Scott Olson

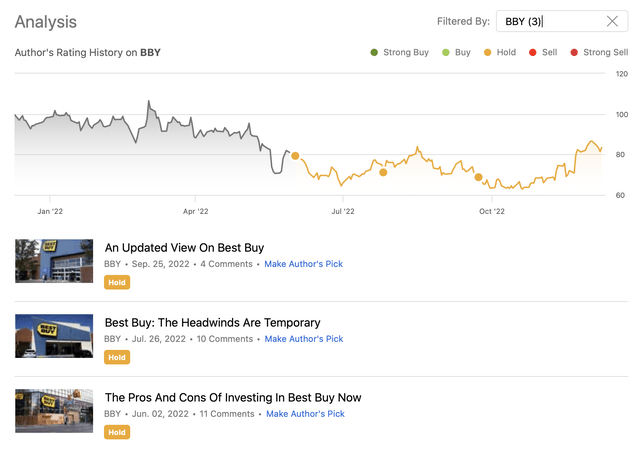

Best Buy Co., Inc. (NYSE:BBY) retails technology products in the United States and Canada. This year, we have published three articles on the firm, rating Best Buy’s stock as “hold” each time.

Throughout the year, we have put emphasis on Best Buy’s strong commitment to return value to their shareholders both in the form of dividends and through share buyback programs. On the other hand, we have underlined the key concerns associated with declining sales, poor consumer sentiment, diminishing positive effects of the Covid-19 pandemic, and the inflationary pressures on the costs and on the margins.

Today, we are revisiting Best Buy once again, and we will provide an updated view on why we still believe that BBY stock could be a good holding for 2023.

We will be focusing primarily on the dividend and share buybacks, but also highlight some key concerns from the latest earnings release that investors need to keep in mind.

Dividends

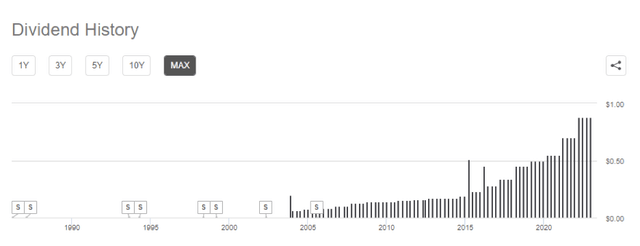

Best Buy has a strong track record of paying dividends to its shareholders. As of now, they have been paying dividends each year for the past 17 years and they have even managed to increase their payments for the last 11 years consecutively.

Dividend history (Seeking Alpha)

The dividend yield is currently around 4.2%, corresponding to an annual payout of $3.52 per share, which could be an attractive figure for many dividend and dividend growth investors.

Due to the worsening financial performance of the firm over the past quarters, the dividend payout ratio has somewhat increased since our previous writings. Despite this increase, we still believe that the dividend is safe and sustainable in the coming quarters, despite the macroeconomic headwinds. The current dividend payout ratio (TTM) (GAAP) is 50%, while the dividend coverage ratio (FY1) is 1.89, both indicating that the firm can afford to continue the quarterly payments.

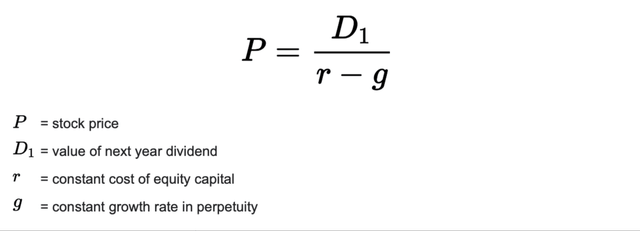

However, when we are focusing on investing in BBY’s business because of the dividends, we also have to understand how much these dividends are worth. To answer this question, we will be using a simple and well-recognized dividend discount model, the Gordon Growth Model (GGM).

The following formula describes the math behind the GGM:

For our estimation of fair value, we will be using the firm’s weighted average cost of capital (WACC) as our required rate of return, which is estimated to be 8.75%.

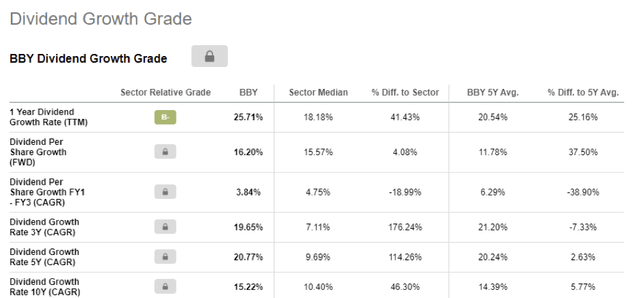

For the constant dividend growth rate in perpetuity, we normally like to look at historical trends to come up with reasonable estimates. However, in BBY’s case these figures appear way too aggressive, especially considering the macroeconomic headwinds.

Dividend growth (Seeking Alpha)

We believe a reasonable dividend growth rate in perpetuity could be in the range of 2.5% to 5%.

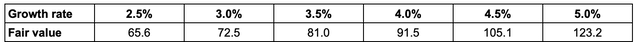

Using these input values, we get the following range of fair values in USD per share:

Fair value in USD per share (Author)

Currently, Best Buy is trading in the middle of this range.

Share buyback

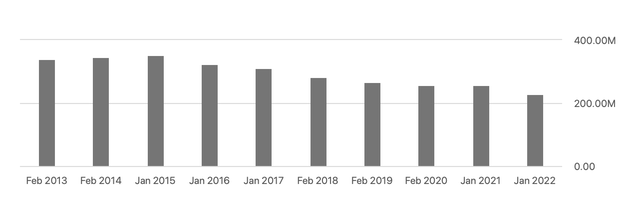

Best Buy has a strong track record of buying back their shares outstanding. The following chart shows how the number of shares outstanding have decreased over the past decade.

Shares outstanding (Seeking Alpha)

While dividends are great and often loved by investors, share buybacks also have their own advantages.

First, share repurchase programs often give the firm more financial flexibility, which is especially important in challenging macroeconomic environments. If the dividend is paused or cut, investors normally react negatively and the share price can be substantially hurt. With share repurchase programs, the firm is somewhat more flexible in the decision, when to actually buy the shares back and, therefore, when to actually return the value to the investors. And Best Buy, in fact, is taking advantage of this tool. The firm has paused their repurchase activities during Q2, and they have now announced to resume it, and are expecting to spend as much as $1 billion this year.

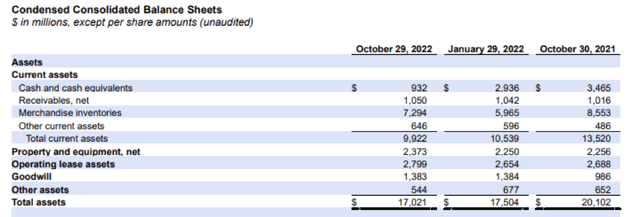

As the Board of Directors approved a $5.0 billion share repurchase program in February 2022, there is still a substantial amount available to continue the buybacks in the quarters to come. As of October 29, 2022, $4.7 billion of the $5.0 billion share repurchase authorization has been still available. To put this figure into perspective, BBY’s current market cap is about $18.5 billion, meaning that the remaining amount for buybacks could potentially result in a substantial upside for shareholders.

Second, share repurchases can sometimes also be a more tax efficient way of returning value to the shareholders than simply paying quarterly dividends.

When the stock looks quite attractive from a dividend and share buyback perspective, why do we still not rate the stock as “buy”? The answer is the uncertainty with regards to Best Buy’s latest quarterly results.

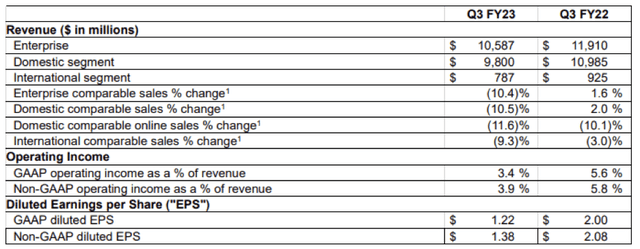

Q3 results

Revenue, gross profit, gross margin, operating profit, operating margin and EPS have all been declining.

Lower demand across all product categories has been driving the decline in sales, potentially due to the diminishing positive impacts of the Covid-19 pandemic on BBY’s business. The gross margin has been declining due to increased promotion and therefore lower product margin rates, lower service margin rates and higher supply chain costs. The international segment sales has been additionally hurt by the unfavorable FX environment.

Further, the merchandise inventory of the firm kept growing. This year, we have seen several times that inventory management issues can cause real problems. If the demand remains low in the coming quarters for BBY products, part of their inventory may become obsolete and they may have to use substantial discounting to get rid of the excess products. This could further negatively impact the margins.

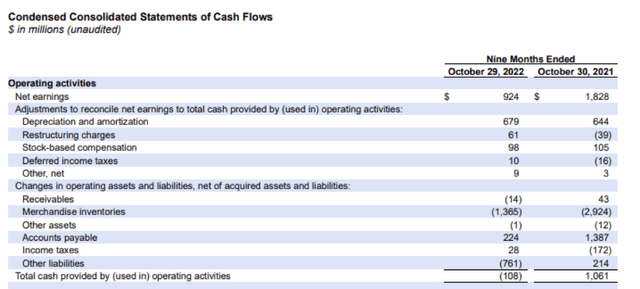

We also have to keep in mind that the cash flow from operating activities has been negative in the first two quarters this year, and has also remained negative in the third.

For these reasons, we do not believe that a “buy” rating is justified for Best Buy’s stock. We would like to see an improvement in the consumer sentiment readings, a reduction of inventories and a positive cash flow from operations before we would consider upgrading Best Buy stock.

Be the first to comment