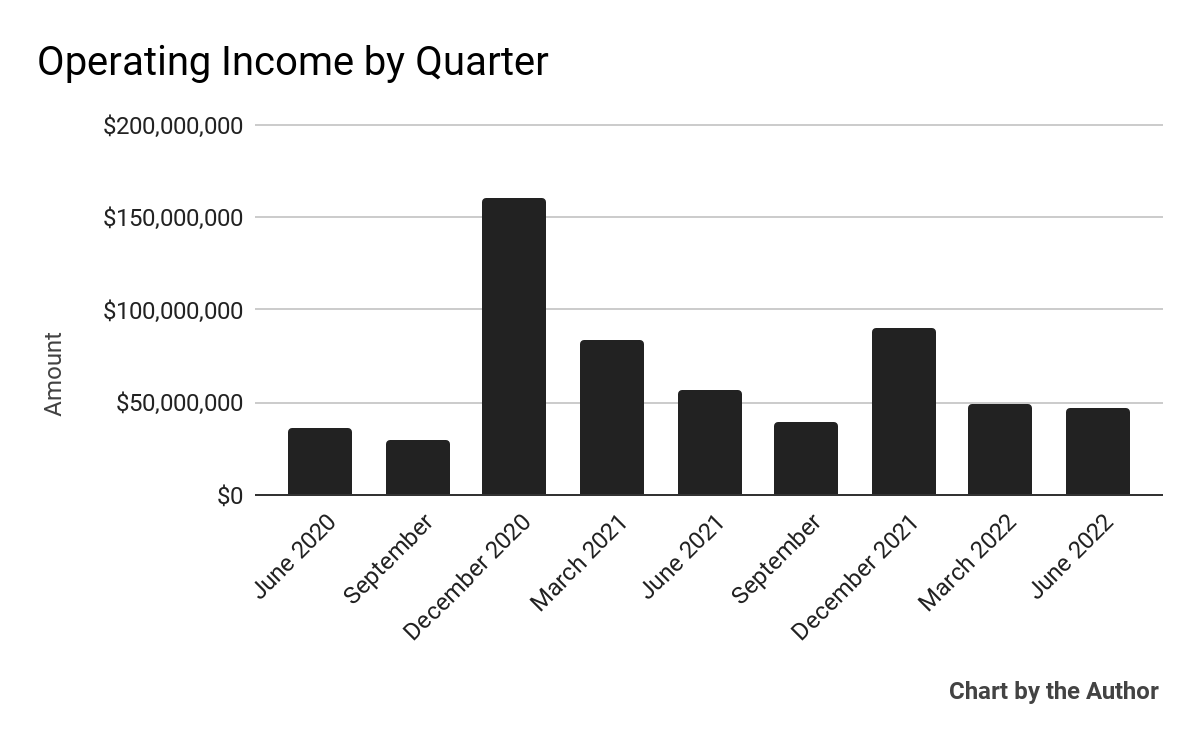

Operating income by quarter has been trending lower:

9 Quarter Operating Income (Seeking Alpha)

-

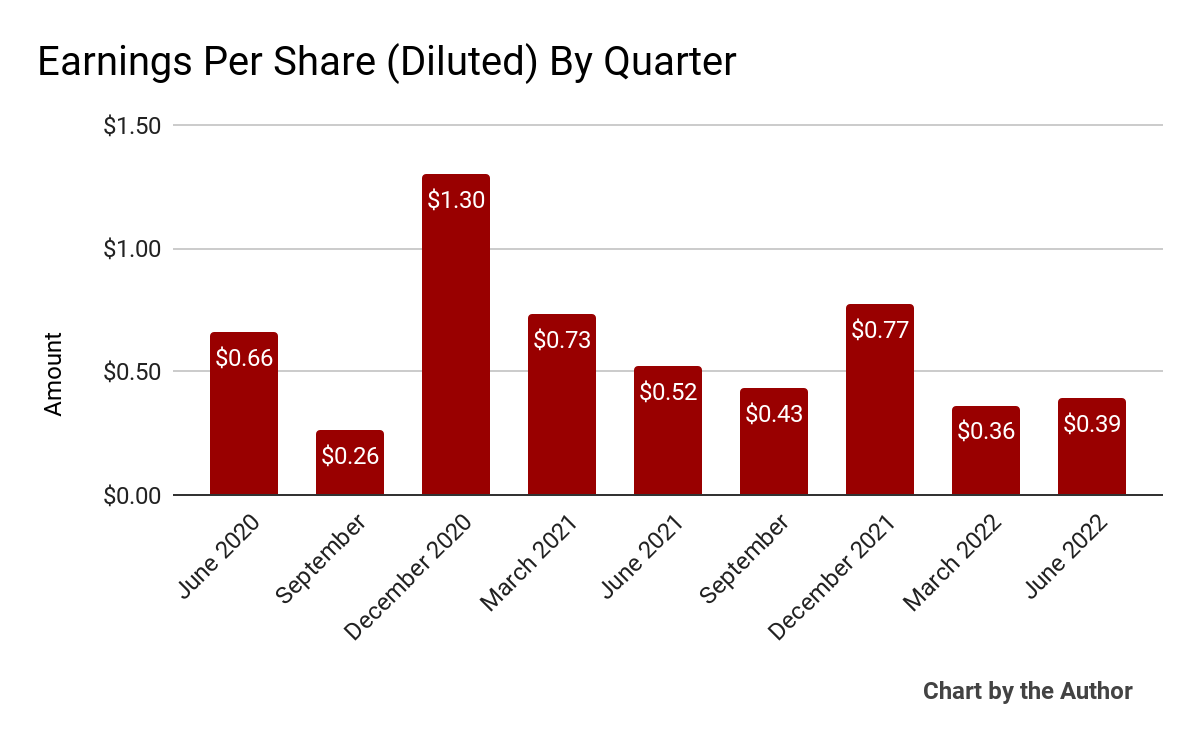

Earnings per share (Diluted) have also been lowered more recently, as the chart shows here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

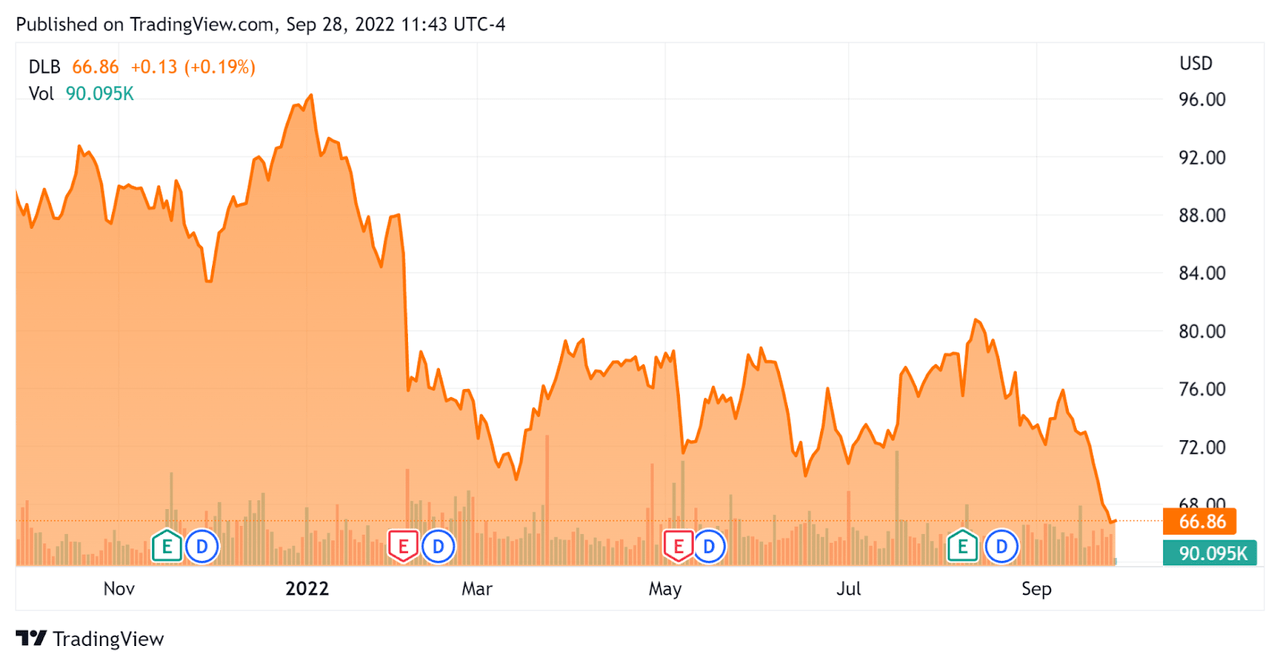

In the past 12 months, DLB’s stock price has fallen 25.6% vs. the U.S. S&P 500 Index’s drop of around 17.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Dolby Laboratories

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

4.47 |

|

Revenue Growth Rate |

-0.5% |

|

Net Income Margin |

15.9% |

|

GAAP EBITDA % |

25.4% |

|

Market Capitalization |

$6,590,000,000 |

|

Enterprise Value |

$5,640,000,000 |

|

Operating Cash Flow |

$377,040,000 |

|

Earnings Per Share (Fully Diluted) |

$1.95 |

(Source – Seeking Alpha)

