Jay Yuno/E+ via Getty Images

Introduction

A lot has happened since our last Bitfarms (NASDAQ:BITF) coverage 2 quarters ago. The recent headline news was BITF forgoing its HODL strategy to accumulate the mined Bitcoins (BTC-USD). This implication is massive because it affects BITF’s valuation and perceived risks.

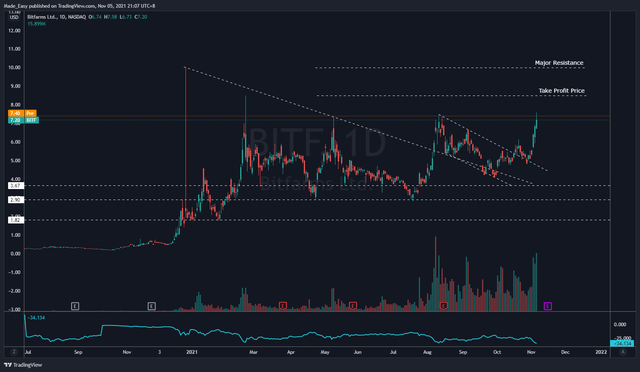

We’re no stranger to BITF and have successfully traded BITF in the past. We formulated our thesis to issue a price target of $8.50 when BITF was trading in the $3.00 range. Several months later, BITF reached $9.30 to hit our target. We then updated our thesis and explained 2 major hurdles that might prevent BITF from going higher. The 2 hurdles at that time were BITF’s $10 all-time high resistance and Bitcoin’s bearish bias. Hence, we issued a call to sell call options with the $10 strike price to protect against the downside risk.

Now that BITF is trading in the $1 range, we were prompted by the headline news to revisit and determine BITF’s investability in this time of distress.

Fig 1. BITF reaching our price targets (Author, TradingView)

Liquidation of Bitcoin Reserve Is No Surprise

BITF liquidated about 3,352 Bitcoins or about 50% of Bitcoin reserves. The liquidation of BITF’s Bitcoin reserve shouldn’t come as a surprise. Our warnings were timely back to May 2021 when Bitcoin was flying high. We predicted 5 sequences of events to happen from May 2021 to between May 2022 and Dec 2022. These 5 sequences of events are:

Bitcoin’s past 2 bear markets showed that the 5 sequences of events over the 1-year bear market are as follows:

- Reversal pattern

- 50% decline from peak

- Rebound back to 20% from peak

- Another decline to 70% from peak

- Bottom out at 85% from peak

More than a year later, 4 out of 5 sequences of events played out exactly as predicted. We presented our thesis on why Bitcoin is expected to fulfill the 5th sequence of events even though this event might prove difficult.

On this basis, we then advised against investing in Bitcoin mining companies during this period. We found that the common all-in business cost of Bitcoin mining companies is in the range of $25,000 to $40,000, even though the electricity/hosting cost might be about $10,000.

With this knowledge, we expected Bitcoin mining companies to deplete Bitcoin reserves to cover business costs should Bitcoin fall below their all-in business cost. We used HUT 8 Mining (HUT) as the reference:

On the other hand, HUT prides itself on having a balance sheet-first mindset towards its mining operations, meaning it prioritizes growing its Bitcoin holdings as fast as possible and as much as possible. In Q3 2021, Hut managed to grow its Bitcoin by 302 BTC per month, compared to 220 BTC (28% less) and 115.25 BTC (62% less) per month for BITF and RIOT, respectively. Regardless of how well HUT has executed its balance sheet-first strategies, HUT is expected to lose its ability to accumulate Bitcoin meaningfully should Bitcoin trade below its $27,000 per BTC total all-in Bitcoin mining cost.

This echoes our statements in one of our initial coverage on BITF in June 2021:

Ideally, Bitfarms would try to keep as much mined BTC as possible because of an expectation that BTC would appreciate over time. The lower Bitcoin is priced, the more BTC Bitfarms is forced to sell to cover costs and expenses, ultimately less BTC ends up in the balance sheet.

Is BITF’s Bitcoin Mining Operation Still Functional?

Fortunately, we still think that BITF’s Bitcoin mining operations are still functional with Bitcoin at $20,000. BITF reported that its electricity/hosting cost for 2022Q1 is $8,700 per BTC. This implies that its Bitcoin mining operations are still profitable. BITF’s average historical electricity/hosting is $8,200 since 2021Q1 (Table 1).

Table 1. BITF Electricity/Hosting Cost per BTC Since 2021Q1

|

QR |

Electricity/Hosting ($) |

|

2022Q1 |

8,700 |

|

2021Q4 |

8,000 |

|

2021Q3 |

6,900 |

|

2021Q2 |

9,000 |

|

2021Q1 |

8,400 |

Source: BITF

So why is BITF liquidating Bitcoin reserves? The answer lies in BITF’s all-in business cost. When considering other costs such as infrastructure, wages, rent, R&D, depreciation, professional services, marketing, financial expense, and other business costs, BITF’s all-in business cost per BTC is $34,340 in 2022Q1. This figure is not an outlier and aligns with its quarterly average since 2021Q1 (Table 2).

Table 2. BITF’s All-in Business Cost per BTC Since 2021Q1

| QR | Bitcoins Mined | Cost of Revenue ($mil) | General & Administrative ($mil) | Financial Expense ($mil) | Business Cost ($mil) | Business Cost per BTC ($) |

| 2022Q1 | 961 | 23.3 | 13,843 | -4 | 33 | 34,340 |

| 2021Q4 | 1,045 | 20.62 | 18.93 | -2.932 | 36.6 | 35,000 |

| 2021Q3 | 1,051 | 15.3 | 10.884 | -0.62 | 25.564 | 24.323 |

| 2021Q2 | 759 | 13.332 | 10.607 | 1.127 | 25.1 | 33,025 |

| 2021Q1 | 598 | 9.12 | 2.819 | 23.425 | 35.364 | 59,137 |

Source: BITF Form 10-Qs,10-K Fillings, and Investor Presentations

Therefore, BITF’s overall business is making losses despite its operations being profitable at Bitcoin’s current price. This simply means that BITF’s income from mining Bitcoin is not sufficient to cover its overall business expenses.

Does Cost Reduce With Scale?

BITF’s business cost per BTC may be in the $35,000 range now, but it’ll come down over time as it scales, right? Especially when BITF is expected to achieve 8 EH/s by end of 2022 or a 300% increase from April 2022 mining capacity, right?

Not necessarily. The common understanding is that fixed costs would be spread across more Bitcoins mined (Just look at the comments of our previously published articles).

This is because mining profitability is relative to the overall Bitcoin network hash rate. To increase profitability, miners must strive to have more share in the Bitcoin network. This is done by having more mining capacity relative to all other miners combined. The Bitcoin network hash rate represents the total mining capacity of all Bitcoin miners online.

- If a miner’s capacity remains constant while other miners increase capacities, that miner’s share in the Bitcoin network will decrease along with its profitability.

- If a miner’s capacity increases at the same rate as other miners, that miner’s share in the Bitcoin network will remain constant along with its profitability.

- If a miner’s capacity increases more than other miners, that miner’s share in the Bitcoin network will increase along with its profitability.

What this means is that even if BITF’s mining capacity is expected to triple, it does not mean that BITF can mine more Bitcoin when other Bitcoin mining companies are also increasing mining capacity (Table 3).

This argument is also reflected in BITF’s data. BITF’s mining capacity increased by almost 300% from 1.2 EH/s in 2021Q1 to 3.3 EH/s in 2022Q1 but Bitcoin mined only increased by 60%. Furthermore, Bitcoins mined have been stagnant over the past 3 quarters despite capacity increases.

Our biggest concern though is Bitcoin’s next halving event where Bitcoin rewards will be cut in half, further decreasing the number of Bitcoins mined. If the Bitcoin price does not at least double from current highs, Bitcoin mining companies will face material insolvency risk.

Table 3. Near Future Expected Capacities of Bitcoin Mining Companies

| Company | Built-up Capacity | Near Future Expected Capacity |

| BITF | 3.3 | 8 |

| Core Scientific (CORZ) | 8.3 (Self) | ~16 (Self) |

| Soluna Holdings (SLNH) | 1 | 4 |

| Iris Energy (IREN) | 1.1 | 10 |

| Riot Blockchain (RIOT) | 4.3 | 12.8 |

| Marathon Digital (MARA) | 3.9 | 23.3 |

Source: Company Investor Presentations

Valuation: BITF is Fairly Priced

Our previous valuation framework is based on earnings and is not applicable under loss-making circumstances. Under the current circumstances, we’re looking for Bitcoin mining companies that are priced near their hard asset value (such as cash, Bitcoin holdings, and properties) in excess of total liabilities.

For instance, IREN is priced ($182mil market cap) near its $155 hard asset value. As of CY2022Q1, IREN’s hard assets (land, grid-connected power facilities, and cash only) are valued at $253mil while only having $98mil in total liabilities. This means investors are buying into IREN’s hard assets and are getting its Bitcoin mining business for free. Such safety of margins is desirable during a Bitcoin downturn.

BITF’s hard assets are as follow:

- Cash = $77.3mil

- Bitcoin reserves = 3,144 BTC (worth about $63mil)

- Property, plant and equipment = $181mil

- Prepayments not included for conservative reasons.

- Total = $321.3mil

BITF’s total liability is valued at $180mil in 2022Q1. Although this number could be lower after a series of payments (which reduces both assets and liabilities), we’ll be conservative and only adjust when more information surfaces:

Selling 3,352 BTC during the month for total proceeds of US$69 million, a portion of which was used to pay down the BTC-backed facility.

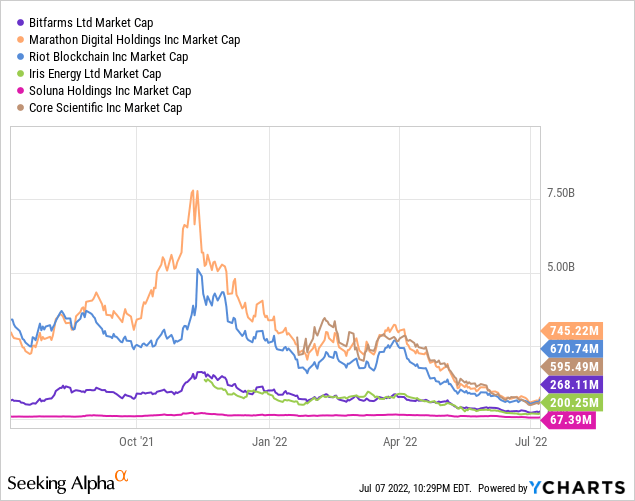

Therefore, BITF’s hard asset value in excess of total liabilities is $141mil compared to BITF’s market cap at about $235mil (USD). On this basis, IREN has a better margin of safety.

When prepayments are considered, IREN provides even more margin of safety. BITF’s hard assets are valued at $241mil (with prepayments) which is similar to BITF’s market cap. Hence, we could also say that BITF is fairly priced and that investors would be buying into BITF’s hard assets and are getting the prospects of BITF Bitcoin mining for free.

It’s just that IREN’s hard asset value (with prepayments) in excess of total liabilities would be about $333mil, 83% higher than IREN’s market cap.

Furthermore, IREN is expected to achieve 10 EH/s by end of 2022 and 15 EH/s by 2023Q1 while BITF is only expected to achieve 8 EH/s. In addition, IREN is powered by 100% renewables while some of BITF’s operations are still not.

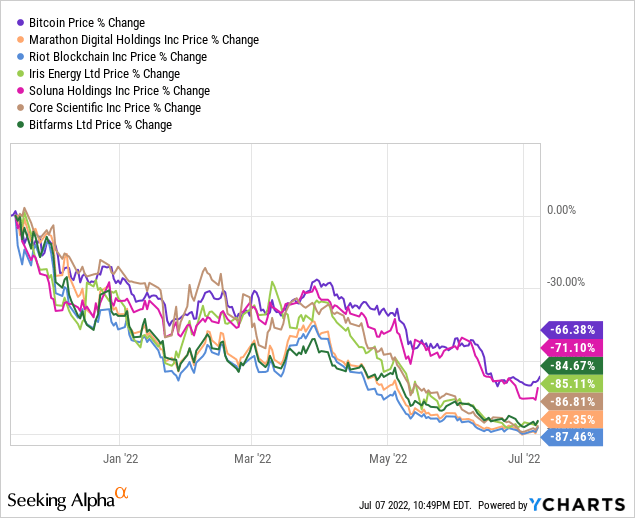

Therefore, we would still prefer IREN more than BITF for now unless Bitcoin recovers soon. Perhaps BITF’s premium can be justified if Bitcoin were to recover now as BITF’s 3x higher built-up capacity is advantageous. We still see more downside to Bitcoin mining companies as we expect Bitcoin to hit $10,000 by the end of 2022.

Based on near future expected capacity, BITF is also fairly priced. CORZ’s expected capacity is 2x of BITF, their market caps reflect that. Marathon’s expected capacity is 3x of BITF, their market caps also reflect that.

On the other hand, Soluna’s expected capacity is 50% of BITF but is priced at only 25% of BITF. In this respect, Soluna could be more undervalued than BITF. However, one crucial risk to Soluna’s business model we found is Soluna is limited to curtailed energy, unlike BITF which is open to any renewable power source. Should curtailment of energy occur, our concern is that curtailed energy costs might put Soluna at a disadvantage.

Verdict

Overall, we find that BITF’s mining operations are intact should Bitcoin reach a low of $10,000. However, we should also expect potentially more Bitcoin reserve liquidation to cover other business expenses under that circumstances.

We were unable to observe any material decline in cost even as BITF scale mining capacity to 300% of 2021Q1 levels. We’ll continue to monitor this aspect closely.

We found that BITF is fairly priced and provides investors with sufficient safety of margins based on the value of its hard assets.

Bitcoin’s $20,000 price level is a solid support level as it represents the high of Bitcoin’s previous cycle bull market. We explained that Bitcoin has never broken this level in its previous cycles but needed to do so to complete its 5th sequence of events in a bear market. Our bias remains to the downside unless economic fundamentals change. Therefore, we maintain our view that holding Bitcoin is still a better overall option than Bitcoin mining companies in the near term.

Be the first to comment