sasirin pamai

The microscopes scanning for the tiniest signs of the end of monetary tightening went into overdrive after the Bank of Canada’s December release on monetary policy. Reuters rushed out the enticing headline “Bank of Canada increases rates by 50 bps, says hikes may be over.” Unfortunately, these microscopes need some tuning. The Bank of Canada (‘BoC’) did not say anywhere in its statement that rate hikes may be over. This eager headline loosely constructed this conclusion because the BoC did not reiterate the forward guidance it gave in the October statement on monetary policy: “Given elevated inflation and inflation expectations, as well as ongoing demand pressures in the economy, the Governing Council expects that the policy interest rate will need to rise further.”

Compare this claim that the Bank of Canada may be done hiking to what Canada’s central bank observed on the hot side of inflation:

- Regarding inflation’s level: “inflation is still too high”

- Regarding expectations: “short-term inflation expectations remain elevated”

- Regarding demand pressures: “the economy continued to operate in excess demand”

If I created an equation from these observations, I would automatically assume the Bank of Canada is fully prepared to hike rates again. I absolutely would not conclude that rate hikes may be over. I would even hazard to guess that the Bank of Canada cringed at headlines suggesting rates may have finally peaked. Since a press conference did not accompany December’s statement, Governor Tim Macklem did not get a chance to answer questions seeking to clarify forward guidance. I fully expect such a clarification going into the January monetary policy report.

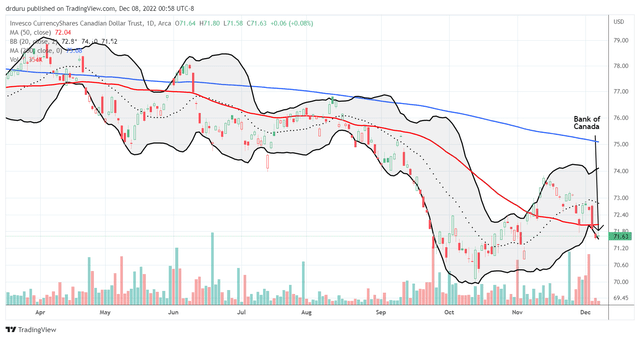

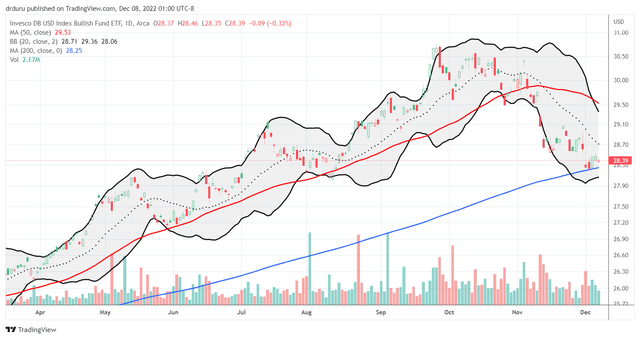

Accordingly, I went on a limb to bet this clarification will make another rate hike a lot more likely; I purposely chose a contrary title for emphasis on this bet. Accordingly, I started shorting USD/CAD (long Invesco CurrencyShares Canadian Dollar Trust (NYSEARCA:FXC)) as a contrary bet even though the technicals point to bearish conditions with trade dropping below the 50-day moving average (DMA) (the red line below) for FXC. I am expecting the weakening trend in the U.S. dollar (UUP) to support this trade, even if I end up on the wrong side of the rate hike bet.

The Invesco CurrencyShares Canadian Dollar Trust (FXC) suffered a bearish breakdown below its 50DMA ahead of the Bank of Canada’s monetary policy statement. (TradingView.com)

Invesco DB US Dollar Index Bullish Fund (UUP) hit a peak in September and now faces a critical test at its uptrending 200DMA. (TradingView.com)

I do acknowledge that the BoC left some nuggets for selective microscopes to land on expectations for an end to rate hikes. The BoC observed that “there is growing evidence that tighter monetary policy is restraining domestic demand.” However, the BoC did not translate that observation into a reduction in growth expectations. Instead, the BoC used that observation to validate earlier growth expectations. So if these same growth expectations support an end to rate hikes, then the BoC could have and should have dropped its forward guidance in October for higher rates.

The Bank of Canada also delivered the following nugget: “Three-month rates of change in core inflation have come down, an early indicator that price pressures may be losing momentum.” Taken at a surface value, I can sympathize with those who next jump to the conclusion that rate hikes may be over. However, the BoC immediately followed this observation with an inflation warning: “inflation is still too high and short-term inflation expectations remain elevated. The longer that consumers and businesses expect inflation to be above the target, the greater the risk that elevated inflation becomes entrenched.” This caution does not sound like it comes from a central bank ready to end rate hikes.

Ultimately, the Bank of Canada did open the possibility for a pause on rate hikes in the next meeting: “Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.” Even a generous interpretation of this statement should not leap to the conclusion that rate hikes are over. With inflation remaining too high, it is entirely possible the bank will slow the pace of rate hikes by skipping some meetings.

I am keen to fade potentially premature excitement over relief from monetary tightening because of recent market behavior where such excitement quickly wanes in the face of subsequent data. Moreover, the Bank of Canada is continuing with quantitative tightening. As always, I will re-evaluate if conditions definitively change to support monetary “lightening.”

Be careful out there!

Be the first to comment