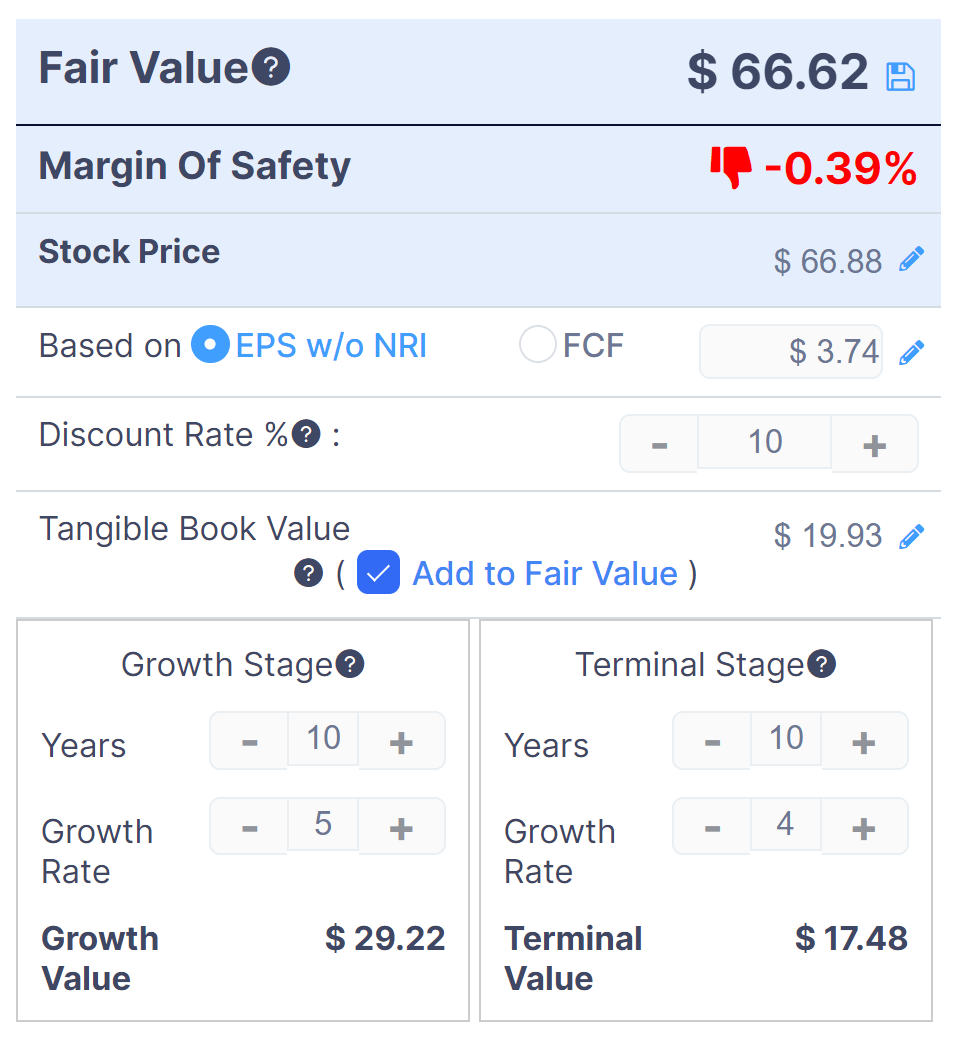

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

DLB Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $66.62 versus the current price of $66.88, indicating they are potentially currently fully valued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Dolby

In its last earnings call (Source – Seeking Alpha), covering FQ3 2022’s results, management highlighted its focus on bringing its technologies to ‘more types of content.’

To that end, it is devoting resources to its Dolby.io platform as it aims its products directly at developers seeking API access to its various audio and video technologies, although this ‘channel’ accounts for little revenue at this time.

Management is focused on expanding its Atmos technology into other, more immersive forms of content, along with its Dolby Vision system, which has recently won its first major Android mobile account through a new relationship with Xiaomi (OTCPK:XIACF) for its top-of-the-line smartphone in China.

As to its financial results, revenue rose only 1% year-over-year, with bright spots being Atmos and Vision and revenue disappointments in broadcast and PC unit shipments.

Non-GAAP gross margin dropped 1.7% to a still-impressive 88% while non-GAAP operating expenses grew by 3% due to increases in travel and entertainment and marketing.

For the balance sheet, the firm finished the quarter with $1.1 billion in cash and investments and no long-term debt.

Over the trailing twelve months, free cash flow was a very impressive $327.9 million, and the firm continues to buy back its stock at a significant rate, ending the quarter with $230 million in repurchase authorization still available.

The Board subsequently authorized another $350 million repurchase, which raised the company’s total buyback authorization to $580 million.

The company also announced a $0.25 per share cash dividend.

Looking ahead, management reduced its forward revenue guidance for fiscal 2022 to ‘more or less flat’, with non-GAAP gross margin rising slightly and operating expenses expected to drop.

Regarding valuation, my discounted cash flow analysis is indicating the stock may be fully valued at its current price of around $67.

However, this does not take into account the Board’s additional buyback authorization, which may provide a floor to the stock at this level.

The primary risk to the company’s outlook is a growing likelihood of a macroeconomic slowdown affecting its various consumer-facing businesses.

Optimistic investors could make a case for an attractive entry point for the stock here, supported by the strong Board buyback moves and a 1.5% forward dividend yield.

However, I’m not optimistic on the overall sour global economic backdrop, which I believe will weigh negatively on the firm’s growth trajectory.

So, I’m on Hold for DLB in the near term.

Be the first to comment