tumsasedgars/iStock via Getty Images

by Rob Isbitts

Summary

iShares 25+ Year Treasury STRIPS Bond ETF (BATS:GOVZ) debuted in September 2020, and has been losing money since. That may explain why we are the first to write about it on Seeking Alpha. However, the current interest rate environment has suddenly made long-term U.S. Treasury ETFs appealing. The bond market is significantly more volatile than it used to be, so this is a tactical call for now. Still, given the dramatic decline in the long bond, and this ETF’s twist on long bond investing, there could be an upside window here. We rate GOVZ a Buy.

Strategy

GOVZ aims to track the ICE® BofA® Long US Treasury Principal STRIPS Index. As stated in the ETF’s prospectus, that index is “composed of the principal payments of U.S. Treasury bonds (specifically principal “STRIPS”, also known as “Separate Trading of Registered Interest and Principal of Securities”) with remaining maturities of at least 25 years.” Strips may also be thought of as bonds which have been “stripped” of their coupon payments. Also known as “zero coupon bonds,” these securities mature at a pre-determined value (100 cents on the dollar), but are issued at a discount to that maturity value.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Bonds

-

Sub-Segment: Treasuries

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

Strengths

GOVZ’s price volatility could be confused with that of the stock market. After all, Zero-Coupon bonds offer greater potential upside than bonds with coupons, because they don’t have that coupon as a cushion. That means the bond price is left to move on its own, which adds volatility, but also opportunity. GOVZ also focuses exclusively on bonds maturing in at least 25 years. That’s the most volatile part of the yield curve. These are U.S. Treasury Bonds, so there is that assumed safety that comes with that bond type, versus bonds backed by entities other than the U.S. Government.

Weaknesses

Those strengths are very helpful when rates are falling. When they are rising, GOVZ represents a toxic bond cocktail of sorts. Price risk from the long-term maturity of the holdings, mixed with the risk of zeros as compared with coupon bonds. So, the benefits associated with ZROZ can also be its weaknesses. In addition, this ETF is liquid, but not nearly as liquid as many iShares ETFs. It has assets under management around $325mm, and averages about $1.5mm in trading volume per day. Those reflect the lack of popularity of this asset class, given what’s happened since GOVZ debuted.

Opportunities

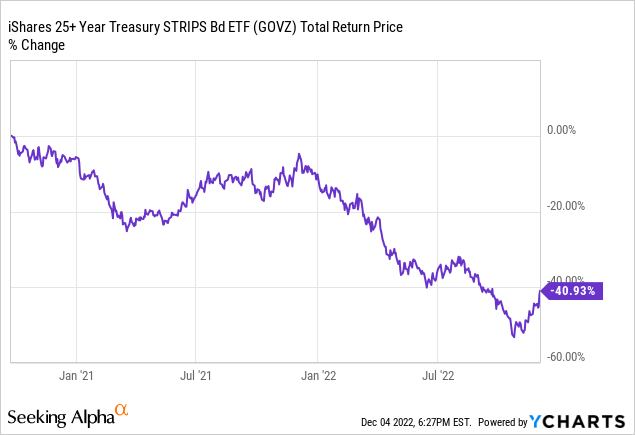

As you can see in the graph above, GOVZ has a price chart only a contrarian investor can love. And, while we acknowledge that the bond market is as chaotic as we’ve ever seen, this looks like a solid contrarian situation to us. The bond market has been absolutely thrashed in 2022. And, the Fed is likely to continue raising rates. However, the rates they raise are the shortest-term ones. Longer maturities are not controlled by the Fed, but by the bond market itself.

While Fed rate increases often result in long-term bond rates going up in sync, this cycle is different. The Fed has raised rates so quickly that it has created a historically-high “inversion” in the bond yield curve. In other words, long-term rates, which are normally higher than short-term rates, are instead lower. This is often a precursor to a recession. But the goal here is to evaluate GOVZ, and the circumstances of the current inflation/recession/Fed obsession by the market might just create a temporary juggernaut of an opportunity. This may already be underway, given recent price action.

Threats

The threat is plain to see on that chart above. “Bonds” and “50% decline” don’t normally land in the same sentence. But when we are talking about long-term zero coupon bonds, they can, and have. While the technical and contrarian picture point to a good reward/risk tradeoff here in late 2022, the bond market is both fickle and illiquid, compared to its long-time norms.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

This ETF provides access to a bond asset class that really acts more like a stock ETF in terms of volatility. But it does it simply, and well. This is a blip on the radar in terms of the total assets overseen by the behemoth iShares. But that may change soon.

ETF Investment Opinion

GOVZ has ridden the down escalator with stocks most of this year. Prior to that, its returns were unremarkable. We decided to be the first to cover GOVZ for Seeking Alpha because as we see it, there is a good chance that it produces a nice gain into the first part of 2023. Furthermore, there is a “fighting chance” that GOVZ flies higher, as the bond market rapidly reverses its plunge, akin to how the stock market behaved into and out of the onset of the Covid pandemic in 2020. Bottom-line: GOVZ still represents a volatile ride in the bond market. But we rate it a Buy for now, since that risk is paired with a potentially-dramatic upside potential, should long-term Treasury Bonds be viewed as a “flight to quality” trade as they have been at times in the past.

Be the first to comment