Ekaterina79

We’re bullish on Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:GOOGL) (“Google”). Cutting out all the market noise, we believe Alphabet is one of the better-positioned companies to grow through 2023.

Our bullish sentiment on the stock comes from two sources: Google Ads and Google Cloud. On the one hand, Google Ads is the company’s bread and butter, accounting for almost 79% of Alphabet’s 3Q22 revenue. While Google Ads has been Alphabet’s revenue driver, it is also the reason the company missed revenue expectations by around 10%. We believe macroeconomic headwinds have heavily bit into advertising spending this quarter. We expect Alphabet to enjoy demand tailwinds in its advertisement revenue as soon as market tension eases.

On the other hand, we expect Google Cloud to be a future revenue driver. The cloud market is estimated to grow at a CAGR of 17.9% between 2022-2027, and we believe Google Cloud will benefit from the global shift to the cloud. We don’t expect Alphabet’s stock to rally before 1H23, but we believe Alphabet’s current valuation provides an attractive entry point to invest in Alphabet’s 2023 growth.

Google Ads is a double-edged sword

Alphabet’s stock dropped around 7% in extended earnings the day after the company reported earnings for 3Q22- we believe the disappointing quarter was primarily the result of weakening advertising spending. We interact with Alphabet on several platforms a day; the company makes the bulk of its revenue through being an attractive advertising platform. Inflationary pressures hiked interest rates, and the overall macroeconomic environment caused advertising spending to weaken.

We believe the weak advertising spending gate lowers Alphabet’s double-digit growth. Yet, Alphabet remains a lucrative advertisement platform, and hence we expect Alphabet’s Google Ads to pick up when macroeconomic headwinds ease. Very few people can say they’ve never used Google- the company’s broad customer base makes it highly lucrative to the global digital advertising market, estimated to grow at a CAGR of 13.9%. We expect most of the Google Ad weakness has been priced into the stock and believe Alphabet’s pullback creates an attractive entry point.

Google Cloud is a revenue driver, in progress

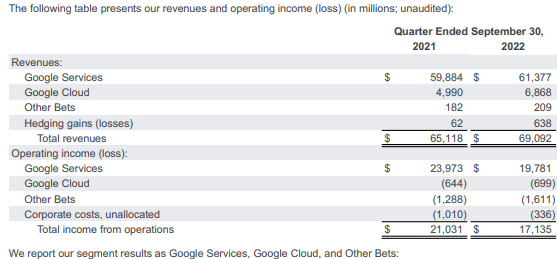

Despite Alphabet’s overall revenue growth slowing to 6% this quarter, Google Cloud grew an impressive 38% despite macroeconomic headwinds. We expect Google Cloud to be the second leg of the table for Alphabet going forward. The following table outlines Alphabet’s revenue by segment in 3Q22.

GOOG earnings 3Q22

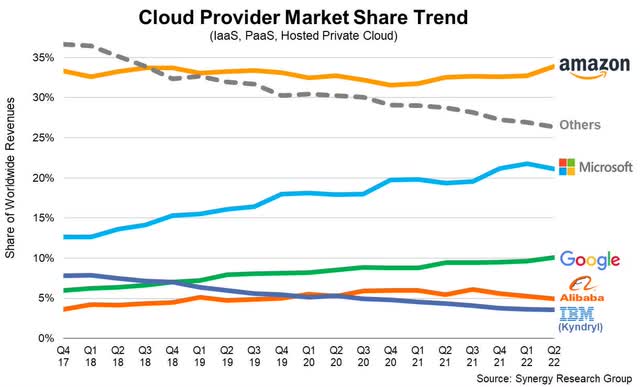

Long-term global digitalization trends are driving cloud adoption; the cloud market is estimated to grow at a CAGR of 17.9% between 2022-2027. Google Cloud is the third largest player in the global public cloud market, after Microsoft’s Azure (MSFT) and Amazon’s AWS (AMZN). Alphabet’s a distant third, with only 10% of the market share. However, with the cloud market booming, we believe there’s plenty of room for market share growth.

Alphabet CEO Sundar Pichai emphasized how cloud growth is a key priority for the company going forward. Google Cloud encompasses Google’s infrastructure and platform services, collaboration tools, and other services for enterprise customers. We expect cloud spending to be weakened by current macroeconomic headwinds and sluggish consumer spending, and expect this will impact Alphabet alongside Microsoft and Amazon. Despite headwinds, Google’s Cloud 38% growth Y/Y outperformed Microsoft’s Cloud growth of 20%. Alphabet has a small base compared to Microsoft and Amazon, and we believe the company has a long way to go before it can become first or second place in the market. Yet, we believe the growth opportunities in the cloud market make it realistic for Google Cloud to grow meaningfully in 2023.

Risks to our bullish sentiment

Alphabet’s underwhelming earnings report in 3Q22 instigated a harsh market reaction. We believe Alphabet’s stock price remains volatile towards the end of the year, but we expect the pullback creates an attractive entry point into Alphabet’s 2023 growth. We believe the company’s main near-term risks are weakening advertising spending and potential Cloud CAPEX cuts due to weakening consumer spending and macroeconomic headwinds. We’re not too worried about the company, as we believe Alphabet’s focus on expanding its cloud presence serves as a long-term growth driver. We also believe the company’s advertisement revenue will rally when markets pick up.

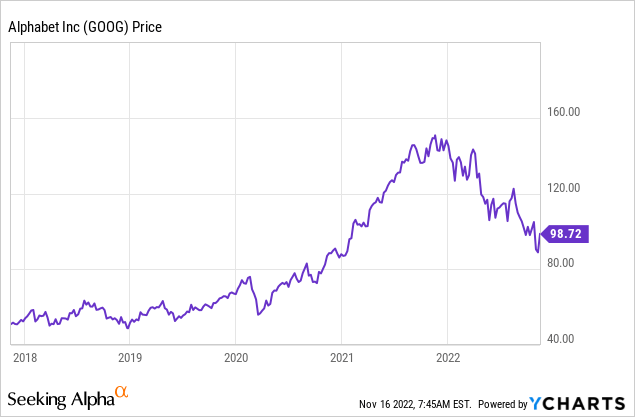

Stock pullback

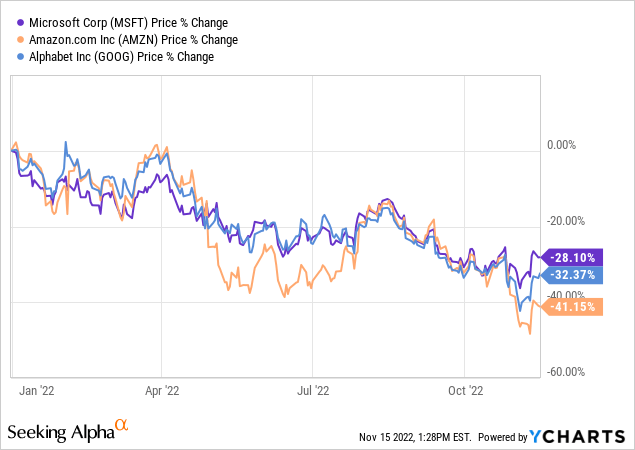

Alphabet grew almost 99% over the past year. YTD, the stock is down around 32%, alongside the larger tech peer group. YTD, Alphabet’s two largest competitions in the cloud and advertisement space are also in negative territory, with Microsoft dropping around 28% and Amazon around 41%. We attribute the declines across the board to the harsh macroeconomic environment and spending cuts on advertising. We recommend investors buy Alphabet’s stock pullback.

The following graphs outline Alphabet’s five-year and YTD stock performance alongside the competition.

TechStockPros TechStockPros

Attractive valuation

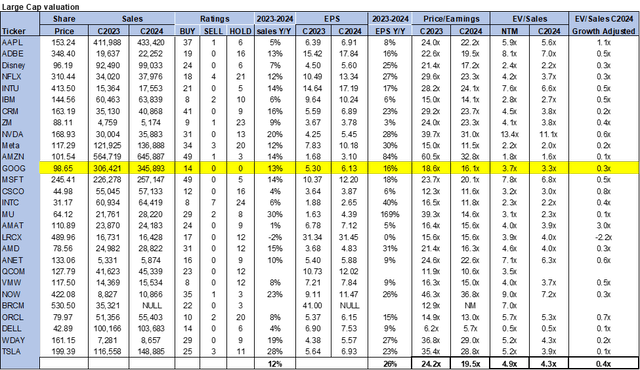

Alphabet is relatively cheap, trading at 16.1x C2024 EPS $6.13 on a P/E basis compared to the peer group average of 19.5x. On EV/Sales, the stock is trading at 3.3x C2024 compared to the peer group average of 4.3x. We like Alphabet’s valuation and believe the stock provides an attractive entry point into one of the largest tech companies at a discount.

The following graph outlines Alphabet’s valuation compared to the peer group.

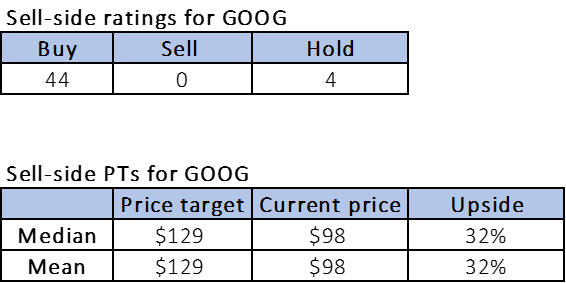

Word on Wall Street

Wall Street shares our bullish sentiment on Alphabet. Of the 48 analysts covering the stock, 44 are buy-rated, and four are hold-rated. The stock is currently trading at $98. The median and mean sell-side price targets are set at $129 with a potential upside of 32%.

The following tables outline Alphabet’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

While Alphabet’s had a rough quarter, we expect the company will grow meaningfully in 2023 on the back of Google Cloud and the recovery of advertising markets for Google Ads. The stock price remains volatile in the near term, but we believe the company’s valuation is being overlooked. Alphabet is trading cheaply relative to the peer group, and we believe the pullback creates an attractive entry point into the stock.

Be the first to comment