Дмитрий Ларичев

Welcome to the August edition of the graphite miners news.

August saw flat graphite prices and plenty of good news from the graphite juniors.

Graphite price news

During the past 30 days, the China graphite flake-194 EXW spot price was not updated (up 10.69% the past 360 days). The China graphite flake-199 EXW spot price was up by 0.28%. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was down 0.8% the past 60 days.

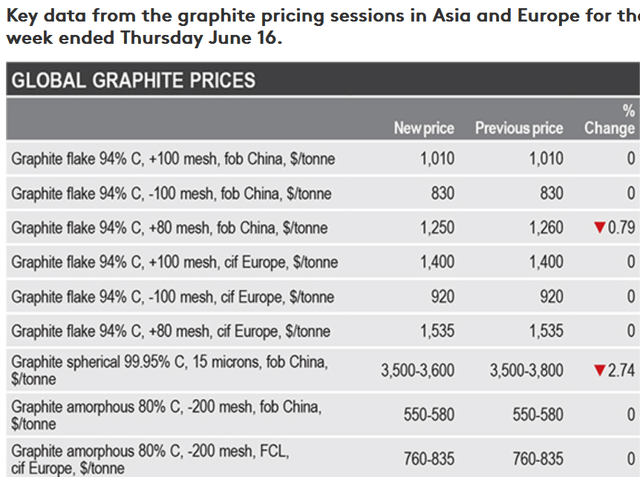

Fastmarkets (see below, not updated the past 2 months) shows China graphite flake 94% C (-100 mesh) prices at US$830/t and Europe graphite flake 94% C (-100 mesh) prices at US$920/t.

Fastmarkets graphite prices the week ending June 16, 2022 (no update available for August 2022)

Note: You can read about the different types of graphite and their uses here.

Graphite demand and supply forecast charts

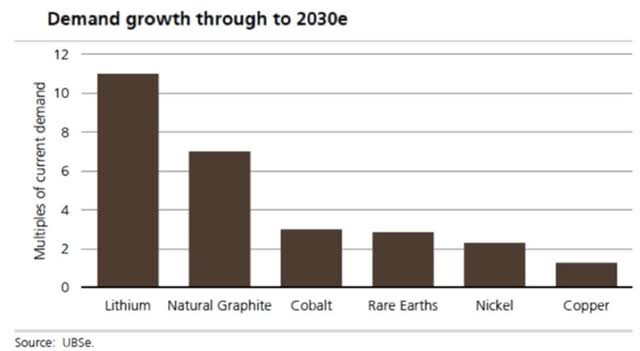

UBS’s EV metals demand forecast (from Nov. 2020)

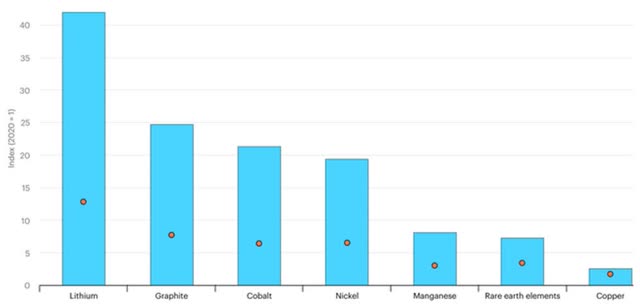

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x.

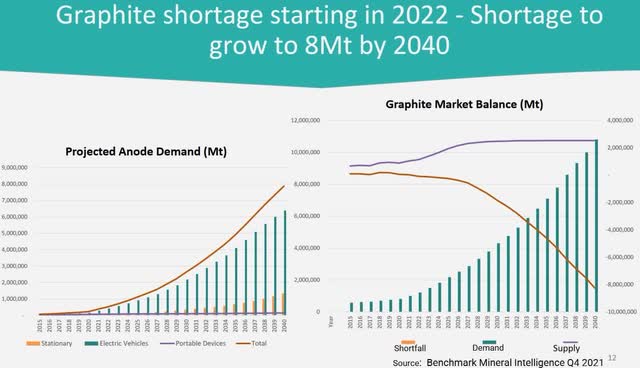

BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

Graphite market news

On August 4, Investing News reported:

