pressureUA/iStock Editorial via Getty Images

Introduction

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) acquired YouTube for just $1.65 billion in October 2006 and this turned out to be an incredible investment. Of course it would have been even more impressive if they would have done it with cash instead of stock. In a perfect world, they would have used some of the $3.5 billion in cash and $7.7 billion in marketable securities from the 2006 balance sheet but that’s splitting hairs.

My thesis is that YouTube makes competitors work extremely hard.

Young Online Users

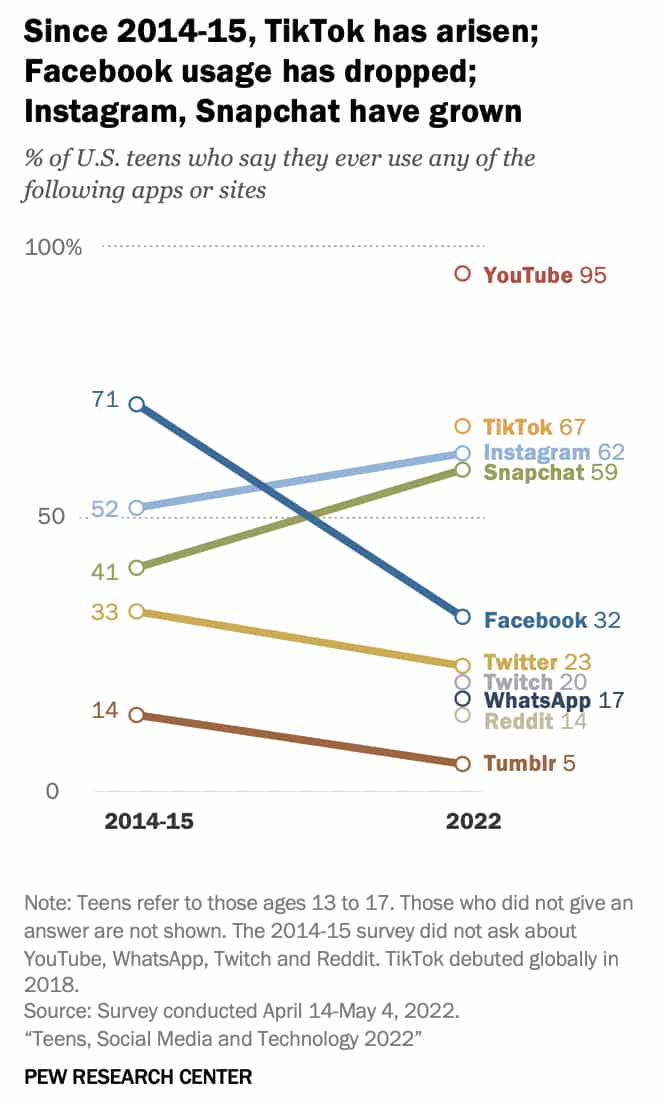

An August Pew Research Center article shows that 95% of U.S. teens use YouTube compared to 67% for TikTok, 62% for Instagram (META), 59% for Snapchat (SNAP) and 32% for Facebook:

Teen users (Pew Research Center)

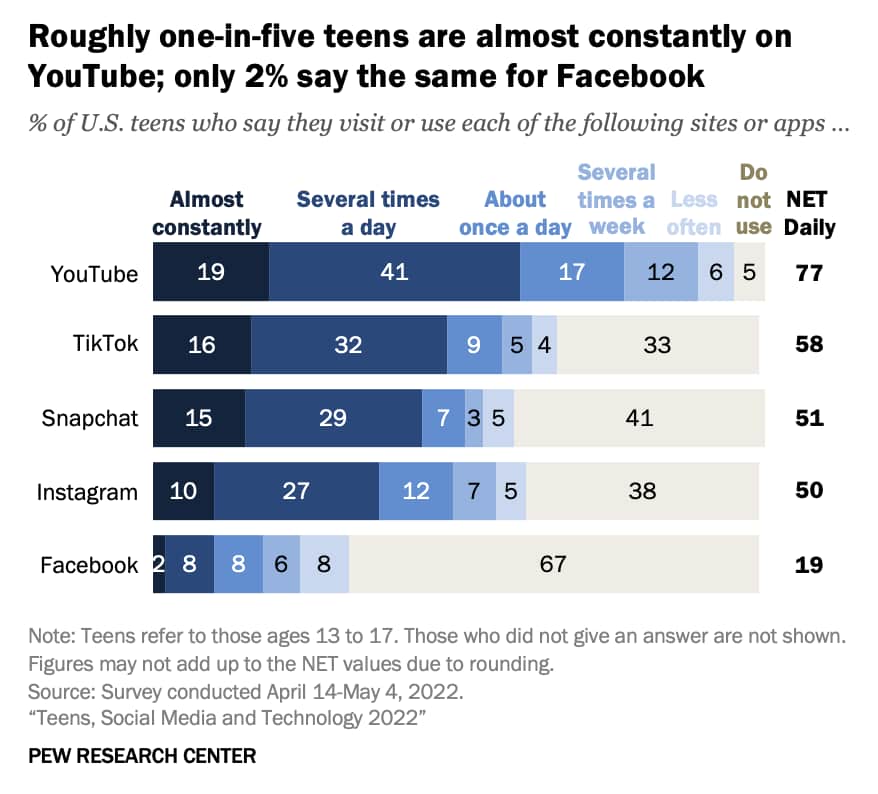

The same article shows that 60% of U.S. teens are on YouTube at least several times a day:

Teen usage (Pew Research Center)

An August HubSpot (HUBS) post shows that YouTube is used as product discovery by 56% of Gen Z, 54% of Millennials, 48% of Gen X, and 26% of Boomers.

