Alena Kravchenko

The valuation of Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) is out of line with the tech company’s sturdy and recession-resistant market position.

Google’s company generates a huge quantity of regular, predictable, and low-risk cash flow that is expected to rise over time.

Google’s strong free cash flow growth and good earnings yield over time make the stock a very appealing option to invest your money. The low earnings multiple relative to Google’s sales potential reduces risk, and the capacity to grow cash flow in a variety of market conditions makes GOOG one of the greatest stocks to invest in.

Gigantic Free Cash Flow And Shareholder Friendly Management

Google’s management has demonstrated over time that it thinks long term and spends cash in sensible, value-adding ways. Google has been at the vanguard of numerous industries at the same time, whether it was the purchase of YouTube years ago, clever, forward-thinking investments in the Cloud market, or, more recently, a relationship with Amazon to capitalize on eCommerce expansion.

As a result of this foresight, the company’s revenues and free cash flow have grown steadily. Investors are particularly interested in Google’s free cash flow growth, because free cash flow is a statistic that indicates how much cash a firm could return to shareholders as dividends or share buybacks.

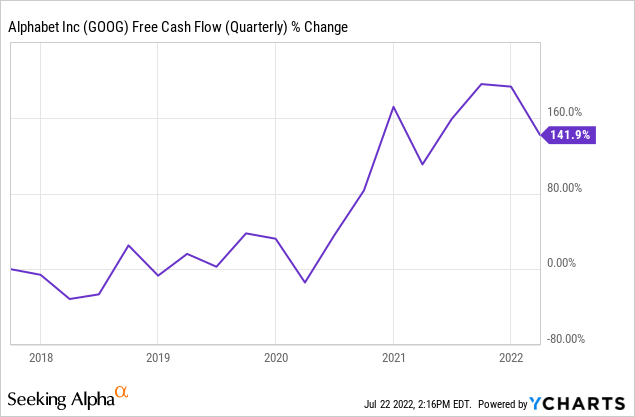

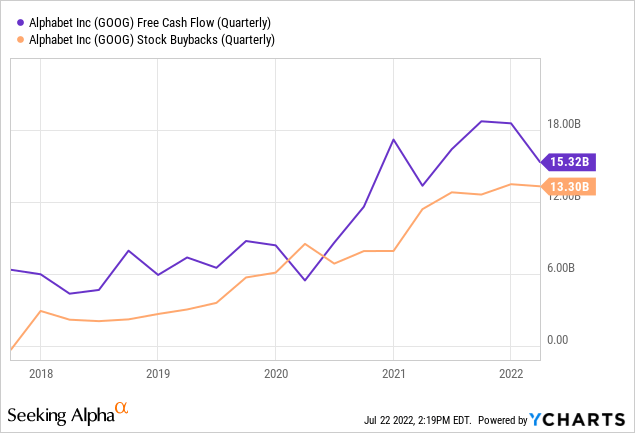

When it comes to cash flow, Google is a true beast. Just in the latest quarter, the corporation generated $25.1 billion in cash from operations. After deducting $9.8 billion in capex, the corporation had $15.3 billion. Google’s free cash flow growth has been nothing short of phenomenal, with total free cash flow increasing by 141.9% over the last five years.

What is Google doing with all of this cash?

It repurchases stock in the market with a significant portion of its free cash flow. Alphabet’s board of directors has approved the corporation to buy back $70 billion in shares, with deals to be conducted as management deems fit. Google’s free cash flow and share buybacks have increased over time.

The free cash flow trend is positive, and the company is about to experience a major trigger that might propel its cash flow to new heights.

Growth Catalyst: YouTube/Shopify Partnership

YouTube made headlines just a few days ago when it announced a new partnership with eCommerce giant Shopify.

Shopify will integrate its shopping systems into creators’ YouTube pages, allowing viewers to shop straight on YouTube without leaving the site, as part of their collaboration.

The collaboration benefits from two major inputs: YouTube has 2 billion monthly logged-in users, and Shopify is the leading platform for small businesses. There are considerable synergies in this relationship, as YouTube’s creative community will benefit greatly from integrated shopping services, while Shopify will profit from entering a market that may not yet be well supplied.

Small and medium-sized businesses, in my opinion, have a lot of overlap with the two core populations that utilize either YouTube or the Shopify platform. YouTube will be able to benefit from Shopify’s expertise in inventory synchronizing, while producers will be able to simply make their products accessible for purchase on their channel, resulting in a seamless purchasing experience. The Shopify connection on YouTube also allows producers to sell things during live streams, which might be a game changer not only for the eCommerce business, but also for Google.

I am quite excited about this potential and believe Google has a fantastic revenue opportunity here. Google largely monetizes YouTube through advertisements, but it also offers subscription services such as YouTube Premium and YouTube TV. The eCommerce collaboration, which will be disclosed soon, could be a powerful accelerator for the video streaming platform’s outstanding sales development.

Google Has An Earnings Yield Of 5% And The Stock Is A Steal

Investing is straightforward. You purchase high-quality businesses with solid cash flow and appealing long-term growth potential in their respective industries. In an ideal world, this increase is greatly discounted, as it is in the case of Google.

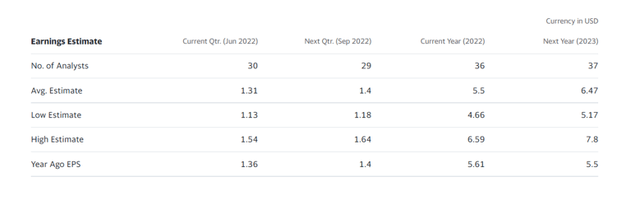

The market anticipates earnings-per-share of $5.47 in 2022, implying a 5.1% earnings yield at the present price of $110. (implied earnings multiple 19.8x). Google’s earnings yield rises to 6.0% based on next year’s expected earnings-per-share of $6.46. (implied earning multiple 16.8x).

An earnings yield of 5%, equivalent to a 20x earnings multiple, is rather low when the market consensus expects 18.1% YoY earnings growth, indicating that the market has gotten overly worried with Google’s growth. However, the relationship between YouTube and Shopify may contribute to Google’s revenue growth in ways that current projections do not fully reflect.

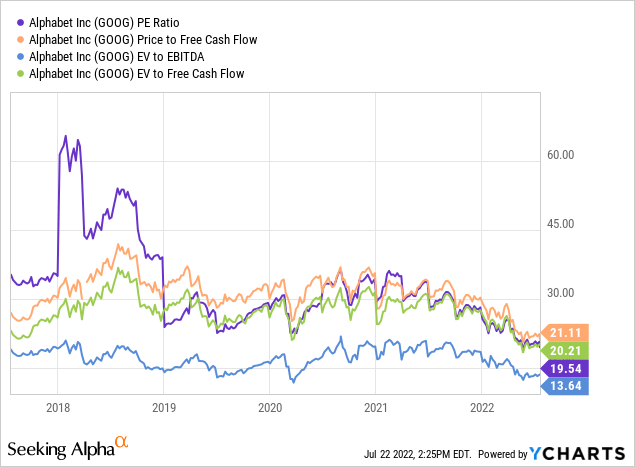

Beyond the P/E ratio, valuation indices have recently solidified, indicating that the market has grown a little more risk-averse with regard to Google.

Valuation indices such as the Price to Free Cash Flow ratio, the Enterprise Value to EBITDA ratio, and the Enterprise Value to Cash Flow ratio have all dropped significantly in 2022, indicating that the market has begun to undervalue Google’s growth prospects.

Why Google Could See A Lower Valuation

Google’s cash flow is heavily reliant on the company’s performance in the digital advertising sector. A recession has the potential to reduce Google’s advertising revenue, which might be reflected in falling free cash flow.

Given the amount of Google’s free cash flow, the technology business is well positioned to weather a downturn. A drop in eCommerce spending that precedes the start of a recession would not derail the YouTube/Shopify alliance, but it might take longer for the market to recognize its true potential.

My Conclusion

At a 16.8x earnings ratio, Google is a steal, and I am aggressively purchasing the stock, GOOG, on the current share price downturn.

Google isn’t the only mega-cap tech firm taking a beating right now, but the company’s cash flow is strong. Even while the stock may trade down in the short term due to economic news, the company’s long-term business orientation is quite strong, and free cash flow is increasing nicely.

Management is shareholder-friendly and repurchases a large number of shares, which helps shareholders. Google is a fantastic deal that should not be passed up.

Be the first to comment