Viorika

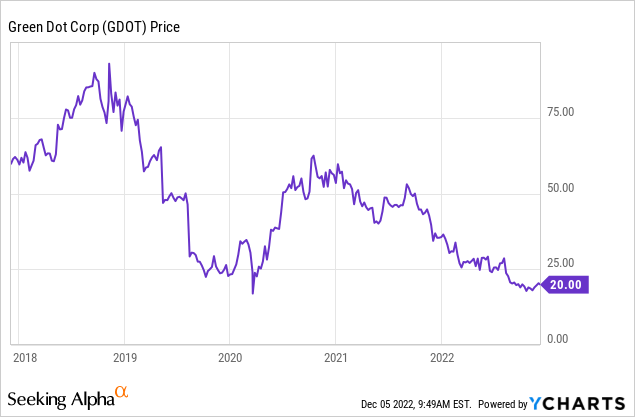

Green Dot (NYSE:GDOT) is an one of the oldest financial technology companies operating as it was founded back in 1999, just before the dot com bubble popped. The company has gradually evolved its business model as its “banking as a service” offers a great solution for other technology company. Green Dot reported solid financial results in the third quarter of 2022, as it beat both top and bottom line financial estimates. In this post I’m going to dive into the business model, financials, valuation, let’s dive in.

Evolving Business Model

Green Dot is a fairly unique fintech company given they are also a registered bank. The majority of Fintech company’s don’t have a banking license and have to partner with established banks for loan services. This means Green Dot is in a fairly unique position which acts as a competitive advantage in the market.

The company was a pioneer in prepaid debt cards such as those used Walmart with its “Money Card” and Turbo Tax with its Debt Card. However, the company has also helped to launch range of co braded card programs such as those with Citibank and A&T. As Green Dot is a registered bank it can couple its card programs with traditional bank accounts such as the 2% savings account offered with Walmart.

Green Dot prepaid debt cards (Green Dot)

Green Dot leverages its unique market position to offer a “Banking as a Service” solution to major technology companies such as Apple (AAPL) with its Apple Pay Cash, Uber (UBER) and even Amazon (AMZN).

The global Banking as a Service industry was valued at $2.41 billion in 2020, and is forecasted to grow at a rapid 17.1% compounded annual growth rate, reaching $11.34 billion by 2030.

In addition, the company offers a “Money Movement” Services segment which helps with payment processing and tax refund processing. The business has 13 issued patents across its technology which also acts as another competitive advantage.

Stable Financials

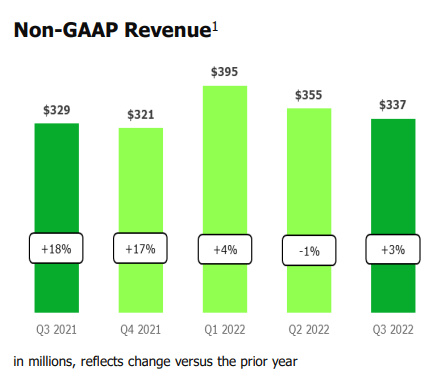

Green Dot reported solid financial results for the third quarter of 2022. Revenue was $337 million for the third quarter of 2022, which slightly beat analyst expectations and increased by 1% year over year.

Revenue (Q3,22)