…Graphite prices increased over the first half of 2022 …Prices for higher-purity 100 mesh flake material, typically used for anodes in the batteries that power EVS, saw a nearly 30 percent increase in the first half of the year… Overall, Benchmark Mineral Intelligence still expects to see a tightly balanced flake graphite market in 2022, leaning towards a supply deficit as demand from the anode industry continues to accelerate… “if recovery from COVID-19 lockdowns in China keeps momentum, then price upside is more likely than price downside, especially with no major volumes from new projects or expansions due to come online before the end of the year,” Jennings-Gray said.

On August 25, Mining.com reported:

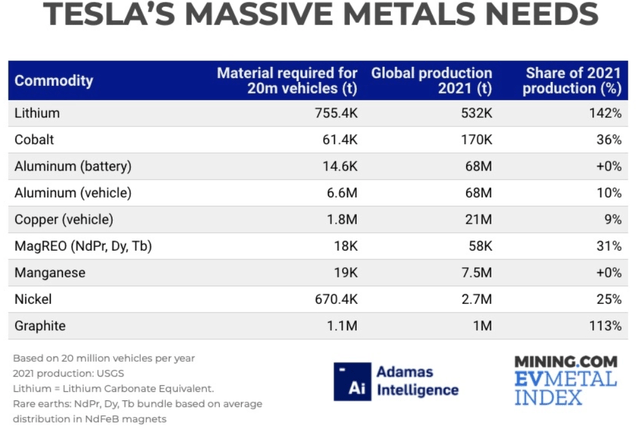

Tesla’s battery metals bill balloons to $100 billion……At today’s price Tesla is on the hook for a bit over $100 billion for the 11.1 million tonnes of raw materials it needs to build 20m cars…….As automakers (and the renewable energy sector) scramble for lithium, nickel, cobalt, graphite, rare earths, aluminium, manganese and copper securing supply may ultimately be a bigger issue than costs…….To produce 20m vehicles Tesla alone needs more than the total volume of lithium and natural graphite produced last year, almost a third of the magnet rare earths, 36% of the cobalt, and so on.

Note: Bold emphasis by the author.

Lithium and natural graphite are forecast to have the greatest demand increase by Tesla as they move towards producing 20m EVs pa (right column forecasts what would be Tesla’s % increase needed on 2021 ‘total’ global production

Graphite miners news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite, vanadium, and lithium. SGL Carbon (OTCPK:SGLFF) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (OTCQX:GRFXY) makes spherical graphite.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF) (OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On July 28, Syrah Resources Limited announced: “Syrah receives US$102 million binding loan from US Department of Energy.” Highlights include:

- Syrah receives US$102 million (A$146 million) binding loan from US Department of Energy (“DOE”) for the initial expansion of Syrah’s Vidalia facility in Louisiana, USA to a 11.25ktpa AAM production capacity.

- Loan represents strong validation of Syrah and Vidalia following detailed due diligence and an extensive negotiation and approvals process.

- Syrah and DOE targeting first loan advance in the December 2022 quarter, subject to satisfaction of customary conditions.

- DOE loan allows Syrah to use surplus existing cash to accelerate its growth strategy.”

You can view the latest investor presentation here.

Catalysts:

- September 2023 quarter – First Stage 11.25ktpa AAM Vidalia facility targeted to start production.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

On August 15, Ceylon Graphite announced:

Ceylon Graphite granted Industrial Mining Licence for the M1 Mining Project – its second full mining licence…..With the M1 permit in hand, the Company expects to be hoisting graphite after the shaft has been deepened by twenty feet and crosscut to a parallel vein system.

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On July 28, Mineral Commodities Ltd. announced: “MRC granted De Punt prospecting right at South Tormin.”

On August 1, Mineral Commodities Ltd. announced: “Quarterly activities report-June 2022.” Highlights include:

- MRC unveils its Five Year Strategic Plan 2022-2026.

