Sean Gallup/Getty Images News

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) submitted its earnings sheet for the third quarter yesterday after the market closed, and the technology company missed estimates both on the top and the bottom line. The earnings sheet also sent shares of Google down 6.7% outside regular trading.

Unfortunately, Google also reported yet another quarter of decelerating growth, as advertisers became more cautious about ad spending in the third-quarter. Revenues generated from YouTube ads actually declined for the first time ever, a sign that the global economic downturn may be more severe than feared. Still, Google generated an immense amount of free cash flow in the third quarter, which will help the technology company execute its ambitious stock buyback and support the stock price. I believe Google stock remains a good deal for investors in the long term!

Google Misses On The Top And Bottom Line

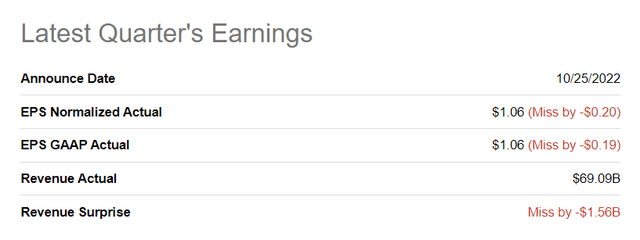

Google generated third-quarter revenues of $69.1B which was $1.6B below the consensus estimate. EPS also came in lower than expectations: the consensus was for EPS of $1.26, while Google actually reported earnings of $1.06 per-share.

Seeking Alpha: Google Q3’22 Results

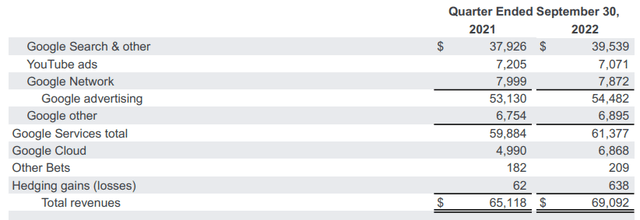

Unfortunately, Google’s revenue growth further decelerated in the third-quarter due to a global slowdown in ad spending: the company’s Q3’22 revenue growth dropped to just 6% year-over-year. In the previous quarter, Google’s top line growth also slowed year-over-year but was about twice as high as top-line growth in Q3’22, about 13%. Google’s advertising revenues increased only 2.5% year-over-year to $54.5B, in large part because of slowing ad revenue growth on the YouTube platform. YouTube-associated ad revenues actually declined 2% year over year to $7.1B, marking the first decline ever, while the consensus expectation called for an increase of 3%.

Google’s Cloud business did well, however, and a little better than expected. The Cloud segment posted revenues of $6.9B, showing top-line growth of 38% year-over-year and a slight acceleration over the second-quarter segment growth rate of 36%. The estimate for Google’s Cloud revenues was $6.7B, so the segment did a little bit better than the consensus called for. Cloud is a key growth engine for Google and should be expected to continue to do well going forward, in part because Google Cloud is a top-three Cloud Service provider, with a market share of approximately 10%, and more IT workloads are migrating to cloud platforms.

Free cash flow, margins and stock buyback

Google generated $16.1B in free cash flow in the third-quarter on revenues of $69.1B, which calculates to a free cash flow margin of 23.3%. Despite the down-turn in the advertising market, Google generated 3.5B more in free cash flow than in the second-quarter. Google’s free cash flow margin improved 5.2 PP quarter-over-quarter.

|

$millions |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

|

Revenues |

$65,118 |

$75,325 |

$68,011 |

$69,685 |

$69,092 |

|

Net cash provided by operating activities |

$25,539 |

$24,934 |

$25,106 |

$19,422 |

$23,353 |

|

Less: purchases of property and equipment |

($6,819) |

($6,383) |

($9,786) |

($6,828) |

($7,276) |

|

Free cash flow |

$18,720 |

$18,551 |

$15,320 |

$12,594 |

$16,077 |

|

Free cash flow margin |

28.7% |

24.6% |

22.5% |

18.1% |

23.3% |

(Source: Author)

Although the ad market is slowing down, Google has no issues generating a ton of free cash flow for the benefit of shareholders. In the third-quarter, Google repurchased $15.4B of its common stock, and more stock buybacks are sure to follow, I believe. Google currently has a stock buyback authorization of $70B in place, which I expect to be exhausted next year. I also expect Google to announce a $100B stock buyback plan in FY 2023.

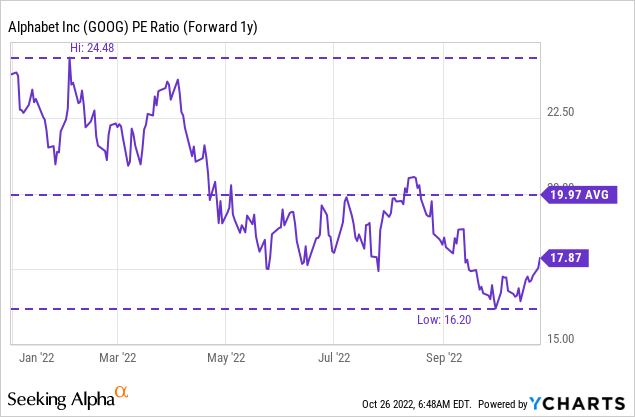

Google is a bargain

Say what you want about Google’s third-quarter, the firm did reasonably well given the headwinds in the ad business. Google is expected to have revenues of $321.3B in FY 2023 and, assuming a free cash flow (“FCF”) margin around 23%, could generate $74B in free cash flow next year. With a market cap of $1.37T, the current valuation implies a P-FCF ratio of 18.5 X. Based off of earnings, Google is also cheap, trading at just 17.9 X earnings and below the 1-year average P/E ratio of 20.0 X.

Risks with Google

Pressure on Google’s advertising top line is set to grow as advertisers react to high inflation and interest rates which are creating risks to economic growth. Google’s advertising growth has slowed to the single digits, unfortunately, in Q3’22 and investors will likely see continual pressure on Google’s revenues as well as on estimates. As analysts rush to update their estimates for FY 2022 and beyond, I believe investors may see a lower valuation factor in the short term.

Final thoughts

The earnings report was not as great as I thought it would be, and shares of Google dived after the earnings report. However, a slowdown in advertising revenues was expected, at least to some extent, and Google’s Cloud business did better than expected. Google generated a ton of free cash flow from its businesses, especially advertising, and the company has considerable fire power to repurchase more shares going forward. I believe that the market overreacted to Google’s results considering that the firm’s free cash flow margins actually improved quarter-over-quarter!

Be the first to comment