May Lim

The article below does not discuss the pros and cons of a general allocation to Bitcoin (BTC-USD) in the current risk-off environment. Rather, it specifically considers Grayscale Bitcoin Trust’s (OTC:GBTC) appropriateness as one means of gaining exposure to the coin. Obviously the Trust is particularly interesting now because it trades at a large and widening discount to the value of its underlying Bitcoin holdings.

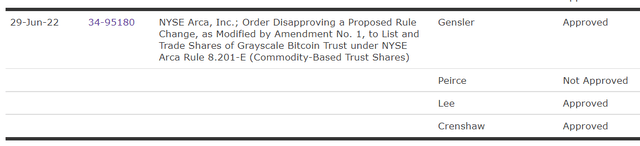

In June the SEC disapproved Grayscale’s proposed conversion of the Trust to a spot Bitcoin ETF. Trading as an ETF would have provided the mechanism for the market price per share to align with the holdings per share value, removing the current 35% discount. Following the decision, Grayscale immediately filed for review of the SEC decision with the United States Court of Appeals for the D.C. Circuit. If Grayscale were to win this lawsuit, the SEC disapproval order would be vacated, making it likely the Trust would convert to an ETF.

So the merits and timing of the case are a key determining factor for if the Trust is investable today. Put differently, due diligence toward understanding the likely outcome could provide excess returns over a benchmark Bitcoin holding.

Before directly discussing the two primary legal arguments Grayscale makes, it is useful to provide a little bit of the bigger picture. From my perspective the following factors tend to make a favorable ruling more likely than the current market opinion suggests.

Frist, and confusingly, when the SEC voted to approve the disapproval order for the ETF to trade, Commissioner Hester Peirce supported the Grayscale position and voted “Not Approved”.

Peirce had argued the Commission is not concerned with “legal and logical coherence”, but has alternative motivations.

The reasons for this resistance to a spot product are difficult to understand apart from a recognition that the Commission has determined to subject anything related to bitcoin-and presumably other digital assets-to a more exacting standard than it applies to other products…

…the Commission has many subtle ways of exercising merit regulation, often without a clear legal basis for doing so.

Commissioner Hester Peirce, “Regulatory Transparency Project Conference on Regulating the New Crypto Ecosystem: Necessary Regulation or Crippling Future Innovation?”, sec.gov/news/speech, 6/14/22

Also, Grayscale is represented by former U.S. Solicitor General Donald Verrilli. Verrilli has successfully argued dozens of cases before the Supreme Court, such as the Affordable Care Act. He is widely recognized for making technical arguments that, as shown in Grayscale’s opening brief, will be necessary to oblige the Court of Appeals to vacate the SEC order.

So any initial thinking that Grayscale’s litigation may be frivolous or a Hail Mary attempt are incorrect. There is already minority support at the SEC supporting Grayscale’s legal arguments and Grayscale’s arguments against the SEC will be presented by a quality, respected and establishment attorney.

Discrimination Between Issuers

Grayscale’s major point in the lawsuit is that the SEC’s disapproval order is arbitrary because their proposed spot Bitcoin ETF is being treated differently than “similarly situated” Bitcoin futures ETFs. Grayscale’s opening brief best explains this as follows:

When approving bitcoin futures ETPs, the Commission necessarily determined-as the Exchange Act requires-that the risk of fraud or manipulation in the spot bitcoin market (which bears directly on the price of bitcoin futures) was sufficiently low that bitcoin futures ETPs could be approved without creating unacceptable risks for investors. But that risk is exactly the same for spot bitcoin ETPs like the one proposed by the Trust. It was entirely arbitrary for the Commission to conclude that any such risk was no obstacle to approving bitcoin futures ETPs and then to reverse course and find the identical risk to be too great to allow approval of spot bitcoin ETPs.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 24

Grayscale makes two general points concerning their accusation of discrimination. The first is that the SEC has not reasonably explained their differentiation between the spot and futures backed Bitcoin ETF requirements. The second is that the SEC appears to use relaxed listing standards when considering the futures backed style products. And though the onus is on Grayscale and NYSE Arca to meet listing requirements, the SEC has an obligation to show their position is coherent and consistent with both rules and prior rulings:

To justify such disparate treatment, an agency must “provide reasoned analysis, resting on articulated objective, nondiscriminatory, and evenhanded criteria.” W. Deptford Energy, 766 F.3d at 21. One searches the Order in vain for any such explanation.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 28 (link above)

This area will likely be the meat of the lawsuit and gets into the tall weeds quickly concerning whether or not the proposed ETF is adequately designed to prevent fraud and manipulation. Specifically the question is if the proposed surveillance-sharing agreement with the CME would “assist in detecting and deterring fraudulent and manipulative misconduct” affecting the price of Bitcoin. And for clarity, Grayscale’s proposal relies on the exact same agreement that as was used in the successful listings of the futures backed Bitcoin ETFs.

Below I have included the SEC’s succinct, most clear and best explanation from the disapproval order of how spot backed products are different from futures backed products. On its face one may think this is somewhat “conclusory” rather than an explicit explanation. However the lawsuit should provide the SEC a better opportunity to forward their reasoning for the Court, Grayscale and the public.

…the CME’s surveillance can reasonably be relied upon to capture the effects on the CME bitcoin futures market caused by a person attempting to manipulate the CME bitcoin futures ETP by manipulating the price of CME bitcoin futures contracts, whether that attempt is made by directly trading on the CME bitcoin futures market or indirectly by trading outside of the CME bitcoin futures market.

…as the Commission also states in those Orders, this reasoning does not extend to spot bitcoin ETPs.

