niphon

Investment Thesis

Graco Inc. (NYSE:GGG) is experiencing healthy demand across its end markets, which is benefiting its order book. The tailwinds in the non-residential, transportation, and semiconductor end markets should help offset the weakening demand in the residential market. The company has a healthy order backlog level which should support the revenue growth in Q4 FY22 and beyond along with the pricing actions taken in FY22 and future price hikes. The margins should benefit from stabilization in input cost pressures, pricing actions, and higher margin business mix, partially offset by the headwind from negative FX. The stock is currently trading at 23.97x FY23 consensus EPS estimate, which is below its five-year average forward P/E of 27.93. Given the company’s good prospects and reasonable valuations, I have a buy rating on the stock.

GGG Revenue Outlook

The company experienced good demand across the majority of its products in Q3 FY22. The order rate in the quarter increased, leading to a backlog of $440 mn, up $65 mn from the end of FY21 and $180 mn higher Y/Y. Graco is usually a book-and-burn business and does not have a very high backlog of orders. However, due to strong demand and supply chain constraints post-Covid, the company’s order backlog has built up. The Contractor segment’s backlog decreased slightly in the quarter sequentially to $90 mn but remains higher vs. the prior year (up 66% Y/Y) due to the unavailability of certain components. In the Industrial segment, the demand in key product categories such as liquid finishing, powder coating, and sealant and adhesive equipment remained strong. The backlog in the segment increased by $25 mn compared to the end of FY21 and $65 mn Y/Y.

The Contractor segment sales were up 12% Y/Y driven by strong growth in the North American business. The demand in the professional paint channel remained strong, along with strong demand for protective coatings and spray foam product lines. The Industrial segment’s sales grew 1% Y/Y with 8% growth in volume and pricing, partially offset by a 7% headwind from negative FX translation. The Process segment grew 31% Y/Y as demand across all regions remained strong in the quarter, with continued broad-based growth in lubrication equipment, process pumps, and environmental and semiconductor products.

Looking forward, the demand for Graco’s product is expected to remain strong in Q4 FY22, given the healthy trends in its end markets, such as transportation, non-residential, semiconductors, and others. This should benefit the company’s order book. The company usually issues price hikes in January, however, due to the higher input costs it took another price hike in August 2022. It is poised to make another price hike in January next year which should also benefit sales. Graco is experiencing good demand in its professional paints business as the Pro paint contractors have a good amount of housing backlog. The strong demand, higher order backlog levels across the business, along with the pricing actions taken in FY22, should benefit the revenue growth in Q4 FY22 and beyond.

GGG is continuing to work on its core strategies, such as the launching of new products, investing in its manufacturing capabilities, expanding its global channel, and pursuing profitable growth opportunities in niche markets such as difficult-to-handle materials with high viscosities, abrasive or corrosive properties, organically or through acquisitions. The company will be opening its second building in Dayton, Minnesota, by FY24, which will be a state-of-the-art distribution center.

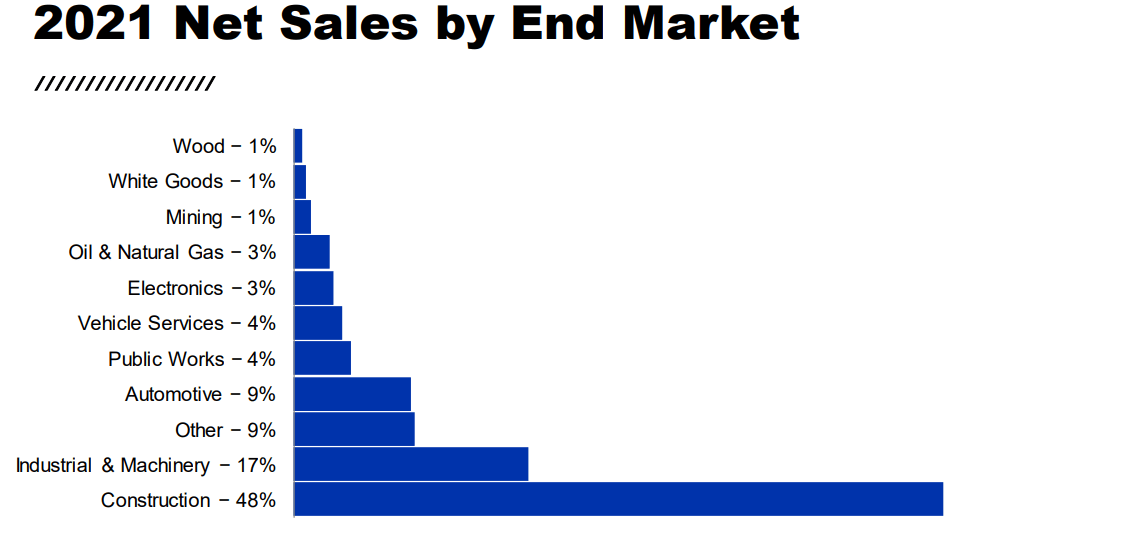

GGG’s net sales by end markets (Company’s Presentation)

The Process segment has its presence in the semiconductor industry, and the semiconductor end market looks strong given the investments by various chip manufacturing companies in the U.S. due to the CHIPS Act. The Contractor segment has a presence in the residential, non-residential, and transportation end markets. The segment should benefit from the funding from the U.S. IIJA as well as the strength in the non-residential side of the business. The Dodge Momentum Index is showing positive signs in non-residential construction. I believe the strength across these end markets should offset the slowdown in the residential end market. Also, even though the residential end market is facing headwinds in the near term, the long-term prospects for the industry remain strong given the significant underbuild in housing and changing demographics. The Industrial segment should also benefit from the strength in the construction industry, given its presence in residential and non-residential markets.

