JHVEPhoto/iStock Editorial via Getty Images

By The Valuentum Team

We remain big fans of Alphabet’s shares and value them at $3,146 each. The company’s share price is down in the dumps trading at just ~$2,370, which according to Yahoo Finance consensus earnings numbers, is just ~18x 2023 estimates. For a company that has a huge net cash position and generates tremendous gobs of free cash flow, the multiple assigned to the market price for shares is far too low. We think long-term shareholders may be well-rewarded by considering shares of Alphabet at these levels.

On April 26, Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) reported first quarter 2022 earnings that missed top-line estimates but beat bottom-line estimates. The firm, however, showcased that it remains a free cash flow powerhouse with a fortress-like balance sheet and an incredibly promising top-line growth outlook. Its core digital advertising business, its high-growth Google Cloud unit, and its longer-term bets such as the self-driving company Waymo underpin our expectations that Alphabet will continue to expand its revenues at a nice premium to global GDP growth for some time to come. We love shares of Alphabet.

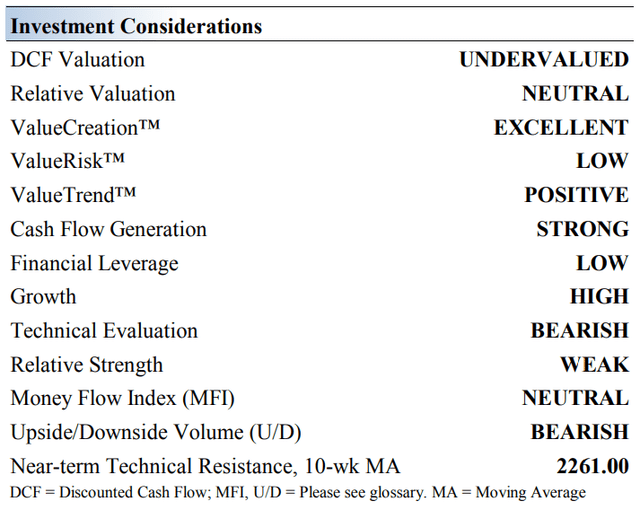

Alphabet’s Key Investment Considerations

Image Source: Valuentum. The key investment considerations we look at when evaluating Alphabet’s shares. (Image Source: Valuentum)

Known for its search dominance, Alphabet is a tech company focused on a number of things: Android, ads, YouTube, Chrome, and research. We think the company will have some megahits in the years ahead. It reports operating losses in its ‘Other Bets’ category frequently, suggesting core levels of profitability are higher than reported.

Alphabet offers investors a compelling combination of attractive valuation, growth potential, cash-flow generation, and competitive profile. Very few firms are more attractive on a fundamental basis, in our view, and its impressive free cash flow conversion rates (consistently above 100%) speak to this.

Alphabet is pleased with momentum in its mobile division, particularly within strong mobile advertising revenue. The mobile Internet space will be key for the firm. YouTube and programmatic advertising offer upside potential, too, but we’re watching spending levels, which have spiked due in part to higher traffic acquisition costs.

Alphabet has a strong future in search, and we continue to be in awe of the strength in this division. Its massive net cash position gives the company a substantial cushion to fall back on as it invests in high-return opportunities and new concepts such as smart home features, Glass, Fiber, or other innovative ideas.

Alphabet has three different stock classes with two different tickers. GOOGL is Class A stock, and GOOG represents the non-voting Class C stock that was created by a stock split in 2014 in order for Google founders to maintain majority control.

Latest Earnings Assessment of Alphabet

During its first quarter of 2022, results released in April, sales at its Google advertising segment (includes Google Search & other, YouTube, and Google Network revenues) rose 23% year-over-year and sales at its Google Cloud segment rose 44% year-over-year. Revenue from its other segments including Google other (includes YouTube Premium and YouTube TV subscriptions) and Other Bets (investments in emerging technologies that may not generate sizable sales for some time, such as Waymo) also climbed higher last quarter.

Alphabet’s GAAP revenues rose 23% year-over-year in the first quarter as its core digital advertising business is performing well while its Google Cloud business, one of its major longer term growth drivers, is growing at a robust pace. In March 2022, Google suspended advertising activities in Russia in the wake of the Russian invasion of Ukraine. During Alphabet’s latest earnings call, management noted that the firm’s “second quarter results will continue to reflect that we suspended the vast majority of our commercial activities in Russia,” and we appreciate Alphabet stepping up on this front.

Alphabet’s total headcount grew 17% year-over-year in the first quarter of 2022 as it continues to invest heavily in the business. Significant growth in its operating expenses (R&D, sales and marketing, and G&A) were largely offset by revenue growth as Alphabet’s GAAP operating income rose by 22% year-over-year last quarter, with its GAAP operating margin standing just above 29.5% (down by ~15 basis points year-over-year).

