DragonImages/iStock via Getty Images

Investment Thesis

Broadcom Inc. (NASDAQ:AVGO) has soared almost 30% in the previous year, outperforming the tech-heavy NASDAQ 100’s 11% gain. Being a cyclical stock, AVGO is responding well to the economic rebound and the high demand that comes with it. Historically, the company has done very well, with over 19 times 10-year price return, 11 consecutive years of dividend growth, and around 50 times increase in annual dividends since 2009.

The company is built on solid fundamentals and robust growth, supporting the bullish stock momentum. However, with great share prices come high valuations, and the most common concern an investor may have when investing in a high-quality stock is whether to invest now or later?

Due to the high price, its valuation metrics are amongst the highest in its peer group. Still, the stock has historically traded at higher PE values for the better part of 2019 through 2021 and has generated substantial returns for its shareholders.

I rate the stock as a buy because, despite the high price and seemingly expensive valuation metrics, the medium to long-term prospects of the stock are bolstered on the back of increasing market demand, solid expected earnings, a rising 5G market, and strong dividend distribution prospects.

The Semiconductor Market is Flourishing

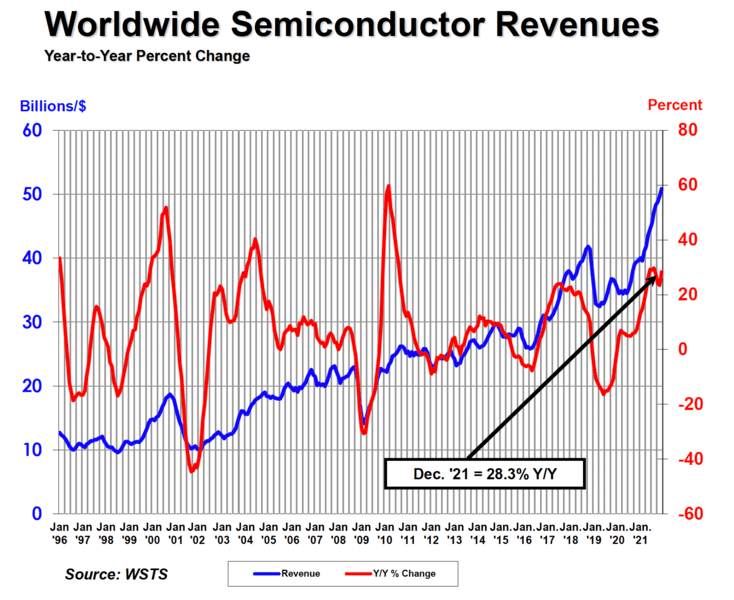

According to the Semiconductor Industry Association (SIA), the global semiconductor industry sales in 2021 totaled $555.9 billion, shipping a record 1.15 trillion semiconductor units. China remained the largest individual market for semiconductors, accounting for about 35% of sales at $192.5 billion.

Semiconductors.org

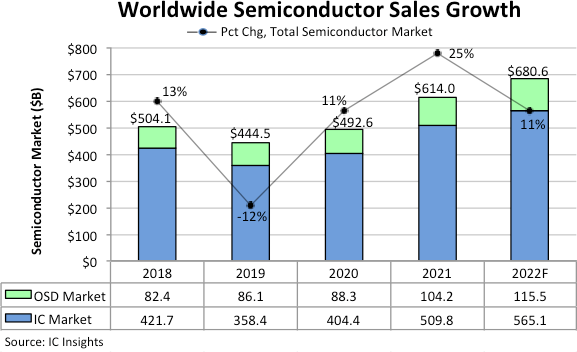

In 2022, IC Insights estimates the total semiconductor sales to grow 11% and reach a record-high $680.6 billion, composed of $565.1 billion in optoelectronics, sensors/actuators, and discrete (OSD) revenue and $115.5 billion in Integrated Circuits (IC) revenue. Semiconductor demand in the decade will be mostly focused on computer accelerators, such as GPUs, 5G mobile networks, and electric cars.