I am optimistic about GGG’s sales growth prospects and believe it should benefit from the strong demand in its end markets, higher backlog levels, and the pricing actions partially offset by headwinds from the negative FX translation.

Margin Outlook

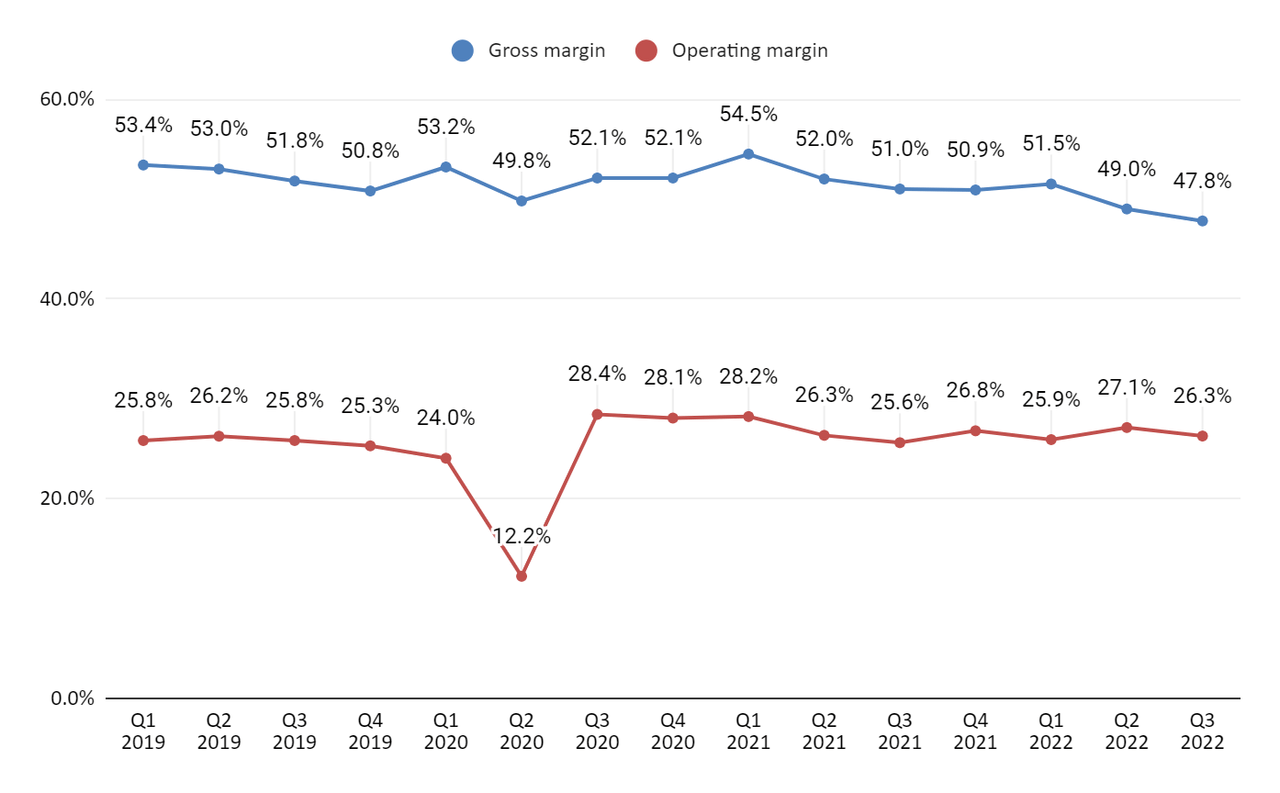

In Q3 FY22, the gross margin declined by 320 bps Y/Y as pricing actions offset costs on a dollar basis but impacted margins by 190 bps. Additionally, foreign exchange translation rates impacted margins by 130 bps. The operating margin improved by 70 bps Y/Y to 26.3% due to the decline in operating expenses in the quarter.

GGG’s gross margin and operating margin (Company data, GS Analytics Research)

Looking forward, the company’s gross margin should improve with the stabilization in input cost pressures and pricing actions. Graco took a price hike in August and should make another price hike in January, which is its usual rate hike period. The company is also experiencing good demand in its pro paint channels, which is a higher-margin business and should benefit margins. I believe the stabilization of input cost pressures, pricing actions, and the higher margin business mix should help offset the currency translation headwind, benefiting margin growth.

Valuation & Conclusion

The stock is currently trading at 23.97x FY23 consensus EPS estimate of $2.76, which is below its five-year average forward P/E of 27.93x. The company’s revenue should benefit from the healthy demand, strong order backlog level, and pricing actions. The margins should expand with moderation in input costs and price hikes. I have a buy rating on the stock given its reasonable valuations and good growth prospects.

Be the first to comment