Its operating income is entirely derived from its Google Services segment which includes its digital advertising operations and revenues from its YouTube subscriptions. On a segment-level basis, Alphabet generated $22.9 billion in positive operating income from its Google Services segment last quarter, up 17% year-over-year. The operating loss at its Google Cloud segment shrank modestly year-over-year in the first quarter, though the goal in this area is to build up a sizable revenue base first before Alphabet tries to make the segment profitable. Alphabet is spending heavily on bulking up its Google Cloud workforce and data center operations to become a serious competitor in the space. The operating loss of its Other Bets segment grew marginally, and its unallocated corporate-level costs declined materially last quarter on a year-over-year basis.

Image Source: Alphabet – First Quarter of 2022 Earnings Press Release. Alphabet’s core business is much profitable than it first appears as the firm is utilizing those profits to fund investments in its longer term growth drivers, particularly at its Google Cloud and various Other Bets operations. (Image Source: Alphabet – First Quarter of 2022 Earnings Press Release.)

During Alphabet’s latest earnings call, management had this to say on its Google Cloud growth ambitions:

Turning to Google Cloud. Cloud’s performance in the first quarter reflects growing deal volume and strength across multiple industries and regions. Customers are increasingly choosing Google Cloud to help them digitally transform their businesses using our global infrastructure offerings, our data analytics and AI capabilities and the collaboration benefits of Workspace. We continue to invest aggressively in Cloud given the sizable market opportunity we see. – Ruth Porat, CFO of Alphabet

Alphabet’s GAAP net income and diluted EPS declined last quarter on a year-over-year basis due to its ‘other income (expense), net line-item flipping from a sizable gain to a moderate loss. The company’s underlying business is doing well, and we want to stress that Alphabet’s core digital advertising operations are much more profitable than a first glance would suggest given that these operations are effectively funding its longer term bets. By almost all measures, it was a solid quarter for Alphabet, as a whole.

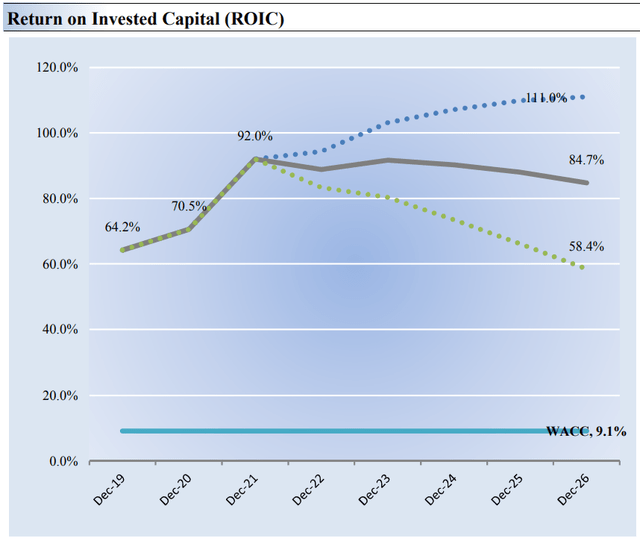

Alphabet’s Economic Value Analysis

Image Source: Valuentum. Alphabet is a tremendous economic-value generator. (Image Source: Valuentum)

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Alphabet’s 3-year historical return on invested capital (without goodwill) is 75.6%, which is above the estimate of its cost of capital of 9.1%.

As such, we assign Alphabet a ValueCreation rating of EXCELLENT. In the chart above, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. We think Alphabet will continue to be an excellent economic-profit generator.

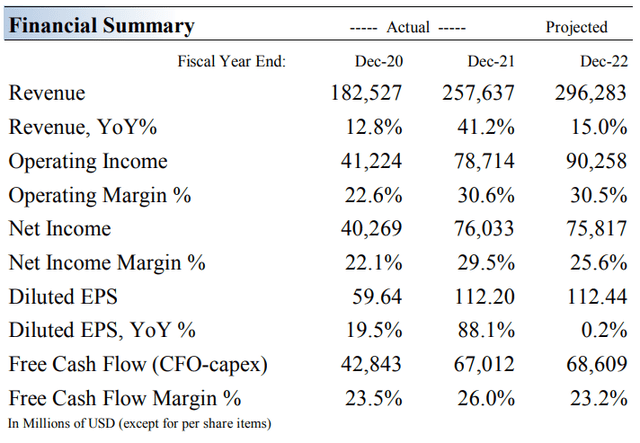

Alphabet’s Cash Flow Valuation Analysis

Image Source: Valuentum. A glimpse of some of the key financials of Alphabet. (Image Source: Valuentum)