IC Insights

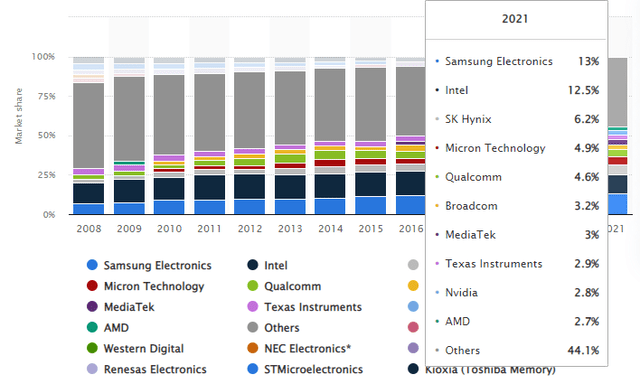

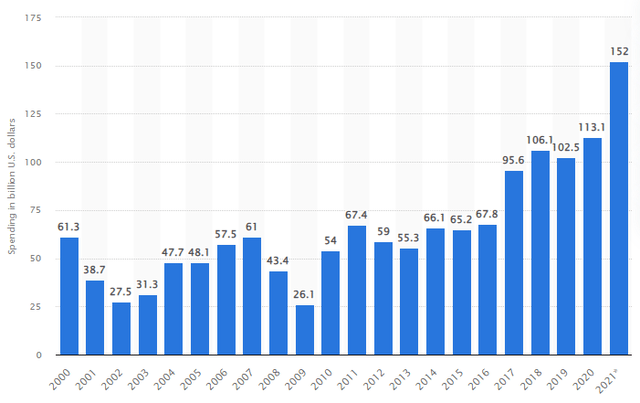

Below is a graph chart depicting the global market share in the semiconductor market from 2008 to 2021.

Following this trend, Intel has predicted $1 trillion in semiconductor spending by the end of this decade ‘as the insatiable demand for computing power grows.’ Accordingly, the semiconductor behemoth recently announced that it plans to invest as much as 80 billion Euros in the European Union over the next decade along the entire semiconductor value chain – from research and development (R&D) to manufacturing to state-of-the-art packaging technologies.

Deloitte’s 2022 semiconductor outlook report iterates that the three largest players in the global semiconductor industry are committing to an unprecedented level of increase in their capital expenditures from their overall output capacity, exceeding $200 billion from 2021 to 2023, with the governments committing hundreds of billion dollars more.

Broadcom’s CEO expressed his view that the industry’s current growth rate is unsustainable, and the industry is likely to grow at the current 10-year CAGR of 5%. Still, with next-gen vehicles and the 5G market boom, I’m inclined to side with Intel’s position of robust industry growth in the coming years. The growing market and R&D expenditure emphasize the significance of the industry in the future and how the semiconductor plays an integral role in establishing other markets.

Deloitte reported that the chip shortage of the past two years resulted in revenue misses of more than $500 billion worldwide between the semiconductor and its customer industries. The green transition around the globe is accelerating the growth of the electric vehicle market, and semiconductor production has been a bottleneck for the industry in recent years. This shortage has resulted in lost automobile sales of more than $210 billion in 2021 alone.

These supply shortages will likely improve in the second half of 2022, with lead times stretching into 2023. This might have a slingshot effect as industries make up for lost sales with aggressive growth in the coming period.

Broadcom’s Strong Topline Growth

The semiconductor industry-wide has seen prominent growth as the economy strengthens in the post-pandemic environment. In March, Broadcom released its Q1 2022 earnings for the quarter ended January 30th, reporting a 16% YoY top-line growth to $7.7 billion and an impressive 83% YoY diluted EPS growth from $3.05 to $5.59. Its solid financial performance was attributed to strong enterprise demand and continued investments in next-generation technology by hyperscale and service providers.

The company’s smartphone solutions continue to be its bedrock, as it generates a significant portion of its revenue from wireless chips and other accessories used in next-generation smartphones. This revenue-generating segment will be further strengthened by the 5G boom in the coming quarters, as 5G establishes itself as the first major improvement in consumer download speeds in almost a decade, sending the market into a multi-year smartphone upgrade frenzy, putting Broadcom’s products in high demand.

Additionally, with the majority of global businesses spiraling toward the cloud, data center demand is on an upward trajectory. This will heavily aid the growth of Broadcom’s access and connectivity chips sales, which make up a smaller portion of its current sales.

Additionally, Broadcom aims to be a key player in the next-gen automobiles market through its solution provision in infotainment systems, driver-assist technology, etc. The new generation of automobiles is heavily reliant on technology, with companies such as Tesla (TSLA) bordering on being tech companies themselves, which bodes excessively well for Broadcom.

The company’s backlog increased to $14.9 billion, up 15% from 2020, and with about 90% of 2021’s production already committed for sale, the company’s solid topline growth is imminent.

In 2021, the top-line growth was complemented by a 13% YoY increase in FCF generation to $3.4 billion, amounting to almost 44% of revenue, $1.8 billion in total dividend distributions, and $2.7 billion share repurchase. The company has consistently improved its operating and net margin in each quarter since Q2 and Q3 2020 to 40% and 31% in Q1 2022, respectively, signifying consistently improving operational efficiencies and the company’s capacity to translate the topline into solid distributable earnings growth.

The company’s top line and bottom line are a core component in its valuation, as it gives rise to the PS and PE multiple, respectively, discussed below. The overall outlook that the strong topline performance and improving profitability margins give us should also be considered when analyzing the company’s valuation, as the premium performance demands a premium on the share price.

Customer Concentration

A major risk to the company is its reliance on a select few customers. The company’s latest SEC filing shows that the aggregate sales from its top 5 customers accounted for over 35%, with Apple Inc. (AAPL) accounting for over 25% of its net revenue. The company expects to rely on these customers for the foreseeable future and iterates that the loss of, or significant decrease in demand from, any of its top five end customers could have a material adverse effect on its business, results of operations, and financial condition.

These customers are not bound to purchase any specific volumes from the company, and any disruption to these sales endpoints will cause significant fluctuation in Broadcom’s topline.

Amid the recent global supply shortages, Apple was forced to slash its production targets by around 10 million in October due to supply issues from Broadcom and Texas Instruments (TXN). Reportedly, Apple has already started working on producing its own chips, aiming to replace components that it currently sources from Broadcom and Skyworks (SWKS).

According to Bloomberg, “the new office is in its early stages but will eventually focus on wireless radios, radio-frequency integrated circuits, and a wireless system-on-a-chip… semiconductors for connecting to Bluetooth and Wi-Fi.”

This is a time-consuming endeavor by Apple and gives Broadcom ample time to diversify its customer portfolio, as failure to do so will weigh heavily on its top line. However, the fact remains that this heavy reliance on a single company is highly risky and needs to be closely monitored and handled.

Valuation

Broadcom is currently trading at a premium to the industry median based on its PE, PS, and PB values. However, due to its robust growth and serious cash flow generation, the company trades at lower PEG, P/CF, and P/FCF ratios than the industry. Additionally, despite being marginally higher than the industry, Broadcom’s forward PE of 26 is substantially lower than its 5 year average of 38.

| Particulars | Broadcom | Industry Median | 5-Year Average |

| PE (TTM) | 36.2 | 28.36 | |

| PE (FWD) | 26.42 | 25.93 | 38.22 |

| PS | 9.16 | 3.71 | 6.11 |

| PB | 11.33 | 3.77 | 5.78 |

| PEG | 0.35 | 0.52 | |

| PCF | 18.33 | 21.74 | 14.08 |

| PFCF | 16.3 | 19.82 | 14.23 |

Depending on your priorities as an investor, you may either decide to add Broadcom to your portfolio by paying a premium for a premium stock, or, as a conservative investor, you may wait further for the price to retract.

Broadcom’s share price has risen by a factor of 20 over the past 9 years to over $630, making the market anticipate a stock split. The company’s last stock split happened a decade before its acquisition by Avago Technologies in 2016. This will likely drop the per-share price to a more easily tradable amount for potential investors.

Another way to look at it is that there is a precedent of share prices going up from the time of a stock split announcement till the actual event, motivating investors to get in on the action before others, leading to a price bump.

Dividends

Broadcom is a cash-making machine and has a long history of distributing this cash among its shareholders, with a cash dividend payout ratio of almost 46%. The company’s forward annual dividend rate of $16.40 yields a solid 2.58%, higher than the industry median of 1.5%. Due to the high price, this is still lower than its 5 year average of a little over 3%.

Over the last decade, the dividend has reliably grown with a CAGR of 42.37%, outmatching the industry’s 10.27%. Even though Broadcom has a lower than industry revenue growth, the company’s EPS growth has been substantial, which has been crucial for the dividend growth. The dividends are expected to grow sustainably at a healthy pace.

For investors interested in a steady income and reliable growth, the stock has historically added considerable value, and there doesn’t seem to be any indication by the company that suggests a change from that trajectory.

Conclusion

Broadcom is a winning stock with solid fundamentals, a great industry outlook, and strong financial performance. These factors have all pitched into the substantial share price growth that the company has seen in the previous decade. The 5-year price returns are almost double the S&P 500’s. Chip in the company’s above-industry average dividend yield, and we have a recipe for solid investor returns.

The relative valuation metrics might not be the best for conservative investors, but looking at the long-term horizon, the company has proved to bear fruit even at such valuations in the past. Even though the past is not a guarantee of future returns, the solid growth prospects of the company do not provide any reason for the stock to get off-railed in the near future.

The customer concentration appears to be a risk down the road that the company needs to address to bolster investor confidence. Apart from that, the AVGO has proven itself to be a sound investment and remains to be a good buy.

Be the first to comment