Evgenii Mitroshin

The international crude oil Brent price has pulled back sharply over recent months to $95 per barrel (at the time of writing) after soaring to a multiyear high of $130 per barrel in early March 2022. Since the Kremlin’s February 2022 invasion of Ukraine, oil and natural gas prices have been extremely volatile. This was further amplified by supply chain constraints caused by the COVID-19 pandemic and fears of an economic hard landing as the U.S: Federal Reserve aggressively hikes interest rates to combat rampant inflation. If those headwinds weren’t enough to impact intermediate oil producers operating in Colombia, there was the victory of former leftist guerilla and senator Gustavo Petro in the Andean county’s 2022 presidential election. Petro campaigned on a platform of ending contracting for hydrocarbon exploration and banning hydraulic fracturing in Colombia.

Intermediate Canadian driller Gran Tierra Energy Inc. (NYSE:GTE) (TSX:GTE:CA), which was priced by the market for bankruptcy during the pandemic, has experienced considerable volatility over the last year. Gran Tierra’s market price has soared by an impressive 52% over the last year, exceeding the 36% increase in the international Brent price benchmark and outperforming its peers. The latest developments since I last wrote on Gran Tierra in May 2022 indicate that now is the time to review the outlook for the company. In that article, published 31 May 2022, I determined that Gran Tierra had an indicative fair value of $3.14 per share based on its 2P Net Asset Value, which is more than double the driller’s market price of $1.39 (at the time of writing).

Geopolitical risks abound

Since the pandemic began, the geopolitical risks faced by energy companies operating in Colombia have ratcheted up significantly. This has occurred for a variety of reasons, notably a marked uptick in lawlessness, crime and violence, most of which is associated with cocaine production. This has caused the security environment to deteriorate. Then there are the political and regulatory risks associated with the recently inaugurated President Gustavo Petro, who is Colombia’s first-ever left-wing leader.

Deteriorating security environment

Lawlessness, crime and violence have exploded since 2019, with massacres now at levels not seen in over a decade, while cocaine production continues to soar to new records. The UNODC recently announced (Spanish) that cocaine production during 2021 reached a new high of an estimated 1,400 metric tons, which was 14% greater than the record 1,228 metric tons reported a year earlier. The volume of land being used for coca cultivation also soared, reaching 500,000 acres or 43% more than 2020. Cocaine production and the vast profits it generates fuels much of Colombia’s civil conflict and finances various illegal armed groups that are responsible for murdering and displacing civilians, sabotaging oil pipelines, and petroleum theft.

The escalating violence occurring in the Andean country is related to soaring coca cultivation and cocaine production as illegal armed groups vie for a greater share of the drug trade and the vast profits that it generates. This is impacting the operations of energy companies in the Andean nation because many of Colombia’s oilfields, proven reserves and hydrocarbon rich areas for exploration are in top coca-growing areas and conflict zones. The central government in Bogota has traditionally had a weak presence in many of those rural areas, further amplifying violence and lawlessness in those regions.

During late April to June 2021, massive anti-government protests swept across Colombia as civil dissatisfaction with the hard-right government of President Ivan Duque reached boiling point. There were many grievances driving the protests, the key being Duque’s proposed tax reform, rising poverty, spiraling cost of living, heightened corruption, growing lawlessness and institutional violence with the police killing unarmed protestors. Those demonstrations eventually morphed into community blockades of transport infrastructure and oilfields, causing Colombia’s oil production to plummet. As a result, the monthly average June 2021 oil output fell to a multi-decade low of 694,151 barrels per day. The tensions driving the social discontent that manifested as the protests have yet to be resolved, with them continuing to simmer below the surface in many communities.

There has long been considerable domestic resistance to oil industry operations in many regional municipalities. The industry’s social license is in a steady decline with it long associated with oppressive corrupt governments in Bogota with the income it generates spent on major cities rather than in the infrastructure-poor region where oil is extracted. This has manifested itself in incidents of oilfield invasions, community blockades of fields and sabotage the sabotage of wellheads as well as vital pipelines. Dissent towards Colombia’s energy patch is creating powerful opposition with a variety of community and environmental groups regularly protesting industry operations as well as hydraulic fracturing. For these reasons, protests which have the potential to interrupt oil industry operations remain a constant threat.