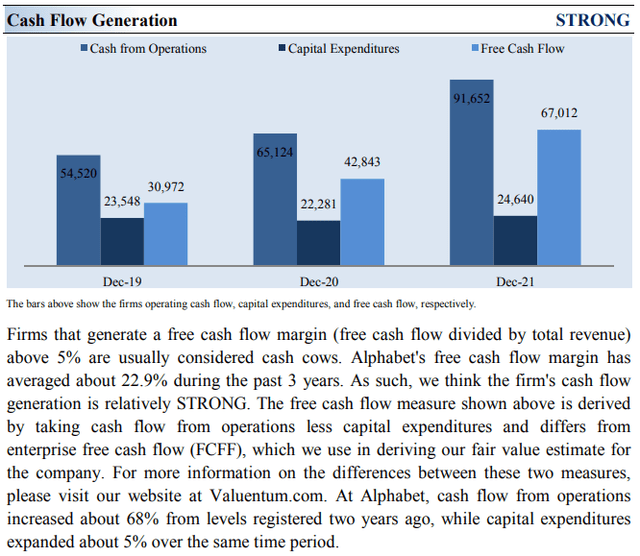

We continue to like Alphabet’s financial profile, which is mighty impressive. The company generated $15.3 billion in free cash flow in the first quarter, up from $13.3 billion in the same period the prior year. Growth in Alphabet’s net operating cash flows offset a significant rise in its capital expenditures to fund its data center, corporate office, and other developments. We’re forecasting free cash flow to edge up marginally in 2022, to reach almost $69 billion.

Management noted during Alphabet’s latest earnings call that it was forecasting “a meaningful increase” in its capital expenditures this year versus 2021 levels. Developments concerning office facilities in New York, London, and Poland are one reason why Alphabet’s capital expenditures are going up this year according to recent management commentary. Additionally, “the increase will be particularly reflected in investments in technical infrastructure globally with servers as the largest component,” and we view these investments as the best way to support its Google Cloud growth runway.

Image Source: Valuentum. Alphabet has been a very strong free cash flow generator, and we expect this to continue going forward. (Image Source: Valuentum)

Last quarter, Alphabet repurchased $13.3 billion of its stock through its share buyback program. These repurchases should continue in earnest going forward as the firm approved an additional $70.0 billion in share buyback authority in April 2022 (covering both Class A and Class C common stock). At the end of March 2022, Alphabet had $119.2 billion in net cash on hand with no short-term debt on the books, and please note that does not include $30.5 billion in noncurrent marketable securities on the books at the end of this period.

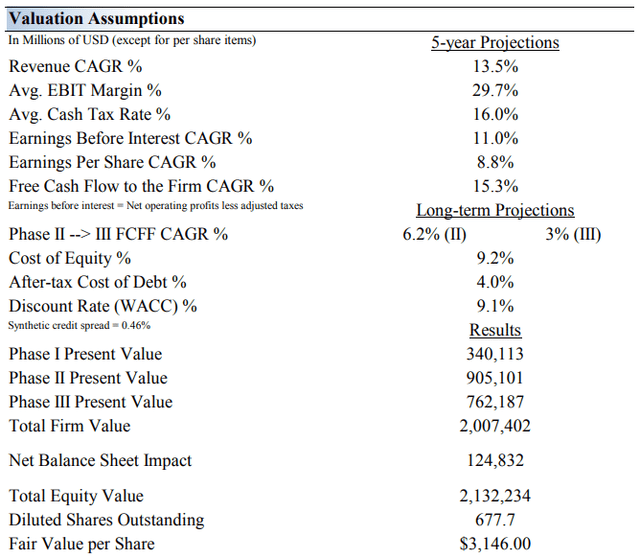

On the basis of our discounted cash flow model construct, we think Alphabet is worth $3,146 per share with a fair value range of $2,517-$3,775. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 13.5% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 23.5%.

Our model reflects a 5-year projected average operating margin of 29.7%, which is above Alphabet’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 6.2% for the next 15 years and 3% in perpetuity. For Alphabet, we use a 9.1% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum. The key summary assumptions that drive our fair value estimate of Alphabet. (Image Source: Valuentum)

Alphabet’s Margin of Safety Analysis

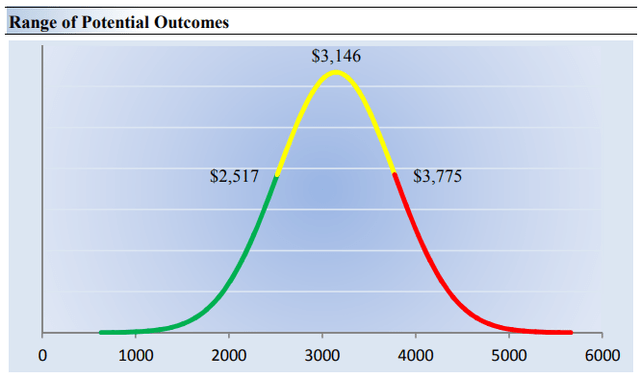

Image Source: Valuentum. The fair value estimate range we derive for shares of Alphabet. (Image Source: Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Alphabet’s fair value at about $3,146 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Alphabet. We think the firm is attractive below $2,517 per share (the green line), but quite expensive above $3,775 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. With shares trading at ~$2,370 each at the time of this writing, Alphabet is one mighty attractive investment consideration.

Concluding Thoughts

Shares of Alphabet are trading below the low end of our fair value estimate range, and multiple analysis helps support our undervalued assessment. Trading at just ~18x consensus earnings estimates for 2023 may be considered a gift for long-term shareholders, as the company’s net cash rich balance sheet, free cash flow generating capacity, and top-line growth prospects remain phenomenal. We continue to be huge fans of Alphabet and its immense capital appreciation upside potential.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment