kajasja/iStock via Getty Images

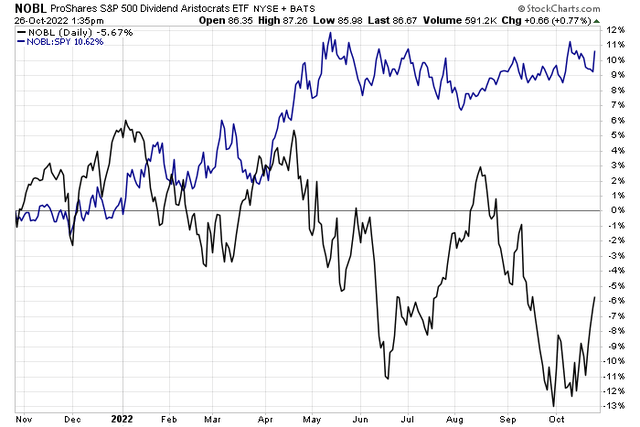

Dividend aristocrats have been treading water against the S&P 500 since late April. Firms with a track record of growing dividends were the darling of investors during the first part of the year, but a recent uptick in Treasury rates perhaps offers an alternative to still-risky dividend-paying stocks.

One component of the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), often seen as a global economic bellwether, reports quarterly results Thursday. Let’s see if it’s worth a long position or if investors should take profits.

Dividend Aristocrats Up Big On SPX YTD, But Sideways Since May

According to Bank of America Global Research, Caterpillar (NYSE:CAT), the largest manufacturer/marketer of construction, mining, and oil and gas equipment worldwide, is also a leading manufacturer of diesel engines and turbines for transport and industrial applications.

The once Illinois-based, now Texas-headquartered, $102.9 billion market cap Machinery industry company within the Industrials sector trades at a near-market 15.8 trailing 12-month GAAP price-to-earnings ratio and pays an above-average 2.4% dividend yield, according to The Wall Street Journal.

CAT’s industry-leading mining, construction, rail, and power systems equipment businesses have felt the brunt of the global economic downturn this year. Expect to hear more about how unfavorable recent currency impacts have been in its earnings report Thursday.

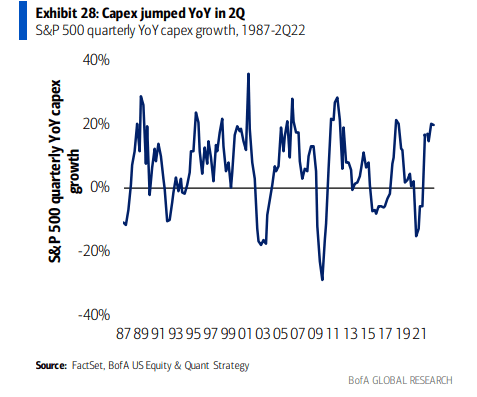

The international growth reset brings the cyclical stock to a fair valuation as it generates significant free cash flow, but risks are obvious if we see further manufacturing weakness across North America, Europe, and Asia. The company is also beholden to the capex cycle, which could actually be an upside catalyst as firms echo the need to spend more on their businesses. Unfortunately, recent commodity price weakness is an apparent headwind.

A Capex Comeback? Executives Suggest So

BofA Global Research

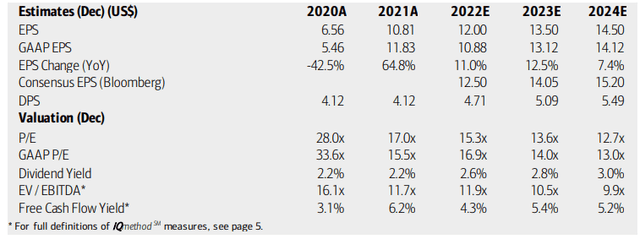

On valuation, analysts at BofA see earnings growing at a rate above inflation this year with even better real EPS in 2023 with moderating growth seen in 2024. The Bloomberg consensus forecast is even more optimistic. Moreover, dividends are seen as continuing at a high rate as CAT spits out free cash flow to shareholders. The company’s EV/EBITDA multiple looks fair given growth expectations. Overall, the valuation is reasonable here, but the stock will certainly move based on how trends in global GDP growth sway.