- MOU signed with technology partner Mitsubishi Chemical Corporation to collaborate on graphitic anode materials supply in Europe.

- MOU signed with sales and marketing partner Traxys North America LLC to collaborate on graphitic anode materials supply in Europe.

- CRC-P Project successfully completed with battery grades achieved for both Munglinup and Skaland spherical graphite, using the CSIRO-development environmentally friendly purification process.

- Successful grant application of US$3.94M to advance commercialisation of a new graphite ore-to-battery anode business on the Munglinup graphite project including process piloting for anode materials production.

- Resolution of Section 102 mining right appeals.

- Priority targets identified at Bukken, Hesten and Vardfjellet graphite prospects near Skaland.

- Electromagnetic survey results indicate excellent new targets at the Munglinup Graphite Project.

- Tormin mining and processing throughput remains above budget expectations.

- Third consecutive quarter of stabilised operating performance at Skaland.”

Tirupati Graphite [LSE:TGR] (OTCQX:TGRHF)

On July 29, Tirupati Graphite announced:

Transaction update – Variation of long stop date. Tirupati Graphite plc (TGR.L, TGRHF.OTCQX) provides an update to its agreement to acquire the entire issued share capital of Suni Resources SA from Battery Minerals Limited, as announced on 17 August 2021. .

On August 15, Tirupati Graphite announced: “Vatomina preconcentrate and road infrastructure rebuilding update.” Highlights include:

Vatomina Preconcentrate Installed and Plant Recommissioned

- “……The construction and relocation of the first leg of Vatomina’s 9,000 ton per annum plant was initiated in mid July 2022. This has now been completed and the preconcentrate and final concentrate plant recommissioned and synchronised in operation.

- As a result, the previous requirement for the transport of c.250,000 tons of ore per annum to the plant has been replaced by the pumping of c.30,000 tons per annum of ‘pre concentrate’ in slurry form to the main processing plant, eliminating reliance on roads and ore transport vehicles……”

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF)

Northern Graphite has agreed to purchase from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On August 8, Northern Graphite announced:

Northern Graphite to acquire Mousseau West Graphite Project. Northern Graphite Corporation (NGC:TSX-V, NGPHF:OTCQB, FRA:ONG, XSTU:ONG) (the “Company” or “Northern”) is pleased to announce that it intends to exercise its option to acquire a 100% interest in the Mousseau West graphite project (“Mousseau West” or the “Property”) which is located approximately 80 kms from, and within economic trucking distance of, the Company’s producing Lac-des-Iles (“LDI”) graphite mine in Quebec….

On August 24, Northern Graphite announced: “Northern Graphite files Preliminary Economic Assessment for Okanjande/Okorusu Project in Namibia…..”

You can view the latest investor presentation here and the latest Trend Investing article on Northern Graphite here or the very recent and excellent Trend Investing CEO interview here.

Graphite developers

Magnis Energy Technologies Ltd [ASX:MNS] (OTCQX:MNSEF)

Magnis is an Australian-based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On August 12, Magnis Energy Technologies Ltd. announced: “New York lithium-ion battery plant begins commercial production.” Highlights include:

- Commercial production has commenced at the iM3NY New York Lithium-ion Battery Plant based in Endicott, New York……

- Initial production of several thousand cells expected in the next month which will ramp up to 15,000 cells/day as production scales up to an annual production rate of 1.8GWh.

- First few weeks of production will be tested for quality assurance before sales start with first revenues expected in late September.

- Green credentialed batteries produced to use C4V’s BMLMP Cathode Technology which DOES NOT contain nickel or conflict metals such as cobalt.

- Green hydroelectricity will be used for production.

- Future plans to increase annual capacity to 38GWh by 2030.”

On August 25, Magnis Energy Technologies Ltd. announced: “Extra fast charging battery results only 3% loss of charge retention after ~2600 cycles.”

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On July 29, Talga Group announced: “Quarterly activities review for period ending 30 June 2022.” Highlights include:

Commercial and project development

- Support from European institutions for Vittangi Anode Project financing.

- Positive mine permitting milestones achieved.

- Qualification and commercial engagements advance with battery customers.

- Front end and value engineering design progresses to optimise development.

- Trial mine commences for total 25,000 tonnes graphite ore.

- 54% increase in Vittangi project graphite mineral resource.

- Exploration drilling reveals wide, high-grade graphite at ‘Niska Link’……”

You can view the latest investor presentation here.

South Star Battery Metals [TSXV:STS] (OTCQB:STSBF)

South Star Battery Metals owns the Santa Cruz Graphite Project in Brazil with a Phase 1 commercial production target for Q4 2022. Plus the right to earn-in to up to 75% for the Graphite Project in Coosa County, Alabama.

On August 15, South Star Battery Metals announced:

South Star Battery Metals announces application submittal for the full mining license doubling production at its Santa Cruz Graphite Project and update on small-scale pilot metallurgical testing program for Alabama Graphite Project. The proposed PAE doubles the Santa Cruz production capacity presented in the previously released PFS (March 2020) and incorporates a third phase of project development. The planned production schedule follows:2 years with 5,000 tonnes per year (“tpy”) of concentrates (Phase 1).2 years with 25,000 tpy of concentrates (Phase 2).Life of mine (“LOM”) with 50,000 tpy of concentrates (Phase 3).

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

On August 11, Westwater Resources Inc. announced:

Westwater Resources, Inc. announces results for second quarter ended June 30, 2022. Company receives air permit from Alabama Department of Environmental Management. Company completes earthwork at Kellyton Graphite Processing Plant Site……”We finished the second quarter with a cash balance of $109.0 million and a working capital balance of $102.7 million,” said Mr. Vigil. “Since beginning construction of Phase I of the Kellyton graphite plant in the fourth quarter of 2021, we have incurred approximately $30.0 million of costs….

On August 19, Westwater Resources Inc. announced:

Westwater Resources applauds the inflation reduction act’s support for domestic production of battery materials.

You can view the latest investor presentation here.

Gratomic Inc. [TSXV:GRAT] [GR:CB82 ] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On August 9, Gratomic Inc. announced:

Gratomic announces initiation of benching program at its Aukam Project in Namibia……This process allows for the collection of graphite in stages as the plaforms are constructed on the Aukam mountain. The Company estimates this phase of the program will take around 6 months and is projected to move an approximated 20,000 tonnes of material from the mountain to be stockpiled at the ROM (Run of Mine) pad of its Aukam processing facility.

On August 18, Gratomic Inc. announced: “Gratomic provides progress update on third trenching program at its Capim Grosso Project in Brazil.”

Black Rock Mining [ASX:BKT] (OTCPK:BKTRF)

No news for the month.

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in March, 2022.

On August 9, NextSource Materials Inc. announced:

NextSource Materials provides progress update on Molo Graphite Mine in Madagascar. President and CEO, Craig Scherba commented, “Now that the processing plant has arrived in-country, on-site activity will ramp up significantly over the next several weeks as we begin re-assembly of the processing plant and the auxiliary buildings”.

Investors can view the latest company presentation here or the latest Trend Investing article here.

Nouveau Monde Graphite [TSXV:NOU] (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) owns the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

On August 11, Nouveau Monde Graphite announced: “NMG provides quarterly update as the Company Advances Phases 2 and 3 of its Growth Plan and files its feasibility study for the Matawinie Mine and Bécancour Battery Material projects.” Highlights include:

- Construction substantially finalized for the Company’s Phase-1 coating unit, with commissioning activities initiated; production is scheduled to start towards the end of Q3-2022.

- Completion of a compliant feasibility study following NI 43-101 rules and guidelines for the Phase-2 Bécancour Battery Material Plant and Matawinie Mine, demonstrating attractive economics with an after-tax net present value of C$ 1,581 million and internal rate of return of 21%.

- Active engagement towards offtake agreement with potential tier-1 customers in the EV and battery sector with the production of samples, site visits, quality checks, commercial discussions, and environmental diligence reviews.

- Signing and closing of a strategic investment agreement with Mason Graphite with a view towards the development and operation of Mason Graphite’s Lac Guéret property, an anchor asset for NMG’s Phase 3.

- Meaningful progress on financing efforts for the development of NMG’s fully vertically integrated Phase-2 operations with strong interest shown towards senior debt from Western World export credit agencies and governmental bodies.

- Continued advancement of the Matawinie Mine through preliminary construction work at the site, engineering progress (63%), development of electrification plans and environmental initiatives supporting progressive site reclamation.

- Publishing of a life cycle assessment for NMG’s portfolio of graphite-based materials, confirming the minimal and industry-leading environmental footprint of the Company’s production…..

- Period-end cash position of $32.1M.”

You can view the latest investor presentation here.

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM])

On July 29, Greenwing Resources Limited announced: “Quarterly activities report – June 2022 quarter.” Highlights include:

- Commencement of detailed Transient Electromagnetic (“TEM”) geophysical survey at the San Jorge Lithium Project, located in the prolific Lithium Triangle.

- Preparation for maiden drilling program at the San Jorge Lithium Project continued.

- Brine samples supplied to leading providers of Direct Lithium Extraction (“DLE”) technology for testing.

- Completion of diamond drilling program at Graphmada Mining Complex with 69 drill holes for a total of 3,268 meters.

- Updated Graphmada Mineral Resource announced of 61.9 million tonnes (Mt) at 4.5% Fixed Carbon (FC), nearly tripling the total contained graphite to 2.7 Mt (refer Table 1).

- Successful production and characterisation of graphene to ISO Technical Standard (TS) 21356-1:2021.”

On August 5, Greenwing Resources Limited announced: “San Jorge Lithium Project update: Geophysics significantly expands brine body area.”

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG] (OTCPK:TTMNF)

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On August 23, Triton Minerals announced:

Company update. Key Directors and Management of Triton recently visited Mozambique for a number of high-level meetings with government officials including the Director General of INAMI (National Mining Institute) with respect to the development of the Ancuabe Graphite Project. The Company reiterated its commitment to the development of the Ancuabe Project and expressed its gratitude to the Ministry of Mineral Resources & Energy and INAMI for their support and guidance.

You can view the latest investor presentation here and the latest article on Trend Investing here.

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

No news for the month.

SRG Mining Inc. (OTCPK:SRGMF) [TSXV:SRG] [GR:18Y] [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

No significant news for the month.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

No news for the month.

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU]

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

On July 29, Renascor Resources announced: “Quarterly activities report for the period ended 30 June 2022.” Highlights include:

- Drill assays at Renascor’s Siviour Graphite Deposit in South Australia confirmed intersections within the project area that are amongst the thickest and highest grade to date, with results including: 45 metres at 9.4% Total Graphitic Carbon (TGC) from 23 metres and 10 metres at 6.6% TGC from 8 metres (SIVRC264), 25 metres at 13.7% TGC from 17 metres (SIVRC266), 20 metres at 7.5% TGC from 7 metres (SIVRC267), 28 metres at 8.2% TGC from 82 metres (SIVRC248), 25 metres at 8.4% TGC from 77 metres, including 18 metres at 10.0% TGC from 84 metres (SIVRC239), and 31 metres at 7.0% TGC from 79 metres (SIVRC247).

- These near-surface, thick and high-grade intercepts include assays from areas to the immediate west of the existing pit design and Siviour Inferred Resource, suggesting strong potential to both improve the mine schedule and increase the scale and confidence level of the Siviour Resource.

- Renascor entered into an access and option agreement that will permit it to explore in, and potentially purchase the land over, an area that includes the north-western extension of the Siviour Inferred Resource and other areas immediately along-strike of the existing Mineral Resource.

- Renascor considers the north-western extension area to offer similar potential for thick, high-grade graphite and an opportunity to further extend the current pit design in future staged expansions to Siviour’s production capacity.

- Renascor is progressing work on an updated, optimised BAM Study that is assessing an increase in Stage 1 PSG production capacity, as well as additional staged expansions of PSG operations in order to meet projected demand. Studies to date have considered an initial Stage 1 production capacity of 28,000tpa PSG.

- Renascor’s cash position as of 30 June 2022 was approximately $74 million.”

On August 18, Renascor Resources announced: “Upgrade of Siviour Mineral Resource. Increase in Measured + Indicated Mineral Resource to support improved mining schedule in updated Battery Anode Material Study.” Highlights include:

- The total (Measured, Indicated and Inferred) Siviour Mineral Resource estimate now consists of 93.5Mt @ 7.3%TGC for 6.9Mt of contained graphite (with 67% classified as Measured or Indicated).

- Siviour is currently the second largest reported Proven Graphite Reserve in the world and the largest Graphite Reserve outside Africa, supporting a 40-year mine life with production of Graphite Concentrates up to 150,000 tonne per annum….”

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On July 29, EcoGraf Limited announced: “Quarterly activities report EcoGraf HFfree™ battery anode material developments positioning for increased demand.” Highlights include:

EcoGraf™ Battery Anode Material

- West Australian HFfree Battery Anode Material Facility regulatory approvals process well advanced and expected to be finalised during the current quarter.

- Positive meetings with lithium-ion cell manufacturers in South Korea and Japan with increased focus on natural battery anode graphite due to environmental advantages over synthetic graphite.

- Export Finance Australia completing credit approval processes for US$40m expansion loan under Australian Government Critical Minerals Facility.

- GR Engineering undertaking detailed design works for procurement of long-lead equipment.

- GreenRECARB and HPA-doped coatings programs delivering encouraging results.

- Cradle-to-gate EcoGraf CO2 study commissioned to quantify environmental benefits of EcoGraf HFfree™ process technology.

- Discussions continuing with overseas battery industry participants and Government agencies in relation to developing EcoGraf HFfree™ Battery Anode Material Facilities in Asia, Europe and North America, as the sector builds regionalised battery mineral supply chains.”

EcoGraf™ Battery Recycling

- Collaboration with European anode recycling expert Anna Vanderbruggen to evaluate EcoGraf HFfree™ purification processes for a range of lithium-ion battery anode materials.

- German Research Institute confirms electrochemical performance of EcoGraf HFfree™ recycled graphite matches industry benchmarks.

- Testwork continuing with battery and lithium-ion cell manufacturers in Europe and Asia.”

EcoGraf™ Natural Flake Graphite

- Meetings with Government of Tanzania on Epanko Framework Agreement, Epanko expansion program and Merelani-Arusha Graphite Project.

- GR Engineering appointed to evaluate expansion options for Epanko.

- Merelani-Arusha Graphite Project expected to provide an additional operation and diversification of supply in Tanzania.

- Evaluation of in-country mechanical shaping facility to create East African supply chain hub.

- Vermeer mining study completed showing a 24.6% reduction in fuel cost and carbon emissions.”

Corporate

- Cash at end of quarter $46.7 million…….”

On August 16, EcoGraf Limited announced: “Local Government Committee supports EcoGraf HFfree™ BAM Facility…..”

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

No news for the month.

Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF)

On July 28, Focus Graphite announced:

Focus Graphite begins Phase 2 (12,000 metres) of its 2022 core drilling program on its Lac Tétépisca project. Marc Roy, CEO of Focus, said: “Our team is pleased to have obtained the necessary approvals to launch the second phase of drilling on our Lac Tétépisca project. We are now able to continue exploration drilling on the West Limb and Southwest MOGC targets as well as deep infill drilling on the MOGC deposit.”

Metals Australia [ASX:MLS] (OTC:MTLAF)

On July 29, Metals Australia reported: “Quarterly activities report for the quarter ended 30 June 2022.” Highlights include:

- Lac Rainy Graphite Project, Quebec, Canada:Post the end of the Quarter the Company completed Phase 2 metallurgical testwork on the Lac Rainy (high-grade) Graphite Project, producing the following outstanding results: Locked closed circuit (LCT) testwork (which approximates plant conditions) produced a combined concentrate grade of 95.5% Cg at a high recovery of 95.1% Cg8. Sulphide flotation of tailings removed 98% of sulphur into a high-grade sulphide concentrate. This represents a saleable product and removes the risk of acid-mine-drainage from tailings.

- In addition, the Company completed pilot-scale production of on-specification bulk concentrate of 6.5kg at a combined grade of 94.0% Cg (target >94%). This bulk concentrate sample has been despatched to ProGraphite in Germany for spherical graphite and lithium-ion battery charging and durability testing.”

Sovereign Metals (OTCPK:SVMLF) [ASX:SVM] [GR:SVM][LSE:SVML]

On July 29, Sovereign Metals announced: “June 2022 quarterly report.” Highlights include:

Expanded Scoping Study results confirm Kasiya as an industry-leading major source of critical raw materials

- The Expanded Scoping Study [ESS] confirmed Kasiya as one of the world’s largest and lowest cost producers of natural rutile and natural graphite with a carbon-footprint substantially lower than current alternatives

- The ESS demonstrated outstanding results including: A two-stage development (stage 2 self-funded) with full production at 24Mtpa operation producing 265kt rutile and 170kt graphite per annum with a 25 year mine life. Exceptional economics including a post-tax NPV8 of US$1,537m and post-tax IRR of 36%. A large-scale operation with a low-cost profile resulting from the deposits near surface nature, grade, conventional processing and excellent existing infrastructure. Conservative assumptions applied with long-term prices used discounted against current spot prices.

- Natural rutile market is in structural deficit with current global supply estimated to decline 45% in the next three years with graphite demand set to soar as electric vehicle production is forecast to increase 12-fold by 2040.

- Highly strategic project and a potential major source of raw materials deemed critical to the decarbonisation of the global economy.”

MRE upgrade confirmed Kasiya as the largest rutile deposit ever discovered

- 1.8 Billion tonnes @ 1.01% rutile and 1.32% graphite (Indicated + Inferred)equating to18 million tonnes contained rutile and 23 million tonnes contained graphite.

- The updated Mineral Resource Estimate (MRE) confirmed Kasiya as the world’s largest rutile deposit and one of the largest flake graphite deposits globally.”

Offtake MoU and Market Alliance with major Japanese trader

- MoU (non-binding) signed with Mitsui & Co Ltd (Mitsui), one of the largest global trading and investment companies in Japan.

- The MoU establishes a marketing alliance and offtake for 30,000 tonnes of natural rutile per annum. The alliance will allow Sovereign to leverage off Mitsui’s extensive network and their market-leading understanding of the titanium industry and global logistics.”

You can view the latest investor presentation here.

Sarytogan Graphite [ASX:SGA]

Sarytogan Graphite has a 209mt @ 28.5% TGC Inferred Resource (60mt contained graphite) in Central Kazakhstan.

On August 15 Sarytogan Graphite reported:

…Hick high-grade graphite intercepts from the first 7 diamond drill holes from the Central Graphite Zone include:

o 62.0m @ 27.5% TGC from surface incl. 5.7m @ 40.1% TGC in ST-60

o 30.5m @ 34.1% TGC from surface incl. 20.0m @ 36.0% TGC, and 68.7m @ 27.5% TGC from 34.7m incl. 4.0m @ 39.0% TGC….

BlackEarth Minerals [ASX:BEM]

On July 29, BlackEarth Minerals announced: “Quarterly activities report quarter ended 30 June 2022.” Highlights include:

- BlackEarth (“the Company”) announced details relating to its drill program at Razafy NW with the results extending graphite mineralisation and included the completion of a follow up 1,670m diamond drilling program

- The Company advised the market that World Bank and Madagascan Government have approved spending on major infrastructure projects with a significant portion of the funds being used to upgrade the key proposed logistics route from the Maniry Project site to the port at Tolagnaro.

- The Company confirmed the range of outstanding results will be incorporated in to our soon to be released, independently commissioned Definitive Feasibility Study (“DFS”).

- Subsequent to the Quarter ended, on 26 July 2022, the Company confirmed details of its upgraded resource which included a 63% increase in the reported overall Mineral Resource tonnes. A further updated Maniry Resource to include Razafy NW is due for release in August 2022.

- Significant progress continued to completing the Company’s DFS which is to include the Company’s new and larger Mineral Resource details with the DFS was on track for publication in October 2022.”

Corporate Highlights

- During the Quarter, the Company confirmed it had entered into a Strategic Partnership (“the Partnership”) with Circulor to measure and manage its supply chain visibility across the entire process of its Maniry Graphite Mine operations.

- Subsequent to the quarter ended, the Company confirmed it had completed its Feasibility Study (“FS”) in relation to its JV with Metachem in India and was proceeding to commence plant construction in the short term. Key highlights of the FS include NPV (post tax US$78m, Net cashflow (pretax) US$219m and payback 1.2 years.

- Cash reserves in excess of $5.8m as at 30 June 2022 – well positioning the Company to fund the completion of its DFS and all of its other immediate objectives.”

On August 9, BlackEarth Minerals announced:

Further high-grade mineral resources add significant potential to Razafy Northwest (NW)…..Total Mineral Resources now stand at 40Mt @ 6.5% TGC.

Zentek Ltd. [TSXV:ZEN] (ZTEK) (formerly ZEN Graphene Solutions Ltd.)

On August 5, Zentek Ltd. announced: “Zentek provides update on commercial partnerships…..”

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], DNI Metals [CSE:DNI] (OTC:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Graphite One Resources Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), International Graphite [ASX:IG6], Metals Australia [ASX:MLS], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L], Walkabout Resources Ltd [ASX:WKT].

Synthetic Graphite companies

- SGL Carbon

- Novonix Ltd [ASX:NVX]

Graphene companies

- Archer Materials [ASX:AXE]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR]

- Zentek Ltd. [TSXV:ZEN]

Conclusion

August saw generally flat flake and spherical graphite prices.

Highlights for the month were:

- Benchmark Mineral Intelligence still expects to see a tightly balanced flake graphite market in 2022, leaning towards a supply deficit as demand from the anode industry continues to accelerate. If recovery from COVID-19 lockdowns in China keeps momentum, then price upside is more likely than price downside.

- To produce 20m vehicles Tesla alone needs more than the total volume of lithium and natural graphite produced last year, almost a third of the magnet rare earths, 36% of the cobalt, and so on.

- Syrah receives US$102 million binding loan from US Department of Energy for the initial expansion of Syrah’s Vidalia facility in Louisiana, USA.

- Ceylon Graphite granted Industrial Mining Licence for the M1 Mining Project in Sri Lanka.

- Magnis Energy Technologies New York lithium-ion battery plant begins commercial production.

- Northern Graphite intends to acquire Mousseau West Graphite Project.

- Nouveau Monde Graphite Matawinie Mine and Bécancour Battery Material construction substantially finalized for the Company’s Phase-1 coating unit, with commissioning activities initiated; production is scheduled to start towards the end of Q3-2022.

- Renascor Resources increases Siviour Graphite Project resource to a total (M, I&I) Siviour Mineral Resource of 93.5Mt @ 7.3%TGC for 6.9Mt of contained graphite.

- Metals Australia Lac Rainy Graphite Project in Quebec, Canada produces a combined concentrate grade of 95.5% Cg at a high recovery of 95.1% Cg.

- Sovereign Metals expanded Scopy Study at Kasiya confirms exceptional economics including a post-tax NPV8 of US$1,537m and post-tax IRR of 36%. Kasiya has 1.8 Billion tonnes @ 1.01% rutile and 1.32% graphite.

- Sarytogan Graphite drills 62.0m @ 27.5% TGC from surface at their Sarytogan Graphite Project in Central Kazakhstan.

As usual, all comments are welcome.

Be the first to comment