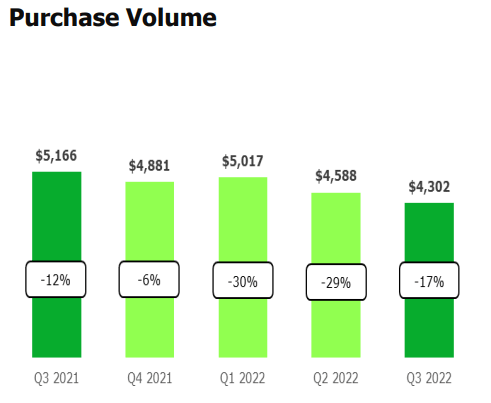

This relatively flat revenue was driven by the combined performance of various business segments. For instance, Consumer Services revenue plummeted 19% to $136 million. This was mainly driven by a 17% decline in Purchase Volume to $4.3 billion, as consumers cut back on spending. These results may look slightly worse than they are, as the financials are against a tough comparison following the strong boom in consumer spending and direct stimulus provided in 2020 and 2021. For example, many consumer accounts benefit from enhanced pandemic related unemployment benefits which was apparent for much of the third quarter of 2021. Its retail channel has been negatively impacted by declining foot traffic at retail stores, after a boom during the “reopening” of 2021.

A positive is Revenue per average active account has surprisingly increased by 13% year over year. This was driven by a better mix of customer accounts, as many of those which used the platform for a stimulus deposit have left. Its current customers are also adopting more features such as overdraft protection.

Declining Purchase volume Consumer segment (Q3,22 report)

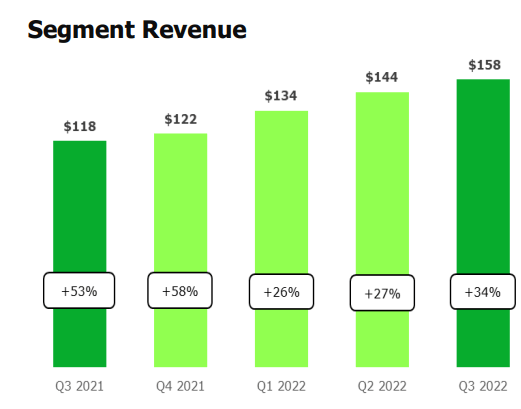

The B2B segment of Green Dot’s business reported strong growth with revenue increasing by a rapid 34% year over year. This segment includes its modern “Banking as a Service” (BaaS) solutions and PayCard channels. The beautiful thing about Green Dot’s platform is it grows with its customers payment volume. The company reported strong growth in volume for one of its “larger customers” which I am guessing could be Uber based on the recent earnings for the business.

Segment Revenue B2B (Q3,22 report)

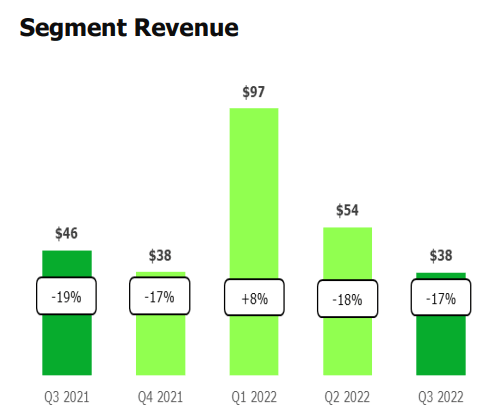

Green Dot’s “Money Movement” business reported revenue decline of 17% year over year to $38 million. This was driven by a reduction in stimulus-related compared to the prior year. In addition, the business has experienced a “normalization” of the tax season. A positive for the business is its interest income on savings accounts increased by a staggering 217% year over year, thanks to rising interest rates.

Money Movement Revenue (Q3,22)

In terms of profitability the company reported $7.3 million in net income, which declined by an eye watering 36% year over year. Earnings per share were $0.09, which declined by 31% but still beat analyst estimates by $0.05. The general decline in earnings was a result of the aforementioned trends. The major contributors to the decline were Consumer Services, which reported a 10% earnings decline to $54 million. In addition to Money Movement services, which reported a 22% decline in earnings to $15 million, driven by the aforementioned “tax normalization”. A positive is B2B segment earnings increased by 21% year over year to $22 million, as the business has benefited from the growth in its underlying customers.

Green Dot has a strong balance sheet with $92 million of unrestricted cash in the overall holding company, which doesn’t include customer funds. In addition to total debt of just $9.7 million, although this metric may be slightly skewed as Green Dot is technically a bank.