Caterpillar: Earnings, Valuation, Dividend Forecasts

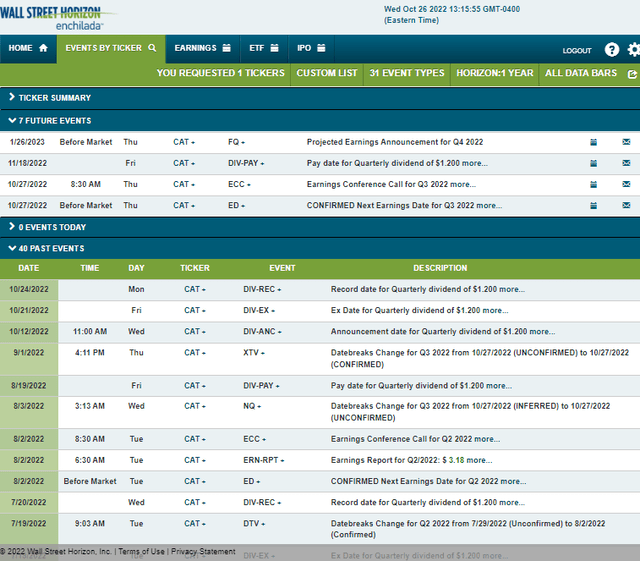

Looking ahead, Wall Street Horizon reports a confirmed Q3 2022 earnings date of Thursday, Oct. 27 BMO with a conference call immediately after results cross the wires. CAT has a dividend payable date on Nov. 18, but the event calendar is light aside from those dates.

Corporate Event Calendar

The Options Angle

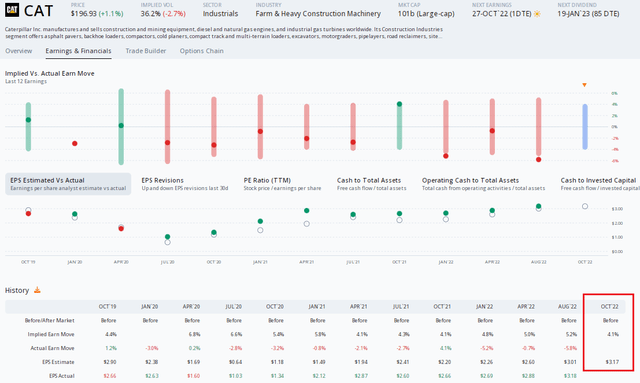

Digging into the earnings report expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS estimate of $3.17 which would be a solid advance compared to $2.66 reported in the same quarter a year ago. Caterpillar boasts a strong EPS beat rate history, topping analyst estimates in each of the previous nine releases.

In terms of the expected stock price swing post-earnings Thursday, the options market has priced in a 4.1% move using the nearest-expiring at-the-money straddle. That’s a relatively narrow move expected given the above-normal market volatility. Also consider last quarter’s 5.8% drop after beating bottom line numbers in July. I would be on the side of being long options into the report.

CAT: A Strong EPS Beat Rate History, Cheap Options

The Technical Take

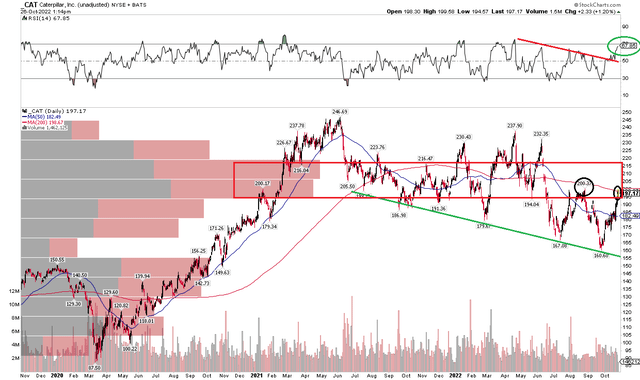

CAT longs have enjoyed a nice run off the September lows with the stock moving about 20% higher to tag its falling 200-day moving average. Shares made an approach of the 200-day back in August but were swiftly and strongly rejected. I continue to expect selling pressure in the near-term based on the chart and volume. Notice on the left side of the chart that the volume-by-price indicator shows a hefty amount of stock traded in the $190 to $220 area – that will be a significant bearish overhead supply.

Meanwhile, the stock is trending down with lower lows being notched dating back to Q2 2021. A bullish factor, however, is that CAT has recently broken above its downtrending RSI indicator. Technicians use RSI as a momentum gauge, and momentum is thought to turn ahead of price, so I must respect that favorable factor.

Overall, the onus is on the CAT bulls to send shares above the 200-day moving average and into the congestion zone (without being rejected) before I’d get long.

CAT: Shares Kiss The 200-Day Once Again

The Bottom Line

There are mixed factors for CAT. Weighing the risks, the burden of proof remains with the bulls as the stock is super cheap and the technical chart shows a stock simply getting back to resistance. There’s more work to do here before a buy recommendation can be issued. I have a soft sell on shares.

Be the first to comment