Heightened political risk

That negative community sentiment toward the oil industry which is a key driver of Petro’s plans to bring an end to Colombia’s hydrocarbon sector. It is the president’s plans to end contracting for oil exploration in Colombia which sparked considerable trepidation among industry participants. This, along with the factors discussed earlier, is weighing heavily on the market price of those oil companies operating in Colombia. During his presidential electoral campaign, Petro made it clear that as part of his plans to transition Colombia to clean energy and reduce the country’s economic dependence on extractive industries he will ban contracting for hydrocarbon exploration. The current administration has started implementing policies designed to end Colombia’s economically crucial oil industry.

For those reasons, intermediate drillers with significant operations in Colombia like Gran Tierra, Frontera (OTCPK:FECCF, FEC:CA), Parex (PXT:CA), GeoPark (GPRK) and Canacol (OTCQX:CNNEF, CNE:CA) have not benefited from substantially higher oil prices like their U.S.-focused peers. While this poses a direct threat to the long-term future of Colombia’s hydrocarbon sector and energy security, it will likely have little short-term impact. Petro’s plan is to gradually wind-down industry operations. In a country which only has proven oil reserves of just over 2 billion barrels with a production life of 7.6 years and has not had a world-class hydrocarbon discovery in three decades, there appears to be little long-term future for Colombia’s oil industry.

This makes it essential to reduce the Andean country’s economic dependence on oil, which is responsible for around a third of exports by value, a fifth of government revenues and 3% of GDP, and replace it with more sustainable industries. What the market fails to appreciate is that while Petro’s proposed policies are alarming for Colombia’s hydrocarbon sector, he has committed to honoring (Spanish) the already existing 330 oil exploration and production contracts that are in place. This means that the implementation of this policy will have little to no immediate material impact on upstream drillers like Gran Tierra.

Petro also intends to hike taxes for energy companies operating in Colombia. Essentially, royalties will no longer be tax deductible and a surcharge tax will be applied to oil profits when the international Brent price exceeds the 20-year average. That surcharge will be applied at increments of 5%, 10% and 15% although it is yet to be decided what price threshold the surcharge will be levied. This will lead to higher costs for Gran Tierra and other drillers in a country where the after-tax breakeven price is estimated at around $44 per barrel Brent. While there are many geopolitical headwinds with the potential to sharply impact Gran Tierra’s operations the market is overstating the negative fallout from those risks and therefore heavily discounting the company’s stock price.

Operational update

After being priced for bankruptcy during 2020 as soft crude oil prices, falling production and an extremely weak balance sheet weighed heavily on Gran Tierra’s outlook the company has staged an impressive transformation. Gran Tierra reported solid third quarter 2022 production of 30,391 barrels per day, which bodes well for higher earnings and cash flow in a quarter where Brent averaged $100.71 per barrel, well above the $95 per barrel budgeted. The driller recently stated its fourth quarter 2022 to date production is around 32,000 barrels per day. If that can be maintained, it will give the fourth quarter 2022 earnings a healthy bump, particularly with oil prices recovering. That will boost earnings as well as cashflows in an operating environment where oil prices are expected to remain firm with OPEC tamping down on supply.

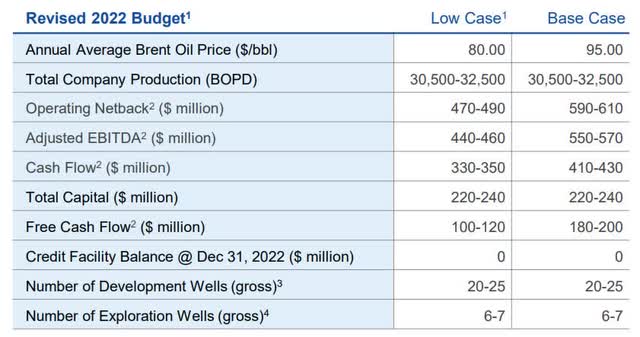

Gran Tierra’s 2022 budget for its base case depends on a forecast average annual Brent price of $95 per barrel, which is well below the average price since the start of 2022 until 24 October 2022 of $104.09 a barrel. Those developments bode well for Gran Tierra to achieve its base case 2022 budget.

Adjusted EBITDA of $550 to $570 million, at the upper end, is more than 2.5 times greater than the $217 million reported for 2021. Gran Tierra will likely achieve the upper end of its guidance with Brent having averaged over $100 per barrel for the first 10 months of 2022. The driller has focused on reducing its debt to manageable levels thereby considerably reducing the investment risk associated with Gran Tierra.