Management showed confidence as they bought back 1.3 million shares at an average price of $22.92 in Q3,22. The company has also $16 million remaining of its share repurchase authorization.

Advanced Valuation

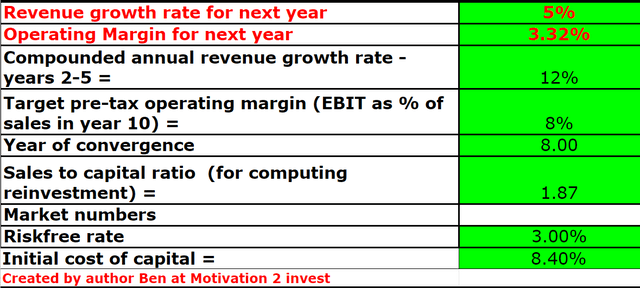

In order to value Green Dot I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 5% revenue growth for next year due to the tough macroeconomic environment. However, in years 2 to 5 I have forecasted a faster 12% revenue growth rate per year, as its B2B business continues to grow.

Green Dot stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted the business to increase its operating margin to 8% within 8 years, as segment profitability from the B2B business makes up a larger portion of total profit.

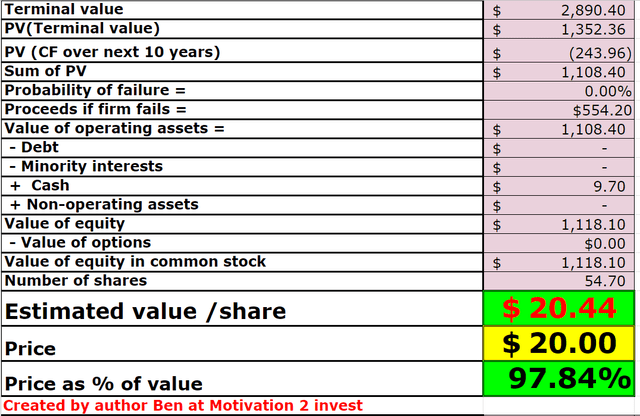

Green Dot stock valuation 2 (created by author Ben at Motivation 2 Invest)

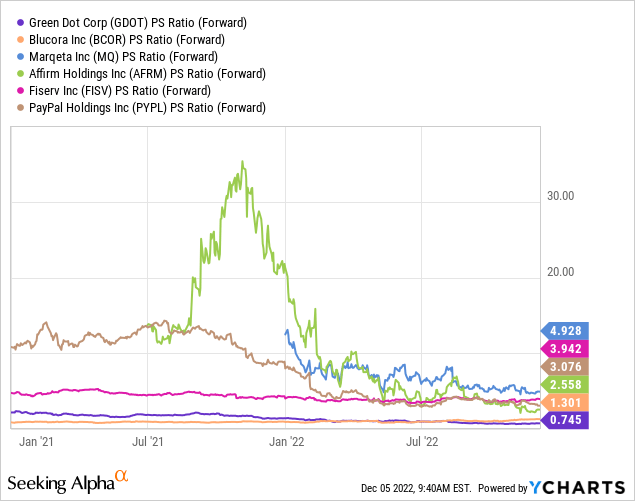

Given these factors I get a fair value of $20 per share, the stock is trading close to this at the time of writing and is thus “fairly valued”. As an extra datapoint, Green Dot has a Non-GAAP PE Ratio = 8 which is 53% cheaper than its 5-year average. Relative to fintech industry peers Green Dot trades at a cheap PS ratio = 0.745, as you can see on the chart below.

Risks

Lower Payment Volume/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. A recessionary environment often results in lower consumer spending which is bad news for fintech businesses.

Final Thoughts

Green Dot is an interesting fintech company which is uniquely positioned to serve multiple markets thanks to its banking license and reputation. The company produced stable financial results in the third quarter and its B2B segment is growing well. The stock is fairly valued at the time of writing and undervalued intrinsically, thus it could be a great long-term investment.

Be the first to comment