JHVEPhoto

The latest depreciation of Google’s (NASDAQ:GOOG)(NASDAQ:GOOGL) stock could be considered a market overreaction. While we’re indeed in a middle of a turbulent macroeconomic environment in which advertising spending is decreasing, Google nevertheless is forecasted to continue to grow at a double-digit rate this year. At the same time, the company has recently reported decent earnings results and it has all the chances to strengthen its position in the digital ads market by doubling down on video content and launching its monetization program for YouTube Shorts next year in order to gain an advantage in the short-form video segment. In addition, my model shows that Google’s stock trades at a discount of ~35% from its fair value, which is an indication that the company’s shares are currently oversold and offer a great entry price for new investors.

Better Than The Others

A few weeks ago, I wrote a bullish article on Google in which I explained that the company is likely to show better results than its peers due to its competitive advantages in various segments of the digital advertising industry. Partially I was right since Google reported that in Q3 its revenue of $69.09 billion was up 6.1% Y/Y, while its EPS was $1.06. However, the company’s top-line growth was still below the street estimates by $1.56 billion mainly due to the decline in advertising spending amid the macroeconomic uncertainty.

The good news about the latest report is nevertheless the fact that unlike Meta Platforms (META), which is forecasted to experience a Y/Y decline in revenues, Google is still on track to grow its own revenues at a double-digit rate. In part, this is thanks to the company’s ability to better track the behavior of its users, which leads to a better performance of ads that the advertisers launch on its platform. This is something that Meta is currently struggling with after the change in Apple’s (AAPL) privacy policy, which is already making the ads of its advertisers underperform and is about to cost it $10 billion in lost revenues this year.

At the same time, as Google’s business continues to grow, the only major risk that the company is currently facing comes from the U.S. and EU antitrust watchdogs, which are trying to disrupt its operations and break up the company. Last month I’ve already made a separate article about the latest regulatory developments and the kind of tools that the regulators would use to do so.

As the DOJ is planning to open a second antitrust case against Google, while the recently passed Digital Markets Act is about to put additional pressure on the company in Europe, it appears that new fines and restrictions against the business are only a matter of time. The good news though is that Google is more than likely going to appeal any fines and restrictions that the regulators impose on it via courts, which would take years before any settlement is reached, which was the case with the recent appeals that the company filed against the European Commission.

As a result, any major risks are unlikely to materialize anytime soon. Therefore, it’s safe to assume that Google is not facing any disruptions to its business at this stage, except for a cyclical decline in ad spending due to macroeconomic events, and the only question that investors need to ask themselves is what kind of catalysts could help Google’s stock to rebound from the oversold territory in light of recent events.

The Market Underestimates Google’s Advantages

Going forward, search and video are likely going to become Google’s biggest drivers of growth in the foreseeable future and help its stock to rebound from the current oversold territory. The latest reports already suggest that search is one of the most resilient segments within the overall digital advertising industry, as the search spending is forecasted to grow 14.5% this year alone to $99 billion, and continue to increase in the following years as well despite the macroeconomic uncertainty. Considering that Google reported its Search & Other business segments to grow at 4.3% Y/Y in Q3 to $39.54 billion, it appears that in case of a potential further cut in advertising spending, the spending in the search business would be cut at the very end in comparison to other segments.

In addition, to strengthen its already dominant position in the search business, Google has started to double down on promoting the use of Performance Max campaigns for its users since the start of this year, which give advertisers more options to efficiently expand their ad campaigns across various Google platforms at once and add more optimization tools to drive conversions. As Google’s Chief Business Officer Philipp Schindler noted during the latest conference call:

In challenging times like these, advertisers are carefully evaluating the effectiveness of their budgets. Search tends to do relatively well in such an environment, given its strong measurability and focus on delivering ROI. It’s also well suited to quickly adjust to changes in consumer behavior. And when Search is coupled with our automation products across bidding, creatives, targeting or Performance Max, it can drive performance even further.

As for the video business, Google has been actively trying to expand its presence in the growing short-form video segment, which is currently dominated by TikTok, by promoting YouTube Shorts. In September, the company introduced ads within YouTube Shorts and during the latest conference call stated that the product currently receives 30 billion daily views and attracts 1.5 billion users every month. To accelerate its expansion within the short-form video segment, Google is planning to launch a revenue-sharing program with its content creators at the beginning of next year, which has the potential to attract a bulk of new creators and create additional value, especially if the U.S. decides to finally ban TikTok on its soil.

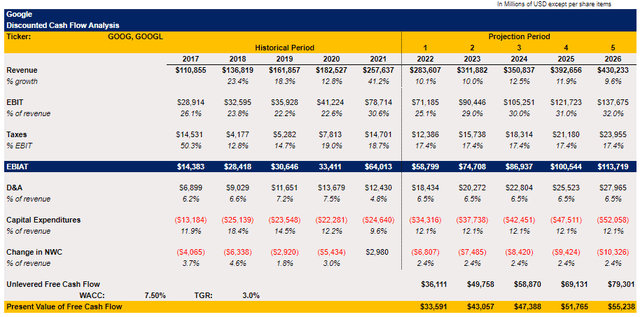

Considering all of those developments, it seems that the only question left unanswered is how big of an upside the company’s stock represents at the current levels. Back in October before the Q3 results came in, my DCF model showed that the company’s fair value is $142.44 per share. However, after Google missed the street estimates in the latest report, I updated my top-line growth assumptions in light of the latest results and at the same time slightly increased WACC to reflect a changing interest rate environment. All the other metrics remained unchanged.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

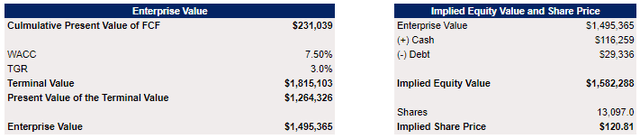

The updated model shows that Google’s enterprise value is $1.5 trillion, while its fair value is $120.81 per share, which represents an upside of ~35% from the current levels and signals that the market currently underestimates the company’s potential to create additional shareholder value in the foreseeable future.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

As most of the major risks are unlikely to materialize in the following years, Google has at least a few years to strengthen its advantage in the digital ads market and find ways to overcome new antitrust regulations at the same time. In addition, the introduction of a monetization program for YouTube Shorts along with a possible ban of TikTok gives the company the ability to strengthen its advantages in the digital ads market, which would more than likely lead to the creation of an additional shareholder value along the way. As Google’s stock is trading at a discount of ~35%, now could be a good time for new investors to think about opening a long position in the business given all the upside that the company offers at the current levels.

Be the first to comment