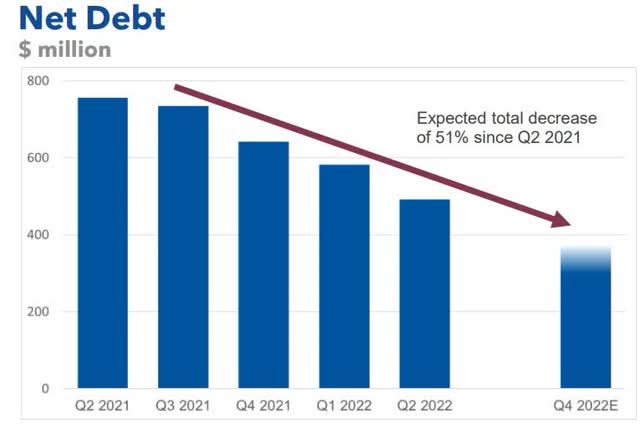

As the chart below shows, the driller’s net debt has fallen significantly and is expected to be less than $400 million by the end of the fourth quarter 2022.

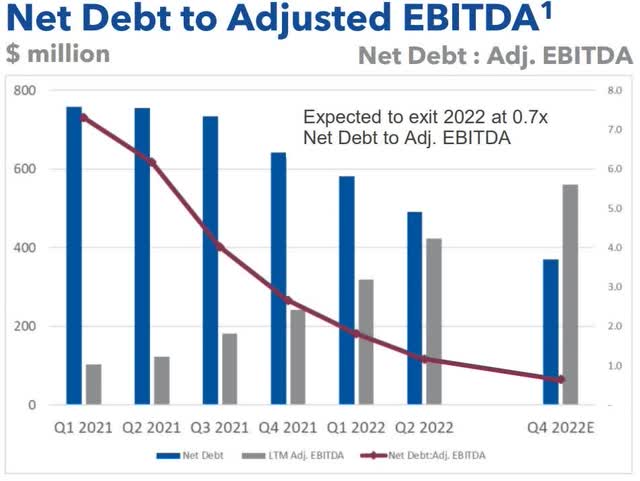

According to Gran Tierra’s October 2022 update, the company has $118 million of cash on its balance sheet, net debt of $462 million, and an undrawn $150 million credit facility. That provides the driller with ample liquidity to support its operations including planned exploration and development drilling. The strength of Gran Tierra’s balance sheet is underscored by its steadily falling net debt to adjusted EBITDA ratio, shown by the chart below, which is expected to be a healthy 0.7 times by the end of fourth quarter 2022.

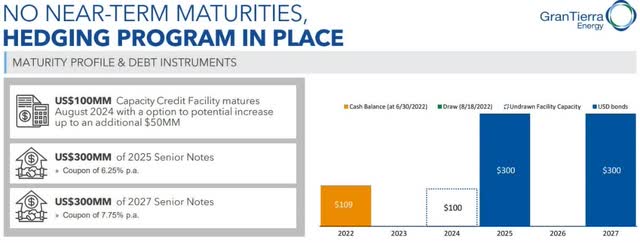

Gran Tierra also has a well-laddered debt profile with no immediate or near-term debt maturities, as the chart below shows. The first maturity is $300 million of senior notes in 2025. The company purchased $20 million of those notes, which is 6.7% of the outstanding bonds and which have a coupon of 6.25%, and will save Gran Tierra $33 million of interest expense.

This further demonstrates the considerable work undertaken by Gran Tierra’s management team to reduce debt and strengthen the driller’s financial position.

These developments further increase the attractiveness of investing in a company which is well-positioned to weather another sharp decline in oil prices while holding sufficient liquidity to meet its near-term needs.

Finding the company’s fair value

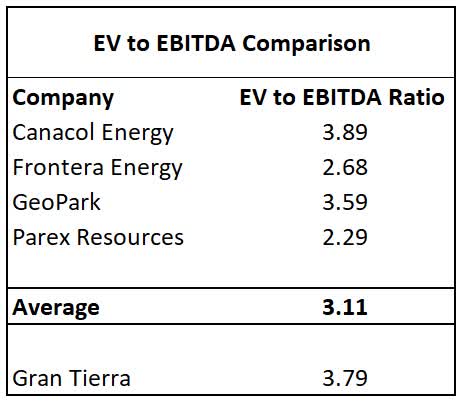

Many of Gran Tierra’s peers operating in Colombia appear cheaper based on enterprise value to EBITDA, as the chart below shows.

Author

Source: Wall Street Journal

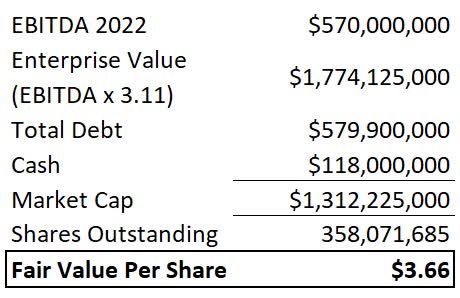

Using the average EBITDA for Gran Tierra’s peers of 3.11, the driller has an indicative fair value of $3.66 per share as the table below shows.

Author

Source: Gran Tierra October 2022 Investor Presentation and Author’s calculations.

*Total Debt sourced from the October 2022 corporate presentation.

** Cash sourced from Third Quarter 2022 Operational Update.

***Shares Outstanding source from Third Quarter 2022 Operational Update.

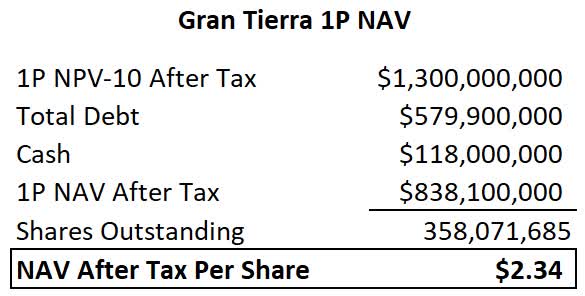

That value is almost double the $1.39 per share that Gran Tierra is trading at the time of writing, indicating that for as long as Brent is trading or above $95 per barrel, Gran Tierra is heavily undervalued. Another way to determine Gran Tierra’s indicative fair value per share is by calculating the net asset value of its oil reserves per share as per the chart below.

Author

Source: Gran Tierra October 2022 Corporate Presentation and Author’s Calculations.

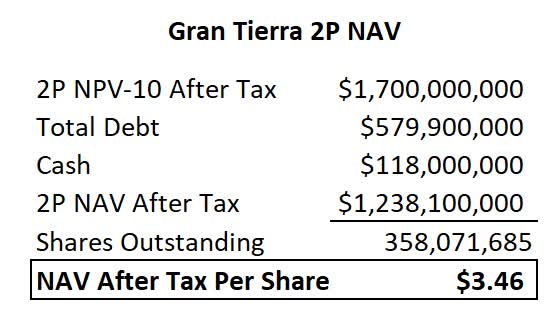

Based on the net present value with a 10% discount rate applied (NPV-10) as per industry methodology for Gran Tierra’s proven reserves (1P), the company has a net asset value of $2.34 per share. That is 72% higher than Gran Tierra’s market price of $1.39 per share at the time of writing, indicating that the driller is heavily undervalued and has a significant margin of safety. If that valuation is expanded to include Gran Tierra’s proven and probable oil reserves, then, as the chart below demonstrates, the company’s indicative value rises to $3.46 per share.

Author

Source: Gran Tierra October 2022 Corporate Presentation and Author’s Calculations.

That gives Gran Tierra an indicative fair value of $3.46 per share which is 2.5 times greater than the company’s share price at the time of writing, further indicating that the driller is heavily undervalued and offers considerable upside.

Both NAV valuations are higher than my earlier May 2022 article because Gran Tierra has reduced both its debt and share count, through a buyback, since that article was published. Typically, when valuing an upstream oil company, the NPV-10 of its 2P reserves is used. It is important to note that both of Gran Tierra’s NAV valuations are dependent on an average Brent price of $72.53 per barrel. In the current environment with Brent trading at around $95 per barrel and having averaged over $100 per barrel since the start of 2022 Gran Tierra’s NAV per share could be a lot higher. This is because higher oil prices will cause the value of Gran Tierra’s reserves to appreciate leading to a higher NPV-10.

Conclusion

Gran Tierra is best by a range of serious headwinds the most worrying being Petro’s plans to end contracting for hydrocarbon exploration. While that along with deteriorating security in Colombia and the erosion of the oil industry’s social license poses a direct threat to Gran Tierra’s operations, the impact of those events has been overcooked by the market.

The driller is heavily undervalued, with it having an indicative fair value of $2.34 to $3.66 per share. At the bottom end, that is nearly double Gran Tierra’s share price of $1.38 at the time of writing and more than 2.5 times greater at the top end. That not only signifies that there is plenty of upside ahead for the driller but there is also a significant margin of safety. When that is coupled with the expectation that oil prices will remain elevated for the foreseeable future with Brent forecast to average $100 per barrel for 2022 and average $94 per during 2023, it makes now the time to buy Gran Tierra.

Be the first to comment