baona

Investment Thesis

Gran Tierra Energy (NYSE:GTE) is a cheaply valued oil and gas company mostly based in Colombia. In fact, the stock is so cheap, that it’s priced at 2x free cash flows.

The main problem though is that Colombia’s new President doesn’t appear inclined to entertain new exploration in the country. And therein lies a problem for GTE. It’s proven plus probable reserves are for 11 years.

This implies that for bullish oil fanatics, GTE is a cheap stock with hairs on it.

To sum up my position, I simply can’t stop myself from being attracted to cheaply valued oil stocks. Even those with unclear paths to shareholder returns.

What’s Happening Right Now?

The vicissitudes of the oil market. Consider this, down 5%. Then up. And now positive. What I’ve described here is 24 hours in the oil market. With this much volatility, how can anyone plan for future production?

When oil was at +$95 WTI only a few months ago, everyone was hopeful. Board members, CEOs, investors, and I, all of us were tremendously bullish that we were going to see oil and gas companies get their day in the sun.

Investors have clearly become saturated with paying high multiples for tech companies where the bulk of their expenses is stock-based compensation. And then, being told that those options are not a drag on profitability.

GTE Q3 2022

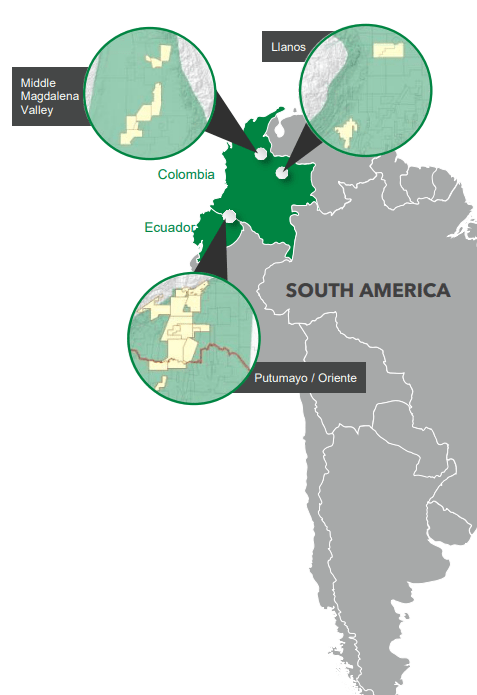

On the other hand, investors can be given a choice to invest in Gran Tierra Energy. A company with oil properties predominantly in Columbia. And clearly, for investors that is one significant headline risk, the fact that Columbia has just elected its first-ever left-wing party.

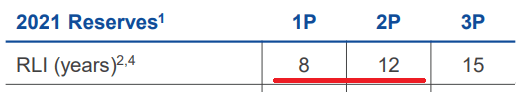

The other consideration that would be worthwhile discussing is that GTE only has 8 years of 1P reserves. Well, probably a year less since this table is 1 year old.

GTE Q3 2022

As you can see above, GTE’s proven plus probable reserves are around 12 years. Not a huge trouble. But at some point in the next two to three years, GTE will have to work to expand those 1P reserves.

When asked on the call about GTE’s inventory this is what GTE’s CEO Gary Guidry said,

President, Petro has clearly said no new exploration contracts.

[…] We’ve also come through a couple of years here where we refocused our exploration efforts. We went through the regulatory process. So we have an inventory of lands — on lands that we currently have to drill over the next couple of years.

President Petro has not said anything about existing lands, and we found that the regulators and the governments are — business as usual cooperating in what we’re doing.

How does a company with a hand full of years worth of proven inventory figure out how to get around this problem? Or perhaps, there are other options available? Could GTE simply move more aggressively into Ecuador?

Financial Position Discussed, 2.9% Buyback

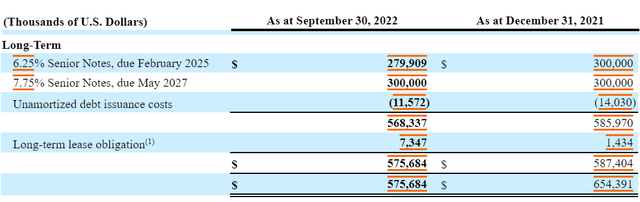

What the table above shows is that GTE has no debt due in either 2023 or 2024. Meaning that its next debt stack falls at the start of 2025.

Consequently, all in, including the recent debt repurchases, GTE’s net debt reaches approximately $460 million.

Put simply, even though GTE repurchased more than 10 million in the quarter, and brought down its total number of shares by 2.9%, I have to question, whether that’s really the best use of capital at this stage.

GTE Stock Valued — Approximately 2x Free Cash Flow

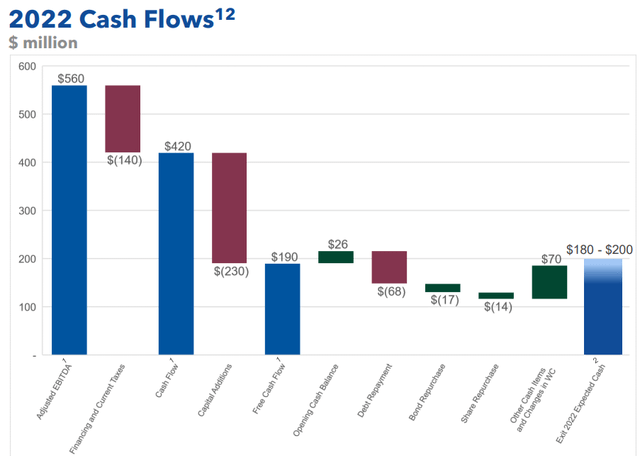

As the graphic above shows, GTE is expecting to bring in approximately $190 of free cash flow this year. This would put the stock at approximately 2x this year’s free cash flows.

But as I’ve noted already, given GTE’s debt profile, this means that it will need oil prices to remain healthy for a few more years, so GTE can peck away at some of its 2025 bonds.

The Bottom Line

GTE has two problems. The first one is that it operates in a country that isn’t well-predisposed toward new exploration ventures.

The second problem is that GTE still carries a fair amount of debt. This second consideration isn’t a deal breaker. Indeed, I believe that the stock is incredibly cheap at 2x free cash flow.

What it does mean is that GTE will have to work to bring that debt down further, before significant capital can be returned to shareholders.

Be the first to comment