JHVEPhoto

Big tech stocks have fallen out of favor with investors over the past year. However, the long-term prospects of these stocks look bright as technology continues to shape the lives of millions of people every day. While I tend to favor investing in dividend payers, I do see the value in a “barbell” approach, with portfolio weighting on steady payers such as Realty Income Corp. (O) and Verizon (VZ) balanced out by high growth tech stocks.

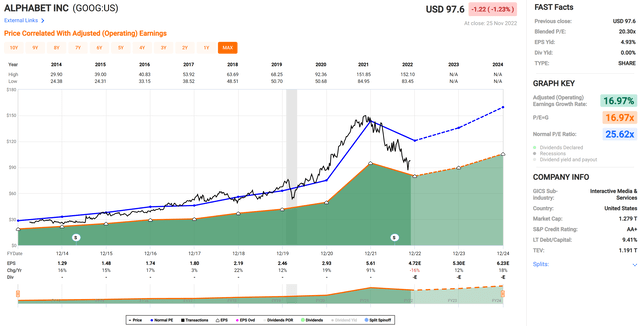

This brings me to tech industry juggernaut (NASDAQ:GOOG) (NASDAQ:GOOGL), which as seen below, is trading well off its 52-week high of $152. In this article, I highlight why pessimism may be overblown, and why now may be an opportune time to buy the stock, so let’s get started.

Strong Fundamentals

Google may no longer by the ultra-growth stock that it once was, but that’s ok. Over the past 2 decades, the company has built an impressive product portfolio which enjoys incredible loyalty among its users. Its iconic search engine is the reason why many people trust Google to power their most important computer needs. And with other products such as Gmail, Android, YouTube, and Google Maps, the company maintains a wide variety of services that are widely used around the world.

Moreover, its cloud division continues to demonstrate double-digit revenue growth, and currently commands 8% share of the total cloud market, sitting behind 21% for Microsoft’s (MSFT) Azure and 33% for Amazon’s (AMZN) AWS.

Meanwhile, Google’s total revenue grew by 6% YoY in its third quarter. While this may not seem too impressive on the surface, it is worth noting that Google has a very strong international presence that’s subject to currency risks, especially considering the strong rise in the dollar this year. Excluding currency effects, Google’s revenue growth was a more impressive 11% YoY.

This was driven by bright spots in search revenue, which grew by 4% YoY and by cloud revenue, which grew by 38% YoY, offset by YouTube and network advertising revenue declining 1.9% and 1.6%, respectively.

YouTube Shorts and DeepMind AI

In addition to its product suite, Google has also made some impressive moves in the world of Artificial Intelligence. Its DeepMind division has achieved several incredible milestones in recent years and is now one of the leading AI companies in the world. This, coupled with advances in other areas such as cloud computing and autonomous vehicles, puts Google at a unique advantage that few other companies can match.

While YouTube’s revenue decline was disappointing, I see long-term potential, considering that YouTube Shorts has now reached 1.5 million monthly active users, helping to allay concerns that TikTok is going to pose a significant risk to the business. Furthermore, Google is leveraging its deep bench of AI expertise to monetize YouTube Shorts and Google Lens, as noted by management during the recent conference call:

At our Search On event, we shared how we are using AI advances to deliver a more natural and intuitive search experience. These advancements will soon help to surface things you might find helpful before you even finish typing. We are also making visual search more natural than ever before.

People now use Google Lens to answer more than 8 billion questions every month using just a photo or an image. Now, we are supercharging our visual search capabilities to help people find what they are looking for at businesses nearby.

Balance Sheet and Valuation

Meanwhile, Google maintains an AA+ rated balance sheet, putting it on par with that of the U.S. Government. This is supported by a staggering $116 billion of cash and short-term investments on the balance sheet, against just $12.9 billion of long-term debt.

Google also trades cheaply relative to historical valuations. At the current price of $97.60, Google carries a forward PE of just 2046, sitting well below its normal PE of 25.6, as shown below. Analysts also estimate 9 – 12% EPS growth annually over the next 2 years. Morningstar has a $160 fair value estimate and analysts have a consensus Strong Buy rating with an average price target of $126.

Given the fortress balance sheet, wide-moat business model, and forward EPS growth estimates, I would expect GOOG to trade with a forward PE in the 25x range, implying a price target of $120. As such, I view Google as being a strong by at the current price, presenting a 20%+ discount from my relatively more conservative price estimate.

Investor Takeaway

Google’s broad technology offerings including its fast growing cloud division, coupled with its fortress balance sheet, wide reach and relatively cheap valuation, makes it an attractive investment at the current time. While its YouTube advertising business saw a slight decline in revenue, I believe the recent launch of YouTube Shorts holds a lot of promise and Google is leveraging its deep bench of AI expertise across its platforms. As such, growth and value investors may be well-served to take a hard look at Google at current levels.

Be the first to comment