…If an exchange seeking to list a spot bitcoin ETP relies on the CME as the regulated market with which it has a comprehensive surveillance-sharing agreement, the assets held by the spot bitcoin ETP would not be traded on the CME. Because of this significant difference, with respect to a spot bitcoin ETP, there would be reason to question whether a surveillance-sharing agreement with the CME would, in fact, assist in detecting and deterring fraudulent and manipulative misconduct affecting the price of the spot bitcoin held by that ETP.

Order Disapproving – List and Trade Shares of Grayscale Bitcoin Trust, sec.gov, pp. 66-67 (link above)

Basically the SEC is saying the CME Bitcoin futures have not been shown to be a “market of significant size related” to spot Bitcoin. And the SEC highlights that futures are regulated, and spot Bitcoin is not. But there remain questions as to how “related” is defined here and the actual connection between the futures and spot markets. Importantly, the SEC is asking, “Is [there] a reasonable likelihood that a person attempting to manipulate the [spot] ETP would also have to trade on [the CME] market”?

But of note and partially captured above, in approving futures backed products, the SEC accepted NYSE Arca’s surveillance-sharing agreement with the CME as a reliable, standards meeting means for detecting manipulation. In one approval, the SEC said the ETF was adequately protected by the surveillance-sharing agreement from manipulation attempts made “indirectly by trading outside of the CME bitcoin futures market”, such as in the underlying spot markets or on unregulated futures exchanges. Of course herein is the unexplained crux… why then would the agreement not also protect spot backed products?

The SEC’s disproval is extensive and contains 1000s of words and 100s of footnotes with voluminous discussions. But Commissioner Peirce described the situation as follows:

The reasoning underlying the Commission’s denials of spot bitcoin ETPs is itself general and conclusory, which makes it difficult to know how approval could be achieved.

Peirce, “Regulatory Transparency Project Conference on Regulating the New Crypto Ecosystem…”, sec.gov, 6/14/22 (link above)

Extratextual Requirements

Grayscale’s secondary point is related to the discussion above in that it also concerns the surveillance-sharing agreement. But it is not arguing the proposed agreement is sufficient for detecting and deterring fraudulent and manipulative misconduct, nor whether it is operatively the same as what was acceptable for the futures backed ETFs.

Rather, Grayscale thinks the SEC has more generally overstepped its authority under the Exchange Act by creating inappropriate rules concerning listing requirements; Grayscale argues that by de facto requiring an appropriate surveillance-sharing agreement, the SEC goes beyond the statutory requirements created by Congress. And it should be noted, particular reliance on surveillance-sharing agreements have not been required for non-digital asset ETFs in the broader commodity space.

There is no reason to conclude that having a surveillance-sharing agreement with a regulated market of significant size is essential to, or inherent in, having rules that are designed to prevent fraudulent and manipulative practices.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 45 (link above)

The SEC has latitude in its rulemaking, but it may be inappropriate for it to have a specific policy concerning the method used to meet the more general retirements of the law. Grayscale argues:

But there is a crucial difference between elucidating a statutory requirement through a series of administrative adjudications and jettisoning the statutory standard in favor of some much stricter requirement that the Commission would have preferred over what Congress has actually written.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 47 (link above)

Here it is useful to note the SEC has acknowledged there could be “other means” of meeting statutory requirements concerning manipulation beyond an appropriate surveillance-sharing agreement. However Grayscale points out the following:

The Commission has never found such a showing sufficient, or even explained what kind of showing could be sufficient.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 43 (link above)

Wait Till November 9th

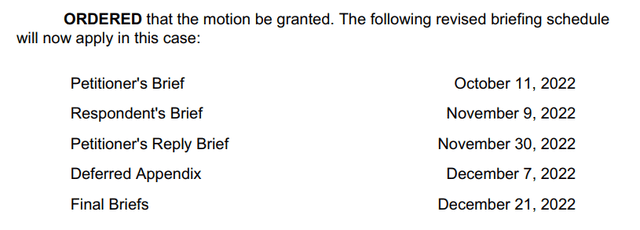

From my perspective the two arguments above are somewhat persuasive, especially when one of the looped-in Commissioners also directly questions the legal reasoning of the SEC’s prior rulings on spot Bitcoin ETFs. But before acting, it will be useful to wait for the SEC’s initial response on November 9th. It is unlikely the SEC, for example, settles prior to this date and the market then quickly removes the Trust’s current discount to NAV, curtailing this opportunity.

Grayscale’s opening brief was indignant, used attacking terminology and put forward clear language that obliges an answer.

If the Exchange’s surveillance-sharing agreement with the CME is sufficient to detect and deter fraudulent or manipulative activity in spot bitcoin markets, then spot bitcoin ETPs and bitcoin futures ETPs are equally protected from such activity.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 32 (link above)

It will be useful to see and open-mindedly weigh what justifications the Commission presents to the Court for this differentiated treatment between issuers and what response is given to the notion their current policy oversteps the statutory requirements. Once considering the strength of counter arguments presented by the SEC, a more accurate expected value of Grayscale’s Bitcoin Trust can be formulated. And with the case moving somewhat faster than initially expected, I will raise my hold recommendation to a buy if Grayscale still appears winning on the merits following the SEC response in November.

My new marketplace service is coming soon. Complete Crypto Analytics is launching in the near future and will provide model allocations for Bitcoin and Bitcoin adjacent names such as GBTC and the miners. Please keep reading my articles here for updates so you can reserve your spot as a Legacy Discount Member. Thank you for following my work.

Be the first to comment