bizoo_n/iStock Editorial via Getty Images

Back in October I predicted the Grayscale Ethereum Trust’s (OTCQX:ETHE) discount to NAV would expand, and that 30% discount was not enough to go long the product.

Originally, I suspected the discount would expand to approximately 42%-45% and that would be that – however due to the collapse of FTX (FTT-USD) the discount has ballooned to a bit more than a 50% discount to NAV.

Part of this is likely due to further disinterest in the cryptocurrency market, as well as price declines, but much of it is likely due to FTX-related fears, solvency, and all that.

To be very clear before we begin – at the time of writing I have liquidated all of my Ethereum (ETH-USD) holdings including my futures contracts and do not plan to repurchase them until macro conditions change. I believe there is a good chance Ethereum declines again to the $650-850 handle before the bottom is in.

Thesis

ETHE’s discount to NAV has now more than priced in the risks and holding period issues (until redemption or ETF conversion is likely) in my opinion.

As a result there are only really two bear cases for the fund left:

-

You believe ETHE, Grayscale, DCG, and most of all Coinbase (COIN) have committed fraud and they do not fundamentally have the Ethereum they claim to have

-

You believe Ethereum is grossly overvalued and much like a tulip

A bit hyperbolic you may say, and I’d agree – after all I do not believe the fraud narrative nor do I believe Ethereum is in a tulip-style bubble.

Ultimately those are the two reasons to not buy or hold the fund – and if ETHE has the Ethereum it claims to have, then you’re effectively buying Ethereum at a 50% discount, meaning even if you believe it’s not cheap at these levels it certainly is cheap NAV-adjusted.

Let’s explore these two bear cases, and find the truth somewhere in between:

Reviewing the Fraud Risk

I believe the risk is overblown for a variety of reasons, much of which is centered around a fundamental misunderstanding of how financial fraud typically occurs amongst funds, money managers, and large companies – as well as a misunderstanding of how Coinbase’s custodian services work.

How do Coinbase’s Custodianship services work?

People seem to think Grayscale can just willy-nilly go in and trade, lend out, and really do whatever they want anytime they want with their Coinbase wallet and that’s Coinbase custodianship.

That’s not how it works – not at all.

When Custodianship accounts are opened, they come with multiple account rolls – each user that is part of the custodianship agreement gets one vote and to make any changes, movement of coins, trades, etc. (if they’re enabled at all), require majority or full-support of all users.

While no clarification has been made as far as I’m aware for Grayscale’s products or the current custodianship agreement I remember in the past they required multiple executives of the custodian-seeking company to be signers, as well as one or two Coinbase employees or executives – meaning there couldn’t be some nonsense going on with one reckless person, like SBF, transferring funds out.

It’s simply not realistic.

But that’s speculative – I’ll give that to the bears, but what’s not speculative is how their custodianship service operates on an ongoing basis and how the system is set up: Auditors have viewing rights directly with Coinbase to view the accounts, all their actions, all their balances, everything.

This means the 10-Q filings, the 3rd-party audits, would have to be part of the fraud if something was going on.

Coinbase also released a statement recently. In short, they claim:

- Funds are not comingled and are separate from Coinbase entirely

- They have audited the funds and continuously do so to verify their presence

- All funds belong to Grayscale and are legally owned by Grayscale

- Coinbase cannot lend or otherwise touch Grayscale’s funds

- Grayscale has 3,056,833.75893012 Ethereum held with Coinbase through the custodianship service as of 9/30/2022 according to their 10-Q filings

This was signed off by the CFO of Coinbase Global and CEO of Coinbase Custody.

What does this tell us? Nothing regarding Grayscale, but reaffirms that any risk in regards to Coinbase as a custodian, is null – the products are completely separate – Coinbase can’t do anything with the funds.

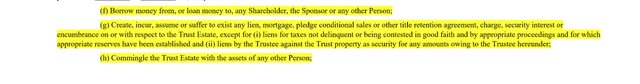

In the ETHE (and other Grayscale products) documentation, they have the following clauses:

Grayscale/SEC filings

In other words, the fund is prohibited from doing essentially anything with the funds – they can’t lend it out, they can’t trade with it, they can’t do anything other than let it sit there and collect their 2% NAV fees.

They also mention how the CEO and CFO must sign off on everything, certifying the 10-Q filings, 3rd-party audits, etc., verifying the authenticity of the statements within.

This means, fundamentally what we’re looking at – if Grayscale’s products, including ETHE, do not hold the underlying assets they had:

- Lied repeatably in SEC filings on a quarterly basis

- 3rd-party auditors in their pocket

- Horrible inadvisable setups with Coinbase Custody from the beginning

- Complicit Coinbase employees, likely high-ranking ones

- Across the board corrupt management who are hand-in-hand in agreement

- etc.

All of which would entail systemic corruption amongst DCG, Grayscale, Coinbase, and 3rd-party auditors, not to mention regulatory bodies.

Financial Fraud, High Return Low Risk

Is it possible DCG, Grayscale, Coinbase, and 3rd-party auditor were complicit, especially when they’re involved with crypto? Absolutely.

Likely? Absolutely not.

The thing is, with financial fraud, this isn’t how it happens or looks. You don’t have a cabal, a huge network and web all working together in a scheme – it’s usually a very small high-level executive who hides everything from everyone else – something not possible here.

The other thing is, well, financial fraud goes unpunished – or lightly punished – as the folks who commit it generally aren’t stupid people. Criminals, heartless, predators, objectively bad people, sure – but they aren’t stupid.

They do it in a way where there is some level of deniability – maybe they were just truly incompetent fools who made bad loans, maybe they hired the wrong team member who had poor risk management, maybe they got hacked, maybe they weren’t organized and accidents happened.

That’s not what we’d be looking at here. If there is fraud here there’s no weaseling your way out of this – it’s a shut case. Straight to jail. Securities fraud, stripping of all personal assets, 20 years in prison for the lot of them. Regulators would throw the book at them.

While no guarantees can be made of course this doesn’t smell like fraud to me – there are too many parties involved, there are too many protections, there’s too much risk involved, and realistically for what – the CEO/CFO/etc., Michael Sonnenshein, doesn’t have an angle or benefit for compromising the fund – he’s well off, has a lot to lose, and has no meaningful connection or obligation to FTX/DCG/etc.

The fraud fear is absurd – and the risk is overblown. Let’s move on.

Is Ethereum/Crypto a Tulip Bubble?

Again yes, a bit hyperbolic – however it is still argued by many people. You may expect me to call it absurd as there are thousands of project building on Ethereum, there’s this and that, all these big DeFi exchanges, etc.

That’s true – a reasonable take – but there is some truth in what the Tulip-doomers say. Most of the 1000s of projects are garbage – either outright scams, silly nothingburgers that have bad tokenomics, solve no problems, etc.

Let’s skip that tired debate, anyone with sense and is still reading knows Ethereum has some value – somewhere – and isn’t just going straight to $0.

But the real question I’d ask is would you buy Ethereum at $1280~/ETH today?

You may have answered yes – I’d like to ask you to read the question again – I said BUY, not hold – would you buy Ethereum today with fresh money?

I don’t think so – nobody I’ve met, nor have I, felt this way about Ethereum for quite some time now. We look at it and want it to go up, but nobody wants to fill a fresh bag with Ethereum right now.

I’d argue this is because we’re arguably teetering on a cliff, a deep recession – and with it, combined with more expensive capital generally, investment in startups and tech will decline – already is declining – and with it so will development on Ethereum.

Interest will likely fade if the economy deteriorates, more cash will be needed to be raised amongst investors and developers alike, and really what catalyst is left for Ethereum to move up?

We’ve had The Merge, it was a success – we’ve had the burn, it was a success, we’ve had DeFi, what is the catalyst now?

What is the Catalyst for Ethereum?

I don’t see any catalysts coming up — the only catalysts I can even think of is the return of easy money, pushing up the whole crypto market and development – or the decay of existing financial systems, pushing more of finance onto Ethereum or simply into crypto for self-custodianship.

With Bitcoin you could have inflation pick back up and that narrative take off, but Ethereum doesn’t have that narrative – so really for the 3rd time, what is the catalyst?

I couldn’t find a catalyst on the horizon, so I sold my Ethereum and decided NOT to take advantage of this -50% discount to NAV, as I believe reality is about to set in over the next few months – and with it Ethereum’s price will collapse.

Where Does that Leave Us With ETHE?

A big discount to NAV, more than is justified – with arguably little to no risk of fraud or wrongdoing – but no real catalyst to the upside.

Let’s not forget about the macroeconomic headwinds pushing the underlying (Ethereum) down in price and the other potential risks in the crypto-market generally, from Tether (USDT-USD) to further contagion risk amongst exchanges, regulation, etc.

I’d like to say ETHE is a buy – I really would, I wanted to – I planned to once we got to this discount to NAV – but I can’t.

I can’t find any reason to take new money and buy ETHE.

Actionable Takeaways

I do see reason in selling spot Ethereum and using a portion of the funds to buy ETHE. Then if a drop occurs either due to fraud or simply macro forces add spot or ETHE lower.

Personally I’m holding off until the macro forces change, Tether blows up, regulation comes, or Ethereum simply dips to below $850, at which point I’ll reevaluate the ETHE situation and, likely, buy substantial amounts of ETHE.

With this being said these are the trades I’m seeing here:

- If neutral to slightly bullish on Ethereum, swap 40%-70% of your target NLV of the position to ETHE and hold the extra cash for a dip or clarity

- If in agreement with my case regarding fraud being unreasonable (<5% chance) short Ethereum Futures or Spot and Long ETHE to collect the 5-10% NLV when this fear subsides

- If temporarily bearish on Ethereum price hold no position and wait to sell puts in Ethereum futures as the price breaks $1000

I am opting for Option #3, as I am no longer bullish on Ethereum’s price.

Risks to Consider

Just want to reiterate while I believe the risk of fraud is minimal, and I’ve been right in the crypto space regarding fraud throughout 2022, there is a chance I’m wrong and if so, not only will the fund have issues, but crypto will collapse in a way much much worse than the FTX-debacle.

This is why I believe even if bullish, it is better to limit notional exposure, as ultimately if wrong about ETHE, the opportunity to ‘buy the dip’ in spot likely recovering a substantial amount of the desired target exposure in ETH terms will present itself.

Be the first to comment