YouTube naturally appeals to young viewers but other online platforms have to make large investments to bring in young audiences. Facebook gained more access to teens in 2012 when they acquired Instagram for $1 billion but now the Instagram user base is getting older and Meta must work hard to find ways of reaching young users organically as opposed to relying on acquisitions.

TV Viewing

For decades, the TV advertising market was unassailable but the internet changed that. Broadcast television has been losing young viewers for years. Citing a UK example, TBI says the following:

92% of 12-15-year-olds watched content, ranging from streamers like BBC iPlayer to platforms such as YouTube, while only 61% engaged with broadcast TV.

It isn’t just young viewers that broadcast TV is losing; declines are taking place for all age groups. Nielsen shows that streaming had 34.8% of U.S. TV viewing in July which was ahead of the 34.4% we saw from cable and the 21.6% from broadcast. YouTube went up from 6.2% of TV viewing time in July 2021 to 7.3% in July 2022 as streaming continues to replace cable and broadcast.

Linear TV companies are constantly working to win back viewers that have left for YouTube. In the 1Q21 call, Senior VP & Chief Business Officer Philipp Schindler noted that more 18 to 49-year-olds watch YouTube than all of linear TV combined. VP Schindler cited additional stats for linear TV in the 2Q21 call, saying 70% of YouTube’s reach was to an audience that isn’t accessible by traditional TV media.

VP Schindler noted the distinction between YouTube and other streaming services in the 1Q22 call:

According to Nielsen, in the U.S., YouTube accounts for over 50% of ad-supported streaming watch time on connected TVs among people ages 18 and up. And over 35% of viewers in this group can’t be reached by any other ad-supported streaming service. In other words, we’re seeing that when users choose to watch ad-supported CTV, they choose to watch YouTube, and YouTube delivers CTV audiences that advertisers can reach anywhere else.

All companies in the TV viewing space must work hard to compete with YouTube. Traditional TV companies must try to bring audiences back while streaming companies have to make massive content investments. Netflix has to change their business model to include advertising and streamers who already have advertising must make their systems more efficient. The experience Google brings over to YouTube from their search advertising business combined with their AI investments make them a fierce competitor in the ad space.

Podcasting

Spotify (SPOT) has to work exceedingly hard to compete against YouTube in the podcasting space. An August Business Insider article talks about the fact that YouTube became the largest podcasting ecosystem without putting forth the type of work seen by Apple (AAPL) and Spotify. Citing the NY Times, the BI article notes that Spotify had to pay over $200 million in order to have 3 years of exclusivity with Joe Rogan:

The details of YouTube’s role in the podcast deal, which haven’t been previously reported, illustrate a surprising development in the podcasting world over the past few years: YouTube has become a juggernaut. Two recent surveys, one by Cumulus Media and one by Voices, showed that YouTube was the most frequently used podcasting platform, edging out Spotify and Apple’s podcasting apps. Even more surprising, the video service has done next to nothing to make it happen.

The article goes on to talk about YouTube’s recommendation capabilities:

But unlike TV, YouTube has a recommendation algorithm that can direct new listeners to shows, solving a problem for podcasters who struggle with discoverability from new audiences.

Latasha James hosts “The Freelance Friday Podcast” and she was quoted as saying that she gets leads for her business from YouTube videos that are 5 years old.

Valuation

YouTube ad revenue climbed 30.5% from $15,149 million in 2019 to $19,772 million in 2020 and then another 45.9% to $28,845 million in 2021! Things have slowed down so far in 2022 as the 1H22 YouTube ad revenue of $14,209 million is only up 9.2% from the $13,007 million in 1H21. YouTube also has subscription revenue that rolls into the “Google other” segment. Variety reports that YouTube CEO Susan Wojcicki wrote a letter to staff about YouTube Chief Business Officer Robert Kyncl stepping down in early 2023. The letter explains that YouTube has paid more than $30 billion to creators, artists and media companies in the last 3 years.

If YouTube was a standalone company then it would be valued in the triple digits of billions but this is only a small part of Google’s overall valuation. My overall valuation thoughts haven’t changed much since my August 4th article. I still think the core segments including YouTube have a valuation range of $1,825 to $2,010 billion. This doesn’t include Google Cloud and Other Bets. The September 8th share prices are $108.38 for GOOGL and $109.42 for GOOG. To get the market cap of $1,420 billion, we multiply these share prices by 6,881 million and 6,163 million which are the A/B and C counts, respectively. The enterprise value is nearly $100 billion less than the market cap due to $125 billion in cash and securities which are only partially offset by considerations like debt and lease liabilities.

The market cap and enterprise value are below my valuation range, and I believe GOOG stock is undervalued.

Be the first to comment