Krisada tepkulmanont/E+ via Getty Images

Thesis

In my initiation article on Grab (NASDAQ:GRAB), I have highlighted that an investment in this SEA-based ride-hailing and delivery company is very speculative and I assigned a Hold recommendation to the stock. Since my article, however, new information surfaced–notably investor sentiment deteriorated further and Grab reported disappointing results for the June quarter. Consequently, as of August 2022, I feel that a ‘Hold’ recommendation does not accurately reflect the company’s business outlook anymore and I feel pressured to downgrade GRAB stock to a ‘Sell’.

For reference, GRAB stock has strongly underperformed the market YTD, being down almost 60% versus a loss of about 15% for the S&P 500 (SPX).

Seeking Alpha

Grab’s June Quarter

Grab announced results for the June quarter on August 25, and, simply speaking, disappointed the market — especially with regards to profitability and outlook. Consequently, GRAB stock fell by as much as 13% in the trading session after the announcement. And rightly so, I argue. Investors should consider that Grab’s June quarter highlighted the challenges of operating a ride-hailing and delivery business model amidst a soft macro-economic backdrop.

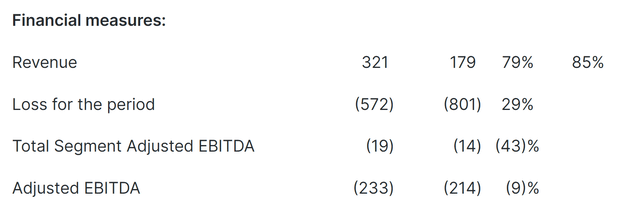

Grab’s revenues for Q2 2022 increased by about 72% to $321 million, versus $179 million in the same period one year prior. Although this appears like a strong result, investors should consider that the topline expansion was not matched by profitability. In fact, Grab has recorded a $547 million loss, as compared to a $335 million loss estimated by analyst consensus estimates, according to data compiled by Bloomberg. Even Grab’s ‘adjusted’ total segment EBITDA calculation showed a $19 million loss.

Grab June Quarter Results

Moreover, investors should consider that in order to support the revenue expansion, Grab ended up spending $212 million in partner incentives and 311 million in consumer incentives, which reflects a year over year increase of a 23% and 27% respectively.

Profitability Remains Challenging

Grab is fighting to achieve profitability by 2023. In that context the company’s CFO commented:

In the quarter, we took action to streamline our organizational cost structure. We optimized our fixed costs, shut unprofitable lines of business and continued to taper incentives as a percentage of GMV.

In my opinion, however, Grab’s outlook for 2023 profitability could be too confident. There are two major reasons: First, in a recessionary macro-environment it is highly likely that (in my opinion) expensive delivery services will experience amongst the sharpest consumer spending cuts, which would obviously pressure Grab’s business model. In that context, in the conference call with analysts Grab’s CEO has admitted that:

customers want to save money… they may actually show a preference to order groceries to cook for themselves.

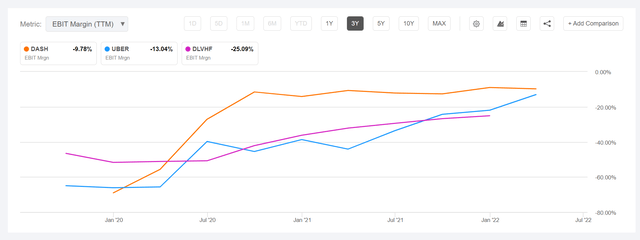

Secondly, I personally believe that food-delivery and ride-hailing companies are structurally unprofitable. Please take note that no major business in this market has yet managed to record a profit. In fact, DoorDash (DASH), UBER (UBER) and Delivery Hero (OTCPK:DLVHF) operate with negative margins.

Seeking Alpha

Moreover, investors should consider that ‘gig-economy’ services build little customer loyalty and offer arguably no value differentiation against competitors, making the company’s value proposition a commodity. This argument is strongly supported by the observation that Grab spent $523 million in incentives while only generating $321 million of sales (June quarter reference).

Risks To My Thesis

I am bearish on Grab. But, of course, my assessment might be wrong. In my opinion, a major risk to my thesis is connected to market sentiment: In case that investors re-discover their risk appetite for speculative investments with a seemingly attractive TAM promise, Grab might easily be able to continue to fund negative operating cash-flow with financing from the capital markets.

Secondly, my negativity on Grab is connected to the company’s lack of operating profitability. Accordingly, my thesis would break if Grab would manage to record a profit for one of the following quarters and convince the market that the profitability is sustainable.

Recommendation

Grab is trading at a x5.5 EV/Sales. In my opinion, this is not justified: Investors should consider that Grab has yet to prove that the company can generate a profit and I do not feel that this will be an easy task–especially in a recessionary environment where customers of the company will likely sharply reduce discretionary spending on food delivery. Following Grab’s Q2 results, I downgrade the stock from ‘Hold’ to ‘Sell’ and I lower my price target to $2/share given a more challenging macro-environment and higher discount rates for growth companies (I now see $425 million EBITDA by 2025 and a 11% WACC). I intend to support this recommendation until Grab can prove sustained profitability for at least two consecutive quarters.

Be the first to comment