Khanchit Khirisutchalual/iStock via Getty Images

By Sherifa Issifu

Compared to the wide range of liquid, tradable instruments associated to more traditional benchmarks like the S&P 500®, the trading ecosystem of ESG-based investment products is still in its infancy. But, with the increased volume in listed futures linked to the S&P 500 ESG Index and S&P Europe 350® ESG Index, change is afoot.

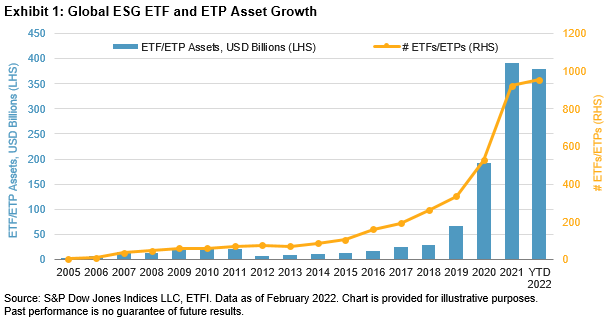

Of course, market participants have used exchange-traded vehicles for ESG investing for quite some time. The first ESG ETF launched 20 years ago, and there are now nearly 1,000 ETFs and ETPs listed globally with approximately USD 400 billion in assets as of February 2022, a massive contrast to the USD 2 billion in assets in 2005, according to ETFGI.

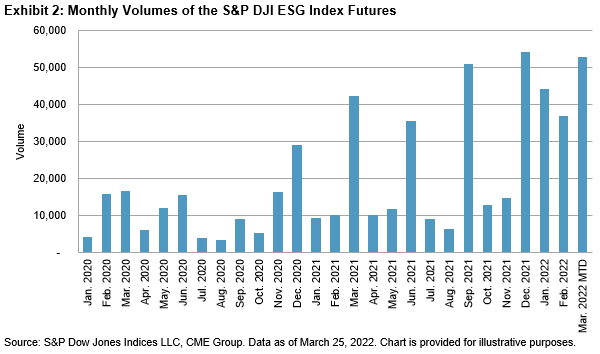

However, the growth of a true trading ecosystem around ESG products is a newer phenomenon. The futures based on S&P DJI ESG Indices have been at the forefront of the development: the S&P 500 variant has the highest dollar volume of any equity index-based ESG future, according to independent research by Graham Capital Management. As Exhibit 2 shows, volumes in S&P DJI ESG futures initially tended to cluster around quarter-end, when positions in front-month contracts are usually rolled or closed. But in 2022, this has begun to change, with more consistent trading through the quarterly cycle.

A 2021 research piece by CME Group titled “Answering the liquidity question” also pointed out that futures on indices of leading benchmarks can be transferred into their ESG futures variants, which means that market makers may be able to rely on global pools of futures, options and ETF liquidity to facilitate trading. Meanwhile, accompanied by the growth in liquidity, index options and ETF options linked to the S&P ESG Indices have also been introduced, providing investors with a broader range of risk management tools to participate, hedge or speculate within U.S markets through a “green” lens.

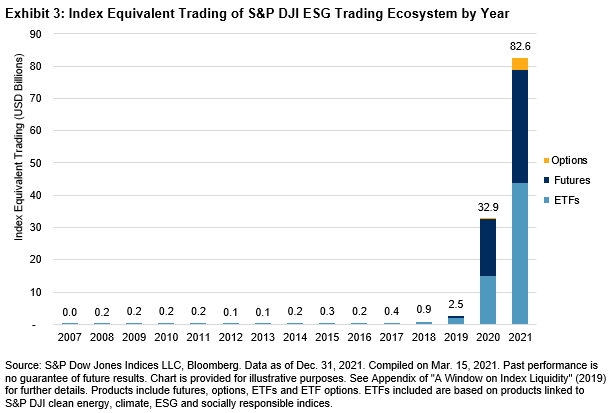

Highlighting the growing importance of ESG index-related futures, Exhibit 3 shows the annual dollar value in trading of all products within the S&P DJI ESG ecosystem, including ETFs, futures and options linked to ESG-themed indices. In terms of the economic value of traded index exposure, ESG futures now make up about 50% of the S&P DJI ESG trading ecosystem.

Why does this matter? If ESG is to become more mainstream, investors may look for ease and speed of execution comparable to traditional benchmarks such as the S&P 500. Futures and options can play an important role in strengthening investor confidence by creating new and deeper pools of liquidity and by bringing the price scrutiny of a small army of arbitrageurs to “police” price discrepancies. A robust network of tradeable products may entice such arbitrageurs, and there are signs that precisely such a network has begun to develop around the S&P 500 ESG Index and the broader S&P DJI ESG ecosystem.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment