SL/iStock Editorial via Getty Images

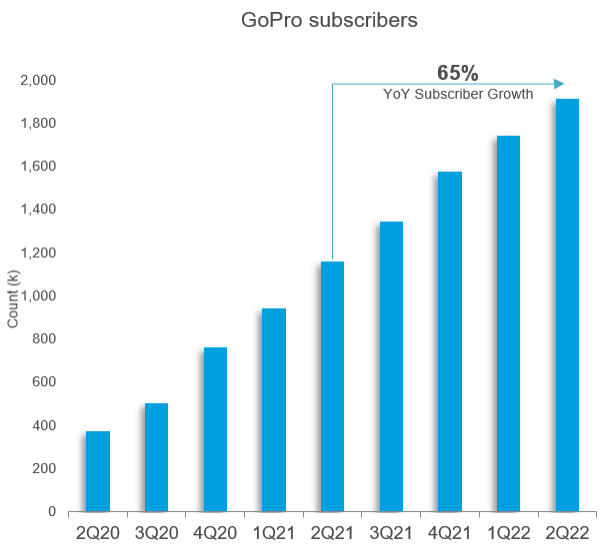

You might look at GoPro’s (NASDAQ:GPRO) earnings report from last week and wonder why the stock isn’t falling like a rock. After all, revenue guidance was below estimates, gross margins were hit, and unit sales for the year were revised down. But then you look at the positives. It beat the upper end of its revenue guidance for the reported quarter, with subscriber growth coming in at an impressive 65% year-over-year, all while navigating a tough inflation and component and shipping cost environment. GoPro’s newfound financial execution is allowing it to stay above water and puts a floor under the stock.

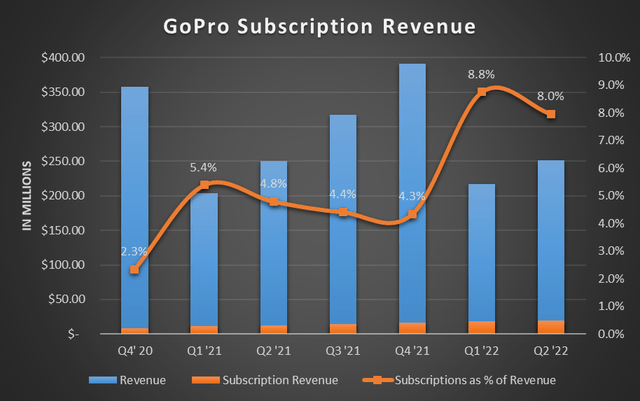

The subscription business is able to grow materially even during storm clouds, supplementing the choppiness in the hardware business. Each quarter progressively improves as the subscription revenue from prior quarters builds, balancing the main business margins facing headwinds due to the external factors I mentioned above. This is why focusing on revenue guidance isn’t as important as the company properly managing these headwinds.

Financial Strength During The Quarter

Digging into the numbers, the company beat analyst estimates and the high-end of its guidance for the reported quarter by several million, coming in at $250.7M versus expectations for $238.72M. This may not seem like a lot, but for GoPro it is, as it follows a darkened track record of putting up guidance then missing it or barely covering it at the midpoint. I’m encouraged by this conservative approach of guiding and beating the guide. It means the company can accurately depict its quarter.

And if that sounds trivial, it’s not. We just watched major companies like Micron (MU), Nvidia (NVDA), and Qualcomm (QCOM) either miss on their current quarter or miss materially on consensus for the upcoming quarter, or both. So GoPro’s relative strength in a purely retail business is quite astonishing.

If nothing else, the company has figured out how to financially manage itself, better insulating itself from external conditions affecting the business. The growth of the subscription business has proven to be a lifeline in this regard.

Churn has been the number one concern among bears, as losing these customers is a risk. But, as the quarters have gone on, the company continues to prove its subscribers pull in net gains year-over-year and quarter-over-quarter.

GoPro’s Management Commentary Q2 ’22

Furthermore, it has continued to show annual subscription rate growth.

Annual subscriptions represented 84% of total subscriptions, up from 73% in Q2’21 and from 24% in Q2’20.

– Q2 ’22 Management Commentary

The subscription business held up well and brought in $20M in Q2. With 1.91M subscribers, annual subscription revenue is nearing $100M and should be there by the end of the third quarter. This is 70%-80% margin revenue, much higher than the mid-30s percent hardware margin, and it’s increasing as a percent of revenue each quarter.

Chart mine, data from company Management Commentary releases

The argument against this could be hardware sales are down, pushing the subscriptions higher in terms of the revenue mix. However, the push toward high margin, recurring revenue is welcomed in any case. And to put a finer point on it, it’s not like hardware sales are dropping and subscription revenue is stagnating. On the contrary, subscription revenue grew 67% in the latest quarter.

This is why guidance isn’t necessarily the key to GoPro’s near-term earnings, even if the guide is not surprising in this environment.

Guidance, But Also Valuation

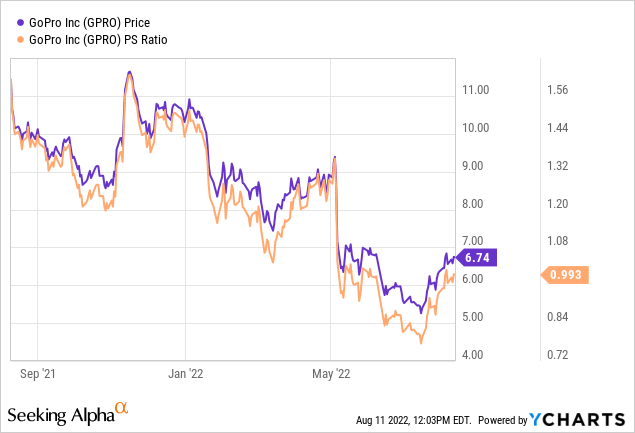

The guide came in at $300M at the midpoint versus expectations for $334M. So it’s not a pretty print and shows the retail weakness, but considering other companies’ weaknesses, this isn’t a complete miss. Management also expects hardware unit sales of 3M versus 3.2M for 2022. It blames inventory reductions happening at retailers as part of this. It also factors in continued forex headwinds from a strong dollar. Considering these factors, the $34M in revenue isn’t something to be too upset about, especially once you factor in where GoPro trades.

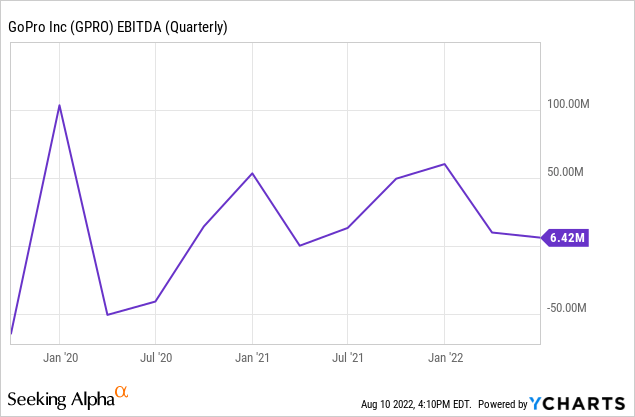

While it still trades under one-times sales, the company is at least increasingly profitable even if growth is in the single digits for the time being. Moreover, positive EBIDTA has contributed to the company maintaining its cash pile and paying off debt taken out during its darkest times, all while economic conditions through weaker retailer channels and forex push back.

Data by YCharts

The company’s focus on profitability and executing to that end has allowed GoPro to prepare for this economic situation. Instead of profits spiraling out of control, management still expects $0.17 in non-GAAP EPS.

With the company appearing to have a handle on its hardware pipeline, solid retention and continued growth of subscriptions are exactly what the company needs to focus on. The economic times are priced in at this juncture, meaning the market can look forward to when a reprieve of the US dollar and retailers move beyond recessionary tightening will take place. Much like my analysis on Micron this week, once the downward revisions come to pass, the market will look beyond the recovery. While the two companies don’t work on the same cycles or in the same industry, they are both caught in the same economic situation.

The bottom line is GoPro has worked surprisingly well on tightening its financial execution over the last two years and has something to show for it – being profitable in struggling times. Making it through this economic season will prove GoPro’s staying power and ability to remain above cash burn levels. I consider this risk versus reward very much a reward-sided investment under $7 and under 1x sales; it’s a buy.

Be the first to comment